Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

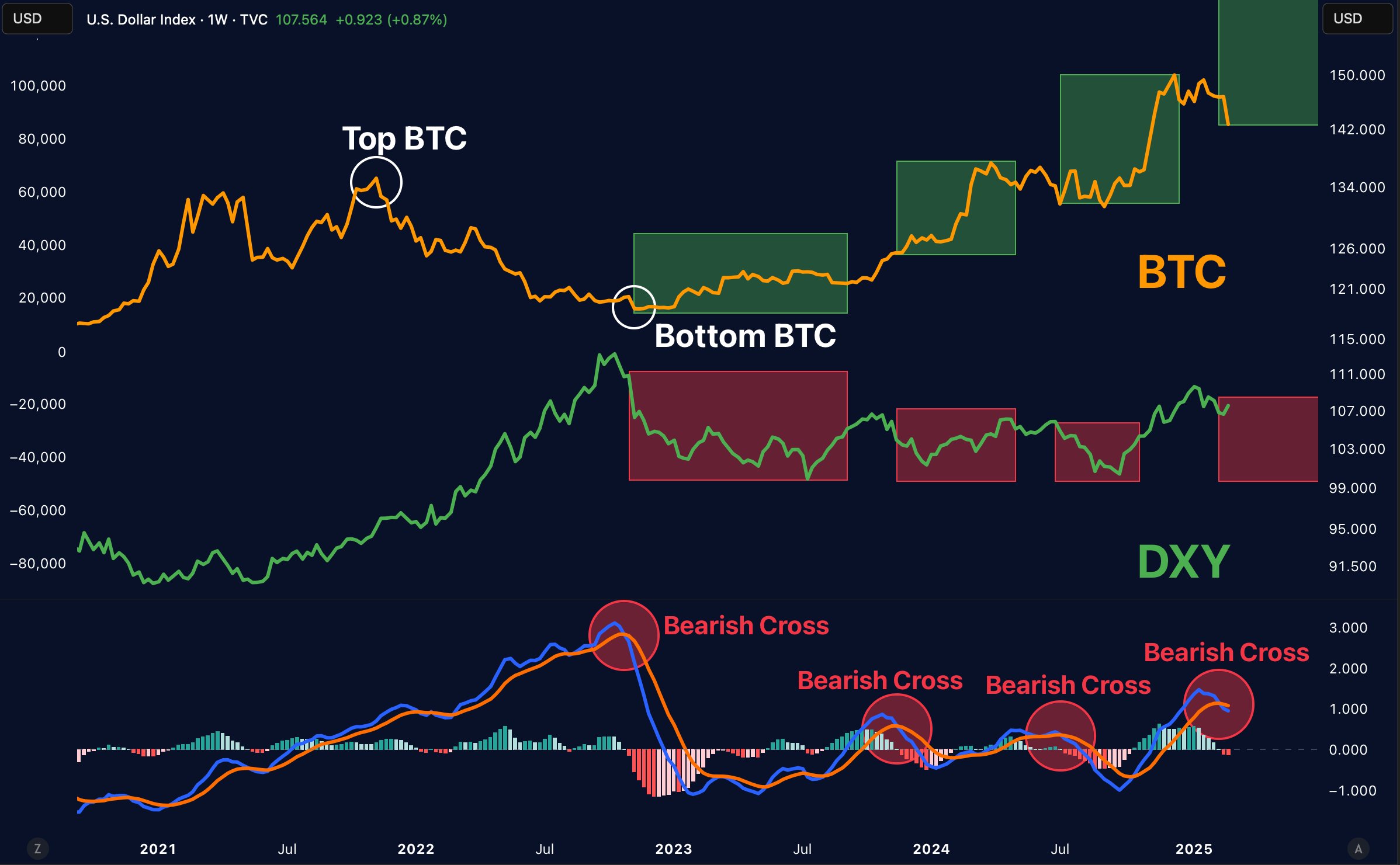

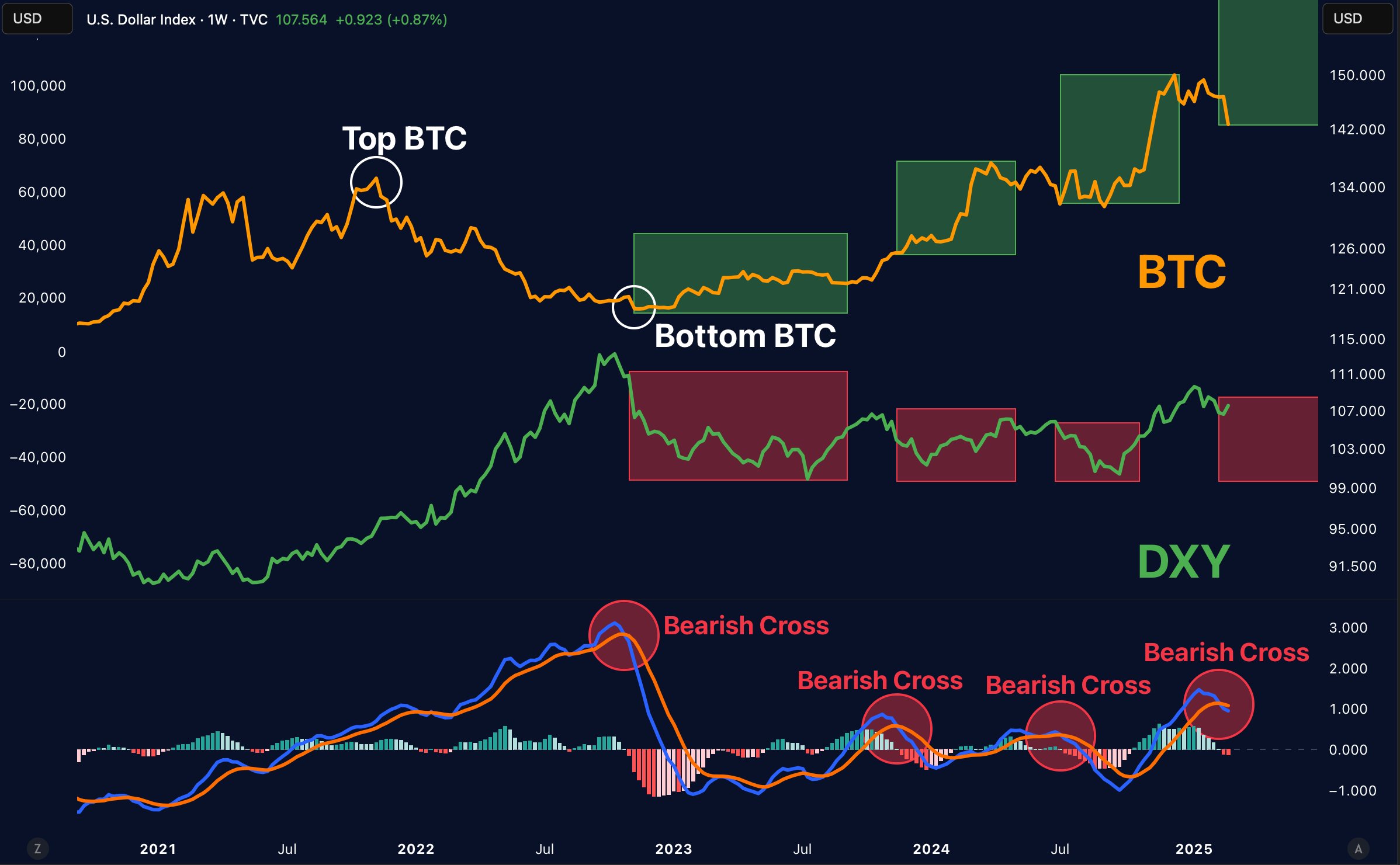

The US greenback index (DXY) is experiencing certainly one of its largest weekly declines since 2013, fuelling optimism for a possible rally amongst risk-on belongings, together with Bitcoin (BTC). The final time the DXY noticed such a pointy pullback was throughout the peak of the FTX fiasco in November 2022, which coincided with a Bitcoin backside.

Will Bitcoin See An Uptrend?

BTC is down almost 10% over the previous two weeks, largely because of the hawkish stance of the US Federal Reserve (Fed) and issues over commerce tariffs from the US towards Canada, Mexico, and China.

Associated Studying

Since March 3, the DXY has slid greater than 3%, tumbling from 107 to 103 on the time of writing. This decline has sparked hope amongst cryptocurrency buyers for a possible rally. Historic information helps this outlook.

Along with the $15,000 BTC backside shaped in November 2022, the DXY has skilled comparable sharp declines on two different events – throughout the COVID crash in March 2020 and again within the 2015 bear market when the premier cryptocurrency traded at $250.

On all three events when the DXY dropped greater than -4 customary deviations, BTC shaped a backside adopted by a pattern reversal that noticed the digital asset resume its bullish momentum. Crypto analyst Merlijn The Dealer shared their ideas on the DXY-BTC relationship.

In an X submit, the analyst famous that every time the DXY Shifting Common Convergence Divergence (MACD) has turned bearish, BTC has rallied. The analyst illustrated this with the next chart.

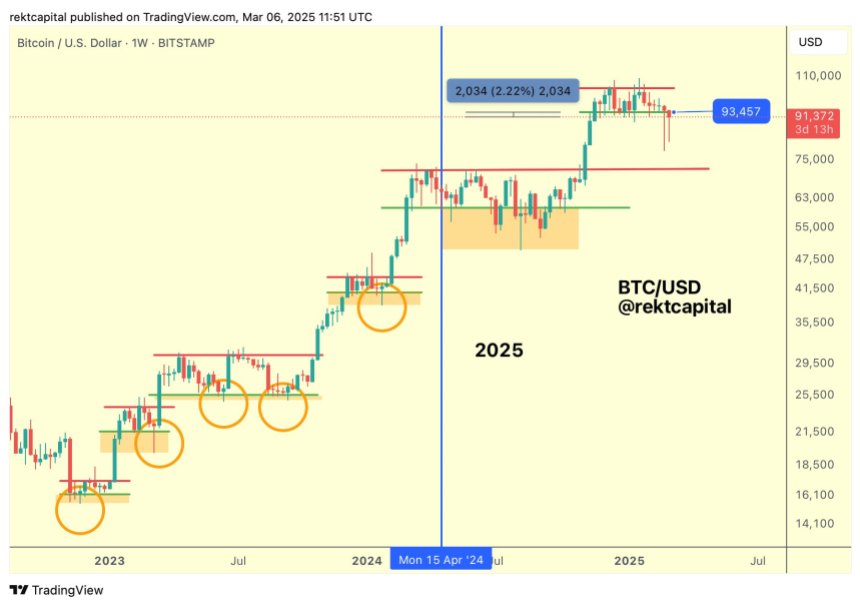

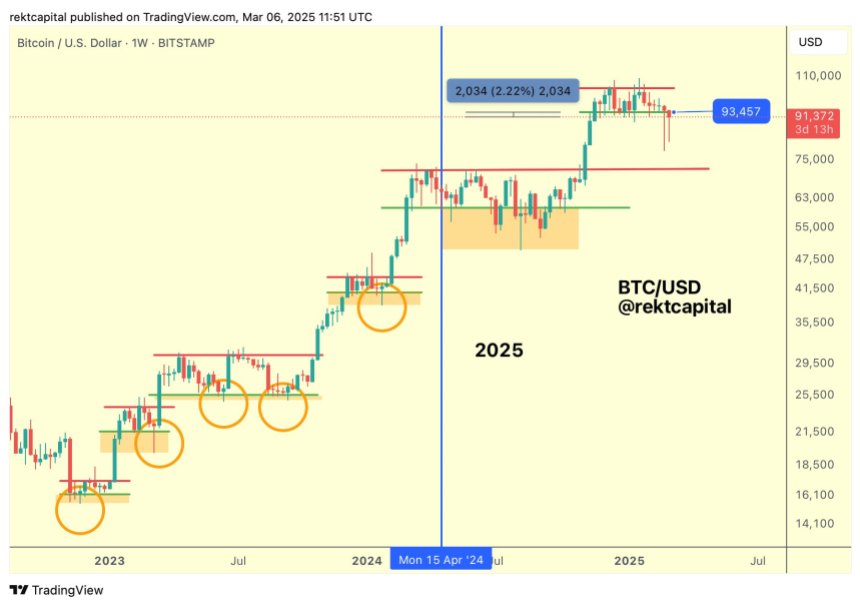

Fellow crypto analyst Rekt Capital had an analogous perspective. The analyst emphasised that BTC has seemingly shaped a better low after one other draw back deviation, which noticed the cryptocurrency hit a low of $78,258 on February 28.

Vital To Clear The $90,000 Resistance

One other crypto dealer, Daan Crypto Dealer, hinted that BTC might goal new all-time highs (ATH) round $120,000 if it continues to consolidate close to vary lows. The dealer defined:

We’ve seen this throughout each consolidation this cycle the place it breaks decrease, fails to see continuation, retakes the vary and strikes increased from there. Let’s see how this one seems. That ~$90K degree stays key.

Associated Studying

Current evaluation from CryptoQuant helps the view that BTC might have already shaped a backside. Moreover, seasoned crypto analyst Ali Martinez not too long ago highlighted that BTC has hit oversold ranges not seen since August 2024, seemingly signalling a pattern reversal within the short-term.

That mentioned, BTC can be going through a bearish deviation because it fills a brand new Chicago Mercantile Trade (CME) hole, which can dampen hopes for a swift worth restoration. At press time, BTC is buying and selling at $86,870, down 3.3% up to now 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The US greenback index (DXY) is experiencing certainly one of its largest weekly declines since 2013, fuelling optimism for a possible rally amongst risk-on belongings, together with Bitcoin (BTC). The final time the DXY noticed such a pointy pullback was throughout the peak of the FTX fiasco in November 2022, which coincided with a Bitcoin backside.

Will Bitcoin See An Uptrend?

BTC is down almost 10% over the previous two weeks, largely because of the hawkish stance of the US Federal Reserve (Fed) and issues over commerce tariffs from the US towards Canada, Mexico, and China.

Associated Studying

Since March 3, the DXY has slid greater than 3%, tumbling from 107 to 103 on the time of writing. This decline has sparked hope amongst cryptocurrency buyers for a possible rally. Historic information helps this outlook.

Along with the $15,000 BTC backside shaped in November 2022, the DXY has skilled comparable sharp declines on two different events – throughout the COVID crash in March 2020 and again within the 2015 bear market when the premier cryptocurrency traded at $250.

On all three events when the DXY dropped greater than -4 customary deviations, BTC shaped a backside adopted by a pattern reversal that noticed the digital asset resume its bullish momentum. Crypto analyst Merlijn The Dealer shared their ideas on the DXY-BTC relationship.

In an X submit, the analyst famous that every time the DXY Shifting Common Convergence Divergence (MACD) has turned bearish, BTC has rallied. The analyst illustrated this with the next chart.

Fellow crypto analyst Rekt Capital had an analogous perspective. The analyst emphasised that BTC has seemingly shaped a better low after one other draw back deviation, which noticed the cryptocurrency hit a low of $78,258 on February 28.

Vital To Clear The $90,000 Resistance

One other crypto dealer, Daan Crypto Dealer, hinted that BTC might goal new all-time highs (ATH) round $120,000 if it continues to consolidate close to vary lows. The dealer defined:

We’ve seen this throughout each consolidation this cycle the place it breaks decrease, fails to see continuation, retakes the vary and strikes increased from there. Let’s see how this one seems. That ~$90K degree stays key.

Associated Studying

Current evaluation from CryptoQuant helps the view that BTC might have already shaped a backside. Moreover, seasoned crypto analyst Ali Martinez not too long ago highlighted that BTC has hit oversold ranges not seen since August 2024, seemingly signalling a pattern reversal within the short-term.

That mentioned, BTC can be going through a bearish deviation because it fills a brand new Chicago Mercantile Trade (CME) hole, which can dampen hopes for a swift worth restoration. At press time, BTC is buying and selling at $86,870, down 3.3% up to now 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com