Binance, the world’s largest crypto alternate by buying and selling quantity metrics, has declared the delisting of three altcoins’ spot buying and selling pairs.

This motion, set to take impact on December 25 at 03:00 UTC, displays Binance’s makes an attempt to reinforce market high quality.

What Binance Customers Want To Do

Binance often evaluations the efficiency of its listed buying and selling pairs, analyzing quite a lot of elements to find out its itemizing and delisting actions. It assesses parts such because the workforce’s dedication to the venture, the extent and high quality of improvement exercise, and the community and good contract stability.

Based mostly on the above, amongst different standards, the alternate removes tokens and buying and selling pairs that don’t meet liquidity and quantity thresholds. The alternate claims these measures shield customers and uphold a high-quality buying and selling surroundings.

“When a coin or token now not meets these requirements or the business panorama adjustments, we conduct a extra in-depth evaluate and doubtlessly delist it. Our precedence is to make sure one of the best companies and protections for our customers whereas persevering with to adapt to evolving market dynamics,” Binance mentioned.

Towards this backdrop, the main alternate has dedicated to delisting buying and selling pairs for Kaon’s powering token, AKRO (previously Akropolis), Bluezelle (BLZ), and WazirX (WRX). Particularly, the alternate will take away and robotically terminate orders for the next buying and selling pairs:

- AKRO/USDT

- BLZ/BTC,

- BLZ/USDT, and

- WRX/USDT

Additional, Binance articulated that the tokens’ valuation will now not be displayed in customers’ wallets after delisting. Deposits of those tokens is not going to be credited to consumer accounts 24 hours after the official delisting. Customers have solely till February 25, 2025, at 03:00 UTC, to withdraw the affected tokens from Binance.

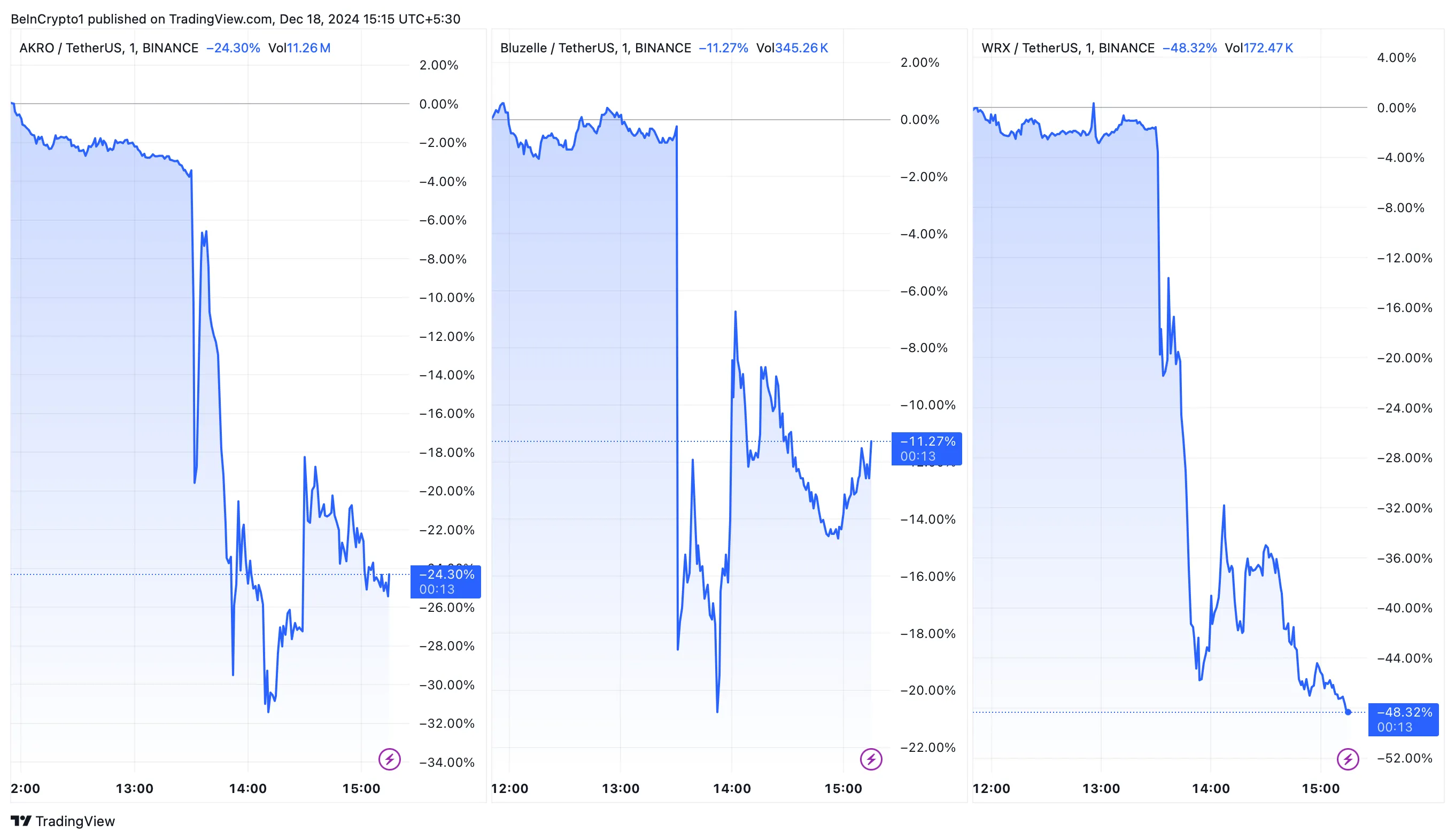

Within the fast aftermath of this announcement, AKRO, BLZ, and WRX token costs dipped by double digits, between 11% and 48%. This final result displays the influence of token delistings from main exchanges.

It’s unsurprising, contemplating the historical past of token delisting bulletins on Binance typically led to volatility. As an example, Binance’s elimination of six altcoins in August led to substantial worth drops for these cryptocurrencies. Notably, PowerPool (CVP) and Ellipsis (EPX) noticed declines of 14% and 22% instantly after their delisting announcement.

Equally, in late November, Binance’s announcement to delist altcoins despatched the costs of GFT, IRIS, KEY, OAX, and REN plummeting. Such outcomes are clear contrasts to itemizing bulletins, which frequently result in the involved tokens hovering.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.