It appeared like science fiction till November 2022, when OpenAI’s ChatGPT sparked a wave of curiosity in synthetic intelligence’s real-world potential.

Since then, virtually each trade has skilled a whirlwind of AI exercise.

Banks are utilizing AI to hedge dangers, drugmakers are investigating its use to develop higher medicines extra shortly, producers are utilizing it to enhance productiveness, and retailers are utilizing it to enhance provide chains. The navy is even contemplating how AI could assistance on the battlefield.

💵💰Do not miss the transfer: Subscribe to TheStreet’s free each day publication 💰💵

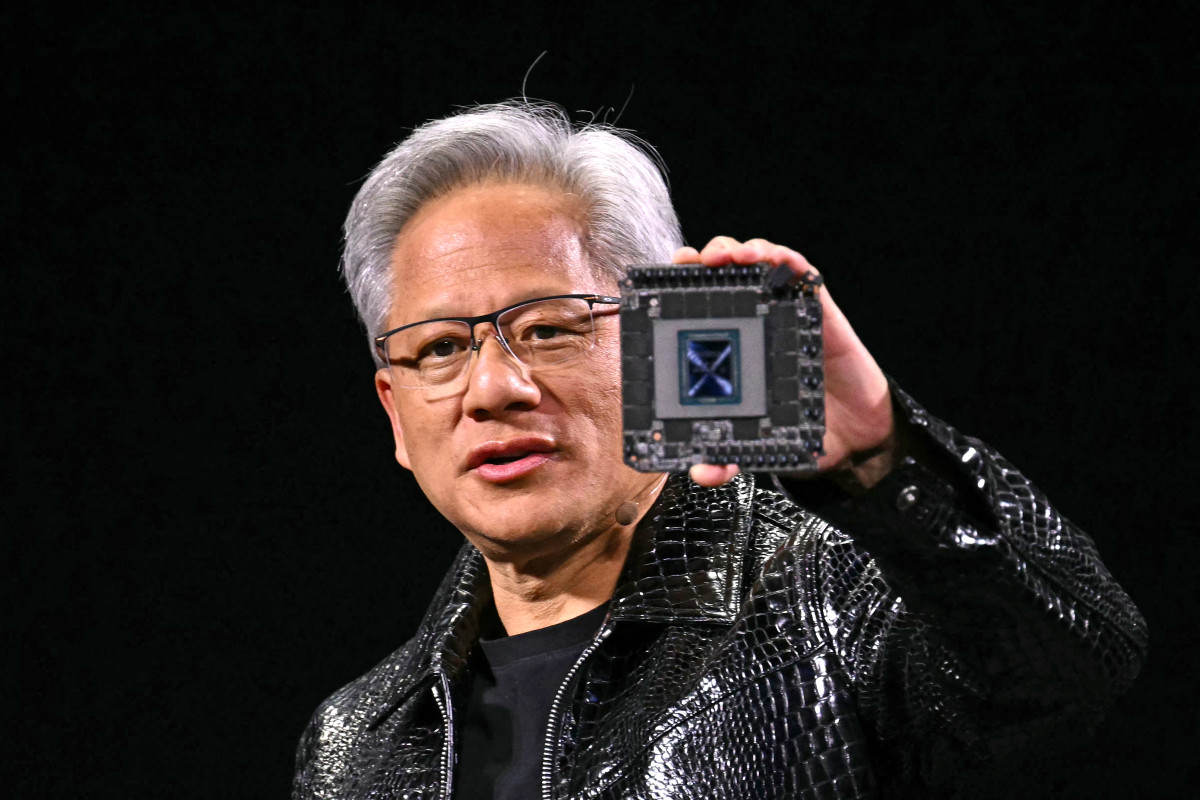

On the middle of all this curiosity sits Nvidia, the world’s largest maker of graphic processing items, or GPUs, ideally suited to coaching and working AI chatbots like ChatGPT, Google’s Gemini, and Microsoft’s CoPilot.

Demand for Nvidia’s chips has been so sturdy that its income and earnings have soared, taking the inventory to arguably stratospheric ranges.

Nvidia’s inventory value rallied 171% in 2024 alone, elevating large questions over whether or not the corporate’s valuation, which now exceeds $2.8 trillion, is stretched.

The most important participant in a fast-growing market

Among the largest know-how firms have ramped their spending to capitalize on the AI alternative.

Associated: Fund supervisor who predicted Nvidia rally revamps inventory forecast

In 2024, Meta Platforms, Microsoft, Google, and Amazon’s capital expenditures totaled $230 billion, up from $144 billion in 2023. In 2025, that spending is anticipated to surge once more to $325 billion. A lot of the rise has gone to upgrading older servers and the silicon chips essential to energy them in cloud networks.

Nvidia is on the forefront of this development due to its high-powered GPUs, which have been finest identified for powering video gaming consoles and mining cryptocurrency earlier than the AI growth.

The surge in demand catapulted Nvidia’s income to $130 billion in 2024 from about $27 billion in 2023.

With a lot cash at stake, Nvidia is plowing {dollars} again into analysis and improvement to stave off rivals, together with Superior Micro Gadgets, which launched its personal AI chips final yr, and firms like Broadcom, which is working with OpenAI to develop its personal chips.

The potential is undeniably massive.

Final October, AMD’s CEO Lisa Su mentioned the GPU market might develop to $500 billion in 2028, or greater than 60% per yr.

Nvidia’s valuation comes underneath the microscope

Expertise shares like Nvidia aren’t identified for being low-cost. Typically, they command larger than market price-to-earnings (P/E) multiples.

Associated: Veteran analyst presents AI spending prediction as worries mount

It isn’t unusual to seek out fast-growing know-how shares buying and selling with P/E ratios within the excessive double digits. Some high-flyers have additionally seen triple-digit multiples that dwarf the S&P 500’s common ahead P/E ratio of about 22.

Given Nvidia’s large run-up, debate has grown over whether or not Nvidia’s inventory value has gotten forward of itself.

Stacy Rasgon, an analyst with Bernstein Société Générale Group, is the most recent analyst to weigh in on the talk. Rasgon’s tackle Nvidia’s valuation could shock you.

Nvidia’s inventory value dropped about 15% this yr as traders turned antsy in regards to the chance of AI spending persevering with to develop quickly.

Rasgon finds that drop “just a little gorgeous,” noting that Nvidia is barely now accelerating gross sales of Blackwell, its latest era of AI chips.

“After yesterday’s rout, the inventory trades at ~25x NTM (subsequent twelve months) earnings, their weakest degree in a yr and near 10-year lows,” wrote Rasgon’s crew in a analysis observe to purchasers. “In truth, the inventory now trades BELOW parity relative to the SOX (one thing we’ve seen solely a couple of times prior to now decade) and at solely a slight S&P premium, the bottom they’ve been since 2016.”

Nvidia’s 5-year trailing P/E low is 26.

The SOX is the Philadelphia Semiconductor Index, comprising 30 of the biggest semiconductor shares.

Final quarter, Nvidia offered $11 billion price of Blackwell chips. On its fourth-quarter convention name, Nvidia CEO Jensen Huang mentioned it was the quickest ramp in Nvidia’s historical past.

“Our post-earnings conversations with the corporate indicated the $11B in FQ4 Blackwell revenues all shipped in January (suggesting the floodgates are actually open) and the corporate indicated to us that demand will proceed to exceed provide for the subsequent a number of quarters as they ramp,” added Rasgon.

Extra Nvidia:

- Nvidia-backed startup could possibly be hottest tech IPO of the yr

- Fund supervisor who predicted Nvidia rally revamps inventory forecast

- Shocking information hits Nvidia inventory value

If true, then Blackwell’s gross sales might proceed supporting Nvidia’s income development, and as soon as manufacturing is at scale, profitability ought to bounce again.

Gross margin is anticipated to fall to 71% this quarter. It was 73% final quarter, down from 76% within the yr prior. Nvidia says it ought to rebound to a mid-70% margin later this yr.

Blackwell’s gross sales potential and the possibility for a rebound in margin might imply that Nvidia is within the discount rack, given its comparatively low P/E ratio in comparison with its historic ranges.

“Valuation is getting more and more engaging,” mentioned Rasgon.

Bernstein’s Nvidia inventory value goal is $185.

Associated: Veteran fund supervisor unveils eye-popping S&P 500 forecast