Bitcoin’s worth has but to succeed in a brand new all-time excessive amid the latest bullish run, because the sellers are defending their final line of resistance.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Each day Chart

On the day by day chart, the asset has just lately rallied above the $64K stage and the 200-day shifting common, situated across the similar space. This uptrend has considerably boosted the chance of Bitcoin creating a brand new all-time excessive quickly.

But, the sellers have defended the $69K resistance stage nicely, as the value is getting rejected to the draw back. A retest of the 200-day shifting common is feasible if a major pullback happens.

The 4-Hour Chart

The 4-hour chart signifies a transparent bearish sign based mostly on worth motion and momentum evaluation. The market has just lately created a rising wedge on the key $69K resistance zone. But, the RSI has displayed a transparent bearish divergence with the latest worth highs.

This has led to a breakdown of the sample, which is a basic bearish reversal sign. The RSI additionally reveals values beneath 50%, which reveals that momentum is bearish within the 4-hour timeframe. But, there’s nonetheless a excessive chance that this transfer is only a momentary correction, as the general market construction stays bullish.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

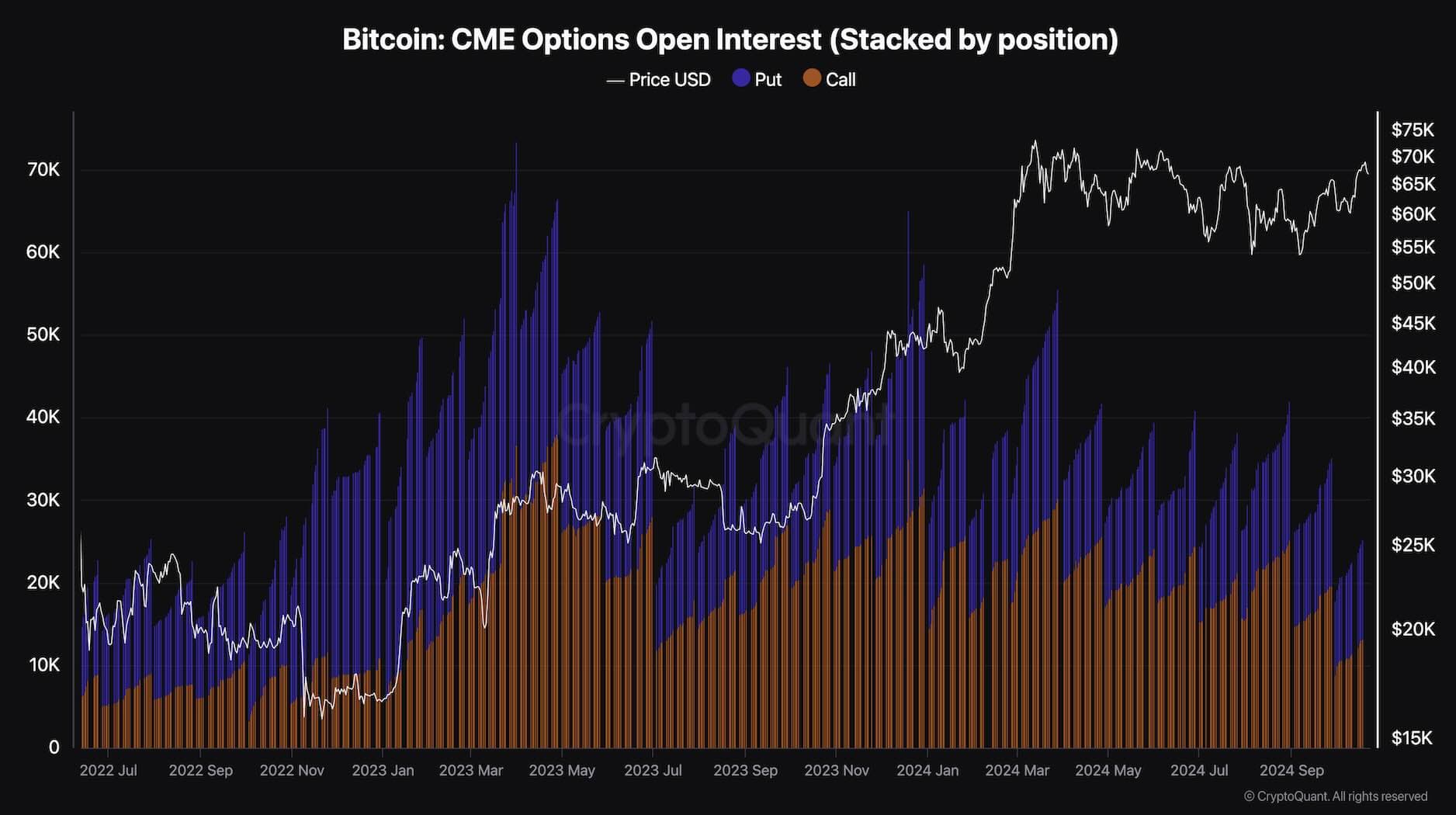

Bitcoin CME Choices Open Curiosity (Stacked)

Amid Bitcoin’s latest worth rise, traders have gotten more and more optimistic {that a} new report excessive and long-term rally will quickly happen. But, there’s a slight likelihood that this optimism may result in the market’s downfall.

This chart demonstrates the Bitcoin CME Choices Open Curiosity (Stacked), which measures the variety of open choices positions, each calls and places. Evidently, there’s a notable lower in combination choices open curiosity (OI) in comparison with the degrees seen earlier within the bull market and close to the market backside, the place each calls and places have been extra closely stacked.

This discount in OI means that traders are experiencing much less uncertainty about Bitcoin’s worth actions, main them to tackle extra directional positions with much less want for hedging by choices. On the similar time, the rising open curiosity in CME futures signifies that traders have gotten extra assured within the development, keen to take extra leveraged positions and assume extra vital dangers. For sure, leverage is a two-edged sword.

The submit Bitcoin Value Evaluation: What Are BTC’s Possibilities for New ATH After the Rejection at $69K? appeared first on CryptoPotato.