We lately studied how trades velocity across the market — usually ranging from a dealer order in Secaucus, touring on the velocity of fiber to take orders on exchanges across the market, then inflicting a response perform on the velocity of microwave.

At this time, we’re taking a look at how quote updates usually stream across the market.

What we discover is that major itemizing exchanges set the brand new Nationwide Greatest Bid and Provide (NBBO) more often than not. Then, most venues see orders arriving at a reasonably constant price over time, however some venues have a speedy improve in quotes on the new NBBO inside the first millisecond.

Whether or not that’s good or dangerous for market construction and routers is an fascinating query.

Itemizing venues set probably the most NBBOs

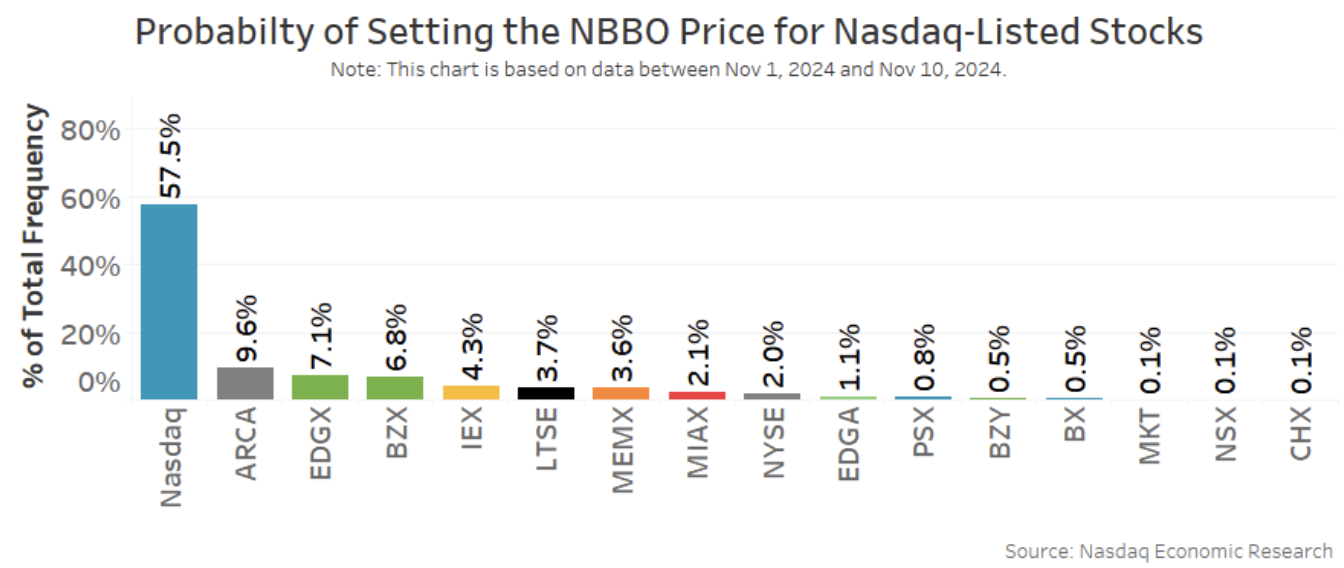

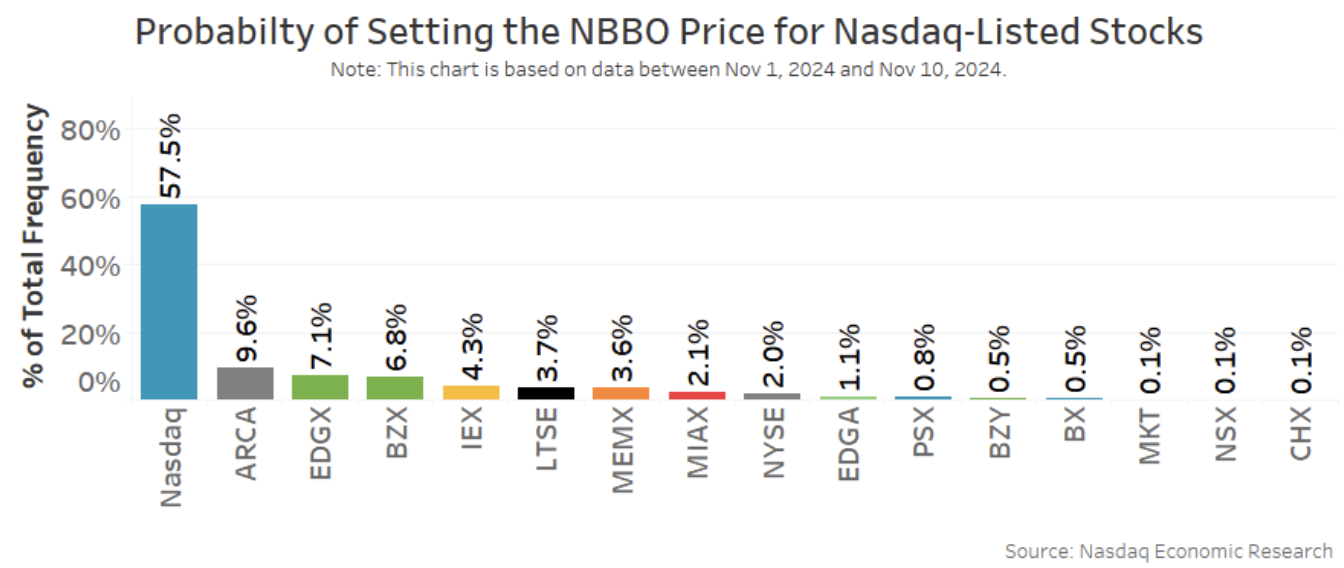

We have a look at who units new NBBOs utilizing venue timestamps throughout all exchanges. That removes any delays reporting new trades again to the SIP.

We see that major exchanges set the brand new NBBO nearly all of the time. That shouldn’t be stunning, as major exchanges additionally have to compete for firm listings, and firms examine them based mostly on issues that scale back their prices of capital, equivalent to constant quotes and tight spreads.

For instance, Nasdaq market makers set quotes in Nasdaq-listed shares near 58% of the time. In distinction, all different exchanges mixed enhance the NBBO for Nasdaq shares lower than 43% of the time.

Chart 1: Greater than half of the time new NBBO worth is about by the first itemizing change

Different venues be part of NBBO at completely different charges and speeds

What does are likely to occur extra persistently is that different venues be part of (or copy) the NBBO costs which were set on the first.

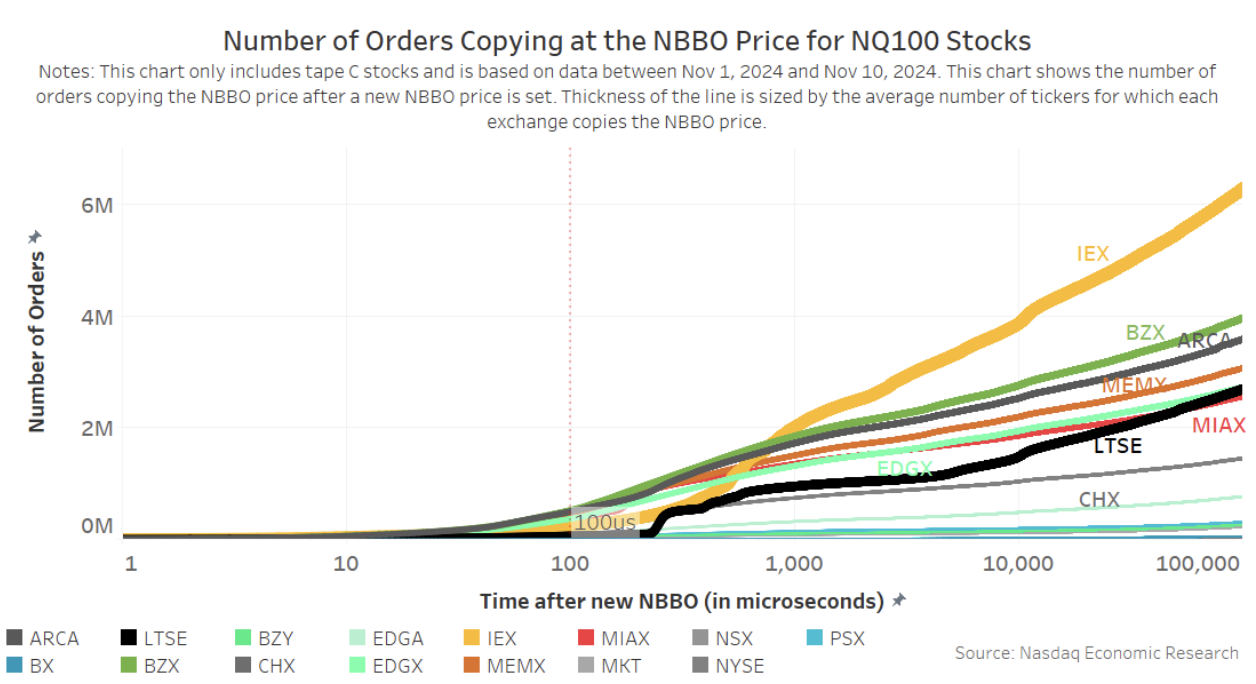

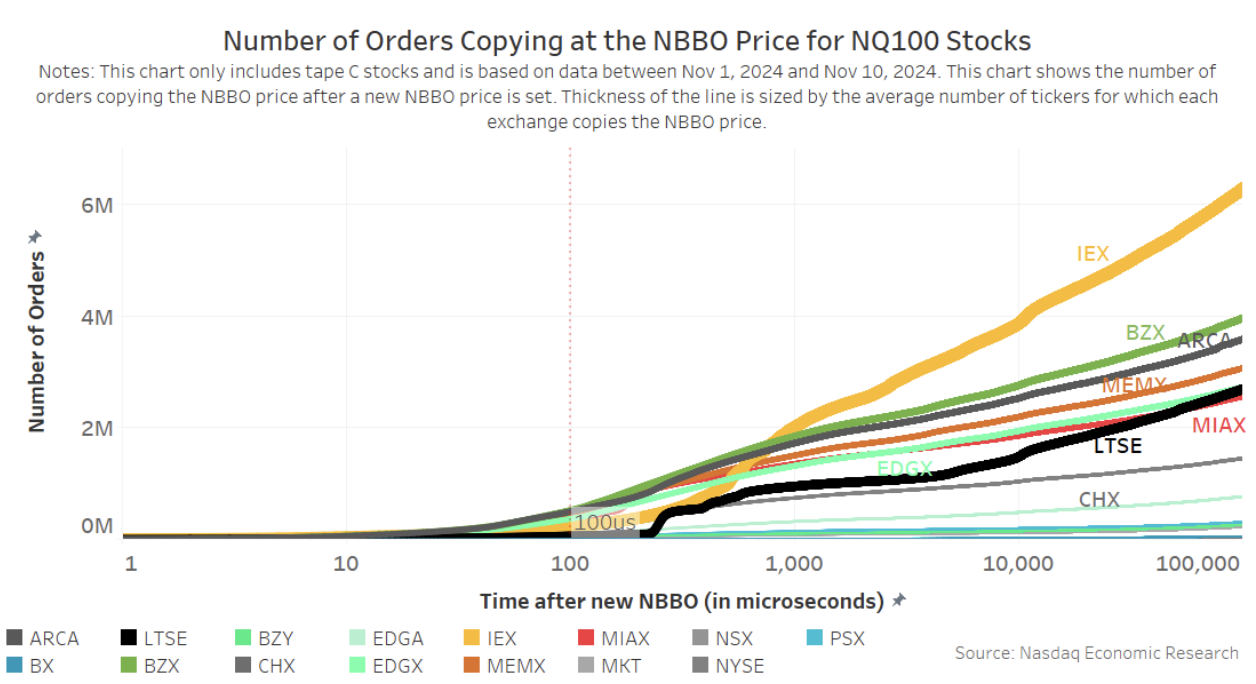

Importantly, we don’t see all venues dashing to repeat the NBBO quotes at precisely the velocity of sunshine. As an alternative, most exchanges see a constant arrival of latest orders as time (x-axis) progresses.

However there are just a few fascinating exceptions:

- Sharp jumps present a speedy copying of latest quotes. LTSE, and later IEX, stand out, with each having a pointy bounce in copy quotes each properly inside 1 millisecond.

- Top of the road exhibits that IEX stands out, particularly for extra liquid shares within the Nasdaq-100 (Chart 2a), the place it has extra quotes copying the NBBO than some other change — by a major margin — regardless of a number of different exchanges really offering the market with extra liquidity (ARCA, EDGX and BATS).

- Line thickness exhibits the breadth of shares within the universe the place quotes are copied. IEX and LTSE stand out once more, with copy-quotes on way more shares, giving the looks of widespread liquidity to buyers, particularly versus their buying and selling market share (Chart 3).

Chart 2a: IEX ship orders copying NBBO quotes for liquid (Nasdaq-100) shares

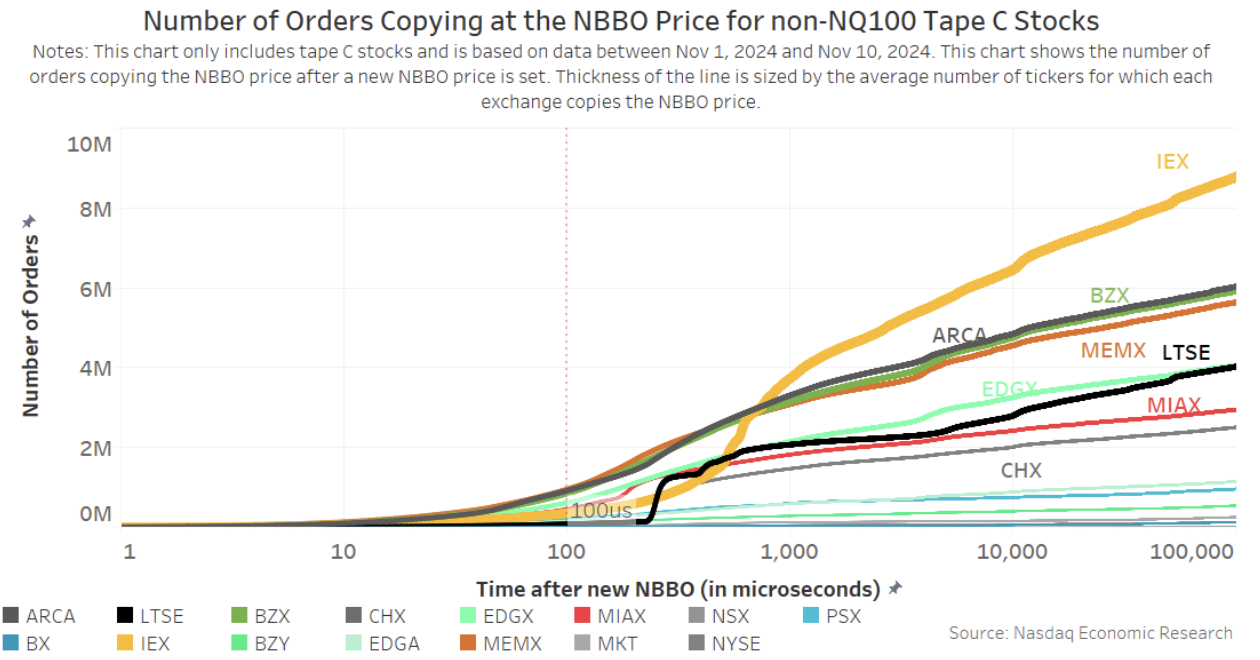

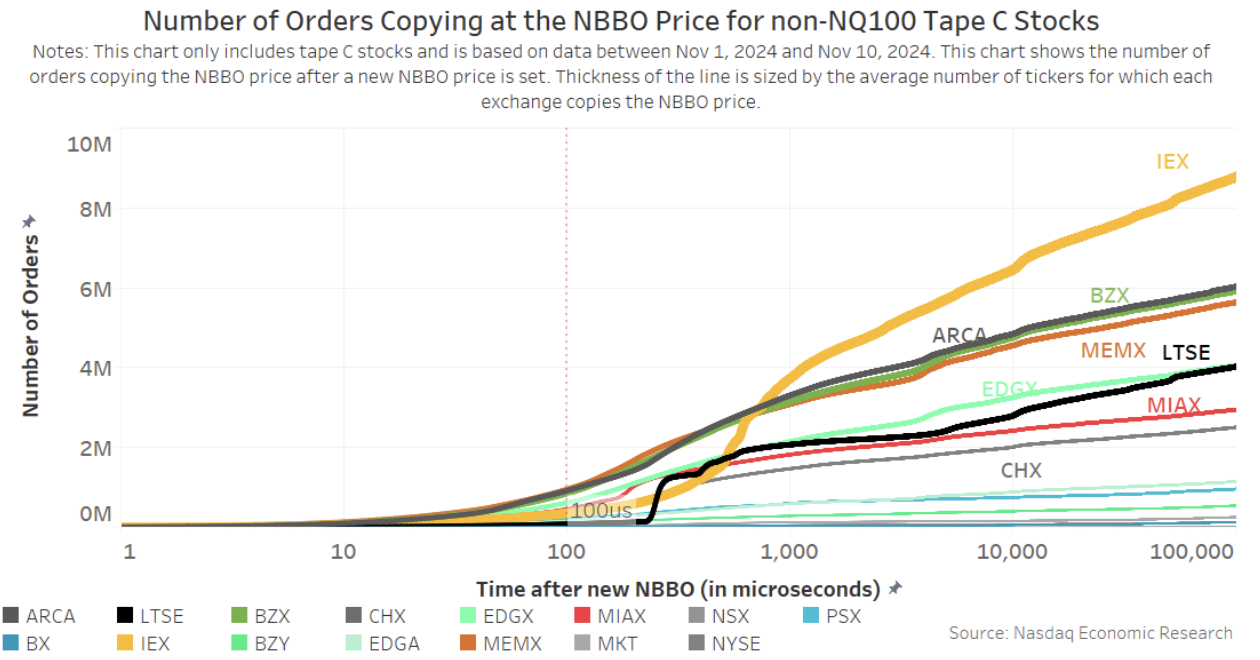

Apparently, the patterns change little or no after we have a look at much less liquid shares.

Given there are about 3,300 firms within the chart under (versus simply 100 within the chart above), the rise in complete quotes is comparatively small. It is in all probability true that, with these smaller firms, they’re additionally much less worthwhile to cite. However these are additionally the tickers that want liquidity assist probably the most. Even the SIP income allocation components is tilted in favor of quotes in these shares.

What the information exhibits is that for these much less liquid shares, IEX and LTSE skilled an excellent sharper bounce within the variety of copying quotes. Nonetheless, as you will note in Chart 3, these massive numbers of quotes don’t ultimately result in trades.

Chart 2b: There’s much less curiosity in copying quotes for much less liquid, smaller-cap, shares

Is that this good or dangerous for market construction?

This issues in several methods to completely different members.

For brokers and merchants, it reduces the unique want for velocity to be on the high of the queue. That’s as a result of, so long as you’ll find a venue with no order on that venue, you might be on the high of their queue. That, in flip, helps improve unfold seize and profitability for merchants on these exchanges.

However fragmentation provides different prices for brokers, together with extra connections and extra sophisticated routing. It additionally provides prices to buyers by greater alternative prices.

There are different prices of diluting queue precedence, too.

The system doesn’t reward aggressive quotes that result in trades

Extra importantly, fragmentation of quoting is dangerous for the market makers really setting the quotes within the first place. Their enterprise is to revenue from unfold seize, however copy quotes make that much less seemingly.

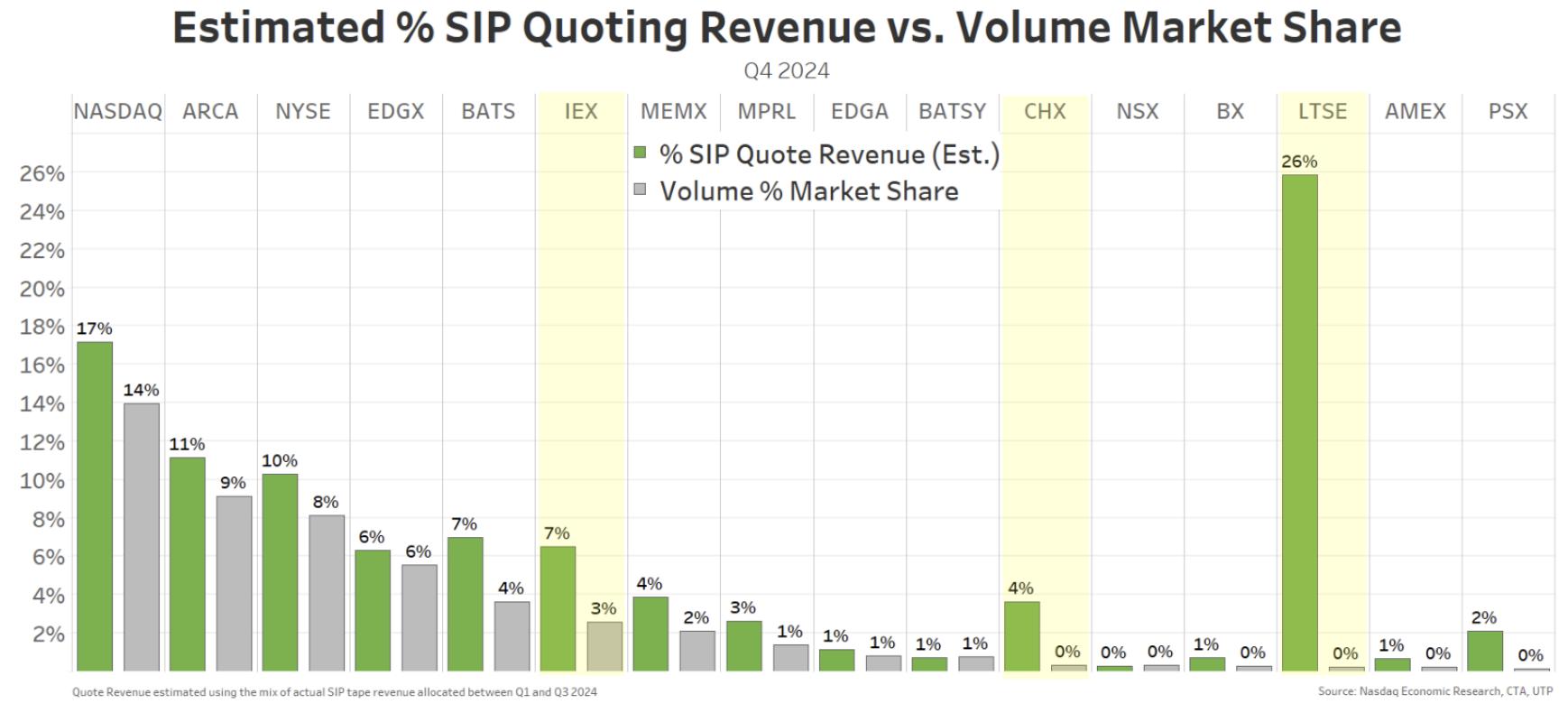

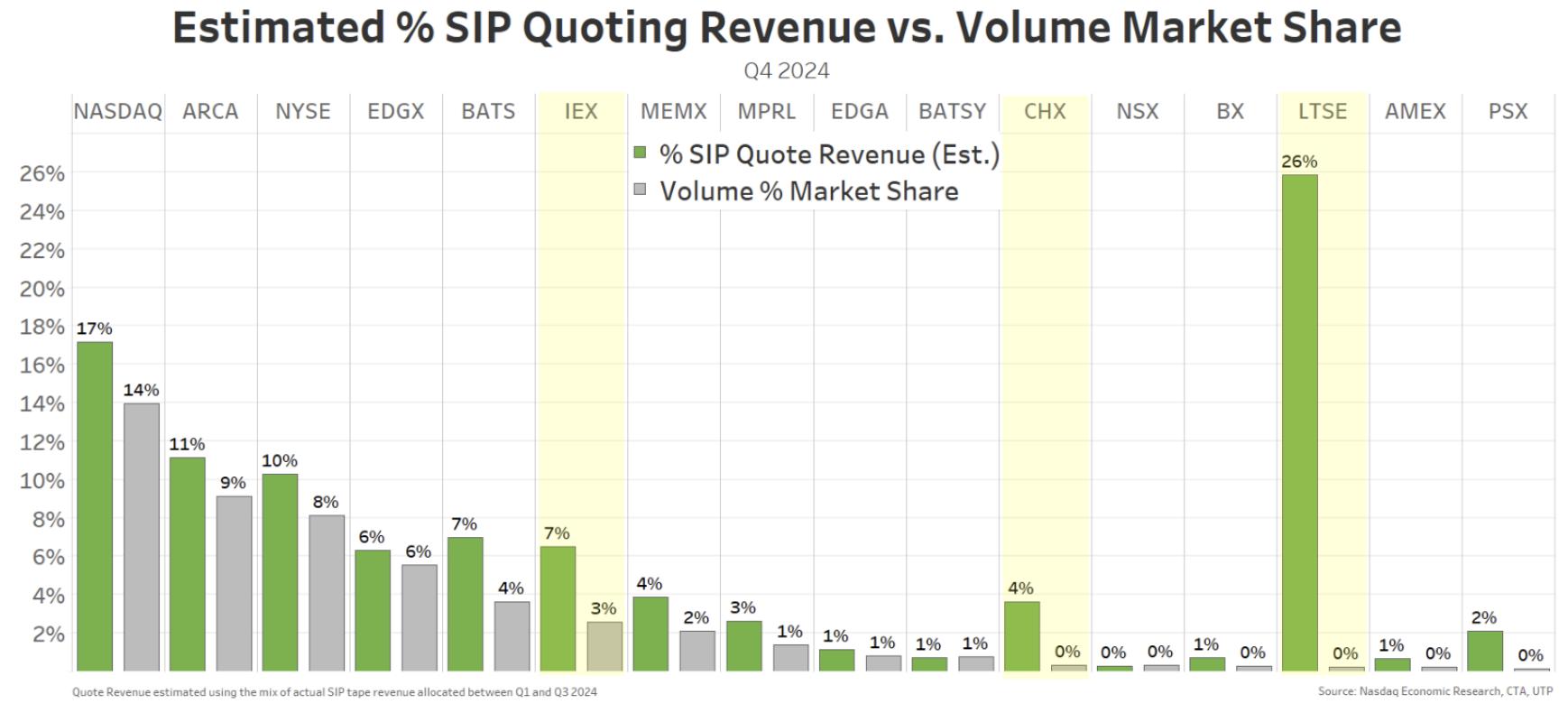

Maybe even worse, the best way regulated information economics works within the U.S. provides to inefficiencies. The SIP income allocation components was designed to reward quotes and trades “equally” no matter who set these costs extra usually. Again earlier than there have been over a dozen exchanges, with some protected quotes utilizing velocity bumps, it was set as much as reward all quotes equally.

Taking a look at current SIP income exhibits that some exchanges appear to earn a variety of quote revenues, with out really doing any buying and selling. In some exchanges, there are clear prices to exchanges, like rebates, to reward market makers offering these quotes, however in different circumstances the associated fee to exchanges and advantages to market makers are much less clear.

Chart 3: LTSE and IEX ship massive variety of orders copying the NBBO quotes

SIP quote revenues can add to tens of tens of millions of {dollars} for some exchanges. That is a man-made incentive that helps fragmentation, with out really making the market extra aggressive and cheaper for buyers.

We’d like to ensure the NBBO is sweet at defending buyers and issuers

Most of us appear to agree that the NBBO is necessary for buyers and issuers. Tutorial analysis additionally means that tight spreads scale back prices of capital and improve liquidity. That, in flip, helps make the U.S. market extra enticing than many markets world wide.

We spend a variety of time arguing about the advantages of a “public” and reasonably priced NBBO. Maybe we additionally have to make it possible for the economics additionally pretty reward the venues and merchants setting these quotes. That might even assist make markets extra environment friendly.

We lately studied how trades velocity across the market — usually ranging from a dealer order in Secaucus, touring on the velocity of fiber to take orders on exchanges across the market, then inflicting a response perform on the velocity of microwave.

At this time, we’re taking a look at how quote updates usually stream across the market.

What we discover is that major itemizing exchanges set the brand new Nationwide Greatest Bid and Provide (NBBO) more often than not. Then, most venues see orders arriving at a reasonably constant price over time, however some venues have a speedy improve in quotes on the new NBBO inside the first millisecond.

Whether or not that’s good or dangerous for market construction and routers is an fascinating query.

Itemizing venues set probably the most NBBOs

We have a look at who units new NBBOs utilizing venue timestamps throughout all exchanges. That removes any delays reporting new trades again to the SIP.

We see that major exchanges set the brand new NBBO nearly all of the time. That shouldn’t be stunning, as major exchanges additionally have to compete for firm listings, and firms examine them based mostly on issues that scale back their prices of capital, equivalent to constant quotes and tight spreads.

For instance, Nasdaq market makers set quotes in Nasdaq-listed shares near 58% of the time. In distinction, all different exchanges mixed enhance the NBBO for Nasdaq shares lower than 43% of the time.

Chart 1: Greater than half of the time new NBBO worth is about by the first itemizing change

Different venues be part of NBBO at completely different charges and speeds

What does are likely to occur extra persistently is that different venues be part of (or copy) the NBBO costs which were set on the first.

Importantly, we don’t see all venues dashing to repeat the NBBO quotes at precisely the velocity of sunshine. As an alternative, most exchanges see a constant arrival of latest orders as time (x-axis) progresses.

However there are just a few fascinating exceptions:

- Sharp jumps present a speedy copying of latest quotes. LTSE, and later IEX, stand out, with each having a pointy bounce in copy quotes each properly inside 1 millisecond.

- Top of the road exhibits that IEX stands out, particularly for extra liquid shares within the Nasdaq-100 (Chart 2a), the place it has extra quotes copying the NBBO than some other change — by a major margin — regardless of a number of different exchanges really offering the market with extra liquidity (ARCA, EDGX and BATS).

- Line thickness exhibits the breadth of shares within the universe the place quotes are copied. IEX and LTSE stand out once more, with copy-quotes on way more shares, giving the looks of widespread liquidity to buyers, particularly versus their buying and selling market share (Chart 3).

Chart 2a: IEX ship orders copying NBBO quotes for liquid (Nasdaq-100) shares

Apparently, the patterns change little or no after we have a look at much less liquid shares.

Given there are about 3,300 firms within the chart under (versus simply 100 within the chart above), the rise in complete quotes is comparatively small. It is in all probability true that, with these smaller firms, they’re additionally much less worthwhile to cite. However these are additionally the tickers that want liquidity assist probably the most. Even the SIP income allocation components is tilted in favor of quotes in these shares.

What the information exhibits is that for these much less liquid shares, IEX and LTSE skilled an excellent sharper bounce within the variety of copying quotes. Nonetheless, as you will note in Chart 3, these massive numbers of quotes don’t ultimately result in trades.

Chart 2b: There’s much less curiosity in copying quotes for much less liquid, smaller-cap, shares

Is that this good or dangerous for market construction?

This issues in several methods to completely different members.

For brokers and merchants, it reduces the unique want for velocity to be on the high of the queue. That’s as a result of, so long as you’ll find a venue with no order on that venue, you might be on the high of their queue. That, in flip, helps improve unfold seize and profitability for merchants on these exchanges.

However fragmentation provides different prices for brokers, together with extra connections and extra sophisticated routing. It additionally provides prices to buyers by greater alternative prices.

There are different prices of diluting queue precedence, too.

The system doesn’t reward aggressive quotes that result in trades

Extra importantly, fragmentation of quoting is dangerous for the market makers really setting the quotes within the first place. Their enterprise is to revenue from unfold seize, however copy quotes make that much less seemingly.

Maybe even worse, the best way regulated information economics works within the U.S. provides to inefficiencies. The SIP income allocation components was designed to reward quotes and trades “equally” no matter who set these costs extra usually. Again earlier than there have been over a dozen exchanges, with some protected quotes utilizing velocity bumps, it was set as much as reward all quotes equally.

Taking a look at current SIP income exhibits that some exchanges appear to earn a variety of quote revenues, with out really doing any buying and selling. In some exchanges, there are clear prices to exchanges, like rebates, to reward market makers offering these quotes, however in different circumstances the associated fee to exchanges and advantages to market makers are much less clear.

Chart 3: LTSE and IEX ship massive variety of orders copying the NBBO quotes

SIP quote revenues can add to tens of tens of millions of {dollars} for some exchanges. That is a man-made incentive that helps fragmentation, with out really making the market extra aggressive and cheaper for buyers.

We’d like to ensure the NBBO is sweet at defending buyers and issuers

Most of us appear to agree that the NBBO is necessary for buyers and issuers. Tutorial analysis additionally means that tight spreads scale back prices of capital and improve liquidity. That, in flip, helps make the U.S. market extra enticing than many markets world wide.

We spend a variety of time arguing about the advantages of a “public” and reasonably priced NBBO. Maybe we additionally have to make it possible for the economics additionally pretty reward the venues and merchants setting these quotes. That might even assist make markets extra environment friendly.