Lebazele

Little or no on this world provides me the type of pleasure that having the ability to improve an organization does. It is thrilling as a result of I like to see companies win, and I like to see buyers have a discount at their disposal. My newest improve includes a agency by the identify of Tennant Firm (NYSE:TNC). You see, again in April of this 12 months, I ended up downgrading the agency from a ‘purchase’ to a ‘maintain’. This got here after the corporate skilled exceptional upside. For the reason that article that I had beforehand written about it and rated it a ‘purchase’ in, shares had skyrocketed 52.4% whereas the S&P 500 was up solely 19%. However after such a surge, I felt as if additional upside can be unlikely. This led me to downgrade it to a ‘maintain’.

Sadly, even that was too optimistic. As an alternative of performing kind of alongside the traces of the broader market, shares underperformed tremendously. The inventory is down 21.6% since then. By comparability, the S&P 500 is up 6.2%. As disappointing as that is, I do now imagine that the image is as soon as once more favorable for buyers. With this 12 months more likely to be barely higher than final 12 months was and the way shares are priced, I imagine that it’s lastly time to improve the corporate as soon as once more to a gentle ‘purchase’.

A distinct segment enterprise with potential

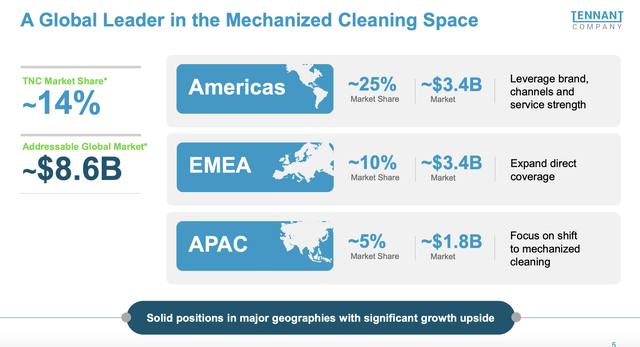

For these not aware of Tennant Firm, the corporate operates as a producer and vendor of guide and mechanized cleansing gear. It additionally sells aftermarket components, associated consumables, and different comparable merchandise. And over its lifetime, the corporate has grown to be a significant participant on this area of interest area. In response to administration, the entire addressable marketplace for the areas of the world during which it operates is value about $8.6 billion. It boasts a 14% market share of all of those within the mixture. Most spectacular is its stake within the Americas. This can be a $3.4 billion market that the corporate controls 25% of. It additionally has a roughly 10% share of the $3.4 billion market within the EMEA (Europe, Center East, and Africa) areas. And within the Asia Pacific area that is value an estimated $1.8 billion, the corporate has a roughly 5% market share.

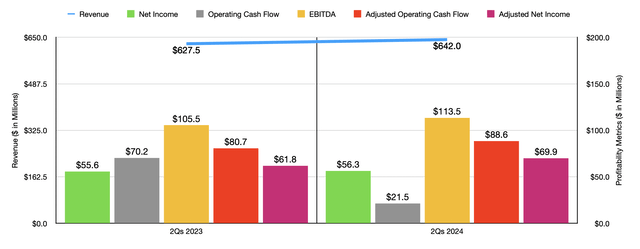

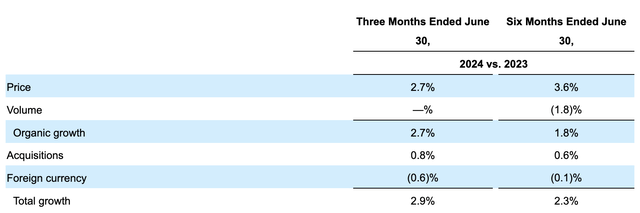

After I final wrote concerning the firm earlier this 12 months, we solely had information overlaying by means of the ultimate quarter of the 2023 fiscal 12 months. However now, outcomes lengthen by means of the first half of 2024. Throughout this time, income for the corporate got here in at $642 million. That is a rise of two.3% over the $627.5 million the corporate reported one 12 months earlier. The image would have been higher had it not been for a 1.8% hit related to quantity. Specifically, the corporate noticed decrease natural gross sales in each the EMEA and Asia Pacific areas. Nonetheless, the corporate did profit from value will increase that added 3.6% to its high line, bringing natural income up 1.8% 12 months over 12 months. Acquisitions added one other 0.6% to its high line.

On the underside line, the corporate noticed a slight enchancment, with internet revenue inching up from $55.6 million to $56.3 million. Along with benefiting from the rise in income, the corporate additionally noticed an enlargement in its gross revenue margin from 42.2% to 43.6%. Greater costs, mixed with cost-saving initiatives greater than offset inflationary pressures and the decline in quantity. A good change in product combine additionally helped, as did a shift to extra direct channel gross sales. Sadly, the agency did see some weak point. Promoting and administrative prices, as an illustration, grew by $14.1 million 12 months over 12 months. This was principally due to increased prices involving sure strategic investments, in addition to increased compensation bills for its workers. Analysis and improvement prices additionally grew relative to income, however solely marginally. Basically, buyers ought to view some of these value will increase favorably, since they’re extremely controllable and investments being made by administration into future development and profitability.

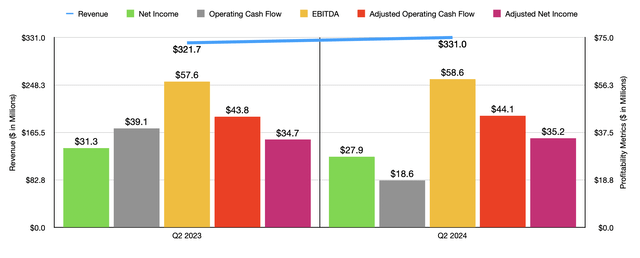

Different profitability metrics for the corporate ended up coming in combined, however have been principally optimistic. Adjusted internet earnings, as an illustration, grew properly from $61.8 million to $69.9 million. Working money stream did plunge from $70.2 million to $21.5 million. Luckily, if we modify for modifications in working capital, we get an enchancment from $80.7 million to $88.6 million. In the meantime, EBITDA for the enterprise expanded from $105.5 million to $113.5 million. Within the chart above, you can even see monetary outcomes overlaying the second quarter of this 12 months by itself. This reveals a lot of the identical with income, adjusted earnings, and money flows, all increased 12 months over 12 months. The one distinction is that internet earnings declined in comparison with what they have been within the second quarter of 2023.

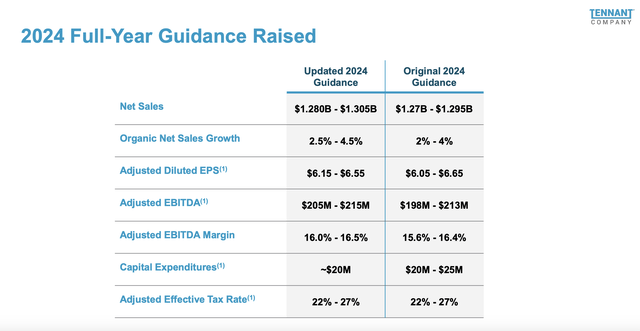

One other wonderful thing about the corporate is that administration just lately elevated steering for the 12 months. Beforehand, they have been forecasting income of between $1.27 billion and $1.295 billion. They now anticipate this to return in at between $1.28 billion and $1.305 billion. It’s because natural internet gross sales at the moment are anticipated to be between 2.5% increased and 4.5% increased in comparison with the two% to 4% enhance administration forecasted for prior steering. The corporate additionally expects earnings per share, on an adjusted foundation, of between $6.15 and $6.55. On the low finish, that is $0.10 per share larger than beforehand forecasted. However on the excessive finish, it is $0.10 per share decrease. This nonetheless has the identical midpoint. Nonetheless, the corporate did enhance steering for EBITDA from between $198 million and $213 million to between $205 million and $215 million. We haven’t any estimates in relation to different profitability metrics. But when we assume that adjusted working money stream will rise on the identical price as EBITDA will, on the midpoint, then we must always anticipate a studying for it of $159.4 million.

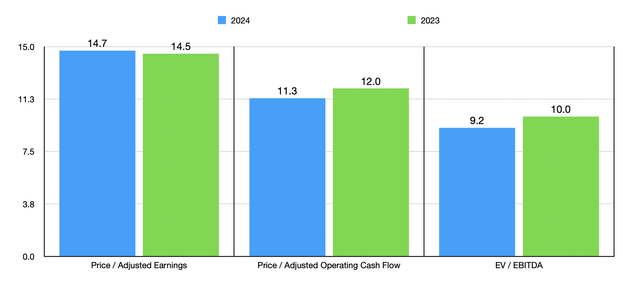

Utilizing these estimates, we will see how shares are priced on a ahead foundation for 2024. This may be seen within the chart above. The chart additionally reveals pricing primarily based on 2023 figures. This locations it on the teetering level between being pretty valued and barely undervalued. Nonetheless, on a relative foundation, shares are additionally marginally enticing. Within the desk under, you may see the corporate stacked up towards 5 comparable corporations. On a value to earnings foundation, solely one of many 5 corporations ended up being cheaper than it’s. And in relation to each the worth to working money stream strategy and the EV to EBITDA strategy, two of the 5 corporations ended up being cheaper than our candidate.

| Firm | Value / Earnings | Value / Working Money Move | EV / EBITDA |

| Tennant Firm | 14.7 | 11.3 | 9.2 |

| Mueller Industries (MLI) | 14.1 | 11.2 | 9.0 |

| SPX Applied sciences (SPXC) | 67.2 | 33.3 | 25.3 |

| Mayville Engineering Firm (MEC) | 37.1 | 5.0 | 8.0 |

| The Timken Firm (TKR) | 16.6 | 11.6 | 9.5 |

| Parker-Hannifin (PH) | 26.3 | 22.1 | 17.4 |

Takeaway

Primarily based on the info supplied, I have to say that Tennant Firm is doing fairly effectively. The rise in steering is sweet to see. The rising income, earnings, and money flows, are actually encouraging. On an absolute foundation, shares are between barely undervalued and pretty valued. However relative to comparable corporations, the corporate positively tilts a bit towards the undervalued class. Add on high of this the agency’s sturdy market share within the areas during which it operates, and I do assume that upgrading it after this latest plunge from a ‘maintain’ to a ‘purchase’ is acceptable.