- SAND’s breakout from a falling wedge sample indicators an 80% value surge if it clears the 100-day shifting common.

- Bullish momentum is supported by rising energetic addresses, decrease trade reserves, and quick liquidations.

The Sandbox [SAND] has confirmed a breakout from its falling wedge sample, elevating anticipation of a major upward value motion. With key targets set at $0.31 and $0.40, analysts are intently watching the 100-day shifting common.

A break above this vital stage may set off an 80% value surge. Will SAND maintain this momentum and ignite a long-term rally?

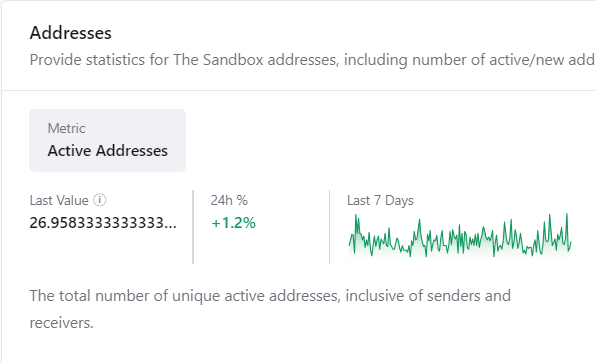

How are transactions and energetic addresses shaping up?

One of many key indicators of market exercise is the variety of distinctive energetic addresses. On the time of press, SAND has 26.96 energetic addresses, reflecting a 1.2% enhance prior to now 24 hours.

Moreover, transaction quantity helps this optimistic momentum, displaying a 1.37% rise to 529 transactions, as per CryptoQuant information.

This regular enhance in exercise signifies that extra customers work together with the community, probably constructing the muse for the anticipated value surge.

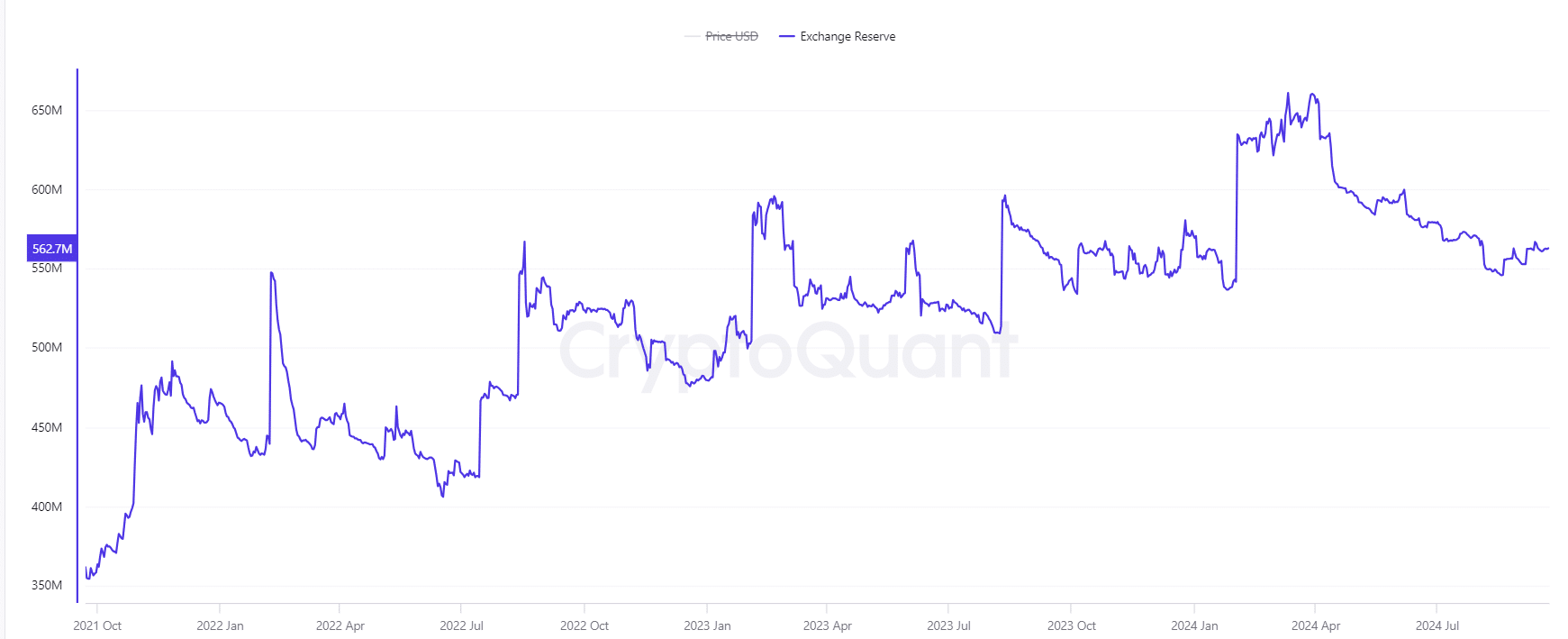

Alternate reserve evaluation: What does it imply?

The trade reserve for SAND at the moment holds 562.76 million tokens. A slight 0.02% lower signifies a discount in promoting strain.

Usually, a falling trade reserve implies that fewer tokens can be found on the market, suggesting that traders are holding onto their belongings in anticipation of a value rise.

Consequently, this aligns with the bullish breakout sample noticed on the every day chart, reinforcing the probability of an upcoming rally.

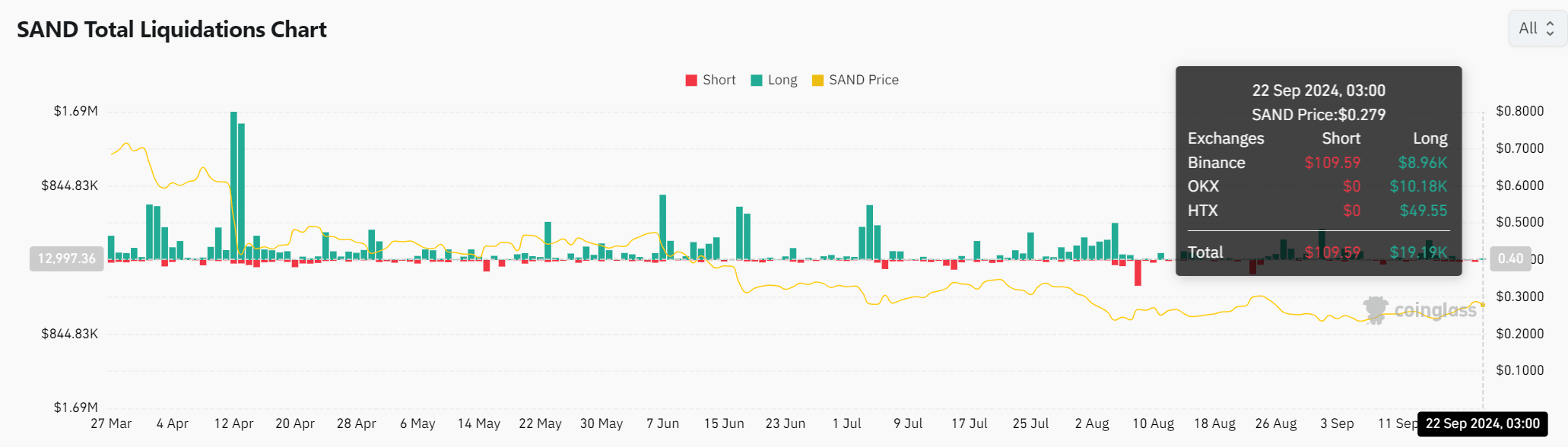

SAND liquidations: Can the bulls take over?

Liquidation information gives a transparent snapshot of market strain. The latest figures reveal that $109.59K of quick positions have been liquidated, in comparison with simply $19.19K in lengthy positions.

This imbalance signifies that merchants betting in opposition to SAND are going through losses because the asset strengthens.

With the worth hovering round $0.279 at press time, this development in liquidations would possibly clear the trail for additional bullish momentum, probably pushing SAND to check the $0.31 goal and past.

Reasonable or not, right here’s SAND market cap in BTC’s phrases

Will SAND maintain its breakout?

With transaction volumes rising, energetic addresses rising, and trade reserves reducing, SAND’s market construction appears well-prepared for a sustained upward transfer. The liquidation information additional bolsters a bullish state of affairs, as quick positions proceed to be squeezed out.

Breaking the 100-day shifting common may solidly place SAND on the trail to important good points, aiming for short-term targets of $0.31 and $0.40.