- Stacks examined the $1.75 help amid a 26% weekly drop

- Ascending channel pointed to bullish potential, with the resistance at $2.40 and goal at $10

Stacks (STX) was buying and selling at $1.71, on the time of writing, following a 11.73% decline during the last 24 hours and a 26.06% drop in simply 7 days. With a circulating provide of 1.5 billion STX, the cryptocurrency had a market capitalization of $2.57 billion.

Buying and selling quantity within the final 24 hours stood at $439 million, indicating substantial exercise throughout this worth drop.

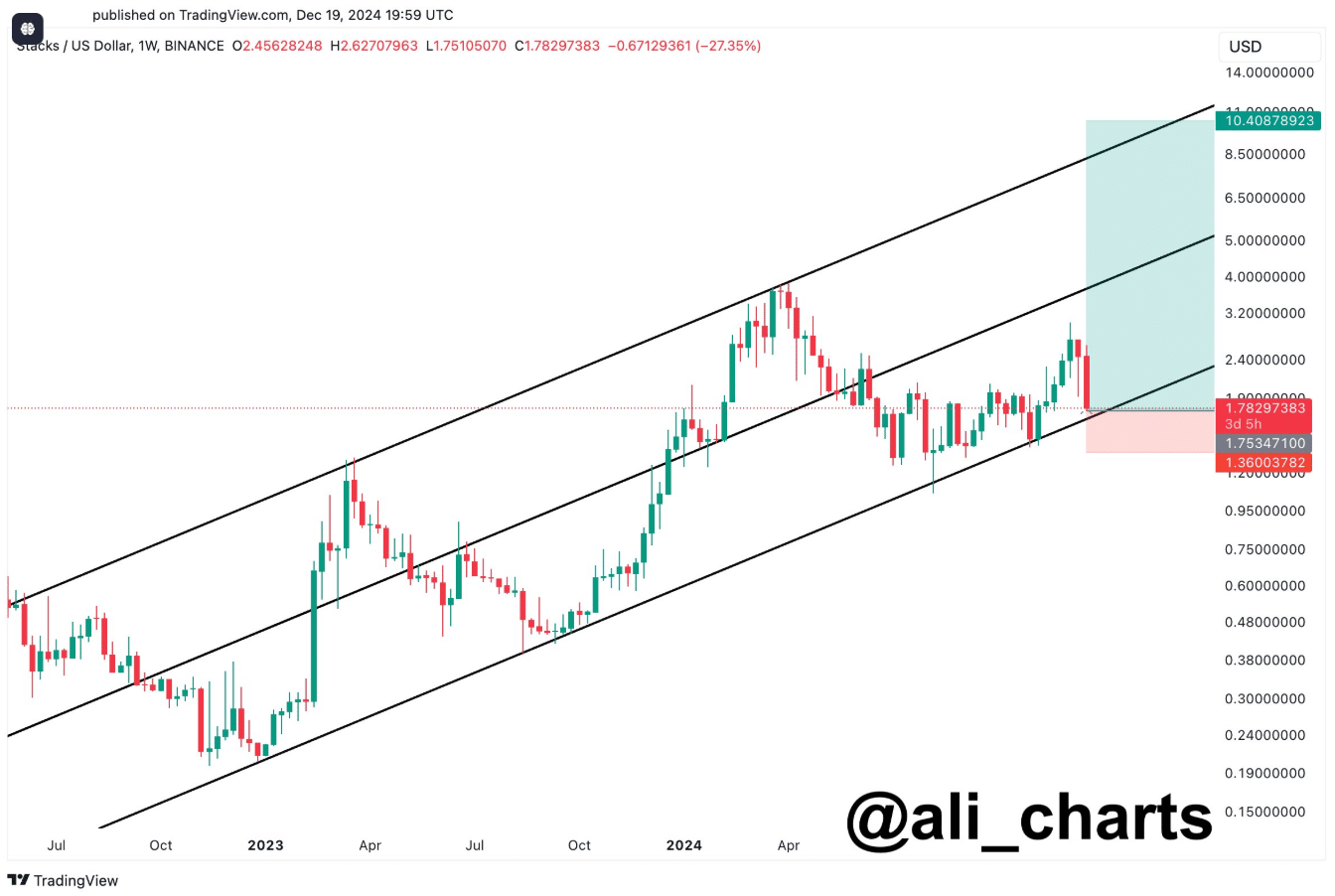

The latest downturn in STX‘s worth appeared to be in keeping with a broader market decline. This downturn pushed the token in direction of its essential help degree inside a long-term ascending channel.

Ascending channel signifies long-term bullish pattern

Based on AMBCrypto’s evaluation, Stacks appeared to be buying and selling inside an outlined ascending channel – An indication of a broader bullish pattern regardless of latest declines. At press time, the value was approaching the decrease boundary of this channel, between $1.70 and $1.80 – A zone that has persistently acted as sturdy help.

The higher boundary of the channel pointed to a possible goal close to $10, suggesting room for future worth restoration if the help holds.

In reality, fashionable analyst Ali Martinez described this section as a attainable shopping for alternative, emphasizing the significance of the ranges for long-term buyers.

Latest correction and key ranges

Stacks pulled again sharply from its mid-channel resistance close to $4.50, falling by 27.35% throughout this correction. Whereas this decline has pushed the value in direction of its help, such pullbacks are widespread in long-term uptrends and will present accumulation alternatives.

The help at $1.75 – $1.78 can be essential in figuring out the following transfer for STX. If this degree holds, it might result in a rebound, with preliminary resistance targets at $2.40 – $2.50 and stronger resistance close to $2.80 – $3.00.

Nevertheless, a breakdown beneath $1.75 might set off additional declines, with the following main help ranges at $1.50 and $1.40.

Momentum indicators sign combined traits

The Superior Oscillator (AO), at press time, displayed purple bars – An indication of bearish momentum. Nevertheless, a declining histogram indicated that promoting strain could also be easing. For a bullish reversal, inexperienced bars on the AO can be wanted, together with a breakout above lower-high resistance ranges.

Merchants ought to carefully monitor the $1.75 zone for indicators of a rebound or additional breakdown. A sustained transfer above this degree might push the value in direction of the $2.00 – $2.40 vary within the close to time period.

Outlook and key metrics to look at

With STX buying and selling close to its help, buyers are watching key ranges to find out the following pattern. The speedy help stands at $1.75, with main resistance zones at $2.40 and $2.80. If the decrease boundary of the ascending channel is breached, draw back targets of $1.50 or decrease might come into play.

This correction, whereas steep, suits inside a bigger sample of progress for Stacks, suggesting potential for restoration if help ranges maintain.

- Stacks examined the $1.75 help amid a 26% weekly drop

- Ascending channel pointed to bullish potential, with the resistance at $2.40 and goal at $10

Stacks (STX) was buying and selling at $1.71, on the time of writing, following a 11.73% decline during the last 24 hours and a 26.06% drop in simply 7 days. With a circulating provide of 1.5 billion STX, the cryptocurrency had a market capitalization of $2.57 billion.

Buying and selling quantity within the final 24 hours stood at $439 million, indicating substantial exercise throughout this worth drop.

The latest downturn in STX‘s worth appeared to be in keeping with a broader market decline. This downturn pushed the token in direction of its essential help degree inside a long-term ascending channel.

Ascending channel signifies long-term bullish pattern

Based on AMBCrypto’s evaluation, Stacks appeared to be buying and selling inside an outlined ascending channel – An indication of a broader bullish pattern regardless of latest declines. At press time, the value was approaching the decrease boundary of this channel, between $1.70 and $1.80 – A zone that has persistently acted as sturdy help.

The higher boundary of the channel pointed to a possible goal close to $10, suggesting room for future worth restoration if the help holds.

In reality, fashionable analyst Ali Martinez described this section as a attainable shopping for alternative, emphasizing the significance of the ranges for long-term buyers.

Latest correction and key ranges

Stacks pulled again sharply from its mid-channel resistance close to $4.50, falling by 27.35% throughout this correction. Whereas this decline has pushed the value in direction of its help, such pullbacks are widespread in long-term uptrends and will present accumulation alternatives.

The help at $1.75 – $1.78 can be essential in figuring out the following transfer for STX. If this degree holds, it might result in a rebound, with preliminary resistance targets at $2.40 – $2.50 and stronger resistance close to $2.80 – $3.00.

Nevertheless, a breakdown beneath $1.75 might set off additional declines, with the following main help ranges at $1.50 and $1.40.

Momentum indicators sign combined traits

The Superior Oscillator (AO), at press time, displayed purple bars – An indication of bearish momentum. Nevertheless, a declining histogram indicated that promoting strain could also be easing. For a bullish reversal, inexperienced bars on the AO can be wanted, together with a breakout above lower-high resistance ranges.

Merchants ought to carefully monitor the $1.75 zone for indicators of a rebound or additional breakdown. A sustained transfer above this degree might push the value in direction of the $2.00 – $2.40 vary within the close to time period.

Outlook and key metrics to look at

With STX buying and selling close to its help, buyers are watching key ranges to find out the following pattern. The speedy help stands at $1.75, with main resistance zones at $2.40 and $2.80. If the decrease boundary of the ascending channel is breached, draw back targets of $1.50 or decrease might come into play.

This correction, whereas steep, suits inside a bigger sample of progress for Stacks, suggesting potential for restoration if help ranges maintain.