Key Takeaways

- US client costs rose 2.7% yearly in November, retaining inflation above the Federal Reserve’s 2% goal.

- Merchants are anticipating a quarter-point discount within the federal funds fee on the upcoming Federal Reserve assembly.

Share this text

Recent November CPI information out Wednesday confirmed client costs elevated as anticipated, retaining the Federal Reserve on observe for a fee reduce subsequent week, particularly when the November jobs report launched earlier this month indicated stable job development.

The Shopper Worth Index climbed 0.2% month-over-month, matching each October’s improve and economist estimates, in keeping with Bureau of Labor Statistics information launched Wednesday.

Core CPI, which excludes unstable meals and vitality costs, elevated 0.3% from October and maintained a 3.3% annual fee, assembly analyst expectations.

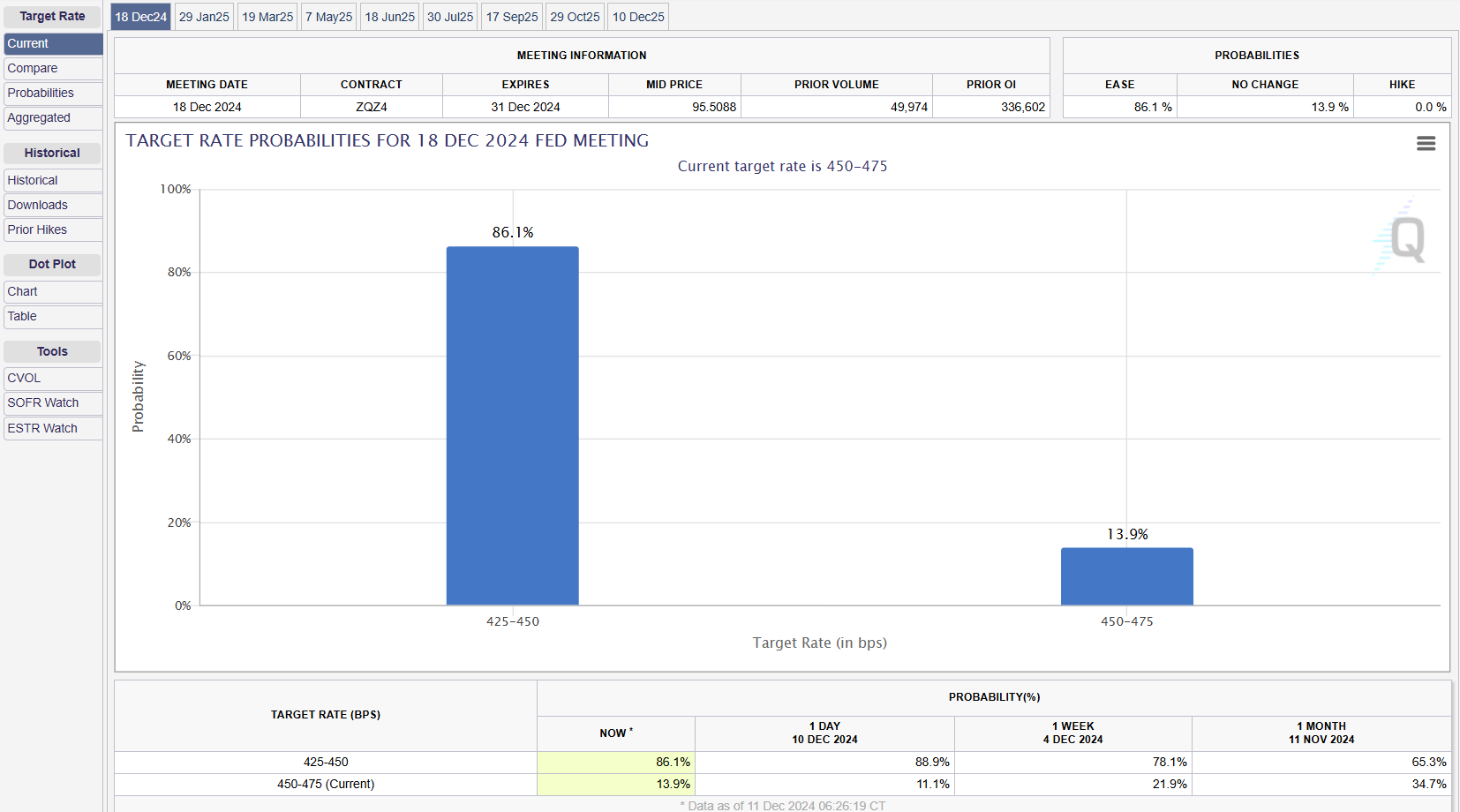

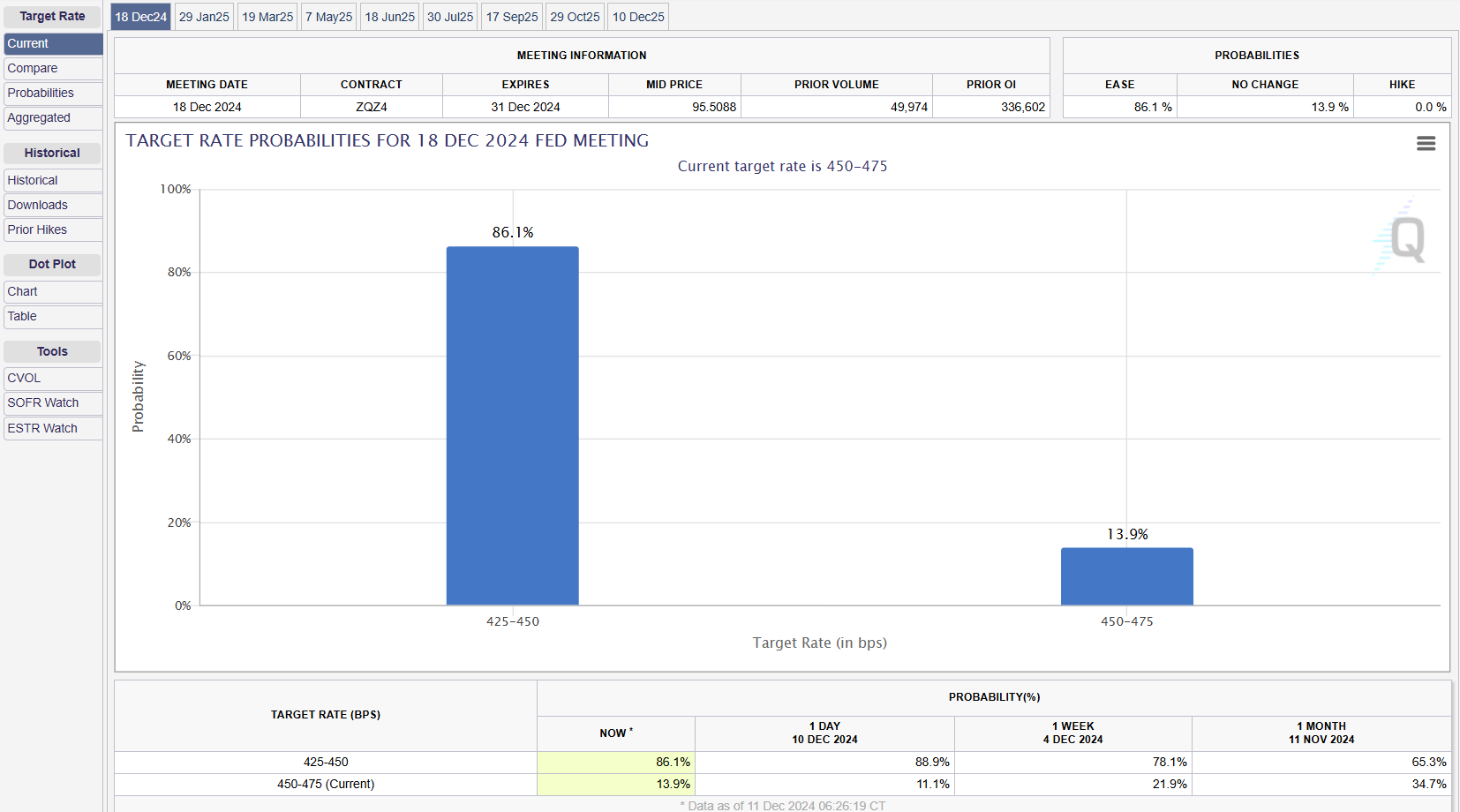

The inflation report comes as markets broadly count on the Fed to chop rates of interest at its December 17-18 assembly. Merchants are pricing in an 86% likelihood of a quarter-point discount within the federal funds fee, in keeping with CME Group’s FedWatch instrument.

The November jobs report, which confirmed a sturdy 227,000 job acquire, additional solidified the case for alleviating financial coverage. The determine surpassed surpassing expectations and marked a sturdy rebound from the earlier month’s lackluster efficiency.

The determine not solely exceeded the Dow Jones consensus estimate of 214,000 but additionally mirrored upward revisions in job features for October and September, bringing the three-month common payroll development to 173,000.

Whereas inflation has cooled considerably from its peak of round 9% in June 2022, latest information suggests costs are stabilizing at ranges above the Fed’s goal.

Bitcoin traded above $98,000 forward of the inflation information launch, recovering from a latest dip under $94,000. The crypto asset has gained 2% within the final seven days, per CoinGecko information.

Share this text