- AUCTION may rally to $76 and $93 subsequent

- On-chain metrics revealed that the token flashed distribution tendencies

Bounce [AUCTION] has rallied by 140.89% since final Saturday. On the time of writing, the token was buying and selling at $60.3, with its 24-hour buying and selling quantity remarkably excessive too. In actual fact, CoinMarketCap’s information revealed that the day by day quantity was $1.33 billion. With a market cap of simply $395.84 million, the quantity to mcap ratio stood at 335%.

This gave the impression to be terribly bullish – Within the brief time period. The worth was just below 17% away from its all-time excessive at $70.44 too.

Therefore, the query – Ought to holders take income now, or look forward to extra positive aspects?

Greed and FOMO mustn’t take the higher hand now

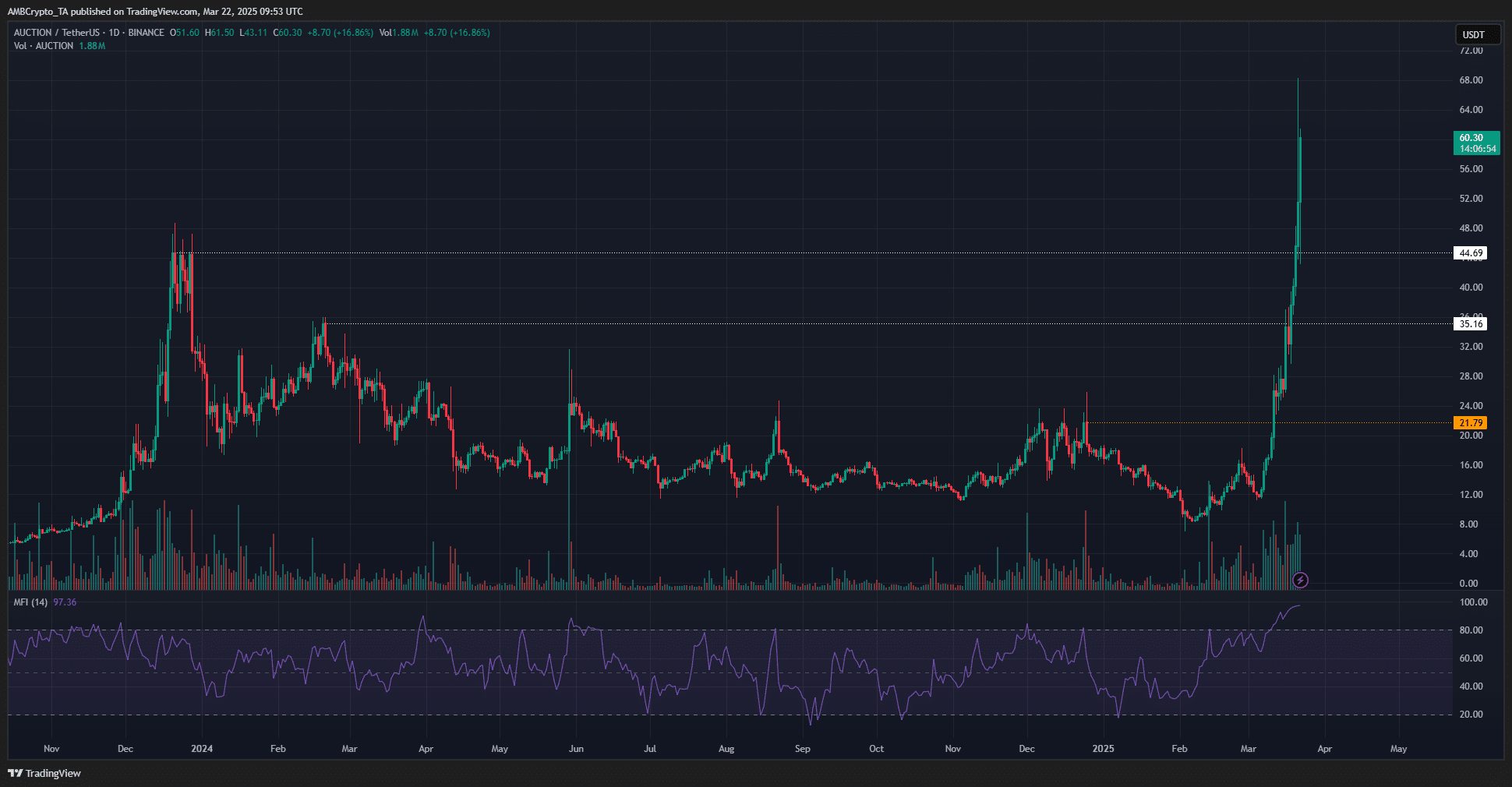

The 1-day value chart revealed that the buying and selling quantity has been growing since February. It outpaced the November-December volumes and maintained its benefit, at the same time as the worth prolonged increased.

The Cash Move Index was at 97 on this timeframe – Its second highest stage after a worth of 98 was posted in July 2023. With AUCTION’s value now only a stone’s throw away from its all-time excessive, it is perhaps an excellent probability to e-book income.

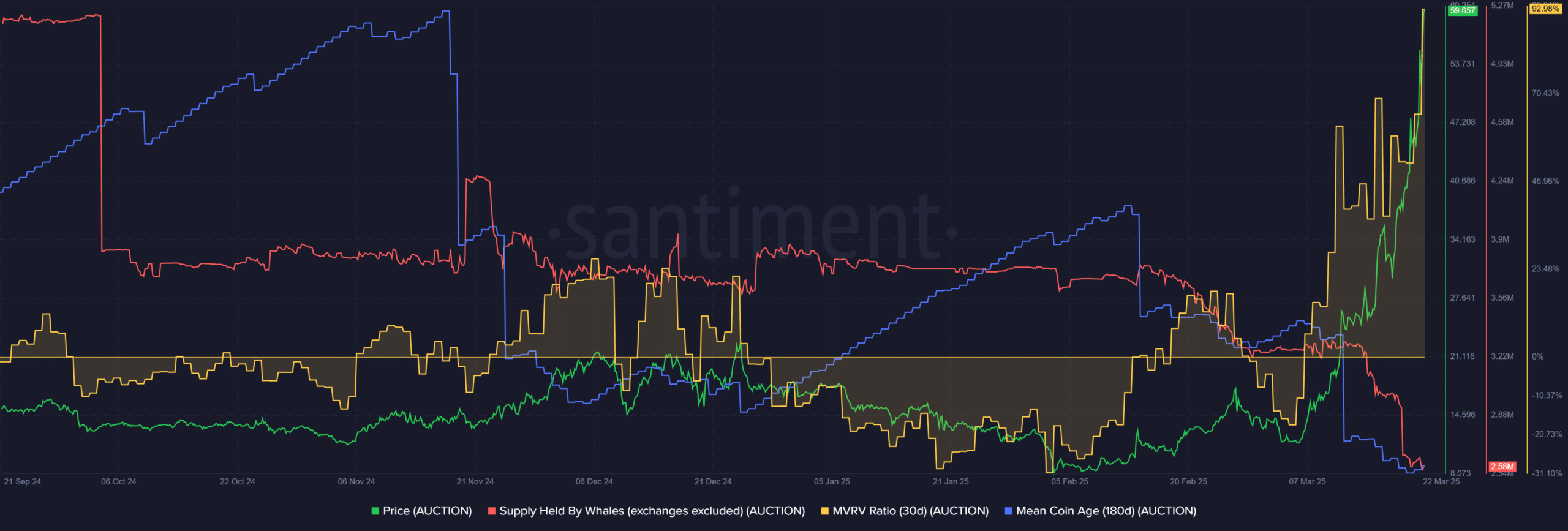

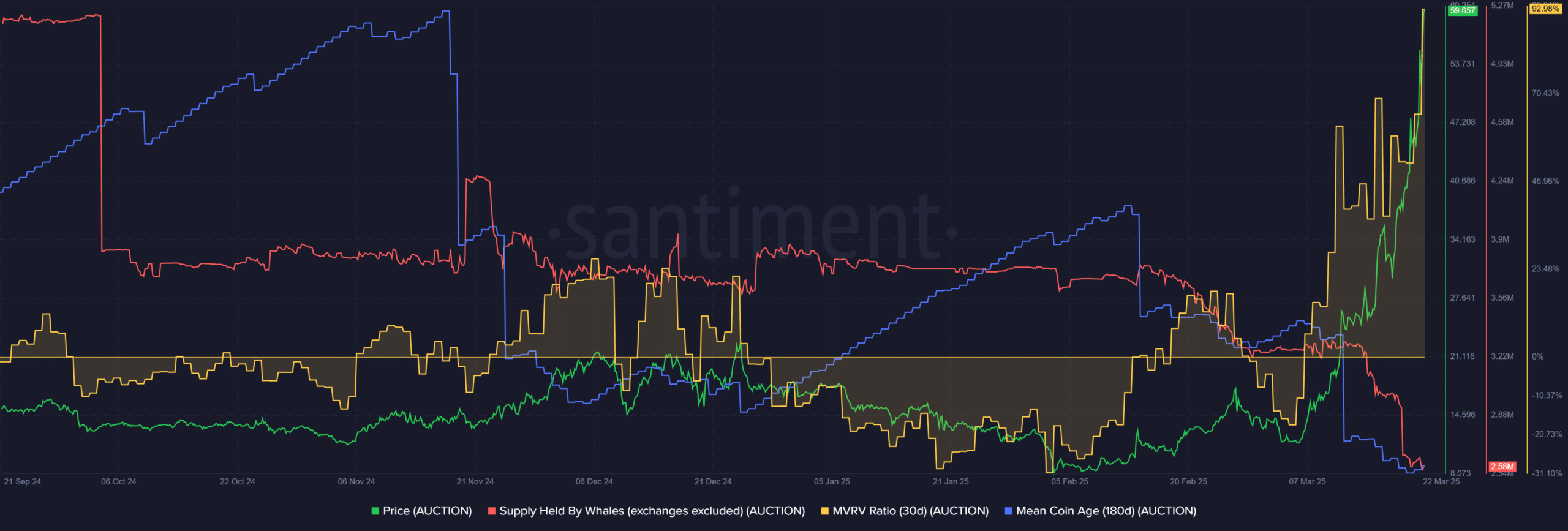

Supply: Santiment

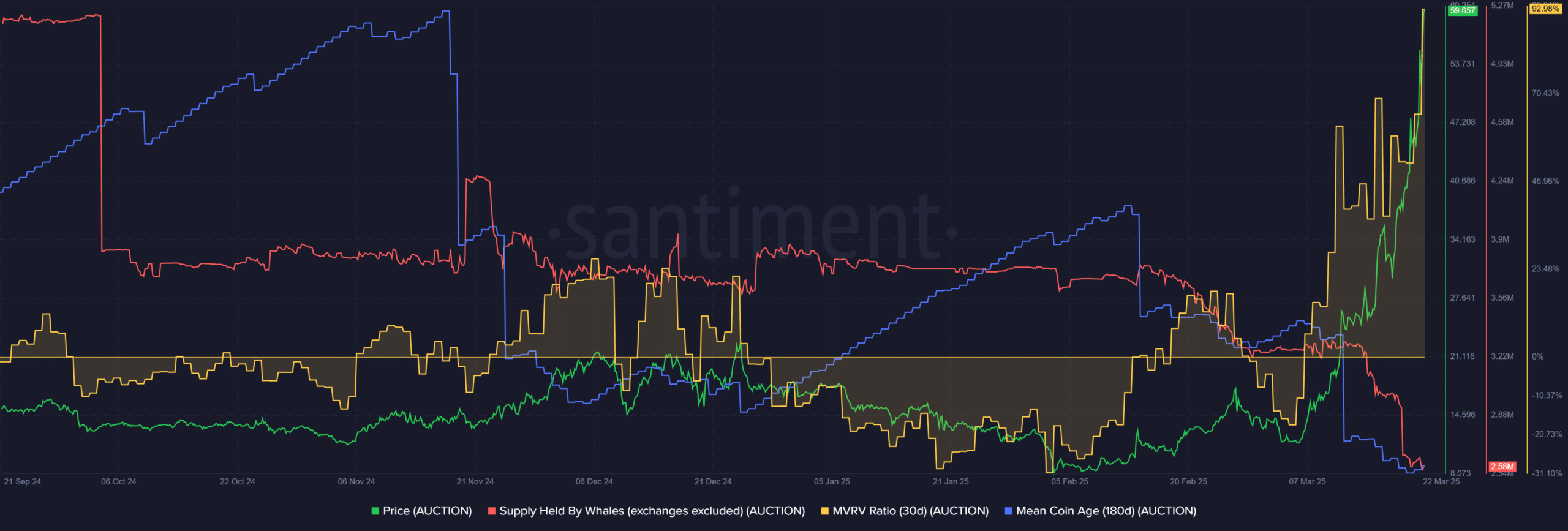

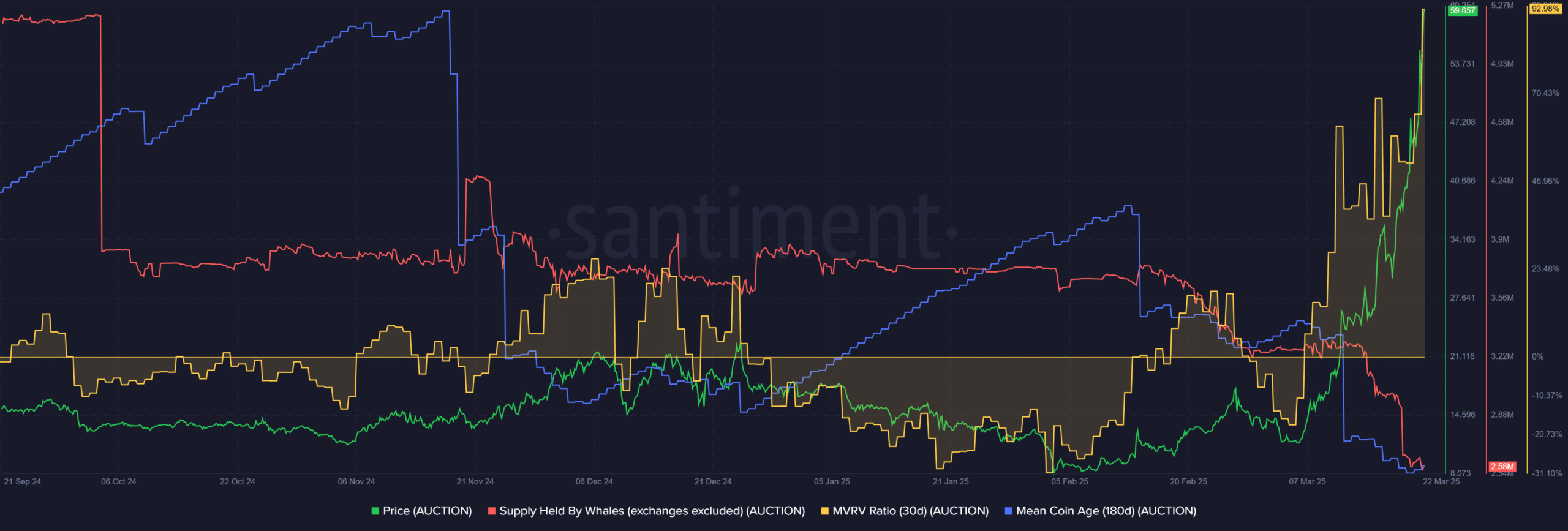

Different superb causes to take income have been illuminated by Santiment metrics. The provision held by whales has been in decline since mid-February. This advised that whale holdings have been in a distribution part.

The Imply Coin Age has additionally been trending south since February. Collectively, they highlighted a network-wide distribution. The decline in whale provide meant that the larger market contributors have been utilizing the rally to take income.

The 30-day MVRV ratio was at 92.98% – The best it has been since December 2023. This implied that short-term AUCTION holders have been, on common, at a excessive revenue. This might be an excellent time to take income, a minimum of partially.

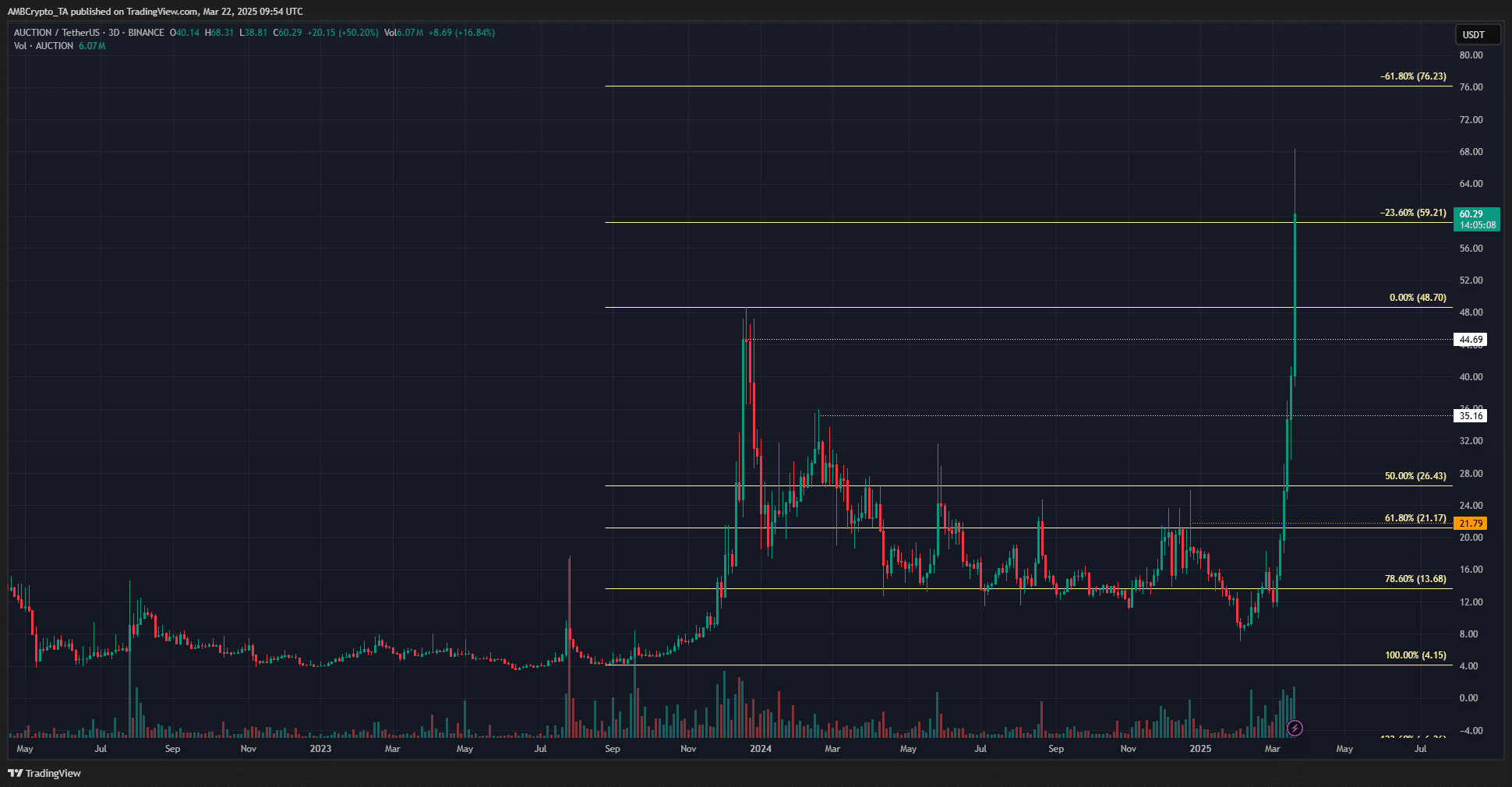

For AUCTION holders decided to HODL, the Fibonacci extension ranges confirmed that the subsequent goal was at $76.23. Past that, the 100% Fibonacci retracement stage confirmed that $93.25 could be the subsequent goal.

These targets could be achievable. The circulating market capitalization of the venture was solely $404 million. Nonetheless, given the sentiment throughout the market and particularly for smaller altcoins, profit-taking is perhaps the prudent plan of action for traders.

New patrons in current days have been in revenue because of the fast positive aspects, however FOMO is perhaps a foul thought. Particularly for the reason that MFI indicated the market was overextended.

- AUCTION may rally to $76 and $93 subsequent

- On-chain metrics revealed that the token flashed distribution tendencies

Bounce [AUCTION] has rallied by 140.89% since final Saturday. On the time of writing, the token was buying and selling at $60.3, with its 24-hour buying and selling quantity remarkably excessive too. In actual fact, CoinMarketCap’s information revealed that the day by day quantity was $1.33 billion. With a market cap of simply $395.84 million, the quantity to mcap ratio stood at 335%.

This gave the impression to be terribly bullish – Within the brief time period. The worth was just below 17% away from its all-time excessive at $70.44 too.

Therefore, the query – Ought to holders take income now, or look forward to extra positive aspects?

Greed and FOMO mustn’t take the higher hand now

The 1-day value chart revealed that the buying and selling quantity has been growing since February. It outpaced the November-December volumes and maintained its benefit, at the same time as the worth prolonged increased.

The Cash Move Index was at 97 on this timeframe – Its second highest stage after a worth of 98 was posted in July 2023. With AUCTION’s value now only a stone’s throw away from its all-time excessive, it is perhaps an excellent probability to e-book income.

Supply: Santiment

Different superb causes to take income have been illuminated by Santiment metrics. The provision held by whales has been in decline since mid-February. This advised that whale holdings have been in a distribution part.

The Imply Coin Age has additionally been trending south since February. Collectively, they highlighted a network-wide distribution. The decline in whale provide meant that the larger market contributors have been utilizing the rally to take income.

The 30-day MVRV ratio was at 92.98% – The best it has been since December 2023. This implied that short-term AUCTION holders have been, on common, at a excessive revenue. This might be an excellent time to take income, a minimum of partially.

For AUCTION holders decided to HODL, the Fibonacci extension ranges confirmed that the subsequent goal was at $76.23. Past that, the 100% Fibonacci retracement stage confirmed that $93.25 could be the subsequent goal.

These targets could be achievable. The circulating market capitalization of the venture was solely $404 million. Nonetheless, given the sentiment throughout the market and particularly for smaller altcoins, profit-taking is perhaps the prudent plan of action for traders.

New patrons in current days have been in revenue because of the fast positive aspects, however FOMO is perhaps a foul thought. Particularly for the reason that MFI indicated the market was overextended.