- Ethereum’s consolidation round $2.6k in February provided some hope for restoration

- On-chain metrics revealed that the altcoin’s sellers aren’t exhausted but

The Bybit hack noticed $1.46 billion value of Ethereum [ETH] siphoned out of a chilly pockets. The trade noticed an unprecedented quantity of withdrawals, nevertheless it has been in a position to course of them easily. On the time of writing, ETH was down 2.64% within the final 24 hours.

Supply: X

Crypto analyst RektProof famous a sample rising in a put up on X. The vary formation from Q1 2024 appeared to be nonetheless in play, and the current occasions offered a deviation beneath the lows. That is additionally a spot the place accumulation occurred from July-October 2024, earlier than the swift rally in November.

A comparability with Bitcoin [BTC] making cycle lows on the again of black swan occasions similar to COVID or the FTX crash was additionally made. This implied that ETH may also be making such lows. Nonetheless, is that this too good to be true?

Metrics confirmed that Ethereum has room to go decrease

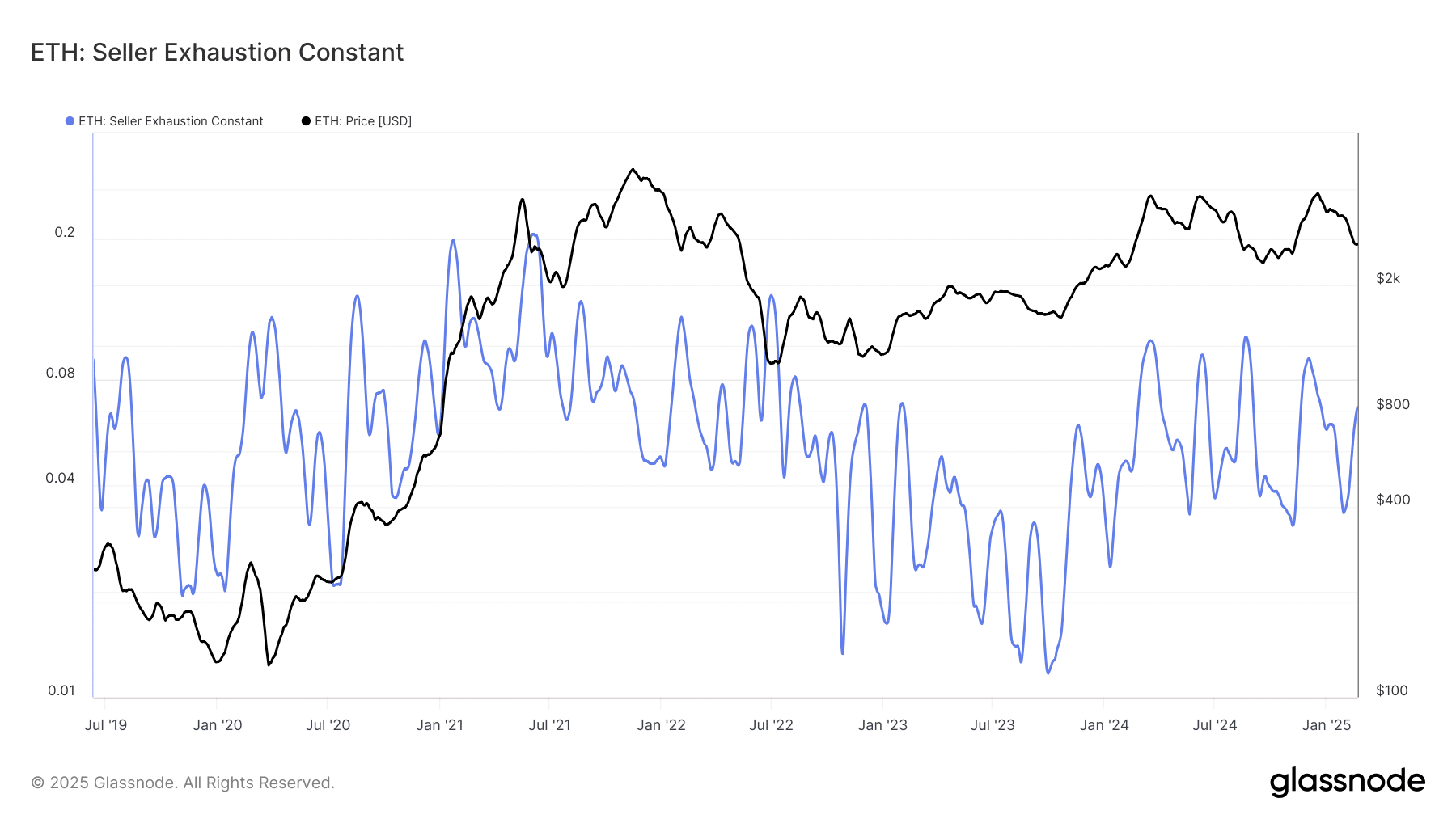

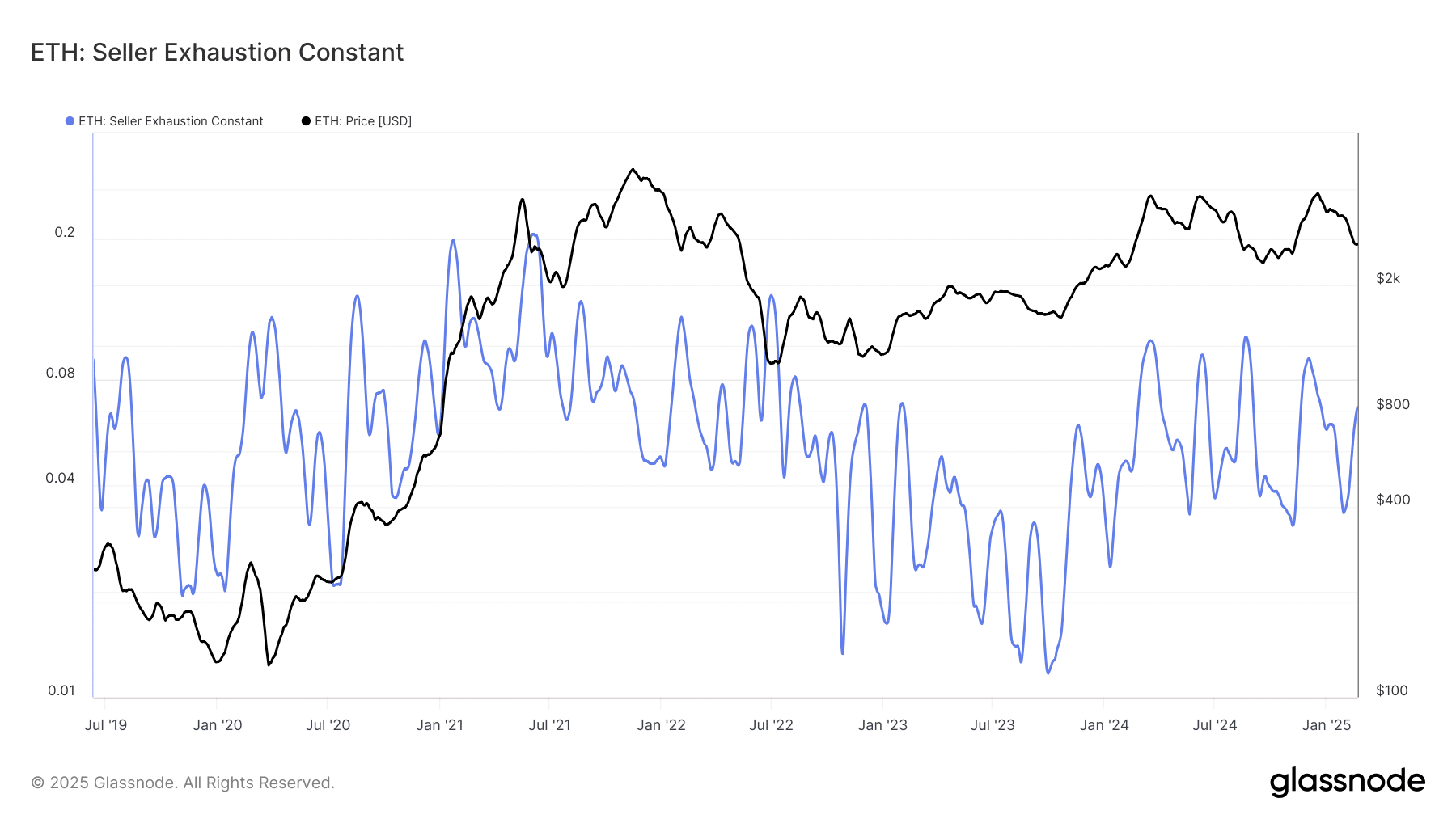

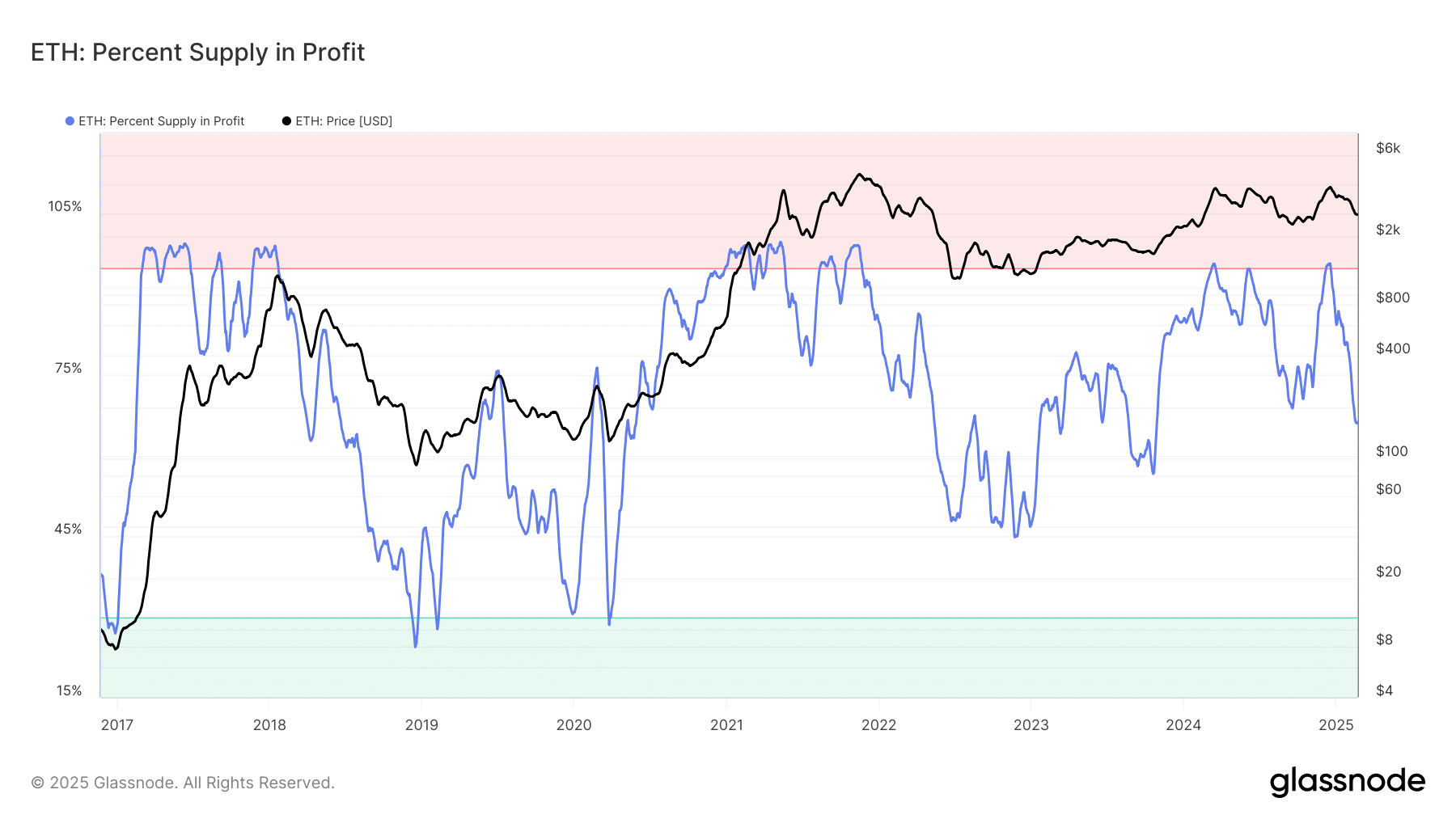

Supply: Glassnode

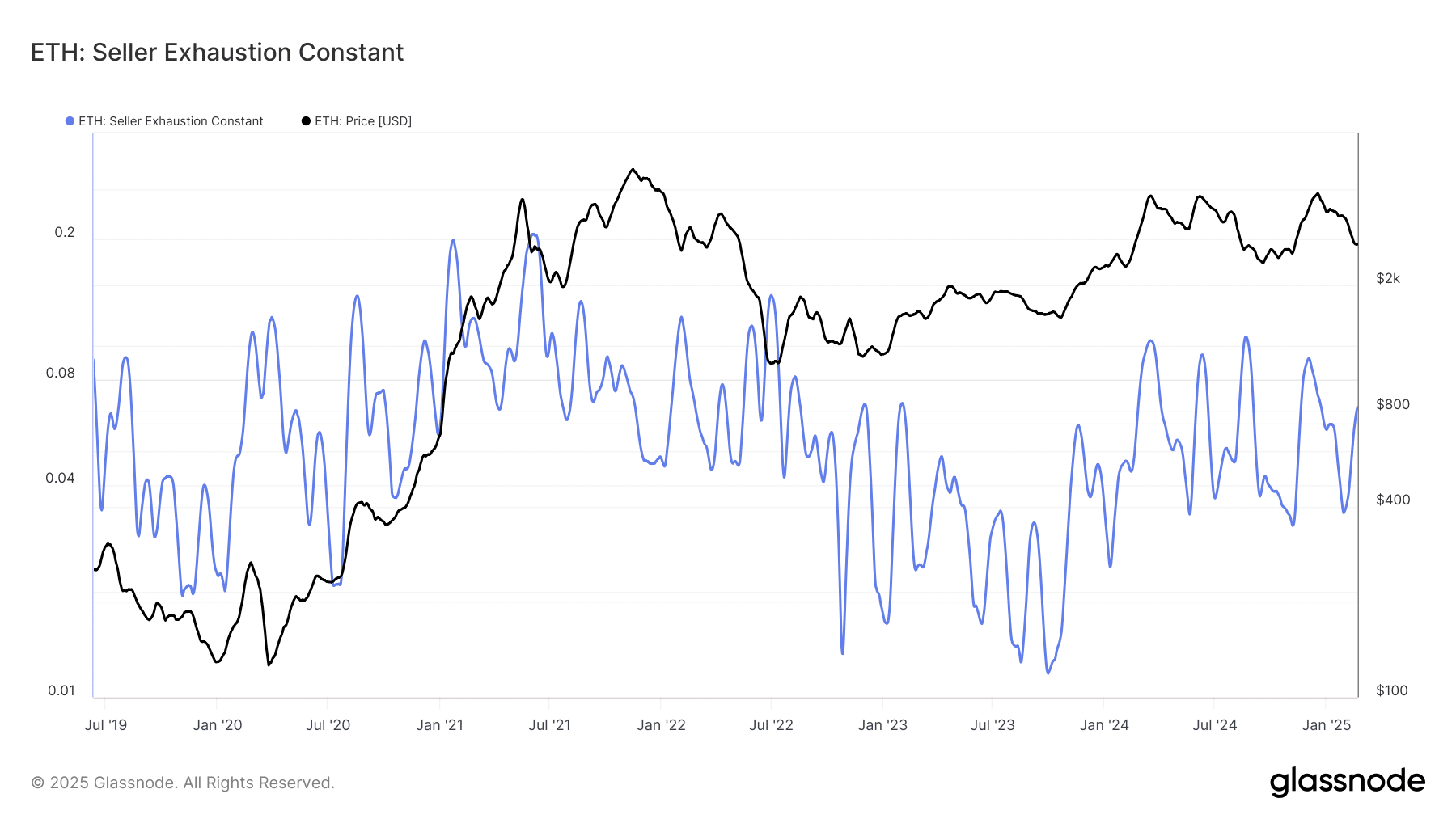

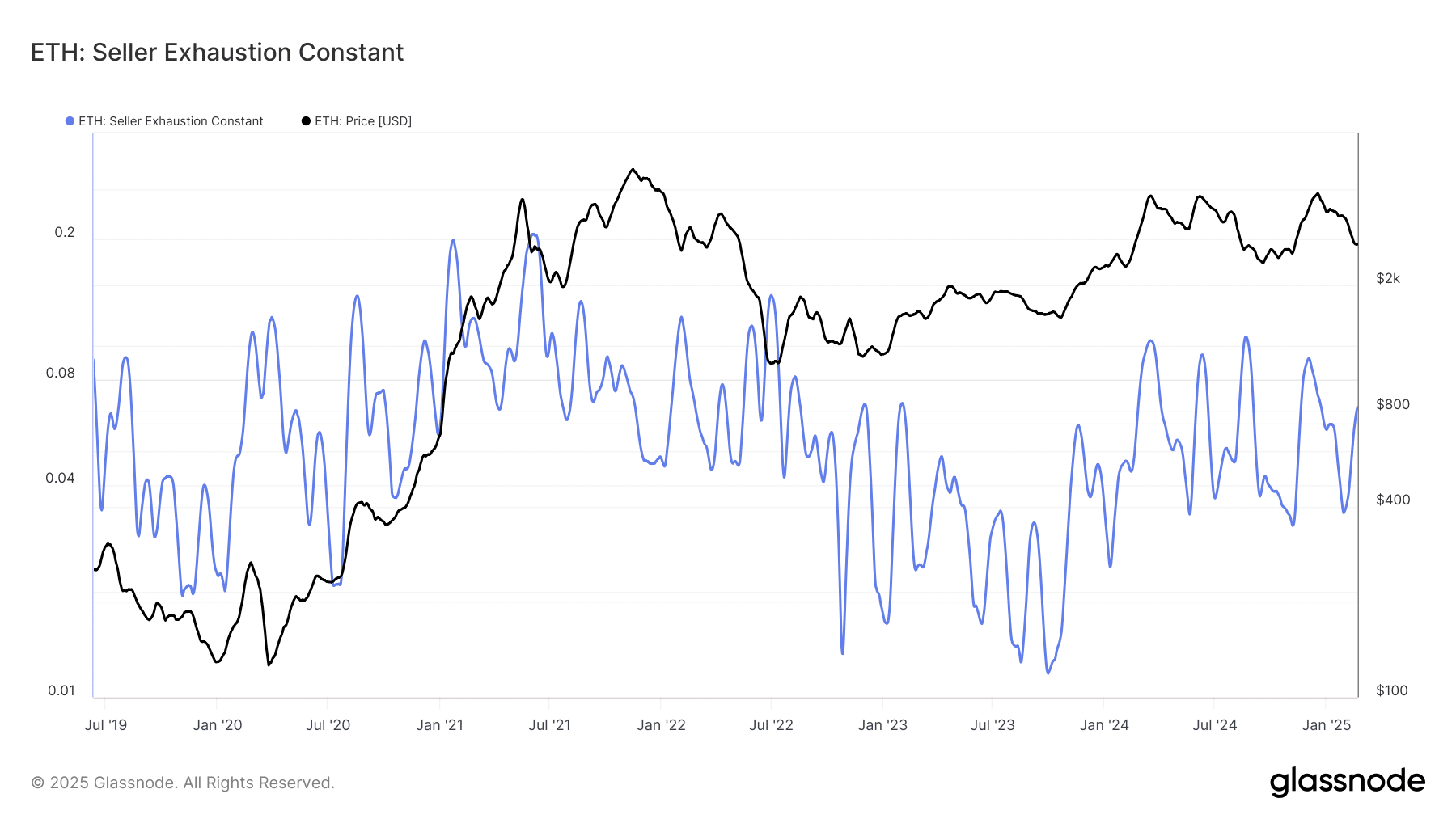

The vendor exhaustion metric is a product of the proportion provide in revenue and the 30-day worth volatility. In current weeks, the volatility has been excessive, whereas the p.c provide in revenue has been falling.

This defined the rise within the exhaustion metric. It’s used to mark low-risk worth bottoms when a sizeable chunk of the provision is just not in revenue and the value is beneath consolidation. The prevailing market situations don’t mirror that although, no less than not on the upper timeframes.

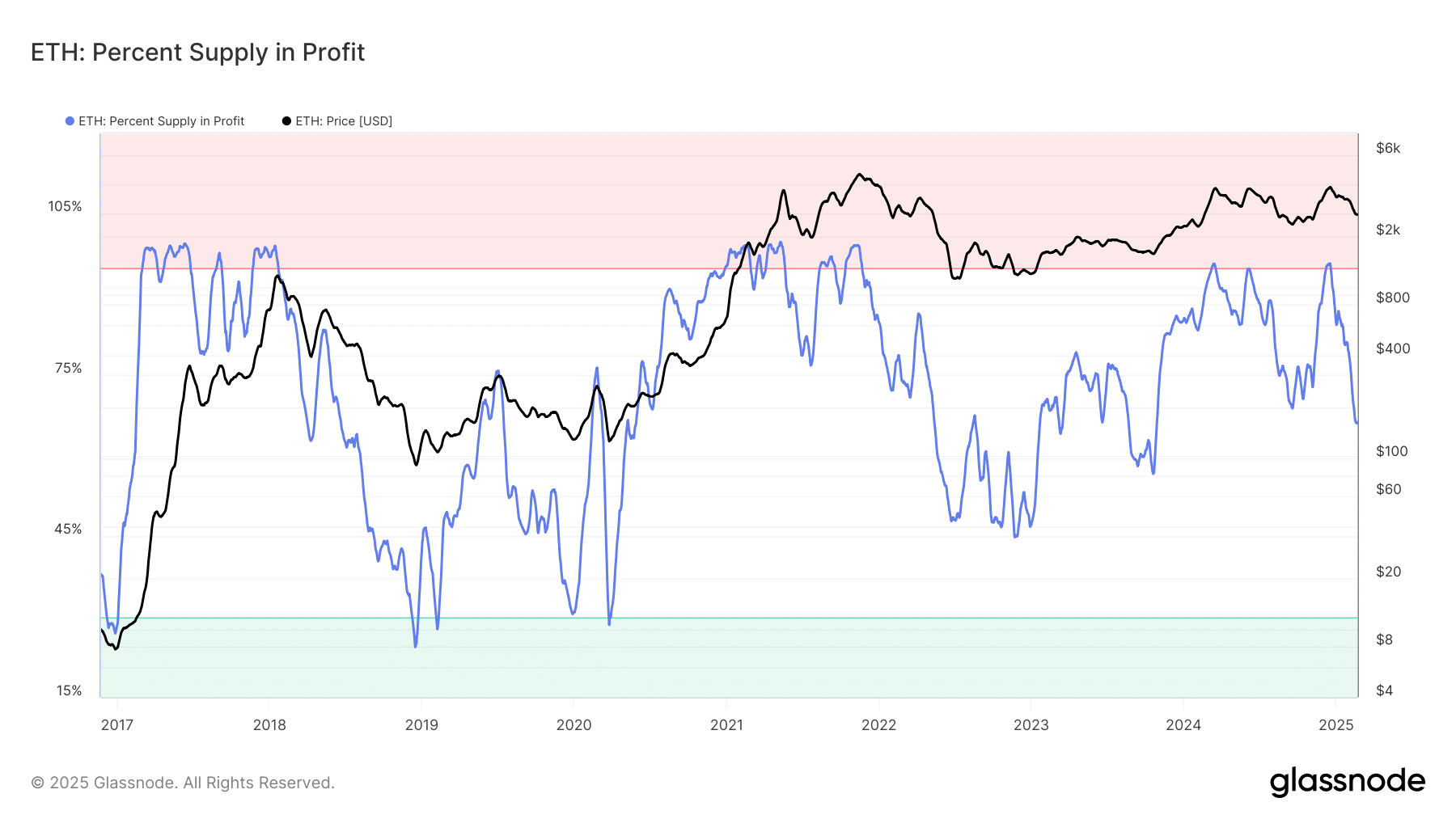

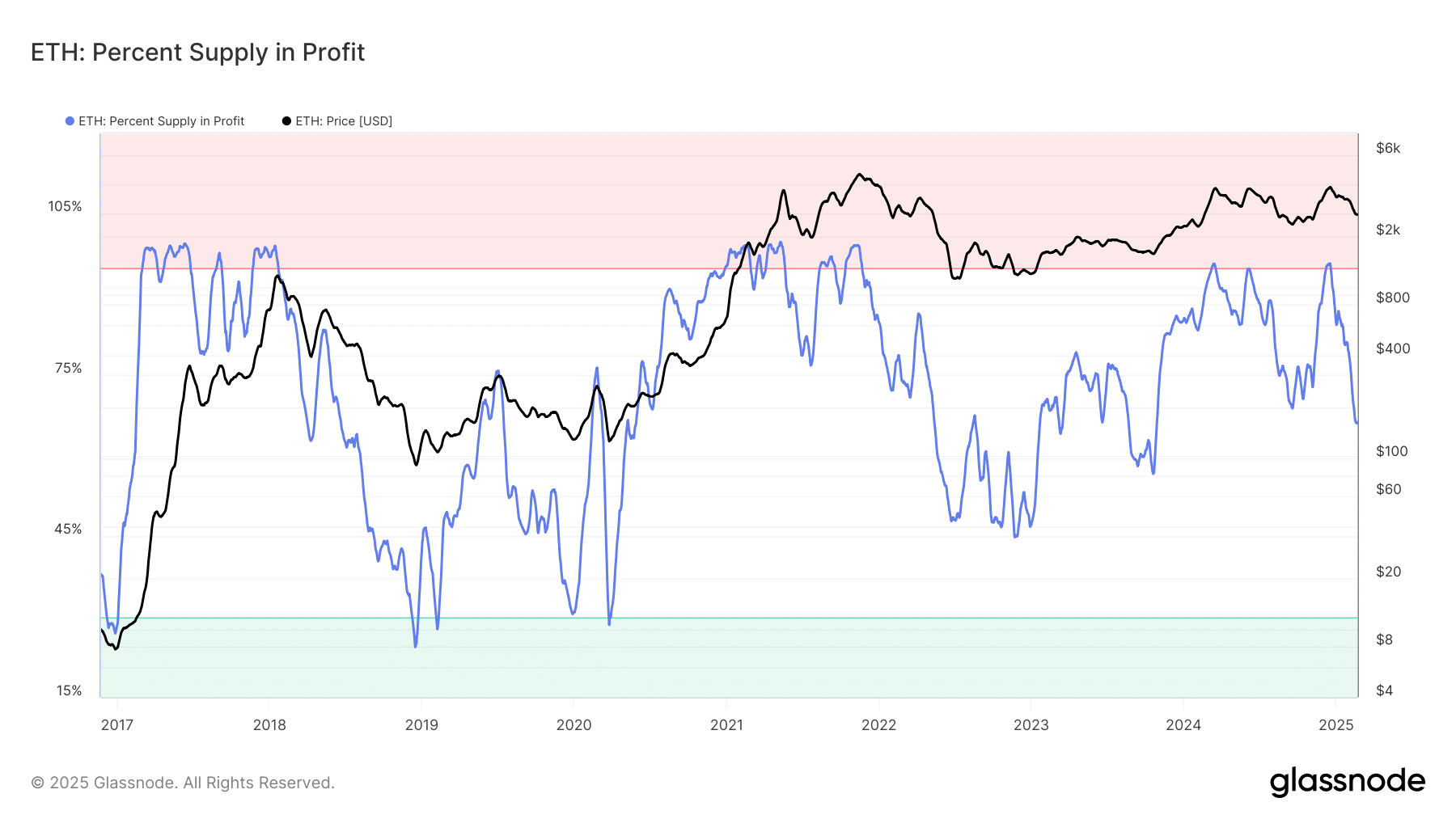

Supply: Glassnode

The proportion provide in revenue has been falling because the worth confronted rejection from $4k in December.

At press time, the metric was decrease than at any level since October 2023. Its weak efficiency whereas Bitcoin traded close to $100k has been a supply of frustration for holders.

Supply: Glassnode

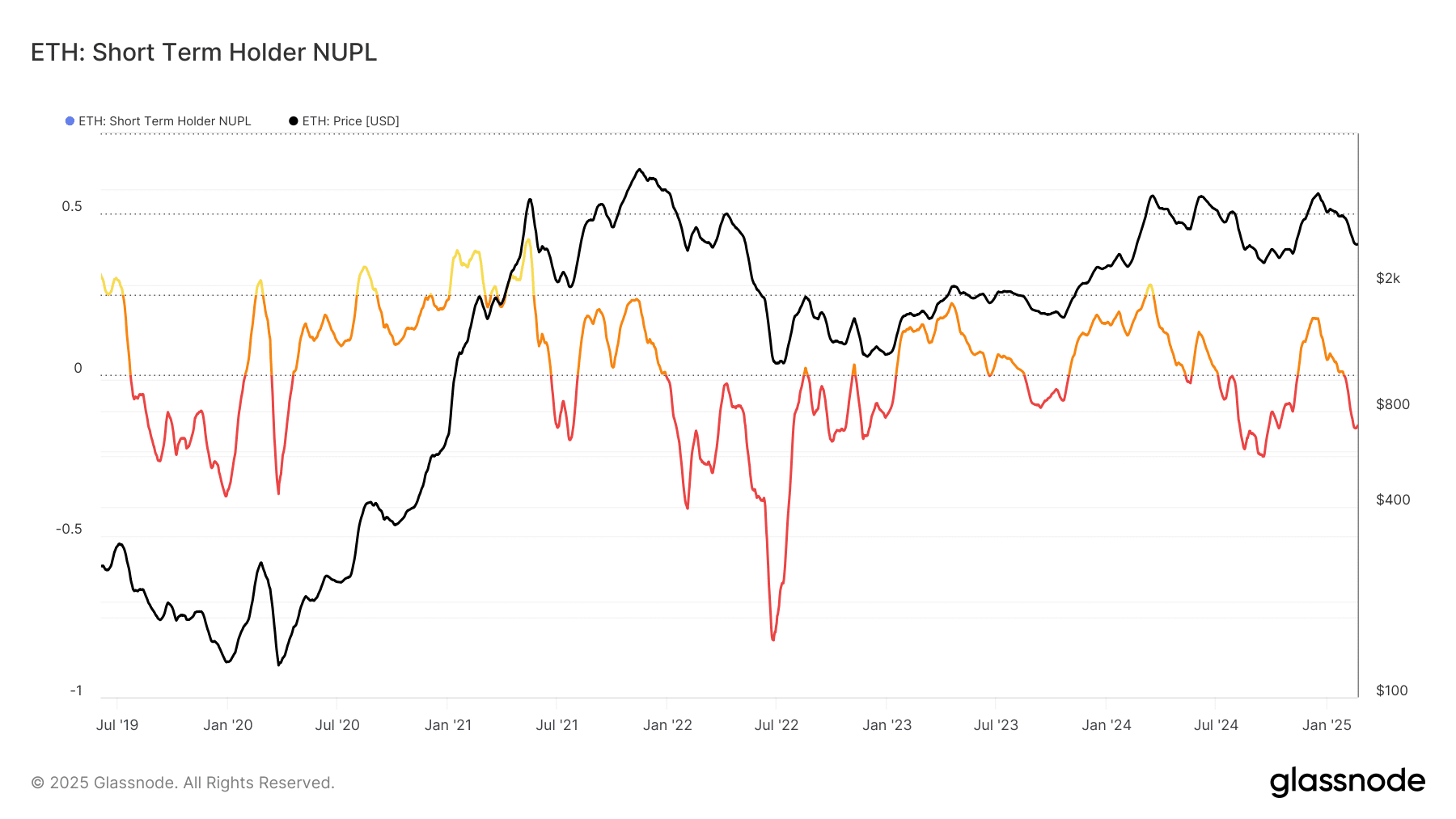

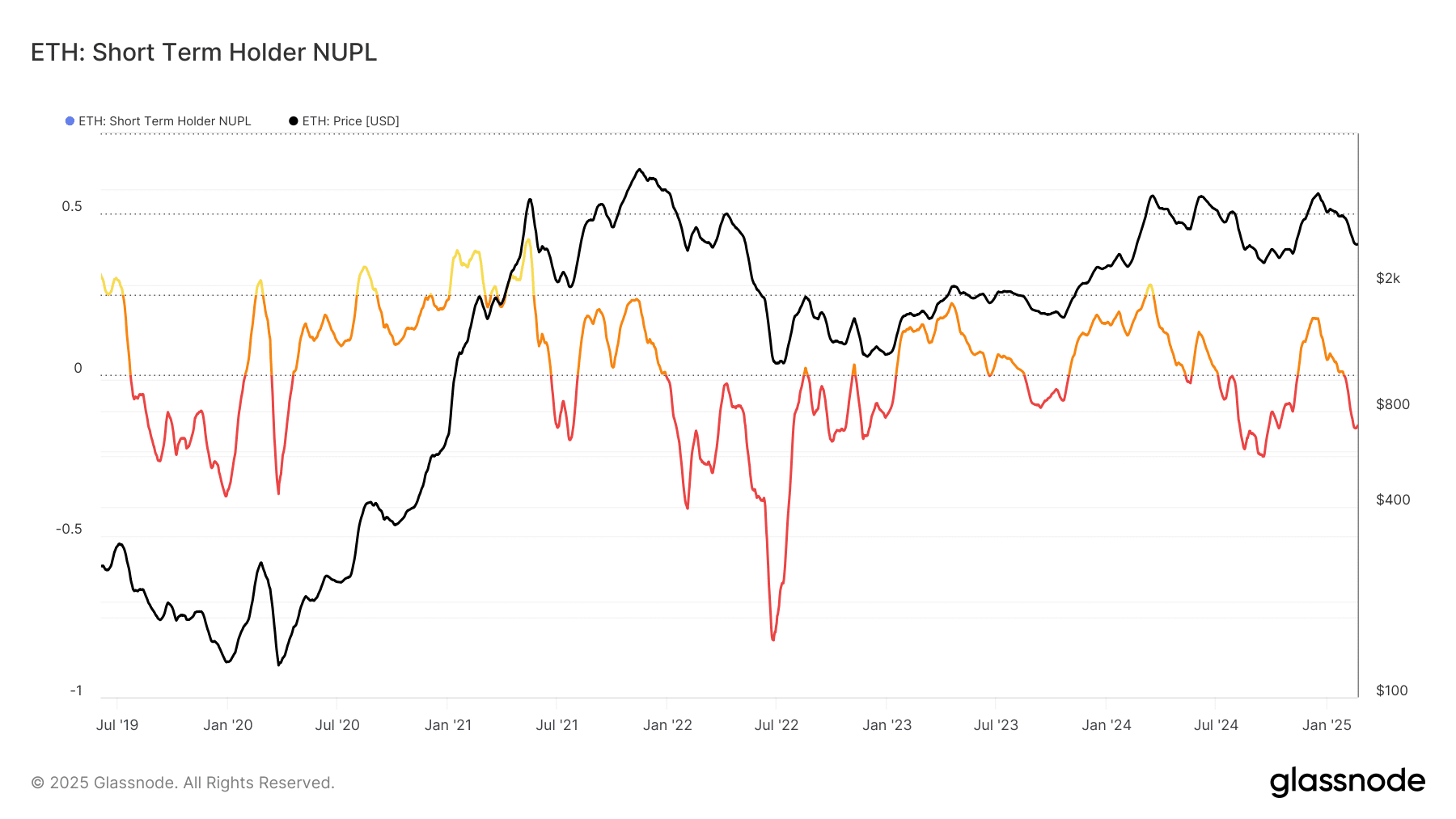

The short-term holder (STH) web unrealized revenue/loss (NUPL) takes under consideration transactions youthful than 155 days. Values beneath 0 point out that STHs are at a loss and at press time, the metric was at -0.164.

Mixed with the vary formation highlighted earlier, it appeared that this could possibly be shopping for alternative for ETH. And but, the NUPL being detrimental doesn’t routinely mark native bottoms.

For instance, in January 2022, the STH NUPL was at -0.018, falling to -0.4 in February. After a couple of weeks of worth consolidation across the $3k-level, Ethereum plunged to $1.1k in June 2022 – Driving the NUPL deeper.

Whereas this was an excessive case, it revealed that the metrics should be used contextually. Combining the value motion with the metrics examined to date, we will see that there’s a likelihood of ETH’s worth dropping in the direction of $2.1k.

- Ethereum’s consolidation round $2.6k in February provided some hope for restoration

- On-chain metrics revealed that the altcoin’s sellers aren’t exhausted but

The Bybit hack noticed $1.46 billion value of Ethereum [ETH] siphoned out of a chilly pockets. The trade noticed an unprecedented quantity of withdrawals, nevertheless it has been in a position to course of them easily. On the time of writing, ETH was down 2.64% within the final 24 hours.

Supply: X

Crypto analyst RektProof famous a sample rising in a put up on X. The vary formation from Q1 2024 appeared to be nonetheless in play, and the current occasions offered a deviation beneath the lows. That is additionally a spot the place accumulation occurred from July-October 2024, earlier than the swift rally in November.

A comparability with Bitcoin [BTC] making cycle lows on the again of black swan occasions similar to COVID or the FTX crash was additionally made. This implied that ETH may also be making such lows. Nonetheless, is that this too good to be true?

Metrics confirmed that Ethereum has room to go decrease

Supply: Glassnode

The vendor exhaustion metric is a product of the proportion provide in revenue and the 30-day worth volatility. In current weeks, the volatility has been excessive, whereas the p.c provide in revenue has been falling.

This defined the rise within the exhaustion metric. It’s used to mark low-risk worth bottoms when a sizeable chunk of the provision is just not in revenue and the value is beneath consolidation. The prevailing market situations don’t mirror that although, no less than not on the upper timeframes.

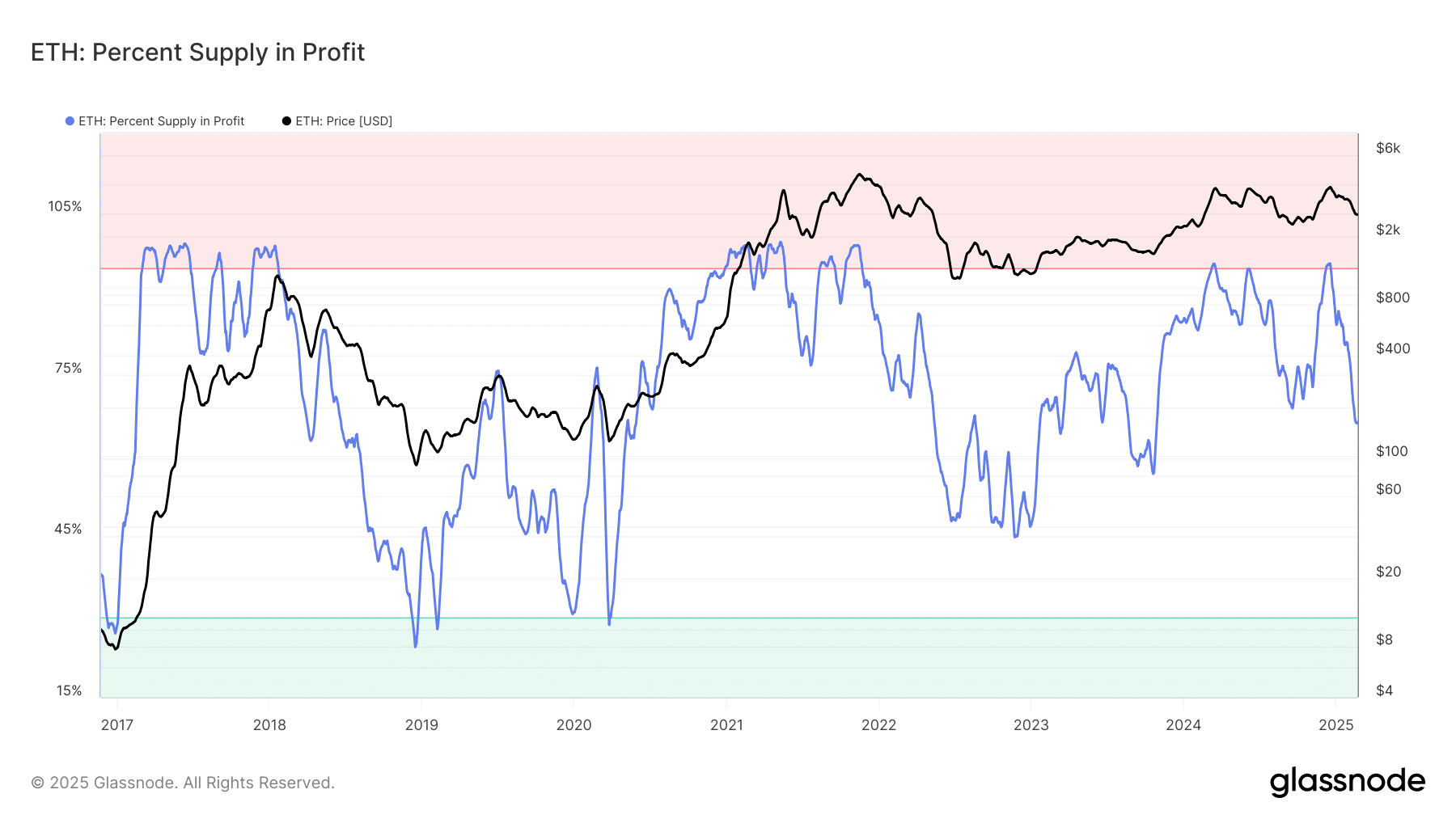

Supply: Glassnode

The proportion provide in revenue has been falling because the worth confronted rejection from $4k in December.

At press time, the metric was decrease than at any level since October 2023. Its weak efficiency whereas Bitcoin traded close to $100k has been a supply of frustration for holders.

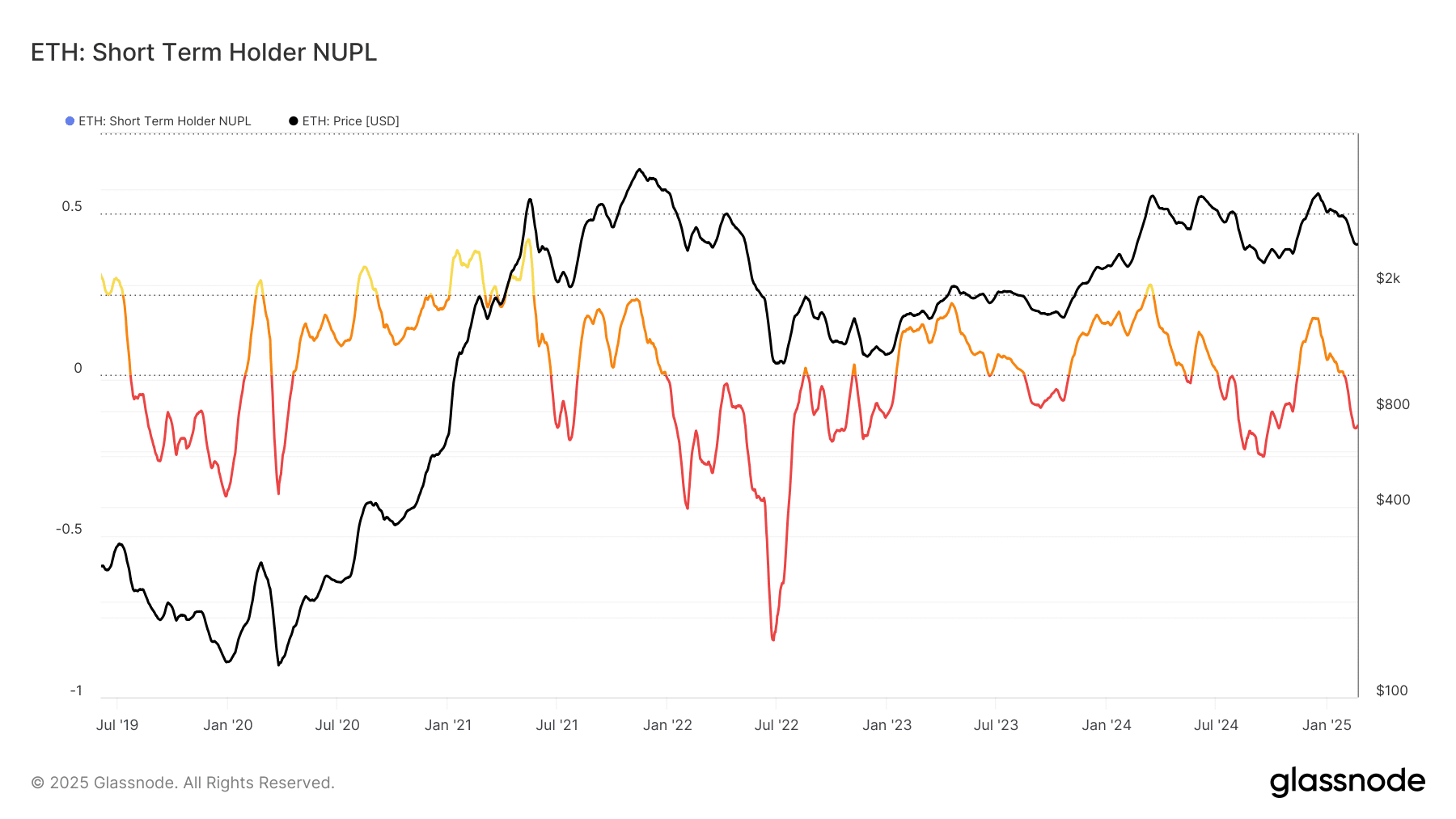

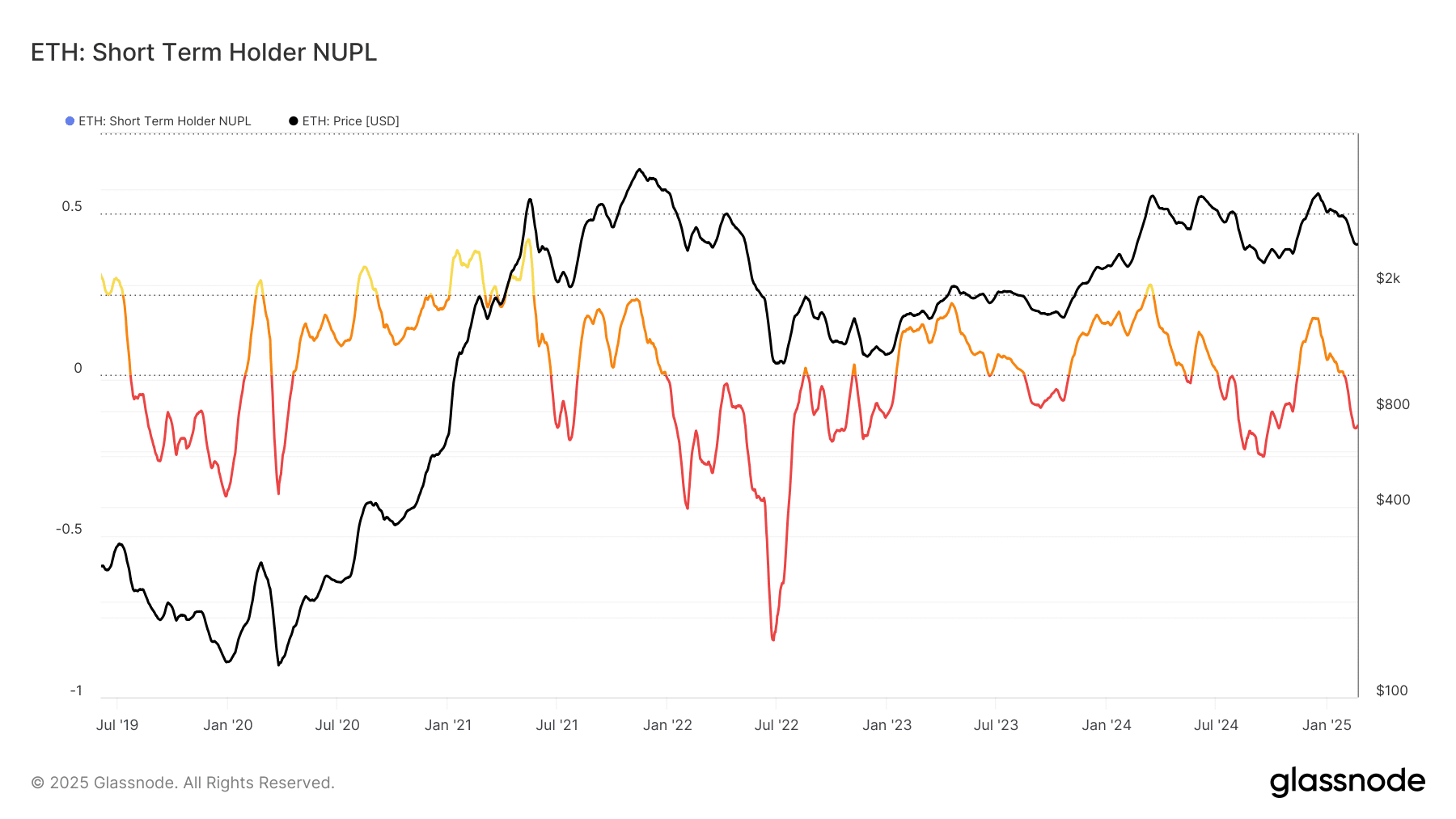

Supply: Glassnode

The short-term holder (STH) web unrealized revenue/loss (NUPL) takes under consideration transactions youthful than 155 days. Values beneath 0 point out that STHs are at a loss and at press time, the metric was at -0.164.

Mixed with the vary formation highlighted earlier, it appeared that this could possibly be shopping for alternative for ETH. And but, the NUPL being detrimental doesn’t routinely mark native bottoms.

For instance, in January 2022, the STH NUPL was at -0.018, falling to -0.4 in February. After a couple of weeks of worth consolidation across the $3k-level, Ethereum plunged to $1.1k in June 2022 – Driving the NUPL deeper.

Whereas this was an excessive case, it revealed that the metrics should be used contextually. Combining the value motion with the metrics examined to date, we will see that there’s a likelihood of ETH’s worth dropping in the direction of $2.1k.