- APT has a strongly bullish outlook within the coming weeks.

- The short-term bias was additionally bullish however BTC volatility may harm it.

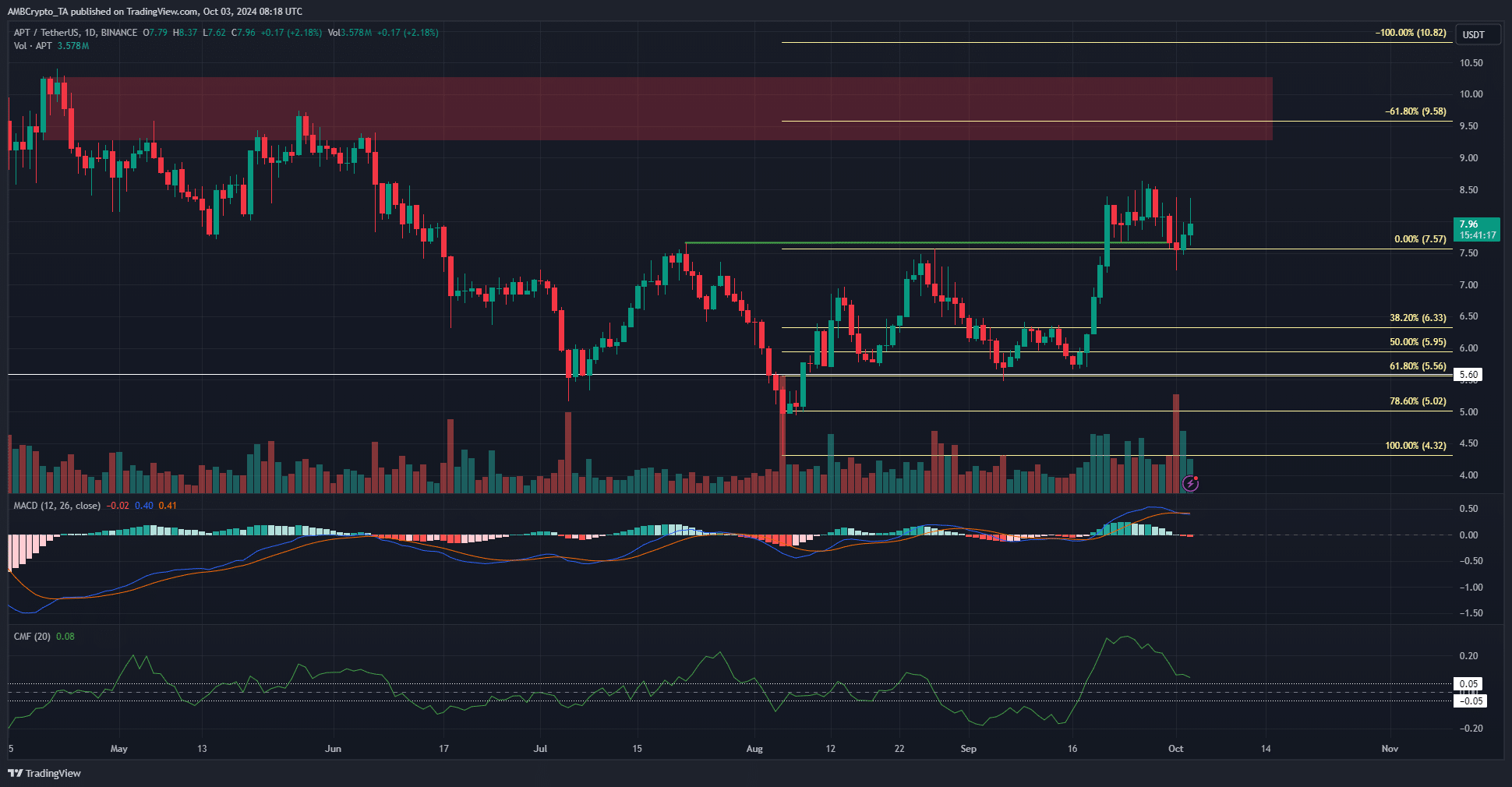

Aptos [APT] has a bullish construction on the weekly chart and maintained its upward trajectory regardless of the volatility and worry out there previously week. The breakout previous $7.5 noticed a pullback alongside the remainder of the market.

But, the upper timeframes didn’t sign a bearish development was in progress. A drop under $7.23 could be the primary signal of a bearish situation. This drop didn’t appear doubtless primarily based on the proof at hand.

Aptos crypto retests August excessive as assist

The volatility on Tuesday, the first of October, noticed Aptos lose 1.56% for the day, however intraday buying and selling was extremely risky. The buying and selling quantity rivaled that of the fifth of August’s panic.

Regardless of this fearful setting, the worth didn’t fall under $7.57. This stage was the excessive in August that was used to plot the Fibonacci retracement and extension ranges. The 61.8% extension at $9.58 lined up nicely with a weekly bearish order block round $10.

The 100% extension stage was at $10.82, a resistance zone from December 2023. Swing merchants might be focusing on these ranges within the coming months.

The development on each the day by day and the weekly charts was bullish, though the MACD shaped a bearish crossover to indicate some bearish short-term momentum. The CMF additionally dropped considerably however was nonetheless above +0.05 to point notable shopping for strain.

Shift within the Open Curiosity developments

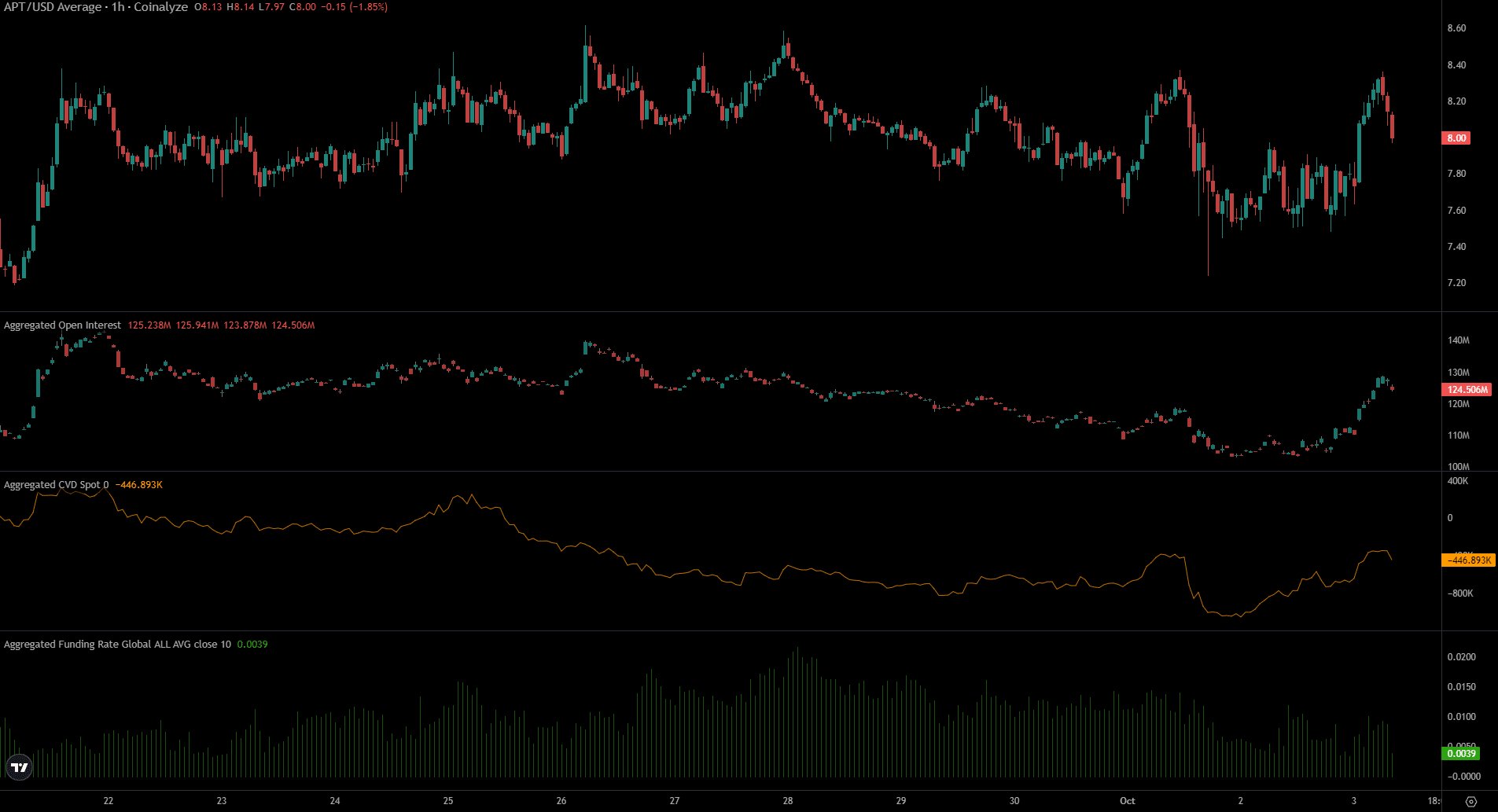

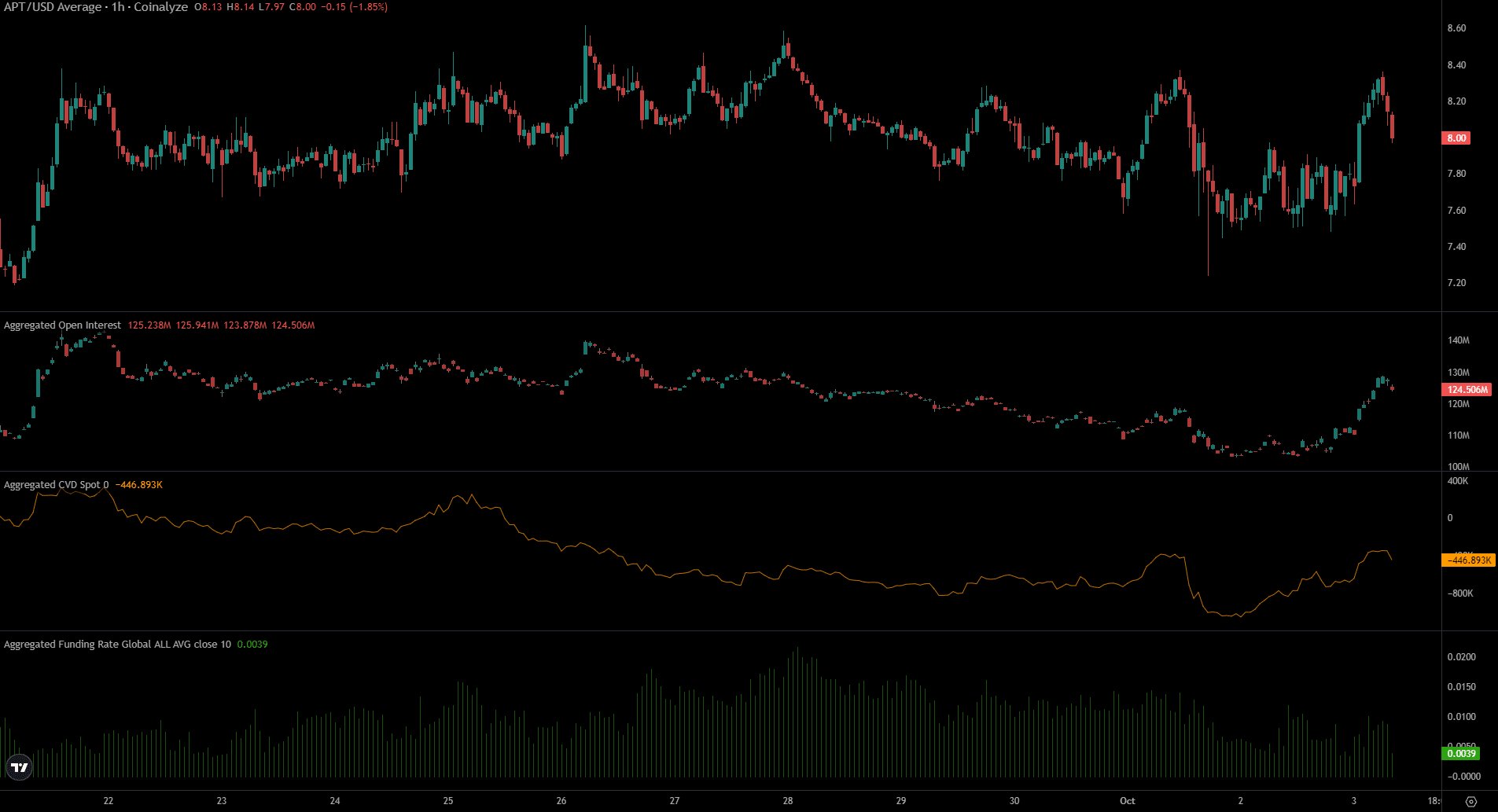

Supply: Coinalyze

The Open Curiosity had been in a downtrend previously week however this modified markedly previously 24 hours. The OI rose from $104 million to face at $124 million whereas APT bounced by 7.2%.

Is your portfolio inexperienced? Verify the Aptos Revenue Calculator

The spot CVD additionally noticed a gradual enhance in current days. Collectively they confirmed that the short-term market sentiment was bullish and members anticipated extra beneficial properties.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion