- AMP to proceed its ascent if it cements its standing above the $0.009176 degree.

- Regardless of AMP’s lively addresses hitting new highs since Might, 72% of the holders nonetheless in loss.

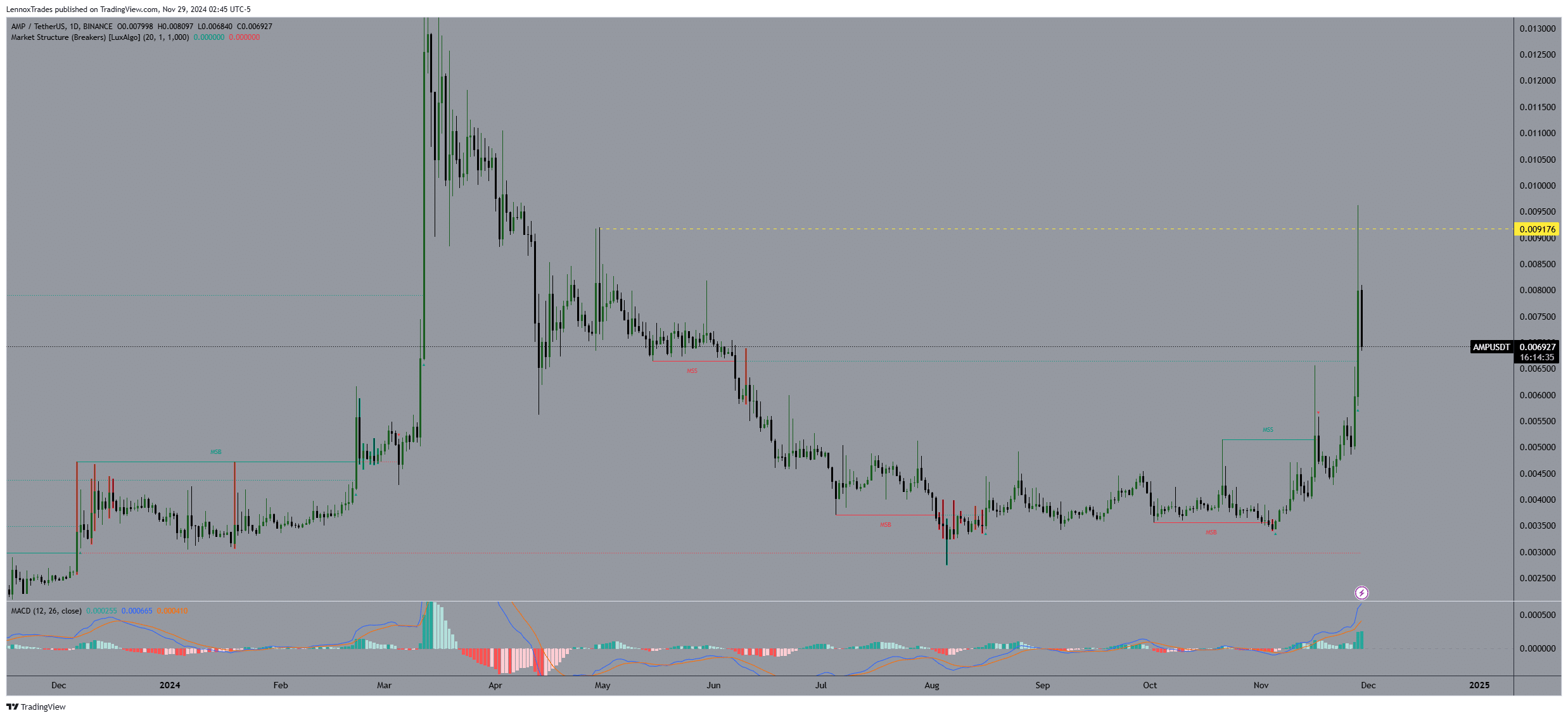

Amp crypto [AMP] noticed a value surge of greater than 30% within the final 24 hours as of press time, with each day buying and selling quantity replicating comparable success with a 5X surge as per CoinMarketCap.

The value of AMP crossed a vital resistance degree at $0.009176, signaling a powerful shopping for curiosity and potential shift towards bullish dominance out there.

This breakthrough coincided with a transparent LuxAlgo Market Construction Breaks sign that turned bullish, indicating that AMP’s market construction on the each day timeframe has transitioned from bearish to bullish.

This was a key second for AMP because it instructed a sustained upward motion might be on the horizon if the value maintains above this degree.

The MACD additional supported this optimistic outlook. The MACD line decisively crossed above the sign line, and the histogram mirrored rising bullish momentum. This was evident because the bars lengthen additional above the zero line.

Furthermore, the latest spike in value pushed AMP’s valuation nearer to the $1 Billion market cap making it the following goal if it continues to carry above the $0.009176 degree.

The following logical goal in line with the present momentum and market sentiment may properly be larger value zones, doubtlessly resulting in a retest of earlier highs and even setting new data.

Energetic addresses attain new highs

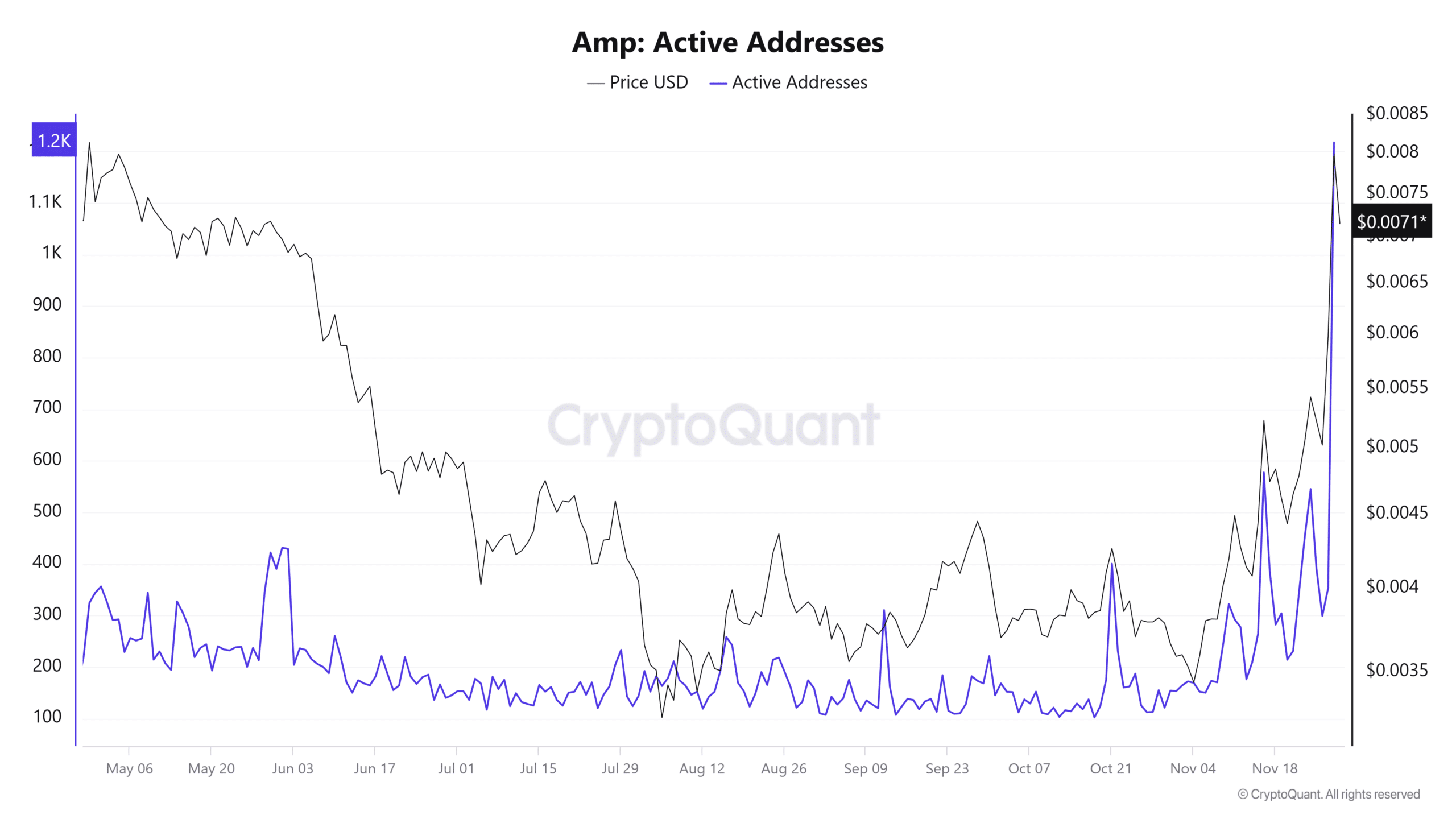

Monitoring AMP’s lively addresses and value revealed a noteworthy surge in person engagement, with lively addresses reaching ranges not seen since early Might.

This improve in lively addresses correlated strongly with a pointy rise in AMP’s value, suggesting a heightened market curiosity and probably speculative exercise.

The latest spike in lively addresses, reaching a peak alongside the value, indicated a sturdy engagement from merchants and traders, doubtlessly pushed by new developments or growing utility inside its community.

This development was a constructive sign for AMP’s ecosystem, reflecting rising person adoption and curiosity.

Energetic AMP holders profitability

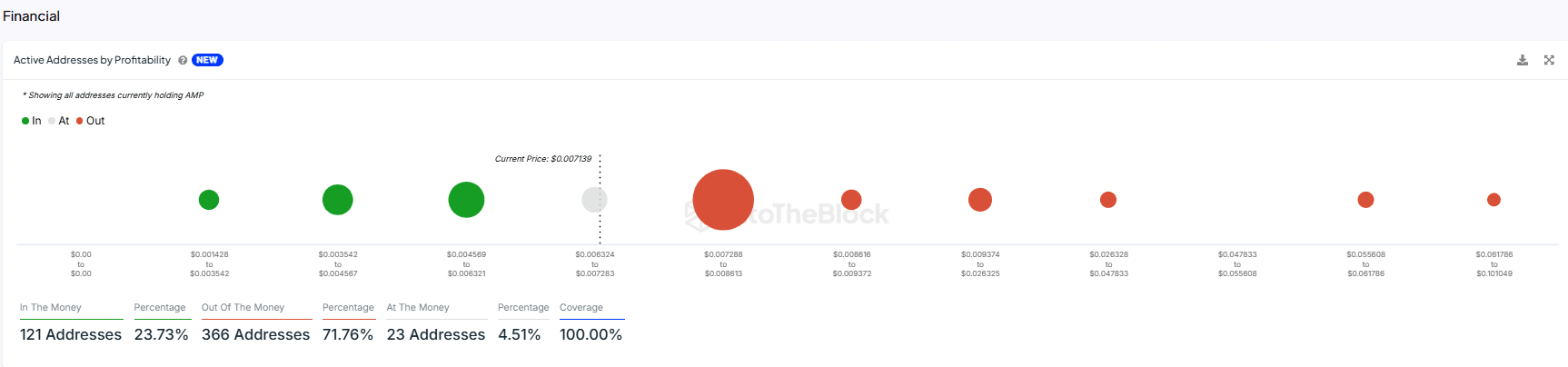

Evaluation of the variety of lively addresses confirmed 71.76% or 366 addresses had been “Out of the Cash” (experiencing losses), reflecting its risky nature and the way AMP has been been within the drawdown for lengthy however its holders had been resilient.

The profitability of AMP holders damaged down in positions relative to their value foundation additional famous solely 23.73% of addresses had been “Within the Cash” (benefiting from their holdings), encompassing 121 addresses.

Moreover, a small fraction, 4.51% which amounted to 23 addresses, had been “On the Cash,” indicating their buy value aligned carefully with the present AMP value of $0.007139.

This distribution instructed that regardless of the latest surge in lively addresses since early Might, most holders had been going through losses, which could have an effect on sentiment and future buying and selling habits.

- AMP to proceed its ascent if it cements its standing above the $0.009176 degree.

- Regardless of AMP’s lively addresses hitting new highs since Might, 72% of the holders nonetheless in loss.

Amp crypto [AMP] noticed a value surge of greater than 30% within the final 24 hours as of press time, with each day buying and selling quantity replicating comparable success with a 5X surge as per CoinMarketCap.

The value of AMP crossed a vital resistance degree at $0.009176, signaling a powerful shopping for curiosity and potential shift towards bullish dominance out there.

This breakthrough coincided with a transparent LuxAlgo Market Construction Breaks sign that turned bullish, indicating that AMP’s market construction on the each day timeframe has transitioned from bearish to bullish.

This was a key second for AMP because it instructed a sustained upward motion might be on the horizon if the value maintains above this degree.

The MACD additional supported this optimistic outlook. The MACD line decisively crossed above the sign line, and the histogram mirrored rising bullish momentum. This was evident because the bars lengthen additional above the zero line.

Furthermore, the latest spike in value pushed AMP’s valuation nearer to the $1 Billion market cap making it the following goal if it continues to carry above the $0.009176 degree.

The following logical goal in line with the present momentum and market sentiment may properly be larger value zones, doubtlessly resulting in a retest of earlier highs and even setting new data.

Energetic addresses attain new highs

Monitoring AMP’s lively addresses and value revealed a noteworthy surge in person engagement, with lively addresses reaching ranges not seen since early Might.

This improve in lively addresses correlated strongly with a pointy rise in AMP’s value, suggesting a heightened market curiosity and probably speculative exercise.

The latest spike in lively addresses, reaching a peak alongside the value, indicated a sturdy engagement from merchants and traders, doubtlessly pushed by new developments or growing utility inside its community.

This development was a constructive sign for AMP’s ecosystem, reflecting rising person adoption and curiosity.

Energetic AMP holders profitability

Evaluation of the variety of lively addresses confirmed 71.76% or 366 addresses had been “Out of the Cash” (experiencing losses), reflecting its risky nature and the way AMP has been been within the drawdown for lengthy however its holders had been resilient.

The profitability of AMP holders damaged down in positions relative to their value foundation additional famous solely 23.73% of addresses had been “Within the Cash” (benefiting from their holdings), encompassing 121 addresses.

Moreover, a small fraction, 4.51% which amounted to 23 addresses, had been “On the Cash,” indicating their buy value aligned carefully with the present AMP value of $0.007139.

This distribution instructed that regardless of the latest surge in lively addresses since early Might, most holders had been going through losses, which could have an effect on sentiment and future buying and selling habits.