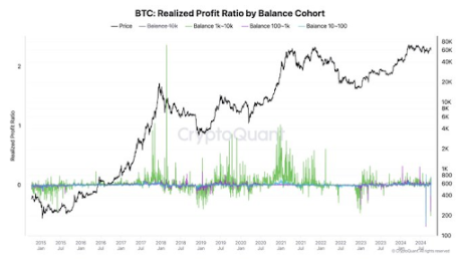

Ki Younger Ju, the founding father of the on-chain analytics platform CryptoQuant, revealed that Bitcoin whales are at present shifting out of character when it comes to profit-taking. These whales probably consider that the bull is much from over, which is why they haven’t secured as a lot revenue as they’ve executed in earlier bull runs.

Bitcoin Whales Have Taken Lesser Earnings In This Market Cycle Than Previous Ones

Ki Younger Ju talked about in an X submit that if the Bitcoin bull cycle had been to finish right here, it might imply that Bitcoin whales have simply set the document for the least profit-taking throughout all cycles ever. Crypto analyst Ali Martinez tried to counter Ki Younger Ju’s level by highlighting how these whales have been distributing their BTC throughout completely different addresses, resulting in a drop within the variety of addresses holding between 1,000 and 10,000 BTC.

Associated Studying

Nevertheless, the CryptoQuant founder claimed that that is nonetheless the bottom return price throughout all cycles, regardless of how a lot these whales offered by way of these completely different wallets. He additionally revealed that the whales which can be promoting now are doing so with little revenue, suggesting that they’re probably new whales with weak palms.

In the meantime, Ki Younger Ju famous that the kind of transactions that Martinez alluded to can not all the time be thought of as gross sales. He remarked that one should have a look at extra macro-level aggregated knowledge, corresponding to historic realized revenue, somewhat than simply transactions to get the larger image.

These whales are believed to be holding again on taking earnings simply but, contemplating that the bull run appears to be removed from over. The CryptoQuant CEO additionally talked about earlier that Bitcoin was nonetheless in the midst of a bull run primarily based available on the market cap to realized cap metric.

As a substitute of taking earnings, these Bitcoin whales are nonetheless accumulating extra BTC forward of the subsequent leg of the bull run. CryptoQuant just lately revealed that there was a surge within the outflows from exchanges, the most important since November 2022. In the meantime, Ki Younger Ju additionally famous that new whales are accumulating at a price the market has by no means witnessed earlier than.

When Is This Market Cycle Anticipated To Peak?

Crypto analysts like Rekt Capital have predicted that the Bitcoin market high may happen someday in mid-September or mid-October 2025. Nevertheless, in a latest report, CoinMarketCap supplied a special opinion, predicting that the cycle high may probably be between mid-Could and mid-June 2025.

Associated Studying

The platform famous that Bitcoin is at present forward of historic tendencies, particularly contemplating that it hit a brand new all-time excessive (ATH) earlier than the Halving occasion. CoinMarketCap identified that this market cycle is accelerating by roughly 100 days, which signifies that the subsequent peak may arrive earlier than anticipated.

Featured picture created with Dall.E, chart from Tradingview.com

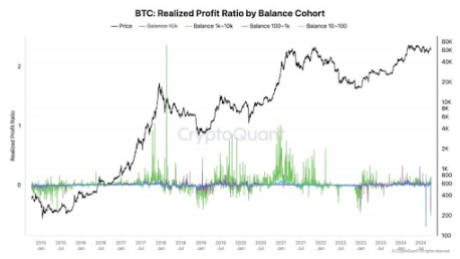

Ki Younger Ju, the founding father of the on-chain analytics platform CryptoQuant, revealed that Bitcoin whales are at present shifting out of character when it comes to profit-taking. These whales probably consider that the bull is much from over, which is why they haven’t secured as a lot revenue as they’ve executed in earlier bull runs.

Bitcoin Whales Have Taken Lesser Earnings In This Market Cycle Than Previous Ones

Ki Younger Ju talked about in an X submit that if the Bitcoin bull cycle had been to finish right here, it might imply that Bitcoin whales have simply set the document for the least profit-taking throughout all cycles ever. Crypto analyst Ali Martinez tried to counter Ki Younger Ju’s level by highlighting how these whales have been distributing their BTC throughout completely different addresses, resulting in a drop within the variety of addresses holding between 1,000 and 10,000 BTC.

Associated Studying

Nevertheless, the CryptoQuant founder claimed that that is nonetheless the bottom return price throughout all cycles, regardless of how a lot these whales offered by way of these completely different wallets. He additionally revealed that the whales which can be promoting now are doing so with little revenue, suggesting that they’re probably new whales with weak palms.

In the meantime, Ki Younger Ju famous that the kind of transactions that Martinez alluded to can not all the time be thought of as gross sales. He remarked that one should have a look at extra macro-level aggregated knowledge, corresponding to historic realized revenue, somewhat than simply transactions to get the larger image.

These whales are believed to be holding again on taking earnings simply but, contemplating that the bull run appears to be removed from over. The CryptoQuant CEO additionally talked about earlier that Bitcoin was nonetheless in the midst of a bull run primarily based available on the market cap to realized cap metric.

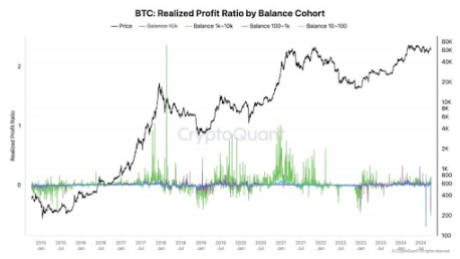

As a substitute of taking earnings, these Bitcoin whales are nonetheless accumulating extra BTC forward of the subsequent leg of the bull run. CryptoQuant just lately revealed that there was a surge within the outflows from exchanges, the most important since November 2022. In the meantime, Ki Younger Ju additionally famous that new whales are accumulating at a price the market has by no means witnessed earlier than.

When Is This Market Cycle Anticipated To Peak?

Crypto analysts like Rekt Capital have predicted that the Bitcoin market high may happen someday in mid-September or mid-October 2025. Nevertheless, in a latest report, CoinMarketCap supplied a special opinion, predicting that the cycle high may probably be between mid-Could and mid-June 2025.

Associated Studying

The platform famous that Bitcoin is at present forward of historic tendencies, particularly contemplating that it hit a brand new all-time excessive (ATH) earlier than the Halving occasion. CoinMarketCap identified that this market cycle is accelerating by roughly 100 days, which signifies that the subsequent peak may arrive earlier than anticipated.

Featured picture created with Dall.E, chart from Tradingview.com