Now, when you’ve spent nearly any time looking for the phrase ‘Foreign exchange’…

…you’ve undoubtedly come throughout MT4, aka MetaTrader 4!

The MT4 platform might be one of many very first platforms you’re launched to in Foreign currency trading.

I imply, it’s written up at virtually each Foreign exchange dealer!

However when you’re something like me, there’s at all times been an enormous draw back to it…

…every little thing appears to be like so difficult!…

And to be sincere, there’s a fact to that.

You truly do want these additional instruments. (ultimately)

Fortunately, within the earlier information…

I taught you how one can arrange your MT4 platform from absolute scratch in solely 10 minutes…

…and it even reveals you how one can handle your danger on the platform, too!

So, with that in place, I’ll share with you the precise workflow I’ve been utilizing for years in immediately’s information.

I’ve change into ultra-efficient with it now, enabling me to research tens of charts and handle all of my trades in lower than 5 minutes a day.

You’re about to be taught it too!

Particularly, you’ll cowl…

- What your MT4 platform ought to appear like, and the way it’s meant for use

- The one factor that it’s best to at all times have in your buying and selling plan to make sure that you by no means run out of buying and selling alternatives

- My “secret” method on how one can discover trades throughout tens of charts in lower than 3 minutes

- The “finest” instruments you possibly can ever purchase and use for MT4

Prepared?

Then let’s get began…

MT4 Suggestions and Methods: Simplifying your platform

On this information…

I’ll educate you a repeatable course of that you would be able to observe to totally make the most of MT4 – it doesn’t matter what buying and selling technique you’ve got.

And to realize that, “simplifying” your platform is available in three steps.

1. Declutter your platform

Your first step is to declutter every little thing in your chart…

Subsequent, select solely the instruments you want on the tabs (as you don’t want most of them)…

And sure, see these additional tabs?

Shut them as nicely!…

Lastly, press “F8” and customise the colours in your chart…

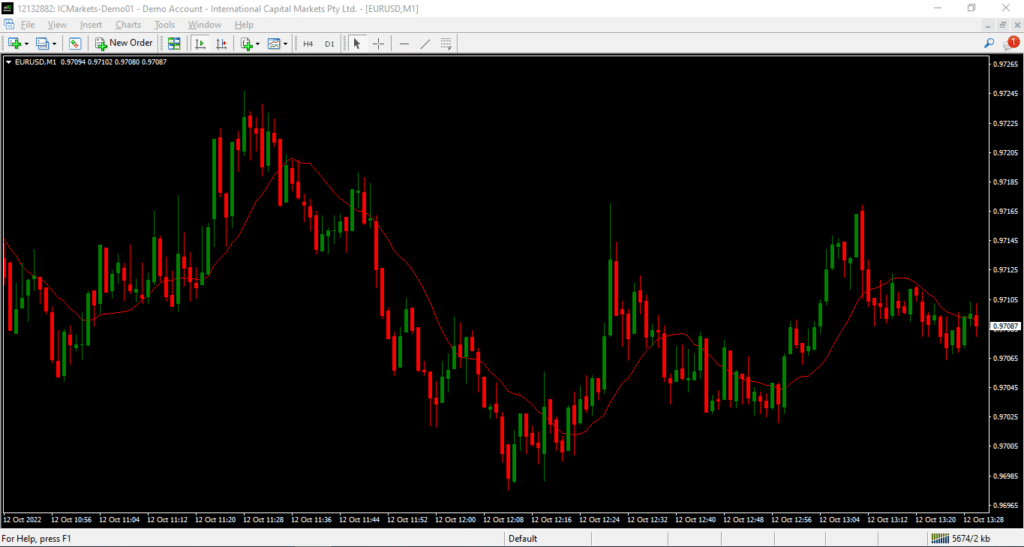

After that, you’ll have a platform that appears one thing like this…

As an alternative of this mess!…

2.Develop a template

The rationale why that is vital is that you would be able to immediately apply your “chosen” indicators to any chart you see…

To do that, merely place the symptoms you usually use and save them as a template…

Now…

All the pieces you’ve discovered to this point is in preparation for what you’ll see later.

A profitable setup lays out the muse to execute your buying and selling technique!

However first, I’ll share with you essentially the most essential facet to contemplate when constructing a buying and selling plan…

MT4 Suggestions and Methods: Outline your market choice technique

In case you take a look at each profitable dealer on the market with a buying and selling plan, there’s at all times one factor they’ve in frequent…

A market choice rule

Each constant dealer has a technique on how one can seek for markets to commerce.

For some, they’ve a set of markets fully fastened on their watchlists!

To be honest, it is a subject that deserves a brand new information by itself… (so watch this area!)

However for example, I’ve a set set of markets to commerce, which you’ll be able to try under…

Main pairs:

- EURUSD

- GBPUSD

- USDCHF

- USDJPY

- AUDUSD

- NZDUSD

- USDCAD

Cross-currency pairs:

- EURCHF

- EURGBP

- EURAUD

- EURJPY

- EURCAD

- GBPCHF

- GBPAUD

- GBPJPY

- GBPCAD

- AUDCHF

- AUDJPY

- AUDNZD

- AUDCAD

- CADJPY

- CADCHF

- NZDJPY

- NZDCHF

- NZDCAD

- CHFJPY

Briefly, I don’t want to alter my watchlist as Forex is usually liquid sufficient to commerce virtually on a regular basis.

However once more, that is simply an instance!

Inventory merchants use a inventory filter, whereas some foreign exchange merchants use a foreign money energy meter, which you can too try right here.

The core precept stays:

You have to have a market choice rule that you would be able to execute constantly with out counting on different dealer’s opinions.

Subsequent…

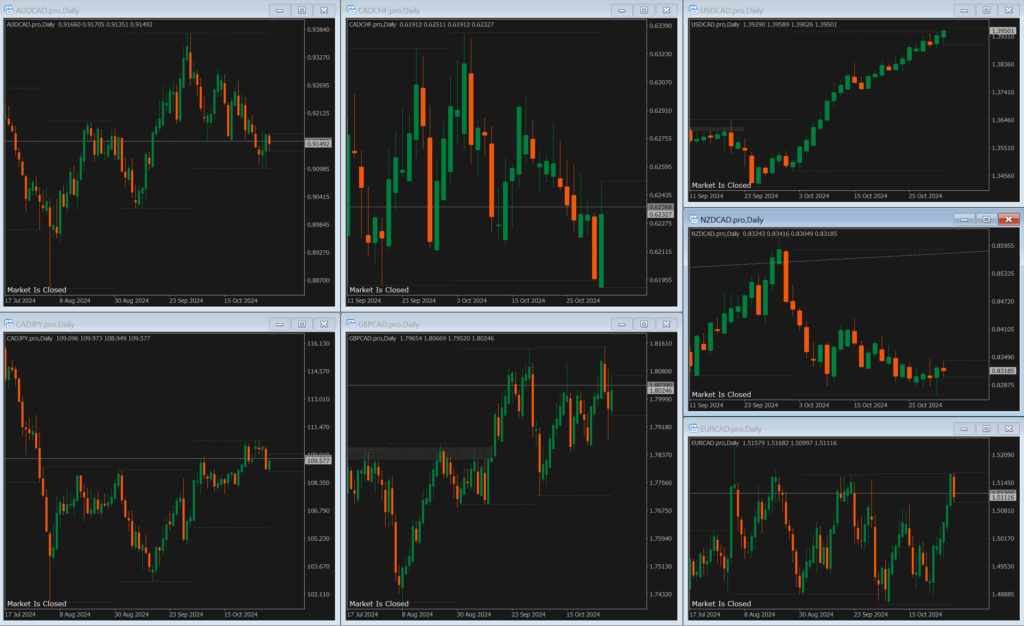

After you have established your watchlist, it’s best to benefit from MT4’s mult-chart device…

Mainly, enter the markets in your watchlist (you possibly can break up your watchlist if it’s too many) by opening a number of charts and urgent ALT + R…

After which click on the “Default” textual content on the backside and save your template…

You may repeat this course of once more, relying on what number of watchlists you’ve got!

When you’ve established your watchlist, you possibly can merely choose the template, and your watchlist will likely be proven accordingly…

Now, what’s subsequent?

How will we take care of all of those charts?

Do I tediously analyze them one after the other?

Effectively, you possibly can do this – however that may take rather a lot longer than 20 minutes!

So, how can we streamline this course of?

Let me present you within the subsequent part…

MT4 Suggestions and Methods: Backside-up method

The very first thing you wish to do when offered with an ocean of charts is take a deep breath…

…and focus in your setups.

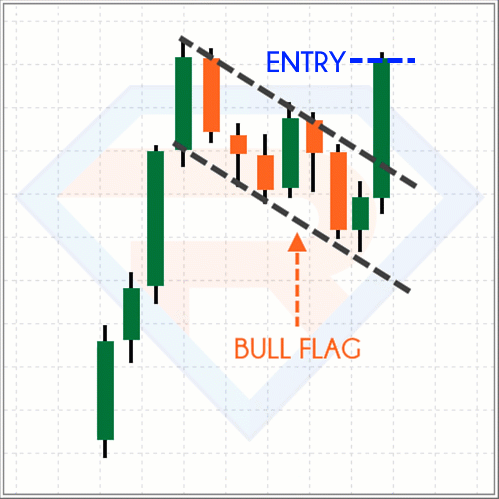

Your buying and selling setup could possibly be a particular chart sample, such because the bull flag…

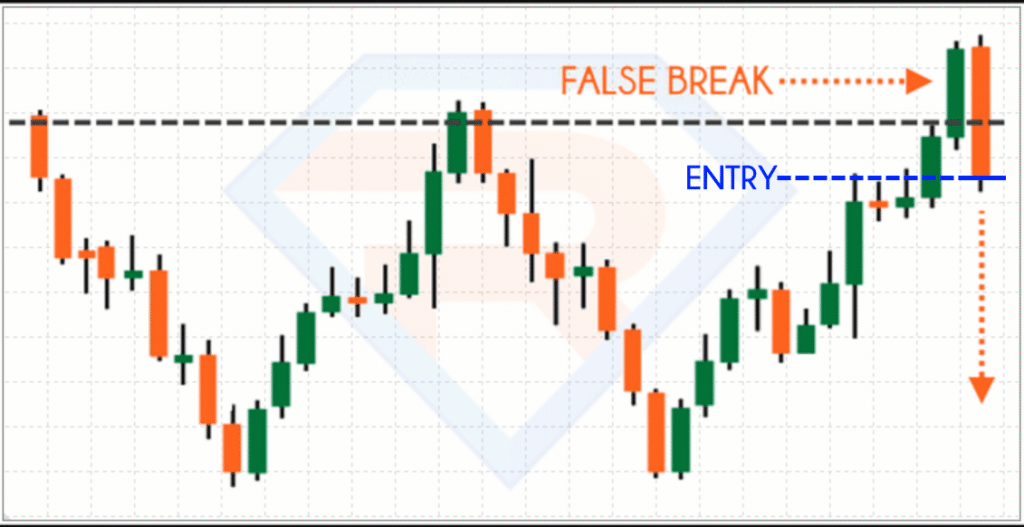

Or maybe a false breakout setup…

What issues is that you just’re limiting what you seek for on a specific chart.

It is going to make it simpler to hit the purchase button and understand how you propose to enter the commerce itself.

I confirmed you worth motion setups, however there are indicator setups as nicely, which you’ll be able to be taught extra about right here.

Keep in mind the watchlist templates I shared with you some time in the past?

Good.

As a result of all that’s left so that you can do is to undergo all of these watchlist templates with multi-chart enabled…

Keep in mind – the solely factor that you have to search for is your setups.

Nothing else!

You don’t analyze the development…

…you don’t determine assist and resistance… (not but.)

…you solely have to determine your buying and selling setup!

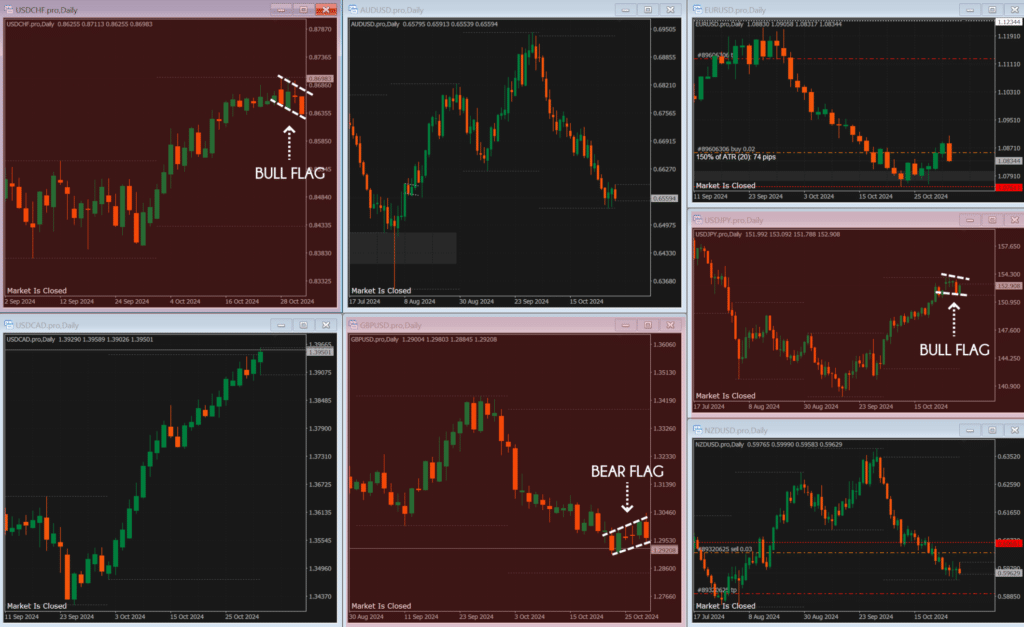

So, on this instance, let’s use worth motion setups.

Particularly, solely flag patterns.

Prepared?

So, let’s take a look.

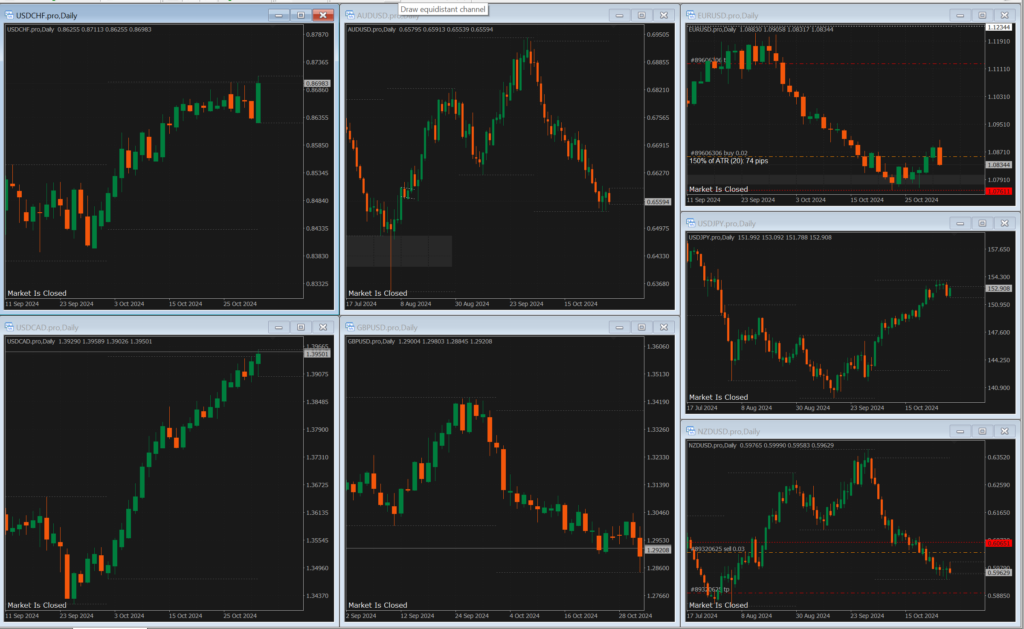

On the 1st template (that are the main pairs), do you see any legitimate flag sample entries?…

Positive, we have now these…

However they haven’t damaged out but, so which means our setup is just not but legitimate. Transferring on.

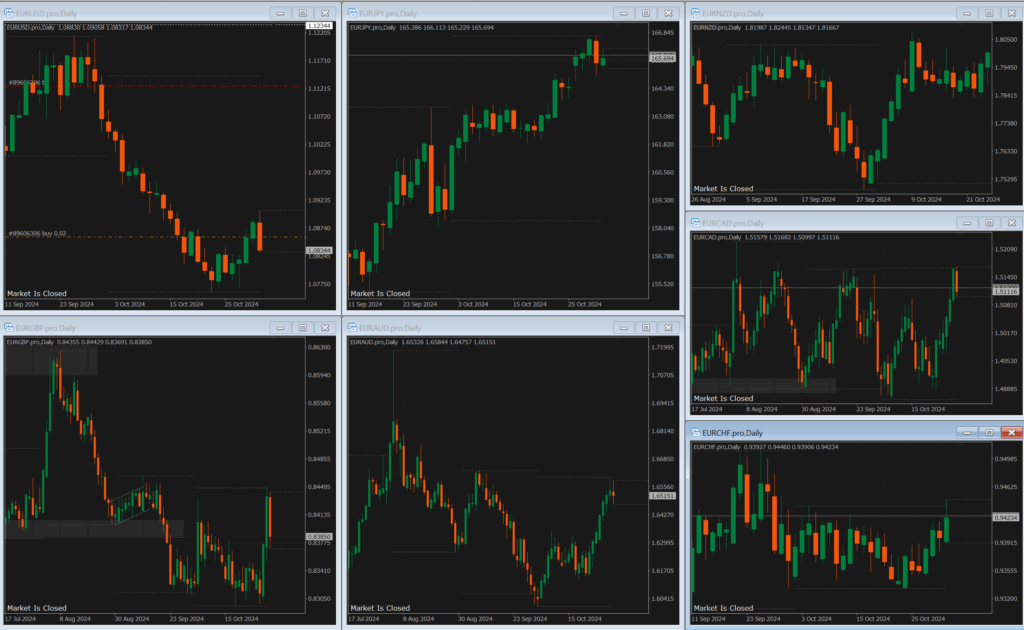

Subsequent template…

None?

Yep, nothing right here.

Subsequent…

Additionally none!

Subsequent…

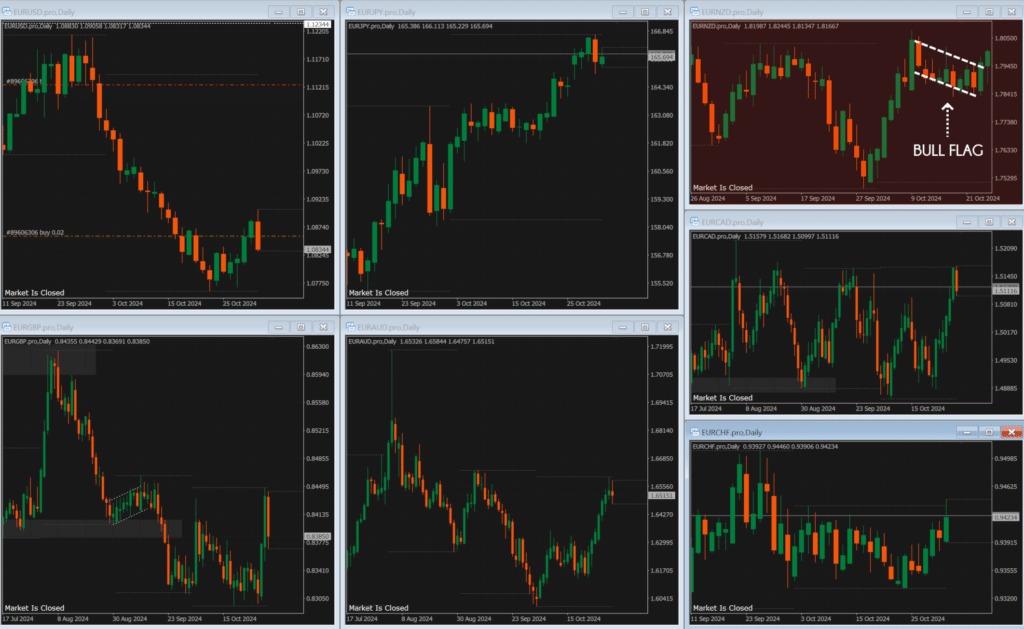

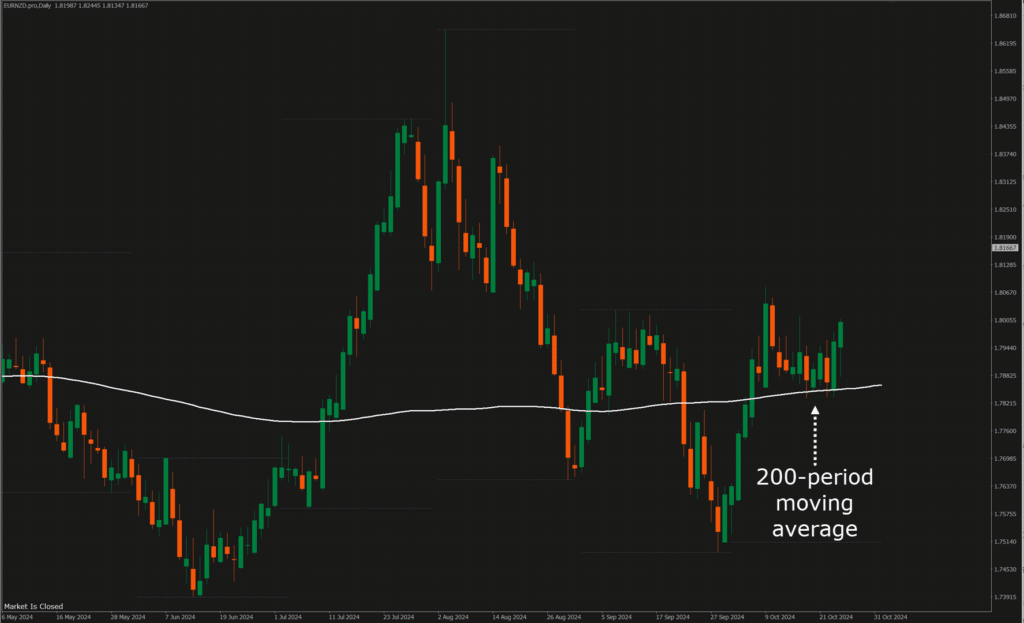

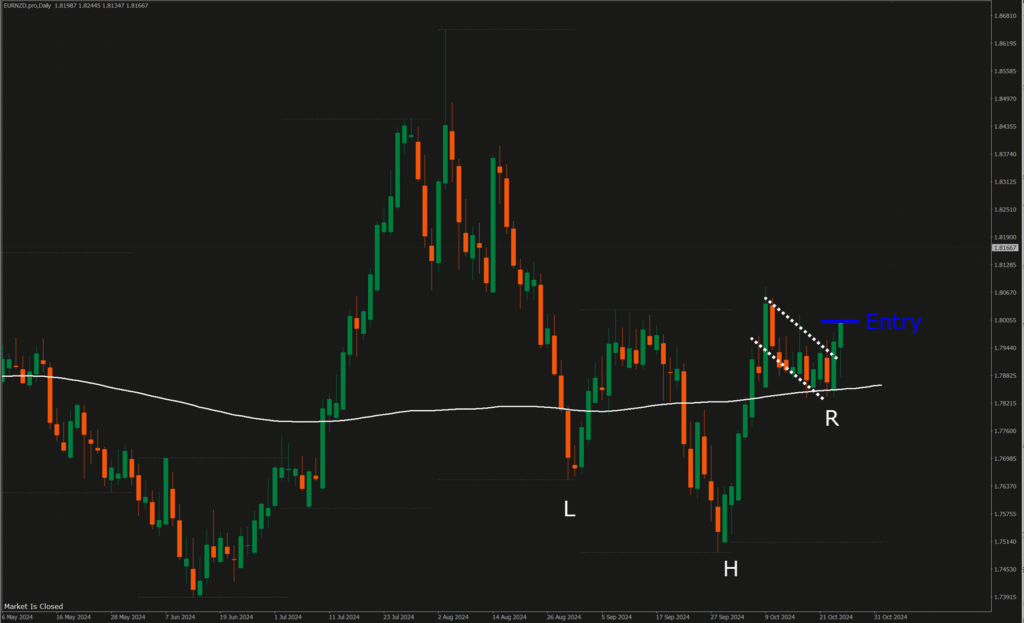

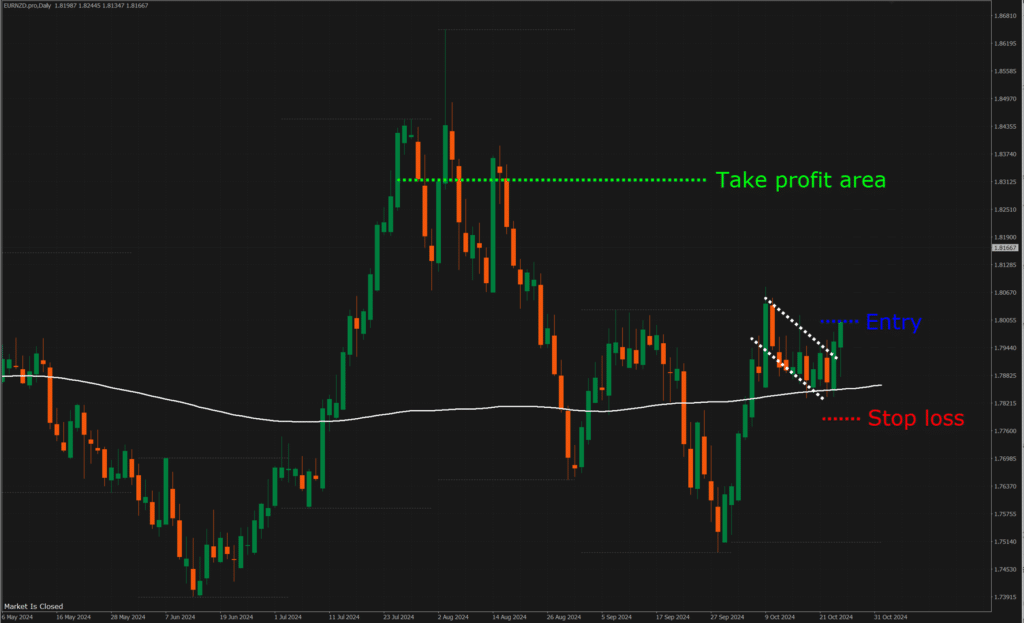

OK, appears to be like like we received one!

This time, it has certainly damaged above the flag sample and has fashioned a legitimate entry set off.

So, pay attention to that foreign money pair and transfer on to the subsequent.

Lastly, the final template for this instance…

…and, none there.

Carried out!

Fairly straightforward, proper?

In lower than 3 minutes, you’ve checked out tens of charts however extracted solely the markets that matter.

This protects a tonne of time and makes the buying and selling course of far more environment friendly!

So, what do you do with the Foreign exchange pair that has a legitimate entry set off?

Effectively, that’s the one to research!

Now, because it seems, the worth is above the 200-period transferring common…

On the similar time, the worth made an inverse head and shoulders sample, and the flag sample was only a affirmation…

This reveals that the worth is displaying indicators of bullishness.

As for take income, you possibly can think about promoting earlier than the closest excessive, and stops under the lows of the flag sample…

Now, cease a second.

Think about when you had to do that similar course of with 20+ charts… each time…

…you’d in all probability go nuts, proper!?

As an alternative, you solely decide the market with a legitimate “entry set off” out of your setup and analyze it from there.

As time goes by, you’ll be capable of full this course of in lower than 5 minutes, I promise!

(I commerce off the every day timeframe, and I test the charts as soon as a day, when you commerce the decrease timeframes, then you definately’d need to test extra steadily)

With that stated…

Let’s prime issues off with some instruments you possibly can think about including to your MT4 platform.

MT4 Suggestions and Methods: Further instruments indicators and instruments to enhance your buying and selling

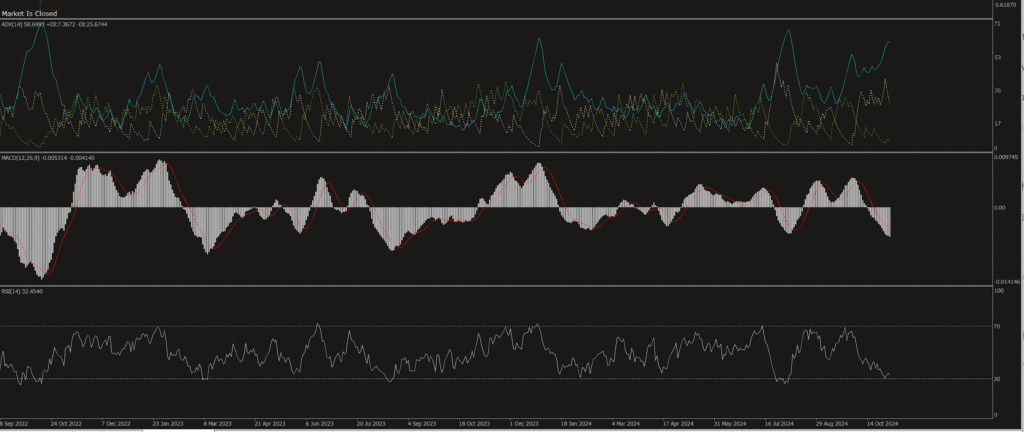

So possibly everytime you hear the phrase “indicator”, you at all times think about one thing like this…

However on this part, I’ll share with you one thing far more smart than that.

Prepared for a game-changer?

Effectively, it’s FXBlue’s built-in commerce administration device…

Sure, that’s proper…

FXBlue’s commerce terminal might be built-in immediately inside your MT4 platform!

This advantages you extra when you’re a day dealer, because it has a number of choices for managing completely different sorts of positions.

Consider this as your buying and selling portfolio’s ”air site visitors controller.”

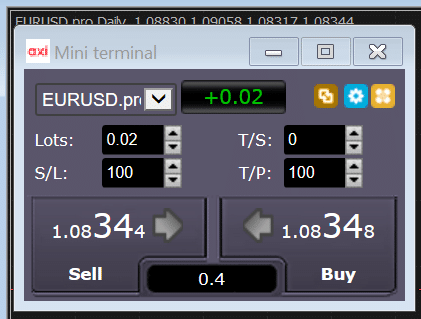

One other factor to think about using is FXBlue’s mini terminal…

An incredible facet of this plugin is its a number of options.

It actually simplifies danger administration, and you’ll even use a development line as a cease loss!

However the factor that makes this device the perfect is that you would be able to actually use it as a simulator.

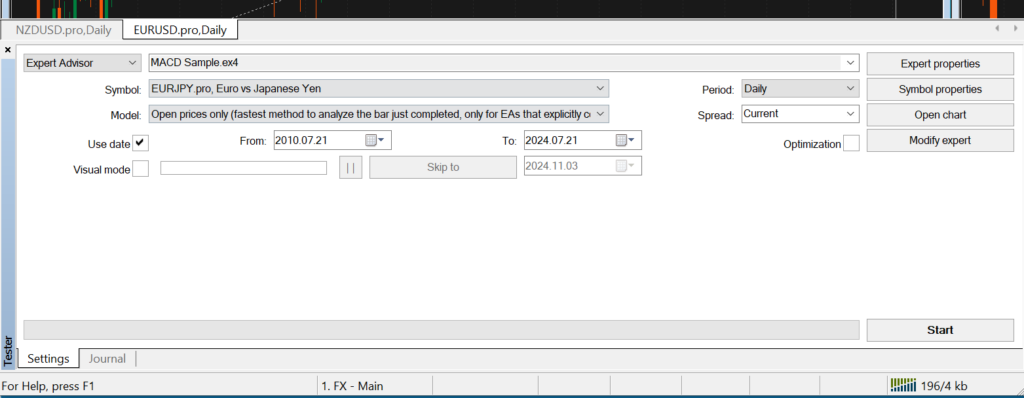

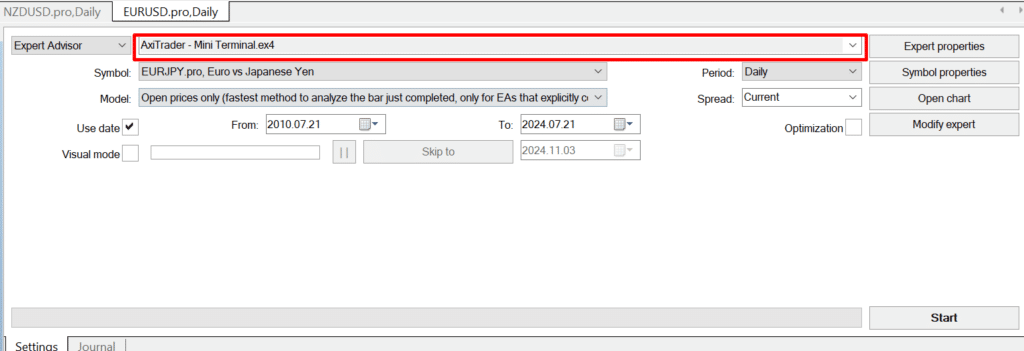

Simply press CTRL + R…

Choose the mini terminal…

You may then observe your buying and selling utilizing historic information!

It’s so helpful I’ve additionally received a information on how one can go about back-testing worth motion like this right here.

At any price, these buying and selling instruments will assist take your buying and selling execution and administration to a a lot larger degree.

With that stated, let’s do a fast recap of what you’ve discovered immediately!

Conclusion

Regardless of its age, MT4 stays the most effective buying and selling platforms for Foreign currency trading on the market.

It has available customized indicators and skilled advisors (not essentially buying and selling robots) so that you can benefit from.

By taking a while to combine these MT4 suggestions and methods, I’m sure you possibly can enhance your buying and selling effectivity very quickly!

Right here’s what you’ve discovered immediately…

- Find out how to simplify your MT4 platform, declutter tabs, and develop a “grasp template” that features all of your indicators

- Understanding that market choice rule is essential, making the most of the multi-chart characteristic to take all of it in at a look

- Utilizing the bottom-to-top method with watchlists, solely analyzing legitimate setups

- Exploring FXBlue’s free instruments that can assist you get the perfect out of the entire platform

And there you go!

An entire information that additional reveals suggestions and methods on the platform!

Notice that I’ve been utilizing this similar course of for round 3 years now, and I’m fully assured that this similar course of will aid you out immensely.

Now I actually wish to know…

What’s your expertise with MT4? (I’m positive you’ve got some!)

Do you’ve got sure setups you like?

How does it evaluate to completely different buying and selling platforms?

Let me know within the feedback under!