Key Takeaways

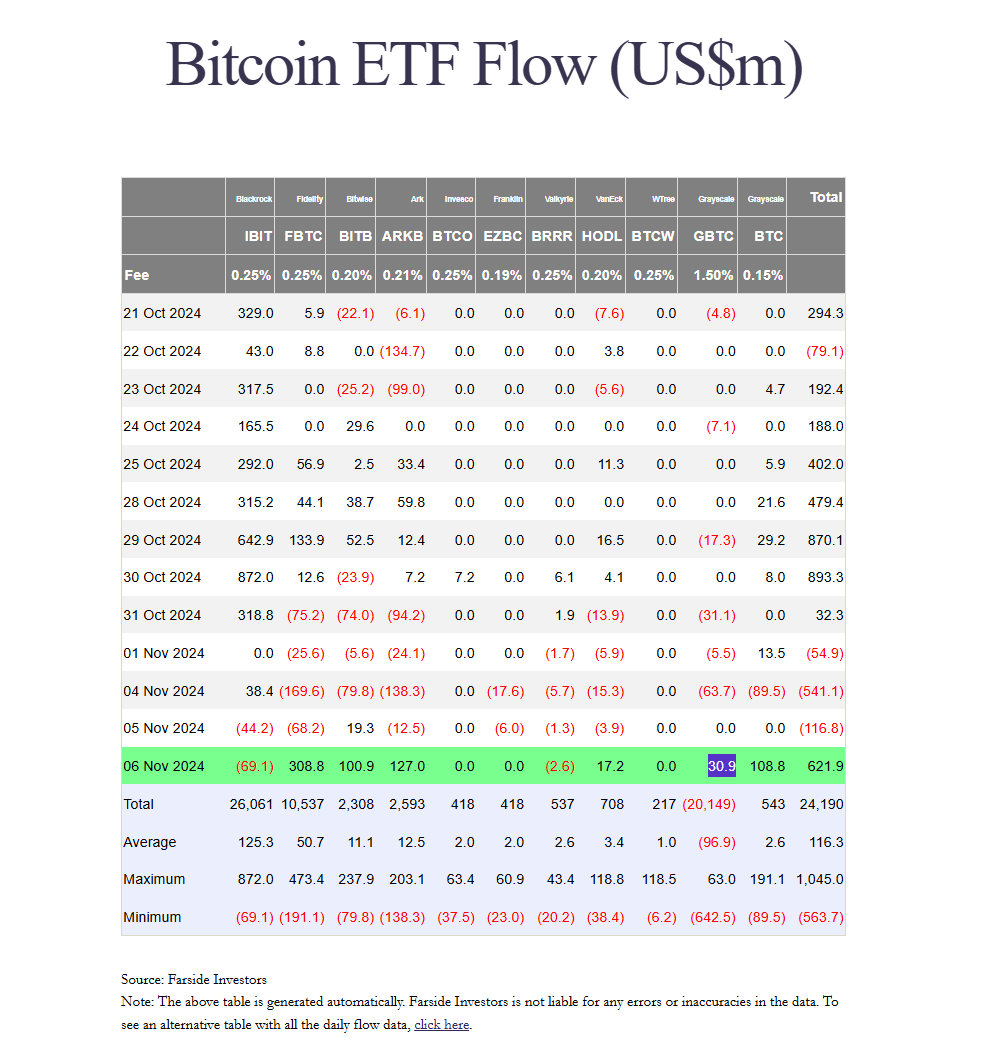

- US spot Bitcoin ETFs break a three-day dropping streak with $622 million in web inflows on November 6.

- Regardless of BlackRock IBIT’s largest outflow day, a number of ETFs, together with Constancy and ARK, led positive factors with substantial inflows.

Share this text

US spot Bitcoin ETFs attracted roughly $622 million in web inflows on November 6, ending a three-day dropping streak, regardless of BlackRock’s IBIT experiencing its largest single-day outflow since launch.

In line with knowledge from Farside Traders, the world’s largest Bitcoin ETF recorded round $69 million in web outflows yesterday, whereas Valkyrie’s BRRR noticed over $2 million in outflows.

IBIT’s loss got here as a shock on condition that the fund began robust with over $1 billion in shares traded inside the first 20 minutes of market opening. In line with Bloomberg ETF analyst Eric Balchunas, IBIT achieved its highest trading-volume day, reaching $4.1 billion.

“For context, that’s extra quantity than shares like Berkshire, Netflix, or Visa noticed in the present day,” the analyst mentioned. “It was additionally up 10%, its second finest day since launching. A few of this may convert into inflows doubtless hitting Tue, Wed evening.”

Nevertheless, he beforehand famous that appreciable shopping for and promoting exercise didn’t translate into new investments or capital inflows into the ETF, that means that top quantity may result from each purchases and gross sales.

Most ETFs traded at double their common quantity, marking one in all their finest buying and selling days since January’s preliminary launch interval, Balchunas acknowledged in a follow-up publish.

On Wednesday, Constancy’s FBTC led the pack with almost $309 million in web shopping for, adopted by ARK Make investments’s ARKB, which took in roughly $127 million.

Main positive factors have been additionally seen in Grayscale’s BTC and Bitwise’s BITB. The low-cost model of GBTC recorded almost $109 million in new capital, its second-largest each day influx since launch.

In the meantime, the BITB fund logged round $101 million, its finest single-day efficiency since mid-February.

Grayscale’s GBTC reported roughly $31 million in web inflows yesterday, whereas VanEck’s HODL noticed round $17 million.

Share this text