- Ethereum Basic’s buying and selling quantity surged to 584.46M, signaling rising investor curiosity amid ETH’s declining energy.

- ETC held above the important thing $22.50 assist whereas ETH struggled beneath its 50-day shifting common, elevating questions on market shifts.

Ethereum Basic [ETC] has seen a barely higher pattern than Ethereum [ETH] of late, resulting in hypothesis that it could possibly be absorbing the liquidity that the latter is shedding.

With each property exhibiting contrasting worth actions and quantity developments, traders query whether or not ETC is rising as a viable various to ETH.

Ethereum Basic’s worth motion: A combined pattern

Ethereum Basic traded at $24.54 at press time, reflecting a 1.72% intraday decline.

The worth chart highlighted that ETC had entered a consolidation section after a robust December rally, buying and selling beneath its 50-day shifting common of $26.87 and above the 200-day shifting common of $23.15.

The truth that it stays above the 200-day MA means that ETC continues to be in a long-term uptrend regardless of short-term bearish actions.

ETC’s current worth motion has been marked by decrease highs, which might point out waning bullish momentum. Nonetheless, assist on the $22.50 degree stays sturdy, suggesting a bounce might happen if the broader market stabilizes.

ETH’s loss, ETC’s acquire?

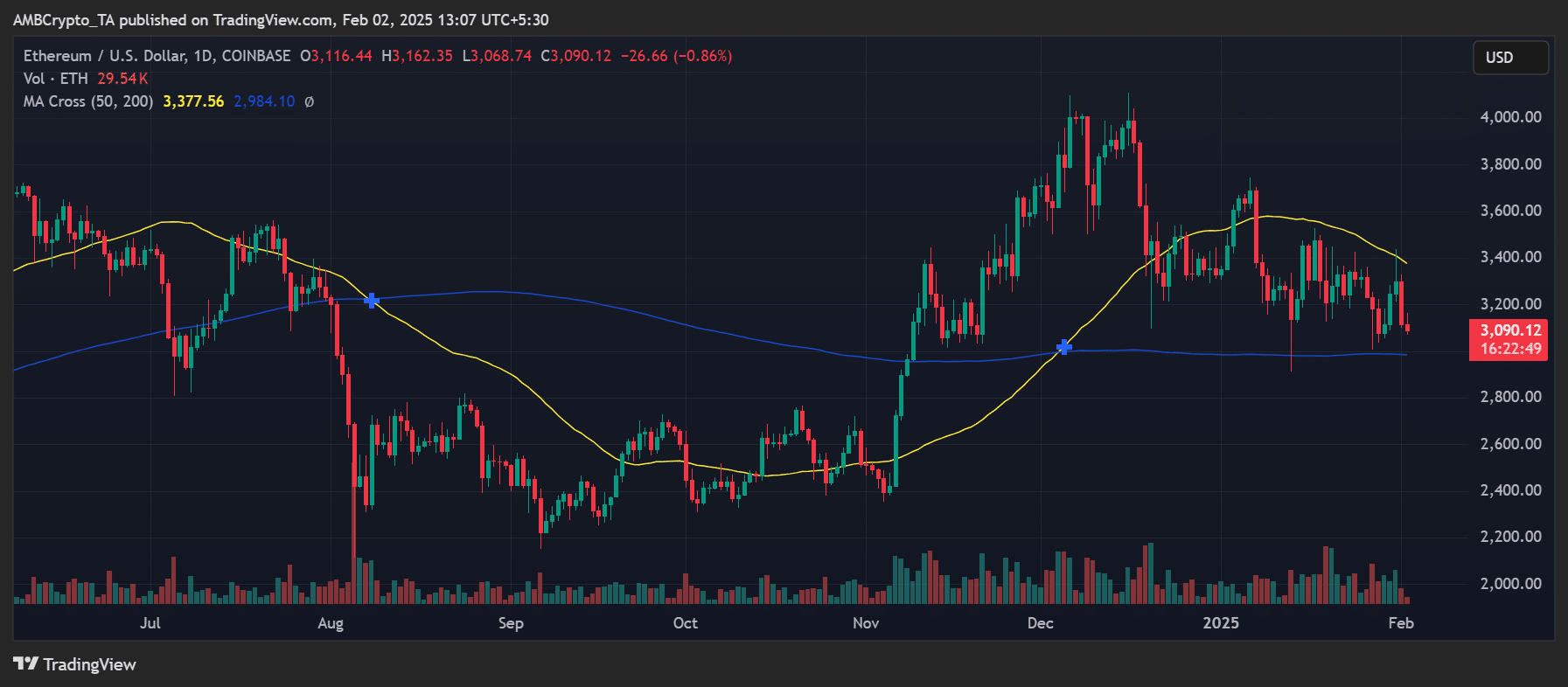

However, Ethereum traded at $3,090.12 on the time of writing, exhibiting a 0.86% decline for the day. Whereas ETH remained in a broader uptrend, it struggled to carry key assist ranges.

The 50-day shifting common was $3,377.56, whereas the 200-day shifting common was $2,984.10.

A breach beneath the 50-day MA signaled a possible lack of short-term momentum, making Ethereum susceptible to additional draw back strain.

Notably, Ethereum’s buying and selling quantity has been petering out, with Santiment’s quantity chart indicating lowered participation from merchants.

This weakening curiosity might clarify why some traders are shifting their focus towards Ethereum Basic, which has demonstrated greater relative energy.

Quantity developments: ETC’s rising momentum

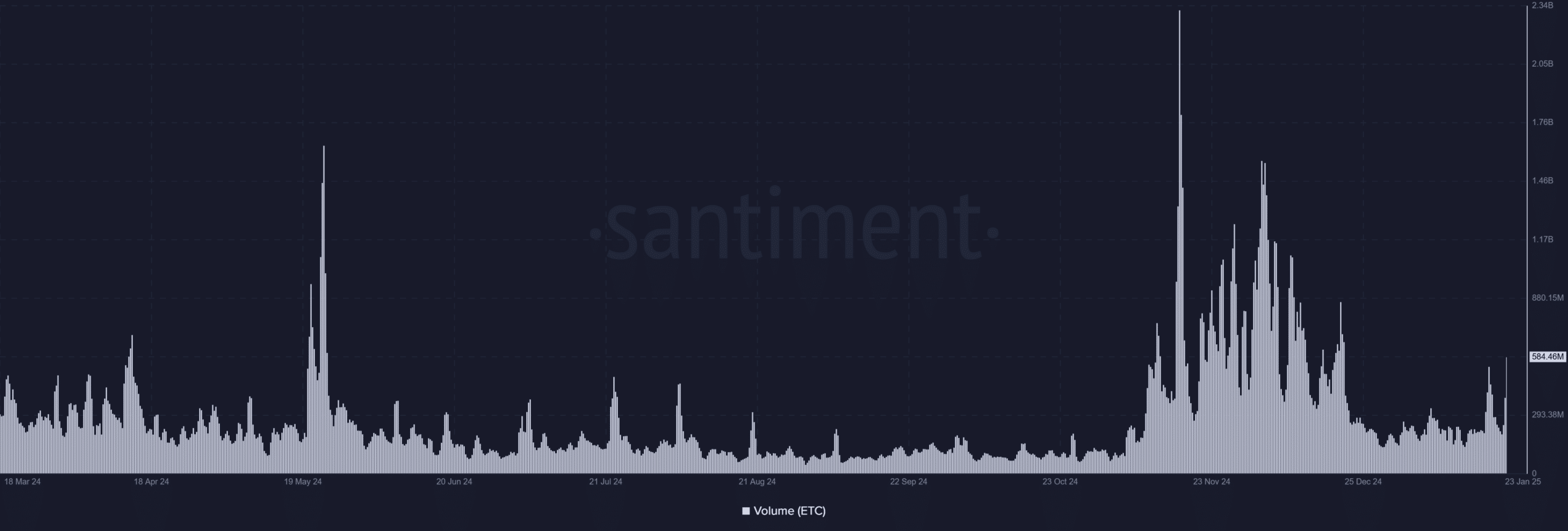

A more in-depth have a look at Santiment’s quantity chart revealed that ETC had been experiencing a gentle enhance in buying and selling quantity, with a current excessive of 584.46M.

This uptick was an indication of renewed investor curiosity and rising confidence in Ethereum Basic as an alternative choice to Ethereum.

In contrast to ETH, whose quantity has been declining, ETC’s liquidity remained strong, probably signaling a switch of market curiosity.

Quantity spikes in late January 2025 aligned with worth actions, reinforcing the concept merchants are actively participating with ETC.

This shift could possibly be resulting from hypothesis that ETC affords a hedge in opposition to Ethereum’s weakening momentum, or resulting from expectations of community developments that would favor ETC.

Ethereum Basic’s subsequent transfer

Wanting forward, ETC should preserve its present buying and selling quantity and maintain above the $22.50 assist zone to proceed positioning itself as a robust various to Ethereum.

If Ethereum’s weak point persists, there’s potential for ETC to achieve additional traction. Nonetheless, traders ought to look ahead to resistance close to $27.50, the place promoting strain has beforehand capped positive factors.

Is your portfolio inexperienced? Take a look at the Ethereum Basic Revenue Calculator

On the macro degree, Ethereum Basic’s correlation with Ethereum implies that broader crypto market developments will play a task in its trajectory.

If ETH recovers, ETC may also profit, although its impartial quantity surge means that merchants are more and more treating it as a standalone asset moderately than a spinoff of Ethereum.