Market Outlook #261 (twenty seventh March 2024)

Howdy and welcome to the 261st instalment of my Market Outlook.

On this week’s submit, I might be masking Bitcoin, Ethereum, Dogecoin, Synthetix, Mina, Kusama. Perpetual Protocol and Litentry.

This submit, I’m taking a look at Binance-listed alts which have had close to two-year accumulation ranges which are solely simply breaking out. We’ve had months of on-chain mania, however nothing actually occurring on CEXes, and I believe we’re on the cusp of issues heating up for conventional retail, which suggests centralised exchanges. It additionally means much less charges for us…

Subsequent week, we’ll be doing a quarterly overview and taking a look at broader market views.

As ever, when you have any requests for subsequent week, please do let me know by way of e mail or within the feedback.

Bitcoin:

Weekly:

Every day:

Value:

Market Cap:

Ideas: If we start by taking a look at BTC/USD on the weekly, we are able to see that the parabola continues to be very a lot intact for now and that final week noticed demand step in at $61k, pushing worth all the best way again in direction of the weekly open, the place the pair closed out at $67.2k. This week’s early price-action has seen consolidation proper round prior cycle highs at $69k, with BTC rallying off the weekly open via $69k into $71.6k earlier than discovering resistance and now sitting simply above that key stage which has capped the weekly closes for the previous three weeks. From right here, given the power of the buyback late final week after pushing low into the 60s, I’d anticipate continuation increased while the parabola holds, with any weekly shut above $69k being the sign for worth discovery, for my part. If we get that acceptance above $69k going into the tip of the month and the quarter, I believe April is tremendous bullish for BTC. Clearly if we proceed to reject at $69k, the extra probably it turns into that we lose momentum right here and break the parabola, resulting in an extended interval of consolidation earlier than continuation increased.

If we drop into the day by day, we are able to see the three eventualities I marked out final week, with worth following a good sharper path than the extra bullish trajectory however mainly mapping it out with that increased low adopted by continuation via prior cycle highs. On this timeframe, we did shut again above $69k a few days in the past and consolidated above it yesterday; I’d now prefer to see a wick beneath that stage that results in one other shut above $60k, confirming it as help, from which level I’d be seeking to $77k adopted by the 1.618 extension of this vary into $86.7k. Now, the bearish situation could be for one more rejection up right here, having closed above $69k after the higher-low, which results in $69k turning into resistance as soon as once more over the following couple of days. In that occasion, we might anticipate to see one other run at $61k within the subsequent week or two earlier than enjoying out that extra shallow continuation sample that protects the parabola into late April. As we’ll see within the quarterly overview subsequent week, so long as we’re closing out March above $61k all of it appears to be like fairly nice for the following quarter.

Ethereum:

ETH/USD

Weekly:

Every day:

ETH/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: If we take a look at ETH/USD on the weekly, we are able to see that the pair adopted BTC increased after the dump final week, bottoming out at $3057 earlier than closing the week at $3454. Weekly RSI reset and is now in a pleasant spot for continuation increased. Early price-action this week has seen rejection round prior help turned resistance at $3580 and it’s key we now shut again above this stage: reject and transfer to contemporary weekly lows beneath $3400 and I believe we take one other stab at $3000 earlier than bottoming. Conversely, maintain above $3600 going into April and I believe that month sees the march to all-time highs. Dropping into the day by day, we are able to see the extra bullish sample enjoying out right here with that increased low above $3284, and so from right here we have to see worth defend that stage on any flush decrease intraweek after which shut via $3580 going into the tip of the week, the place I’d then anticipate $3725 to change into reclaimed help and result in contemporary yearly highs via $4117 in early April. If we reject right here and shut beneath $3284, that might look very very like a lower-high and soon-to-be lower-low, with $3057 turning into a simple sweep from there, which might make that longer consolidation into summer time look extremely possible earlier than the run at new highs begins.

Turning to ETH/BTC, there may be little or no change right here at current, as final week noticed continued consolidation beneath the 360wMA as help turned resistance and help at 0.051, on which the pair is sat proper now. If we shut this week beneath this multi-month help stage, I’d anticipate one other leg decrease to start for the pair via 0.049 into 0.046 in April, probably appearing as a spring, very like the Might/June 2022 low formation. Till we get a weekly shut via 0.06, there may be nothing however continued chop to anticipate for this. Briefly turning to the day by day, we are able to see how help grew to become resistance at 0.0533 final week and worth retraced your entire push off 0.051 help, indicating that this subsequent take a look at is unlikely to be fruitful. Shut the day by day beneath 0.051 and retest it from beneath as resistance and I believe 0.046 is all however assured from there.

Dogecoin:

DOGE/USD

Weekly:

Every day:

DOGE/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with DOGE/USD, on the weekly we are able to see that worth has emerged from a near-two-year vary right here, having been capped by $0.12 because the breakdown in Might 2022 aside from one transient faux out. This additionally aligned with the 200wMA on the previous couple of makes an attempt, however final month the pair broke via $0.12, pushing into $0.15, the place it closed, confirming the breakout. Since, the pair has held above the vary for 4 week, wicking final week in direction of the vary resistance and 200wMA however front-running it as help and shutting at weekly highs round $0.177. We are actually consolidating proper beneath help turned resistance at $0.19 and the 23.6% fib of the bear market – the primary main resistance stage since breaking out. Given the construction right here, I’m anticipating to see a weekly shut via $0.19 in April that results in a push in direction of the following main stage at $0.33, which aligns with the 38.2% fib. Momentum indicators are additionally pointing up. Trying on the day by day, we are able to see that RSI reset to the mid-range on the latest dump, with DOGE v-reversing your entire sell-off to consolidating at yearly highs. If we do settle for above $0.19, the 1.618 extension of the present uptrend additionally sits proper round that resistance cluster at $0.33, offering extra confluence for that stage. Let’s see what early April brings…

Turning to DOGE/BTC, we are able to see that trendline resistance from the April 2021 all-time highs continues to be capping worth, as is the 200wMA at 300 satoshis, beneath which worth is at present sat, however final week noticed help discovered above the 360wMA at 186 and weekly construction maintain as bullish. So long as we are able to now maintain above 244, I believe we see the following leg break via 300 satoshis and thru that trendline, with any weekly shut above that cluster of resistance opening up what’s prone to be a really sharp reversal, as is at all times the case with DOGE. If we do settle for above 300, I’m taking a look at 480 as the following main stage of help turned resistance, however finally I’d anticipate this to proceed to rocket in direction of the all-time excessive at 1290 satoshis within the house of some months. Once more, dropping briefly into the day by day, we are able to see how the 360dMA and 200dMA are actually appearing as help, with the latter having capped most of the rallies for over a yr. We’ve got a higher-low formation at 200 satoshis and the following leg ought to take us into 340 satoshis as a primary goal, adopted by 480 satoshis.

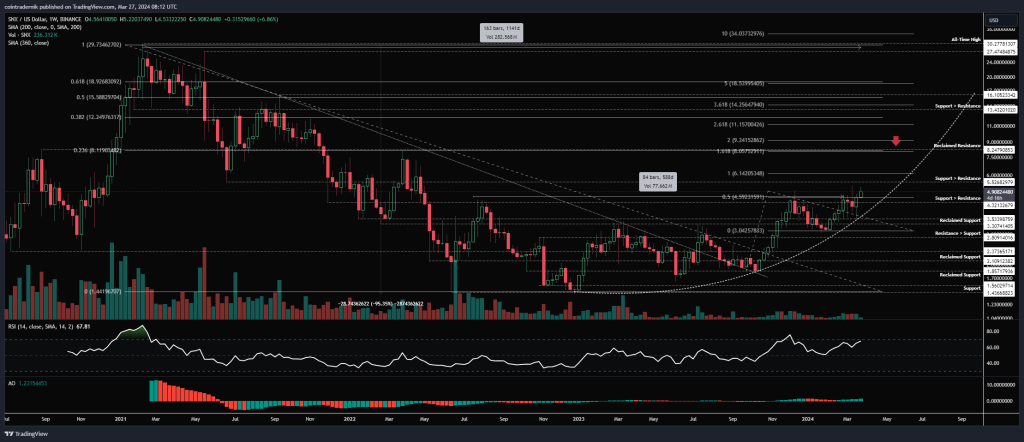

Synthetix:

SNX/USD

Weekly:

Every day:

SNX/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with SNX/USD, on the weekly we are able to see that following the weekly construction reverting to bullish on the shut via $3.30, worth has fashioned the next low above prior resistance turned help at $3 and continued increased, marking out the beginnings of an uptrend and a sustained reversal. We are actually pushing via help turned resistance at $4.30 – a stage that had capped worth for nearly two years prior. Acceptance above this stage will open up the following phases of the market cycle for SNX, with an enormous open vary from this space into $8.25, with solely minor resistance at $5.50. That $8.25 are can also be the 1.618 extension of the present development, in addition to the 23.6% retracement of the bear market, so a lot of confluence for that space. Lastly, we even have a very tight parabola enjoying out from the December 2022 backside, and if it continues to carry we must always see acceleration going into summer time, with a return to the 50% fib retracement and September 2021 highs at $16 someday earlier than September this yr. Dropping into the day by day, we are able to see how there was some exhaustion on the latest push into $5.25, and worth rejected, reset momentum indicators and v-reversed your entire dump, showcasing power right here. So long as we now maintain above $4.30 this week, I believe we push via $5.50 and from there it’s clear skies in direction of $8.25.

Turning to SNX/BTC, we are able to see that the pair has been in a long-term downtrend because the 2020 highs, with a steeper trendline resistance in place since mid-2022, capping the key highs throughout that point. Not too long ago, the pair additionally closed beneath multi-year help at 7500 satoshis, pushing final week into 5400 satoshis and now sat proper again up close to that multi-year help. Now, this might go one in all two methods: both SNX continues to under-perform and the multi-year downtrend persists, or we get an enormous sign to leap in. The latter could be the case if we, having closed beneath help and fashioned a spring, now reverse and settle for again above 7500 turning it into help once more. I’d think about that the primary half of a serious reversal sign. From there, we might look to choose up spot with a view so as to add extra on a weekly shut above that trendline, probably round 9000 satoshis. Acceptance above that stage and I believe SNX begins a brand new bull cycle. If we briefly drop into the day by day, I’ve marked out how this may occasionally play out, with 6900 appearing as the next low earlier than the reclaim of 7500 and continuation increased. I might be maintaining a tally of this for that setup as it’s one in all my favoured backside formations.

Mina:

MINA/USD

Weekly:

Every day:

MINA/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with MINA/USD, we are able to see from the weekly that worth has been consolidating all of this yr after a multi-month run late final yr, with $1.75 now appearing as main resistance, the place the 23.6% fib of the bear market additionally lies. Weekly construction continues to be bullish right here and I’d anticipate to see that increased low at $1 maintain agency; we might sweep it and rally off the sweep, or maintain this higher-low that’s at present in place, however what bulls don’t wish to see is a weekly shut again inside that $1 stage that capped MINA since June 2022. If we do sweep it and shut again above it, that could be a actually clear lengthy sign. Trying forward, I’m anticipating upside decision of this consolidation vary with a weekly shut via $1.80, which is able to result in the following leg increased into $2.50 as main help turned resistance. From there, I believe we see the mid-range tagged at $3.50, which is main resistance. Dropping into the day by day, we are able to see that day by day construction is bearish right here with the lower-low on the break beneath $1.25, however that is simply traditional chop inside a broader vary between $1-1.75, to be sincere. Till we see acceptance via both facet of the vary, I wouldn’t be leaping into any levered positions, solely seeking to maintain spot or add to to identify nearer to the underside of the vary in case you aren’t positioned.

Turning to MINA/BTC, we are able to see that after that massive run up into 3750 satoshis, worth fashioned a decrease excessive and broke again beneath main help now reclaimed as resistance at 2275 satoshis, with some trendline resistance forming. We are actually sat again round prior resistance turned help at 1750 and the consolidation that preceded the earlier run increased. Weekly RSI has been reset and if this market is bullish we must always now see the formation of a low above 1595 satoshis that results in a breakout and shut above trendline resistance and 2400 satoshis. In case you are ready on the side-lines, I’d look so as to add some spot on this space after which fill you place on that shut again above 2400 satoshis as affirmation of continuation increased. Trying on the day by day, we are able to see that worth is consolidating beneath the 200dMA and 360dMA right here, which isn’t the very best signal, however we do have development exhaustion throughout indicators on this most up-to-date push decrease, offering some confluence for a backside formation. Once more, the primary factor to concentrate to right here is that transfer via 2400 – after we see that, then we are able to have assured in continuation increased.

Kusama:

KSM/USD

Weekly:

Every day:

KSM/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: If we start by taking a look at KSM/USD, we are able to see that worth has been capped by help turned resistance at $62.70 since June 2022, lately rejecting off it and forming a higher-low above $33.94, with $43.15 appearing as help. These higher-lows forming with that multi-year flat resistance overhead makes me suppose we see a breakout within the coming weeks, with any weekly shut via that stage opening up an enormous vary in direction of $105 as the following resistance, with long-term trendline resistance above that close to $160, which might even be the 23.6% fib of the bear market. So long as this now holds above $34, I believe the following part of its market cycle is imminent.

Turning to KSM/BTC, we are able to see the pair has been trending decrease for over 1000 days, forming a backside at 66k satoshis late final yr, rallying via long-term trendline resistance into 130k satoshis earlier than retracing now into 70k satoshis, the place bulls wish to see the formation of a better low. So long as 66k is now defended, we must always see worth push again above 91k within the coming weeks, which might clearly mark out that higher-low formation from which the reversal can emerge going into the summer time. Trying briefly on the day by day, we are able to see how sharply the 360dMA and 200dMA have been trending decrease, with the latter capping rallies, earlier than the pair reversed into the New Yr. We’ve got since damaged again beneath each MAs, however this isn’t unusual with altcoin cycles, and what we are actually searching for is that push again above 91k that also needs to deliver the 200dMA above the 360dMA and mark out the start of the bull cycle for the pair. Having appeared on the prior cycle bottoms, alts would normally get round 300 days of upside after this crossover.

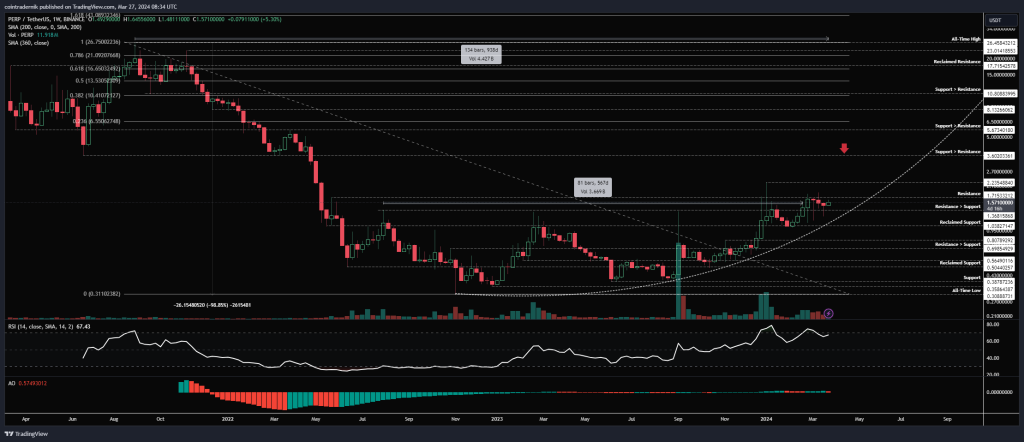

Perpetual Protocol:

PERP/USD

Weekly:

Every day:

PERP/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with PERP/USD, firstly wish to spotlight how comparable the bottoming formation right here is to SNX/USD, we that multi-year vary resistance capping costs, however higher-lows forming the beginnings of a parabola. Value then depraved via vary resistance earlier this yr, retraced into reclaimed help at $1.04 and held a higher-low, and since rallied via vary resistance, now consolidating with it as help for just a few weeks. We wish to see this parabola maintain right here and worth push off this help over the following week or two via $1.70 into contemporary yearly highs past $2.25, with $3.60 as the following key resistance above it. Turning to the day by day, we are able to see how we’re forming higher-highs and higher-lows after that $1.04 stage held as help however there isn’t an enormous quantity of momentum right here, therefore the choppier behaviour. I’d anticipate to see extra clearly trending price-action above $2. If we do settle for above that space, the 1.618 extension of this development ought to take us proper into that $3.60 stage which I’ve had marked out for months now as a magnet.

Taking a look at PERP/BTC, what I wish to spotlight right here is the distinction in bottoming formation with SNX/BTC. Reasonably than the continued downtrend, we flattened out at all-time lows round 1500 satoshis after which turned weekly construction bullish, now holding above key reclaimed help at 1950 satoshis. That is indicative of underlying power in PERP vs SNX, and will manifest in higher upside when issues tick increased. From this space, we must always proceed to carry 1950 as help and break again above 2600 satoshis from right here, starting the following leg up into 3600 satoshis and past. Solely as soon as we see a weekly shut via 3600 satoshis, nonetheless, can we be assured in disbelief turning into hope and the market cycle persevering with, with 5900 satoshis the key resistance above that, adopted by 8460.

Litentry:

LIT/USD

Weekly:

Every day:

LIT/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Lastly, if we take a look at LIT/USD on the weekly timeframe, we are able to see that the pair had been consolidating for nearly two years with $1.40 as vary resistance, however just a few weeks in the past the pair closed via trendline resistance from the all-time excessive after which via that vary resistance, now turning it into help and consolidating beneath resistance at $1.90. I’d anticipate this breakout to lead to continuation via $1.90 which is what the momentum indicators are suggesting right here, which might start Litentry’s first ever bull cycle. Dropping into the day by day, we are able to see how cleanly resistance is being flipped as help right here and the present development ought to see us lengthen into $2.20 within the coming weeks, the place we might then wish to maintain above $1.90 as a higher-low earlier than pushing in direction of $2.90. I might be seeking to maintain this all through the cycle, nonetheless, because it has by no means skilled a full bull and is well accessible for retail merchants, so I’m anticipating not less than a retest of all-time highs earlier than the cycle peaks.

Turning to LIT/BTC, we are able to see that not like the Greenback pair the BTC pair continues to be beneath trendline resistance however volatility has utterly flattened right here with development exhaustion evident. We’ve got been consolidating between help turned resistance at 2800 satoshis and vary help round 2050 satoshis, and I’d anticipate the transfer via $2 on the Greenback pair to deliver with it a breakout past trendline resistance and vary resistance right here, which is able to give me extra confidence within the new cycle starting for Litentry. As soon as we’re above 3000 satoshis, I believe we start a parabola with 6200 satoshis as the primary main resistance, adopted by 12.2k satoshis.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be happy to go away any feedback or questions beneath, or e mail me immediately at nik@altcointradershandbook.com.