- RENDER’s value development has been bearish in current months.

- The retest of the $4.4 help zone may provide a shopping for alternative.

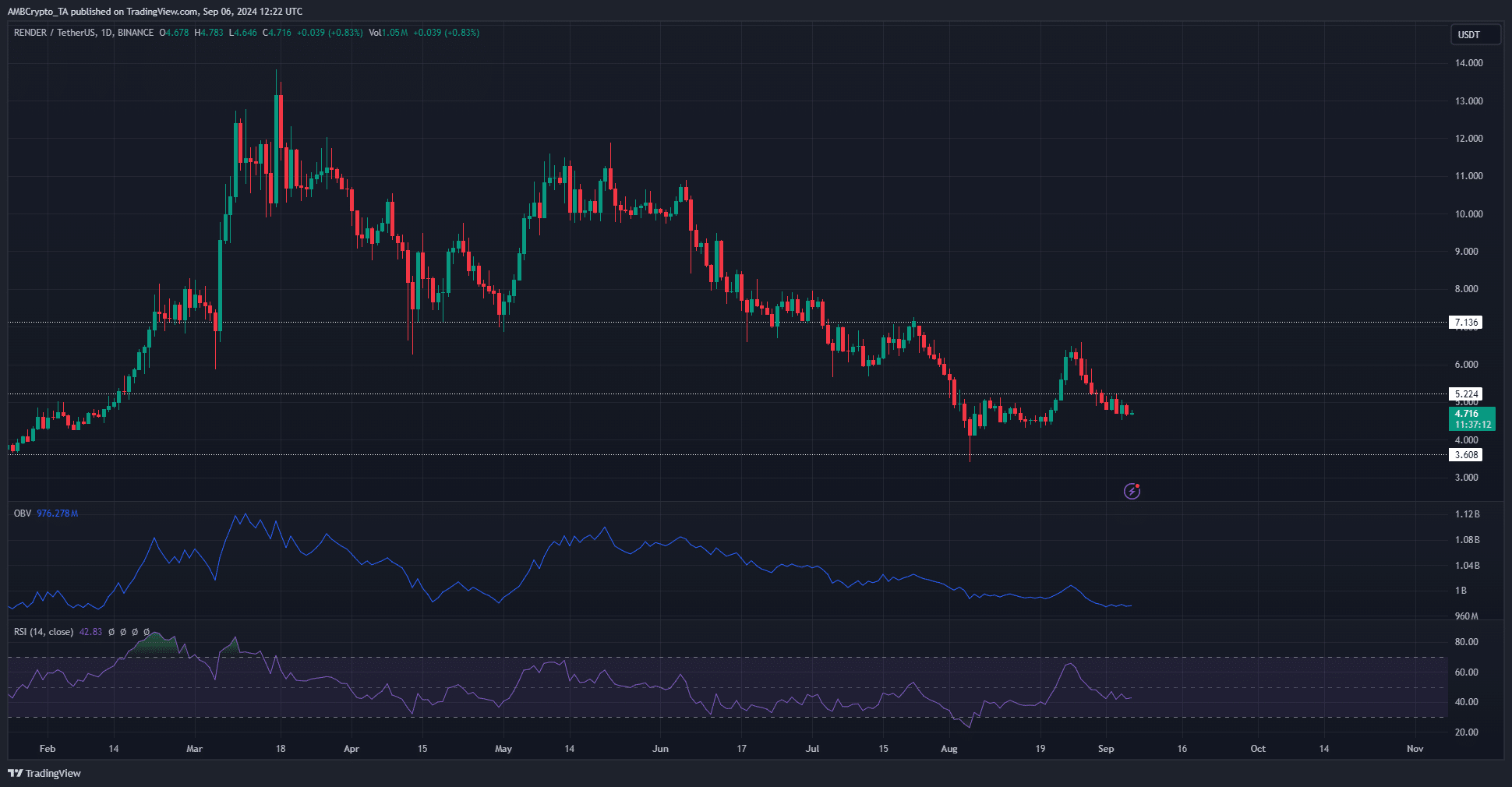

Render [RENDER] has retraced virtually all of the positive factors it made through the value bounce from the twenty first to the twenty sixth of August. It was buying and selling at $4.716 at press time, near the $4.1-$4.4 help zone.

The technical indicators had turned bullish through the value surge, however the patrons couldn’t maintain the stress. The OBV resumed its downtrend and the RSI additionally fell under impartial 50.

Nevertheless, some on-chain metrics gave extra optimistic indicators.

Shopping for alternative for RENDER

Supply: Santiment

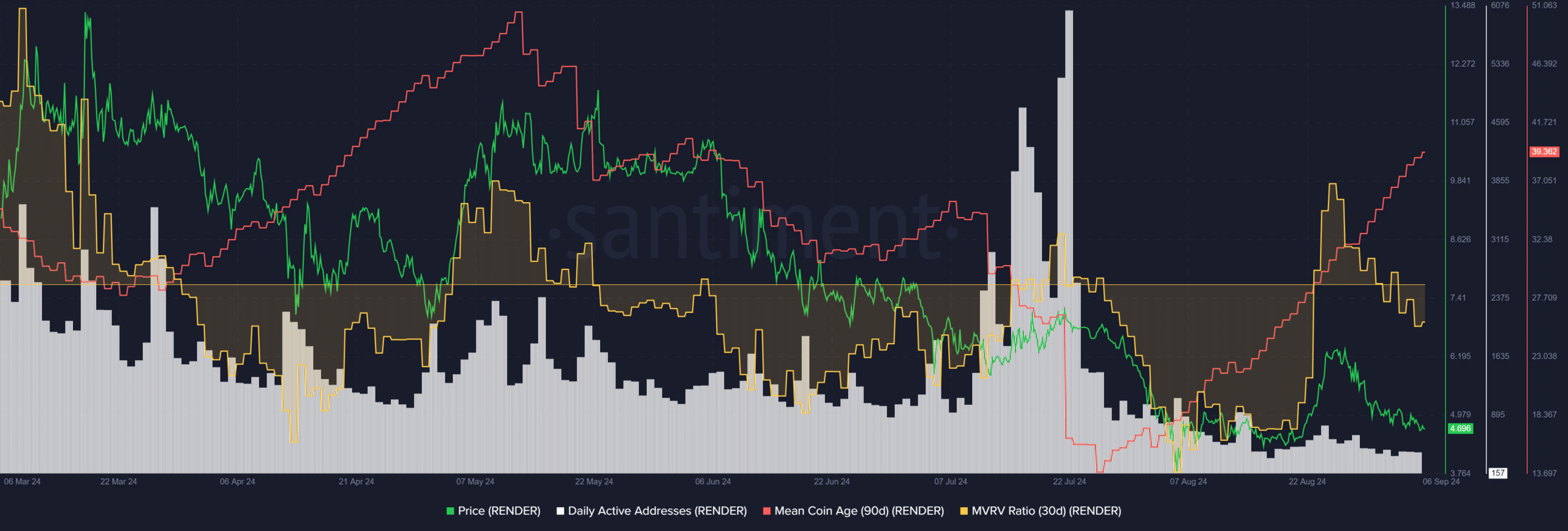

The every day energetic addresses have been in a downtrend because the surge in July. This was disappointing, as lowered community participation signifies decreased demand.

But, the imply coin age has been trending upward for the previous six weeks.

The inference was network-wide accumulation. Furthermore, the 30-day MVRV has fallen under zero to point out short-term holders had been at a minor loss.

Subsequently, the token was undervalued however present process accumulation, presenting an excellent shopping for alternative.

Supply: IntoTheBlock

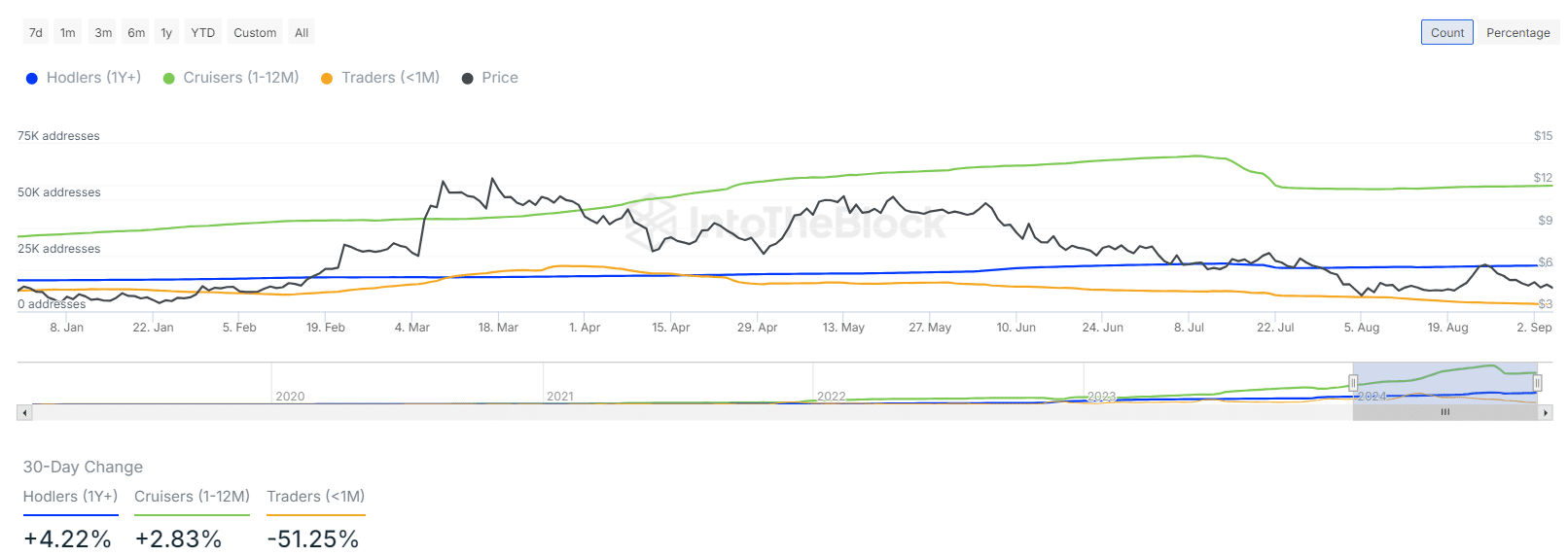

AMBCrypto discovered that over the previous month, the longer-term holders have been rising in quantity. Knowledge from IntoTheBlock confirmed that holders and cruisers have elevated, whereas the merchants have decreased.

Implications for the value traits and market sentiment

Supply: Coinalyze

The decline in energetic merchants from the metric above meant that speculators and short-term holders had been far much less considering holding onto the coin that’s in a short-term downtrend.

The Open Curiosity within the derivatives market has additionally been on a slide in current days, collectively displaying short-term bearish sentiment.

Is your portfolio inexperienced? Verify the Render Revenue Calculator

The spot CVD has additionally been in a persistent downtrend. The dearth of demand within the spot market agreed with the OBV’s proof that purchasing stress was weak.

General, although RENDER offered a shopping for alternative, traders may need to look ahead to a drop into the $4.1-$4.4 zone earlier than seeking to enter.