Do you ever really feel like market turbulence throughout information occasions catches you off guard?

How is it that some merchants can navigate these stormy durations with ease…

…when you’re left scrambling!

Belief me, I’ve been there.

Luckily, it’s not luck or instinct, although.

It’s all right down to technique.

Profitable merchants don’t simply commerce the information – they actively plan for it!

At first look, buying and selling by means of information would possibly really feel like navigating a minefield of sudden spreads, sudden gaps, and excessive volatility that may shake even probably the most seasoned dealer.

However with the fitting strategy, you may undoubtedly deal with these challenges with confidence.

On this article, I’ll information you thru the necessities of reports occasions:

- The several types of financial information

- How market expectations set the scene

- How the precise financial information factors have an effect on the charts

- The function the USD has on the foreign exchange market

- Some threat administration instruments to guard you throughout information occasions

Able to take management of your trades, even throughout probably the most turbulent market moments?

Let’s dive in!

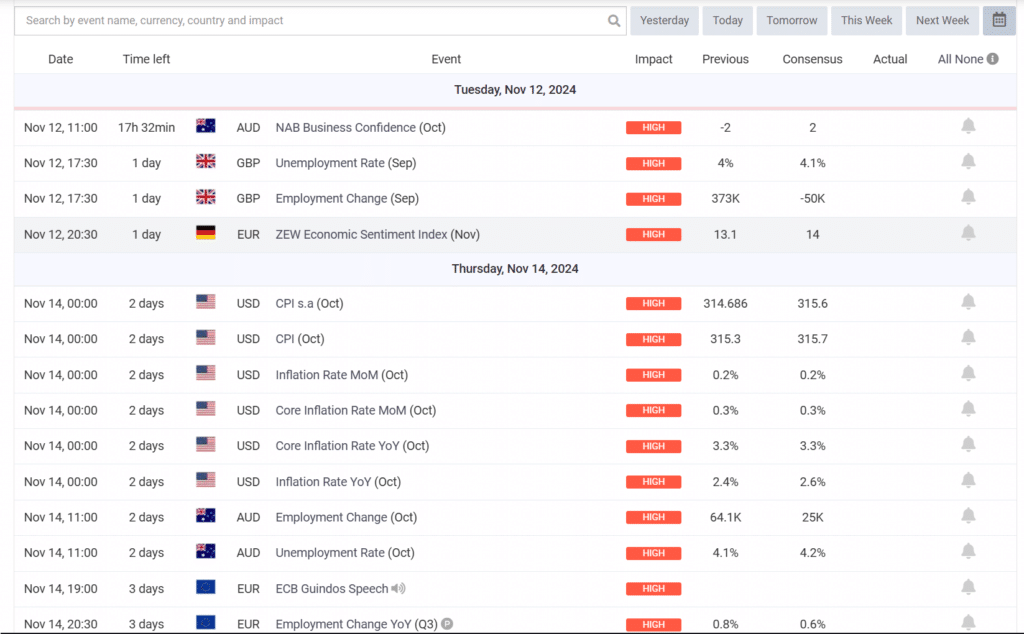

Varieties of Financial Information: Excessive, Medium, and Low Influence

Let’s face it: not all financial information hits the market with the identical power.

Some occasions trigger large waves of volatility, whereas others barely make a ripple.

If you wish to commerce sensible, you’ll want to know which information strikes the needle and the way it influences the markets.

Let’s break it down:

Excessive-Influence Information: The Market Movers

These occasions are the heavy hitters.

When high-impact information drops, markets can react within the blink of an eye fixed, with volatility spiking dramatically.

These are the moments that merchants reside for or dread as a result of they will rapidly flip an excellent day into a foul one or vice versa.

Excessive Influence Information Occasions Instance:

Right here’s what it’s best to regulate:

Central Financial institution Choices

When central banks just like the Federal Reserve or the European Central Financial institution announce rate of interest modifications or tweak their financial coverage, the markets hold on each phrase.

Even a delicate change in tone or terminology can result in main shifts within the markets.

GDP Experiences

Consider Gross Home Product (GDP) because the economic system’s report card.

A shock within the GDP progress fee can jolt the markets, signaling both energy or weak point within the broader economic system.

Merchants typically regulate their positions accordingly, particularly when the numbers are totally different from expectations.

Inflation Knowledge (CPI)

Inflation is one other large information subject

When Shopper Value Index (CPI) information surprises to the upside or draw back, it could possibly gas hypothesis about future rate of interest strikes, sending currencies and commodities on a rollercoaster.

Employment Knowledge (NFP)

The U.S. Non-Farm Payrolls (NFP) financial information report is a month-to-month occasion that each dealer marks on their calendar.

It offers a snapshot of the job market and units the tone for market sentiment.

A robust or weak NFP launch can dramatically shift expectations for financial progress and rates of interest.

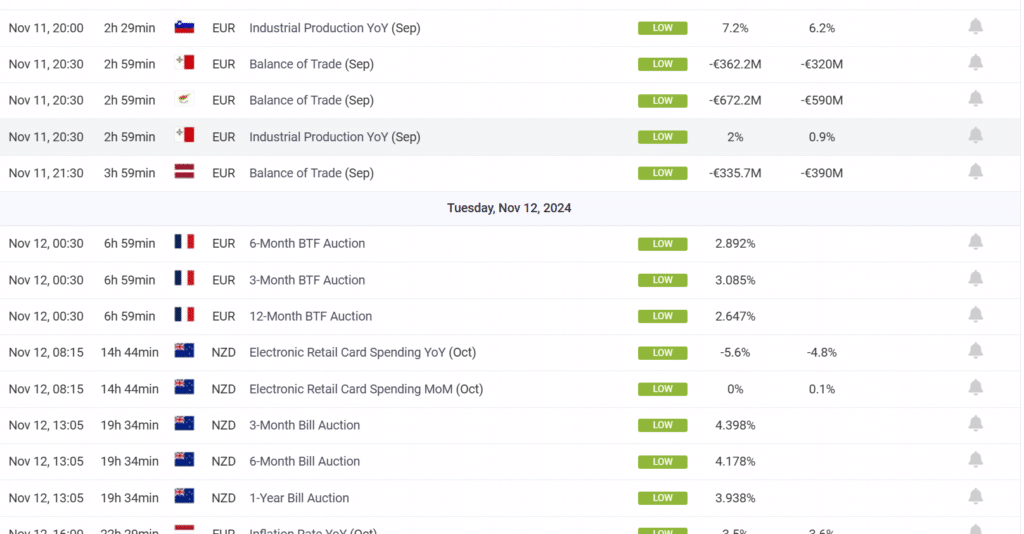

Geopolitical Occasions

Political surprises, comparable to sudden election outcomes, wars, or sudden management modifications, can ship shockwaves by means of international markets.

Merchants typically flock to safe-haven property like gold or the U.S. greenback during times of uncertainty.

Examples embrace the market reactions to the onset of COVID-19 lockdowns, Russia’s invasion of Ukraine, and even the latest election leads to America.

AUD/USD Each day Chart Covid Lockdowns:

See how an sudden occasion like COVID-19 induced panic available in the market?

These conditions are uncommon however at all times extraordinarily vital to pay shut consideration to.

Let’s transfer on to medium-impact information.

Medium-Influence Financial Information: The Regular Drummers

Whereas these occasions could not trigger fast market fireworks, they nonetheless play an vital function in shaping longer-term developments and total sentiment.

Medium-impact information offers useful context and buying and selling alternatives for these paying consideration.

Medium Influence Information Occasions Instance

Let’s take a look at some key examples:

Retail Gross sales Knowledge

Retail gross sales give a snapshot of client spending, which is a serious driver of financial progress.

Surprises on this information can shift market sentiment, particularly in the event that they sign modifications in client confidence or spending habits.

PMI Experiences (Enterprise Confidence)

Buying Managers’ Index (PMI) experiences supply an early glimpse into the well being of the manufacturing and companies sectors.

Robust PMI readings can increase market optimism, whereas weaker numbers could level to potential slowdowns.

Central Financial institution Speeches

Even exterior formal coverage selections, speeches by central financial institution officers can transfer markets.

Some merchants scrutinize their tone and phrase decisions for hints about future financial coverage, making these occasions vital for predicting shifts in market sentiment.

Commerce Steadiness Experiences

These financial information experiences reveal the hole between a rustic’s exports and imports.

A narrowing commerce deficit can sign enhancing financial circumstances, whereas a widening deficit would possibly increase crimson flags.

Though these experiences typically trigger restricted fast market response, surprises can nonetheless shift long-term sentiment.

Why Medium-Influence Information Issues

When you may not see dramatic strikes on the charts except one thing sudden occurs, medium-impact information could also be one thing to concentrate to.

It helps reinforce the narrative set by high-impact occasions and might supply clues about their potential outcomes.

Observant merchants use these experiences to anticipate how markets would possibly react to approaching high-impact information, giving them an edge in making knowledgeable selections.

So, take a look at medium-impact information extra as a touch at what would possibly come.

Low-Influence Information: The Background Noise

Low-impact information may not ship shockwaves by means of the markets, however it nonetheless serves a objective.

Whereas these occasions not often set off important value actions, they add depth to your total market evaluation…

Low Influence Information Occasions Instance:

Right here’s what suits into this class:

Shopper Sentiment Surveys:

These provide you with a really feel for a way optimistic or pessimistic individuals are in regards to the economic system.

Whereas they’re unlikely to trigger large strikes, they’re useful in predicting shifts in client habits.

Building and Housing Knowledge:

Financial information experiences like housing begins and constructing permits primarily have an effect on area of interest sectors, like actual property or building shares, somewhat than the broader market.

Lesser-Recognized Indicators:

Knowledge comparable to wholesale inventories or regional surveys could not make headlines however can nonetheless supply area of interest insights.

Though most merchants don’t give low-impact information a lot consideration, staying knowledgeable can nonetheless be advantageous.

These experiences may not instantly affect main market strikes, however they supply delicate hints about total market well being and might help form your buying and selling bias.

Briefly, there’s no hurt in maintaining a tally of low-impact information it could possibly function a helpful complement to your broader buying and selling technique.

Simply keep in mind to not overreact and overanalyze its outcomes and never let it take up an excessive amount of time and vitality.

Why Does This Financial Information Matter?

Okay Rayner, so there are information occasions which have totally different impacts in the marketplace.

However how does that match into my buying and selling?

Effectively, understanding the affect ranges of financial information means that you can prioritize and handle your focus.

Excessive-impact information? That’s your time to shine. These are the occasions almost certainly to set off important market strikes.

Medium-impact information offers useful context, serving to you gauge developments and put together for future volatility and probably giving insights into what high-impact information end result is more likely to be.

In the meantime, low-impact information provides depth, providing area of interest insights with out overwhelming your evaluation.

It’s very important you acknowledge the variations between these classes so you may keep forward of the curve, keep away from pointless noise, and focus on the occasions that really matter.

However how do you interpret this information in actual time?

And extra importantly, how do you identify whether or not the market will react strongly, mildly, or in no way?

Let’s take a deeper dive into how expectations and precise information affect the market.

Market Expectation

Why does high-impact information typically ship markets right into a frenzy whereas, at different occasions, it barely causes a ripple?

The reply lies in market expectations.

Earlier than any important financial information drops, analysts and economists put out their forecasts.

These predictions are basically the market’s baseline:

- If inflation is predicted to rise by 0.3%, merchants value that in.

- If job progress is projected at 200,000 new jobs, markets regulate forward.

In essence, the market braces itself for the “anticipated” situation, which is why you’ll typically hear the phrase “priced in.”

However right here’s the catch: analysts don’t at all times get it proper.

Market Actuality

As soon as the precise information is launched, merchants evaluate it towards these expectations, which is when the actual motion begins.

Let’s break down the three doable outcomes:

In Line with Expectations:

There is no such thing as a shock right here.

When the financial information information matches forecasts, the market typically stays calm, with minimal value actions. Merchants have been already ready for this, so there’s no need to regulate positions.

Higher Than Anticipated:

That is what merchants love.

Optimistic surprises, like stronger job progress or sooner GDP growth, typically spark shopping for sprees.

You’ll see costs shoot up as market optimism surges.

Worse Than Anticipated:

Unfavourable surprises, comparable to disappointing job numbers or higher-than-expected inflation, can set off sell-offs.

Merchants rapidly regulate to the gloomier outlook, and costs typically tumble.

Take this instance, as an illustration:

Say the market expects 200,000 new jobs, however the report exhibits solely 100,000.

That’s a giant miss, and also you would possibly see shares fall or currencies weaken as merchants reassess their positions.

Volatility when precise financial information outcomes are higher or worse than anticipated could be excessive, which is why merchants both embrace or keep away from these moments, relying on their threat tolerance.

It’s price mentioning the distinction between scheduled and unpredictable information.

As proven above, some market turbulence could be predicted by noting the financial calendar and getting ready for the important thing dates with threat administration strategies.

Nonetheless, some information can catch merchants off guard, comparable to geopolitical tensions and pure disasters.

Subsequent, it’s vital to debate how information affecting the USD impacts the remainder of the market.

The Energy of the USD: How It Strikes World Markets

The U.S. Greenback (USD) isn’t simply any forex; it’s the heavyweight champion of world finance.

Because the world’s most traded forex and the go-to reserve for central banks, its actions drastically have an effect on international markets.

From currencies to commodities like oil and gold, it’s truthful to say nothing comes near the USD.

So when the U.S. releases main financial information information comparable to GDP progress, inflation figures, or employment stats, the whole monetary world takes word.

A strong jobs report or a hawkish resolution from the Federal Reserve can propel the greenback greater, setting off chain reactions in different markets.

As a result of many commodities are priced in USD, shifts of their worth instantly affect commodity-dependent currencies just like the Canadian greenback (CAD) and the Australian greenback (AUD).

So, does each forex react to U.S. information? In a phrase: sure.

However the extent and nature of these reactions range.

Let’s take a better look.

How Different Currencies React

Currencies typically take their cues from the USD.

Main Pairs

EUR/USD

As probably the most traded forex pair, EUR/USD is especially delicate to U.S. financial information releases.

Robust U.S. information sometimes results in a stronger greenback, pushing this pair decrease. Conversely, weak U.S. information or dovish Federal Reserve insurance policies may cause the euro to rise towards the greenback.

GBP/USD

Whereas the pound reacts to U.Ok. information, it typically responds much more sharply to U.S. information.

Occasions like Federal Reserve fee hikes or sudden inflation figures can overshadow home components, driving important strikes on this pair.

USD/JPY

This pair tells a novel story, because the yen is usually seen as a safe-haven forex.

When U.S. information indicators financial energy, USD/JPY tends to rise, reflecting risk-on sentiment.

However in occasions of world uncertainty, the yen positive aspects energy, inflicting the pair to drop as merchants search security.

Let me present you an instance of this…

USD/JPY 4hr Chart Weakening USD/JPY as cash shifts to the Yen:

Commodity-linked currencies just like the Australian Greenback (AUD), New Zealand Greenback (NZD), and Canadian Greenback (CAD) additionally react to U.S. information, particularly when it impacts commodity costs.

A robust greenback can weigh on these currencies by making exports like oil or metals costlier.

Why This Issues for Financial Information and Financial Calendars

Understanding the USD’s affect helps make clear why U.S. information is essential, even for merchants targeted on non-dollar pairs.

Excessive-impact U.S. occasions don’t simply have an effect on the greenback. They’ll shift sentiment throughout the whole monetary ecosystem.

Whether or not you commerce EUR/GBP, AUD/NZD, and even commodities, understanding how these occasions would possibly set off ripple results is vital.

That’s the place financial calendars are available in.

By highlighting main releases like Federal Reserve conferences or U.S. employment information, these instruments allow you to anticipate when volatility may spike.

Recognizing these occasions permits you to keep forward of market strikes and place your self accordingly.

With that in thoughts, let’s check out easy methods to actively use information and calendars in your buying and selling.

Threat Administration: Navigating Market Storms Throughout Financial Information Occasions

Buying and selling round financial information releases can really feel like steering a ship by means of a sudden storm – thrilling however crammed with hazard!

Market volatility throughout these occasions can result in fast value swings, widened spreads, and sudden gaps.

With out a clear threat administration technique, even skilled merchants can face heavy losses.

On this part, let’s discover vital methods to safeguard your buying and selling account throughout this high-stakes motion.

Easy methods to Shield Your self Throughout Information Occasions

Use Cease-Loss Orders:

Cease-loss orders are your first line of defence.

They robotically shut your commerce when the market strikes towards you by a predefined quantity.

This could stop small losses from snowballing into bigger ones.

Nonetheless, in fast-moving markets, slippage is an actual concern, as your order may not execute on the precise stage you set, particularly throughout extremely unstable information occasions.

To mitigate this:

Think about inserting tighter stops when you’re buying and selling smaller, extra unstable property.

You may additionally regulate stops and transfer them into revenue areas when you’re already in a positive commerce, permitting you to safe positive aspects whereas staying protected.

Scale back Place Sizes:

Cutting down your commerce dimension is among the easiest methods to restrict threat.

If a serious announcement is coming, scale back your publicity.

You may additionally contemplate taking some earnings off the desk to cowl prices or lock in positive aspects earlier than the storm hits

Diversify Your Trades:

Keep away from concentrating your threat by diversifying throughout totally different asset lessons or forex pairs.

If one market strikes towards you, different uncorrelated positions would possibly stay unaffected or offset losses.

Be aware, nonetheless, that in excessive international occasions, correlations between property can improve, so select your diversification properly.

Methods to Keep away from Excessive-Threat Information Durations

Generally, the very best transfer is not any transfer, particularly throughout high-risk information occasions.

By figuring out when to step again, you may defend your capital and keep away from pointless stress.

Listed below are some methods I exploit to assist me keep secure when the market is primed for volatility

Verify Financial Calendars:

Instruments like Foreign exchange Manufacturing unit, myfxbook, or TradingView present detailed schedules of upcoming information occasions.

Excessive-impact occasions are normally highlighted, giving a transparent heads-up on when to tread rigorously.

Shut Positions Earlier than Main Financial Information:

In case you’re not assured about dealing with the volatility, contemplate closing open positions beforehand.

This eliminates the danger of sudden value actions and means that you can reevaluate after the mud has settled.

Keep away from Buying and selling Through the First Minutes of Information Releases:

The moments instantly after a serious launch are sometimes probably the most unstable.

Ready for the preliminary mud to settle might help keep away from impulsive trades and erratic value motion.

Give attention to Low and Medium-Influence Information Durations:

In case you want a extra steady buying and selling surroundings, follow occasions when the market isn’t on edge over main bulletins.

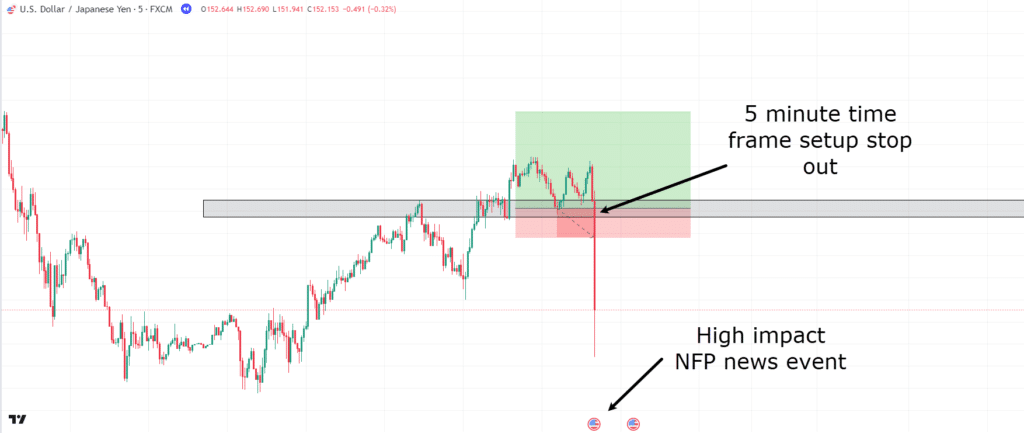

Alter Your Buying and selling Timeframe

Usually, when buying and selling on a better timeframe, information occasions nonetheless can have an effect on your commerce, however typically with a lot much less threat.

On greater timeframe setups, it’s widespread for stops to be wider, targets to be long run, and information occasions to be a blip on the radar within the grand scheme.

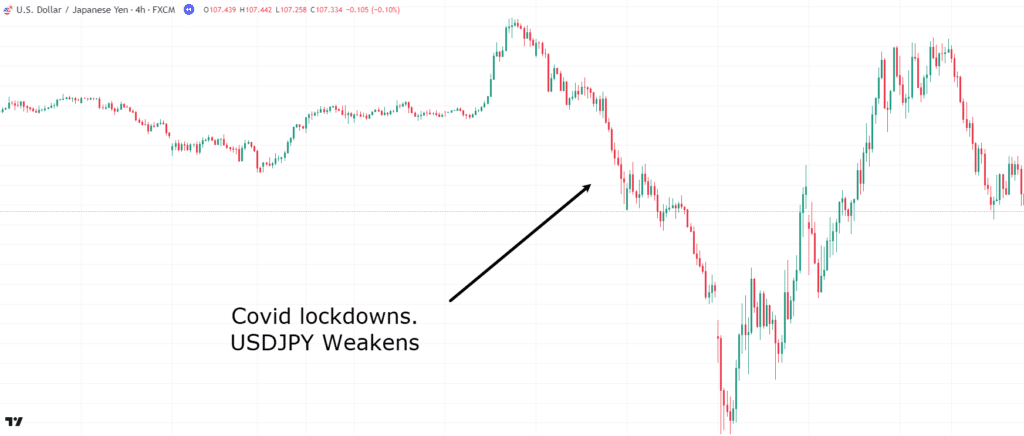

Let me present you an instance…

USD/JPY 5 Minute Chart Failed commerce:

As you may see, a setup revealed itself for a easy assist and resistance flip.

If this commerce had been entered a couple of minutes earlier than one of the vital unstable high-impact information occasions, Non-Farm Payroll, this commerce would’ve resulted in a major loss!

Nonetheless, when you take a look at the upper timeframe, you’ll see one thing utterly totally different…

USD/JPY 1 Hour Chart Zone Revered:

The decrease 1-hour timeframe zone makes way more sense, and as you may see, as unstable because the NFP information occasion was, it nonetheless revered the zone.

Clearly, information occasions are way more unstable when seen by means of the decrease timeframe lens.

On greater timeframes, volatility tends to be much less disruptive to trades deliberate round key ranges.

With wider cease losses and revenue targets, the affect of sudden market strikes can typically be minimized.

As such, if a serious occasion is on the horizon and also you’re in a greater timeframe commerce, there’s normally much less trigger for concern, as your broader commerce construction shouldn’t be as more likely to be affected.

Conclusion

Navigating market turbulence throughout high-impact financial information occasions can really feel daunting, however with the proper technique and threat administration strategies, it doesn’t should be!

Profitable merchants don’t simply react to market shifts; they plan and use confirmed instruments to handle volatility and defend their capital.

On this article, you’ve:

- Explored the several types of financial information and their various impacts in the marketplace

- Discovered how market expectations form the preliminary response to financial information

- Gained a deeper understanding of how precise financial releases have an effect on forex pairs and asset costs

- Found the essential function the U.S. Greenback (USD) performs in international markets

- Recognized key threat administration instruments like stop-loss orders, place sizing, and avoiding high-risk durations to safeguard your trades

By incorporating these insights and techniques into your buying and selling plan, you’ll have the ability to deal with the unpredictable nature of reports occasions with confidence, turning potential pitfalls into worthwhile alternatives.

In case you’re able to take management of your trades and strategy market information with a strong plan, now’s the time to implement what you’ve realized.

And now – I’d love to listen to from you!

How do you handle threat throughout high-impact information occasions?

What instruments or methods have helped you navigate market volatility?

Share your ideas and experiences within the feedback beneath!