The Ethereum token has formally entered the highlight because it breaks out of a multi-year triangle sample on the weekly chart. In keeping with insights from technical analyst Captain Faibik, the breakout alerts the beginning of the much-anticipated 2024-25 bull run. At the moment buying and selling at $4,002, ETH has surged over 7.93% previously week, edging nearer to the essential $4,500 stage.

$ETH is lastly Breaking out of Large Triangle on the Weekly TF Chart..!!

Ethereum 2024-25 bull run is Formally Began. 📈

Midterm Goal: $10K!#Crypto #Ethereum #ETH #ETHUSDT pic.twitter.com/NQ3s2taX92

— Captain Faibik 🐺 (@CryptoFaibik) December 7, 2024

This breakout marks the top of a protracted consolidation section characterised by decrease highs and better lows, culminating in a bullish decision. In consequence, Captain Faibik factors to a possible mid-term goal of $10,000, aligning with historic patterns noticed throughout Ethereum’s earlier bull cycles.

ETH Bullish Sample Targets $4,500

In keeping with a TradingView evaluation, the ETH token chart reveals a textbook cup-and-handle sample, a bullish formation suggesting additional upside potential. The sample’s breakout top of roughly 37%, mixed with Fibonacci extensions, factors to a short-term goal of $4,500.

As of press time, the cryptocurrency is testing the neckline resistance close to $4,087, and a decisive break above this stage may verify the continuation of its rally. Furthermore, the Fib retracement ranges have performed a key position, with the deal with discovering assist close to the 38.2% retracement zone at $3,342, reinforcing the bullish outlook.

From a technical perspective, momentum indicators additional strengthen the bullish case state of affairs. The relative energy index, as an illustration, sits at 72.31, implying a heightened shopping for spree within the ETH cryptocurrency. Traditionally, Ethereum has displayed a capability to carry crucial ranges, constantly constructing on its momentum and reaching new highs in related situations.

But these very ranges typically coincide with overbought circumstances, signaling the potential for short-term corrections. The Directional Motion Index additional solidifies the bullish case, with the +DI line, 31.7980, outpacing the -DI at 8.6811. This exhibits a dominant shopping for energy within the ETH market. Moreover, the ADX worth of 47.0139 confirms the present pattern’s energy and means that the shopping for momentum will possible proceed quickly.

ETH’s On-Chain Metrics Reveals Minimal Resistance Forward

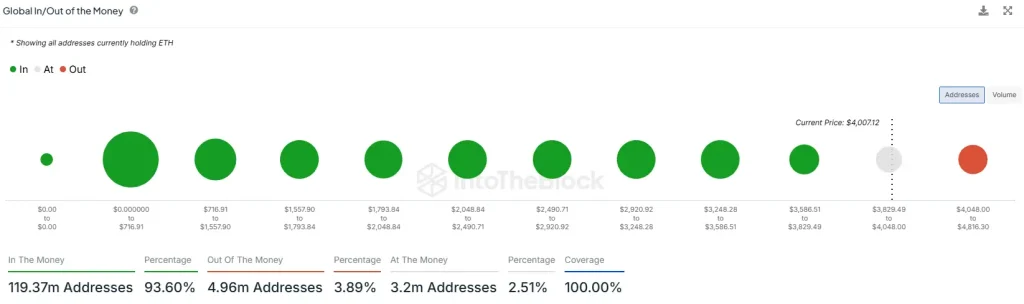

On-chain information reveals that 93.6% of Ethereum addresses, or 119.37 million, are presently “within the cash,” which means they bought ETH at a value decrease than the present $4,007.12. In the meantime, solely 3.89% of addresses, representing 4.96 million holders, are “out of the cash,” indicating resistance if the cryptocurrency’s value approaches their break-even factors.

Moreover, 2.51% of addresses, or 3.2 million, are “on the cash,” suggesting a crucial threshold across the present value stage. Specializing in the value cluster between $3,405.10 and $4,608.43, 75.22% of addresses, or 14.03 million, stay worthwhile.

Nevertheless, 23.81%, or 4.44 million, are out of the cash, which may introduce promoting stress within the higher vary close to $4,250–$4,500. With minimal resistance zones till the $4,500 goal, the token’s breakout momentum might stay intact until market circumstances shift drastically.

Additionally Learn: Is BNB Value $1000 Rally Subsequent After Bitcoins’ $100k Milestone?