HIGHLIGHTS

- Strategic give attention to scaling Envirostream, the Battery Recycling division, because of the potential of elevated recycling volumes and cashflows over time forward

- Battery Recycling: Continued secure operations, rising volumes and working income, and search companions to scale operations consistent with the anticipated waste outlook

- Livium is properly superior on the near-term commercialisation pathways of its different applied sciences:

- Battery Supplies: Outlined pathway for growth of an Australian LFP demonstration plant with funding to be secured instantly into VSPC from strategic companions

- Lithium Chemical compounds: Full JDA actions with MinRes, together with evaluation of alternate commercialisation pathways and choice of the popular lithium product

- Restructuring of the organisation and price reductions being undertaken with estimated annual ongoing financial savings of A$1.5m

Remark concerning the strategic replace from Livium CEO and Managing Director, Simon Linge

“We’ve got superior our technique to inflection factors, with the subsequent phases of development for every division requiring strategic companions to underpin their development and growth. With a give attention to strategic development companions, now we have reviewed our resourcing and made the choice to restructure our organisation and scale back prices.

Livium stays dedicated to delivering returns for shareholders. While organisational modifications might impression our potential to react to alternatives, proper sizing the organisation assists in resetting the Firm’s value base to turn into sustainable over this important interval.”

NEAR TERM PLANS

The next actions have been recognized as key to delivering worth within the close to time period:

- Battery Recycling: Continued secure operations, rising end-of-life volumes, and looking for companions to scale operations consistent with the anticipated waste outlook and to increase into associated providers

- Battery Supplies: Safe funding for an Australian LFP demonstration plant from authorities and personal strategic companions, who will make investments instantly into VSPC

- Lithium Chemical compounds: Full JDA actions with MinRes, together with evaluation of alternate commercialisation pathways and choice of the popular lithium product

- Company: Full implementation of organisation restructure and different value saving initiatives.

BATTERY RECYCLING GROWTH OUTLOOK

The Battery Recycling division generates income at the moment, is the most important recycler of lithium-ion batteries within the nation, attracts on our technical experience to offer value-added providers and has sturdy industrial relationships. Strategic focus is being positioned on Battery Recycling, via Envirostream, because of the potential of elevated recycling volumes over the approaching years.

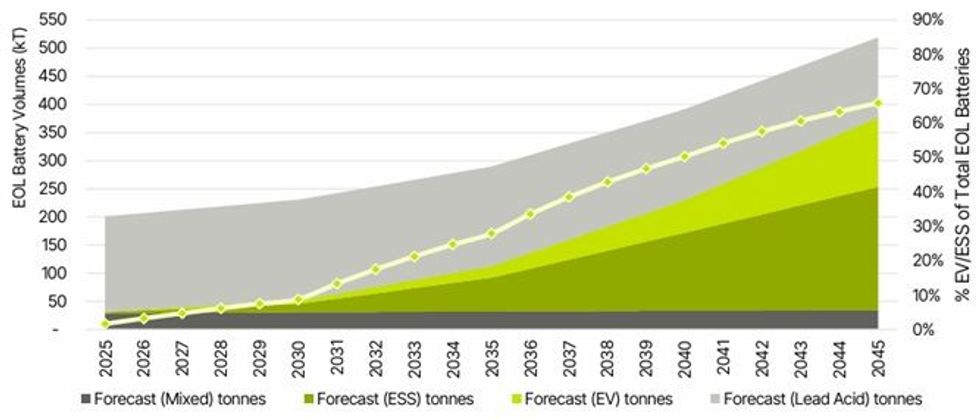

Throughout CY2024, Envirostream efficiently elevated volumes of EV’ andESS2 with many of the quantity being acquired underneath unique buyer preparations. Over CY2024, Envirostream collected 736k tonnes of enormous format batteries and it’s estimated that there are 5 occasions these volumes obtainable at the moment that are more and more anticipated to be recycled attributable to shopper demand and authorities regulation. Of their Battery Market Evaluation, B-cycle present how EV and ESS batteries are anticipated to dominate3.

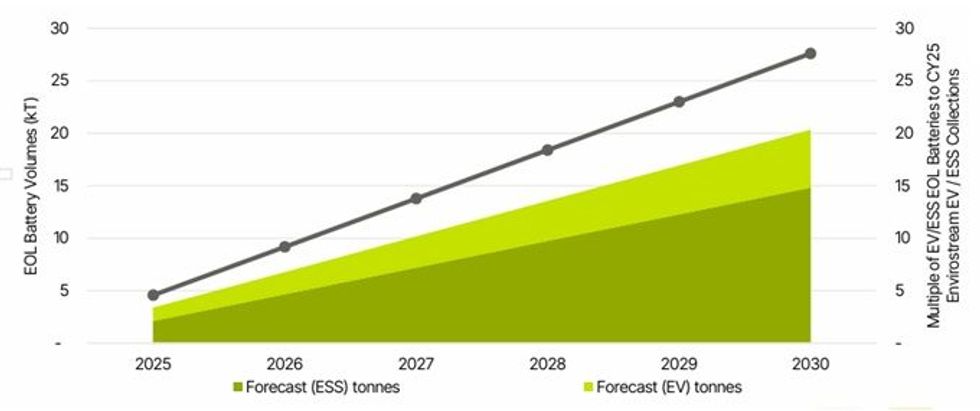

Specializing in solely EV / ESS for the stability of the last decade demonstrates the near-term alternative for Envirostream collections development relative to present efficiency.

Determine 2. 5-12 months EV and ESS EOL Battery Projections3

Determine 2. 5-12 months EV and ESS EOL Battery Projections3

The near-term outlook for Envirostream is constructive, enabling will increase of volumes collected and processed, and offering a chance to increase our service choices consistent with market necessities.

To accommodate expectations of market development, the enterprise intends to discover deploying development capital to enhance working efficiencies and increase capability. The corporate has appointed advisors to coordinate discussions round partnership and development funding choices, which incorporates each strategic companions and different financiers.

Click on right here for the total ASX Launch

This text consists of content material from Livium Ltd, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than performing upon any info offered right here. Please seek advice from our full disclaimer right here.