- Sei broke resistance at $0.635, supported by sturdy RSI and rising social quantity.

- Optimistic funding price and excessive lengthy liquidations pointed to continued bullish sentiment.

Sei [SEI] has achieved a serious milestone with its each day energetic addresses surpassing 280k, marking a brand new all-time excessive.

The surge in consumer exercise, mixed with the addition of three million distinctive customers previously three months, signifies rising momentum throughout the SEI ecosystem.

At press time, the coin was buying and selling at $0.6727 after dipping 1.91% previously 24 hours. Additionally, the challenge’s rising community exercise suggests a optimistic outlook for future development.

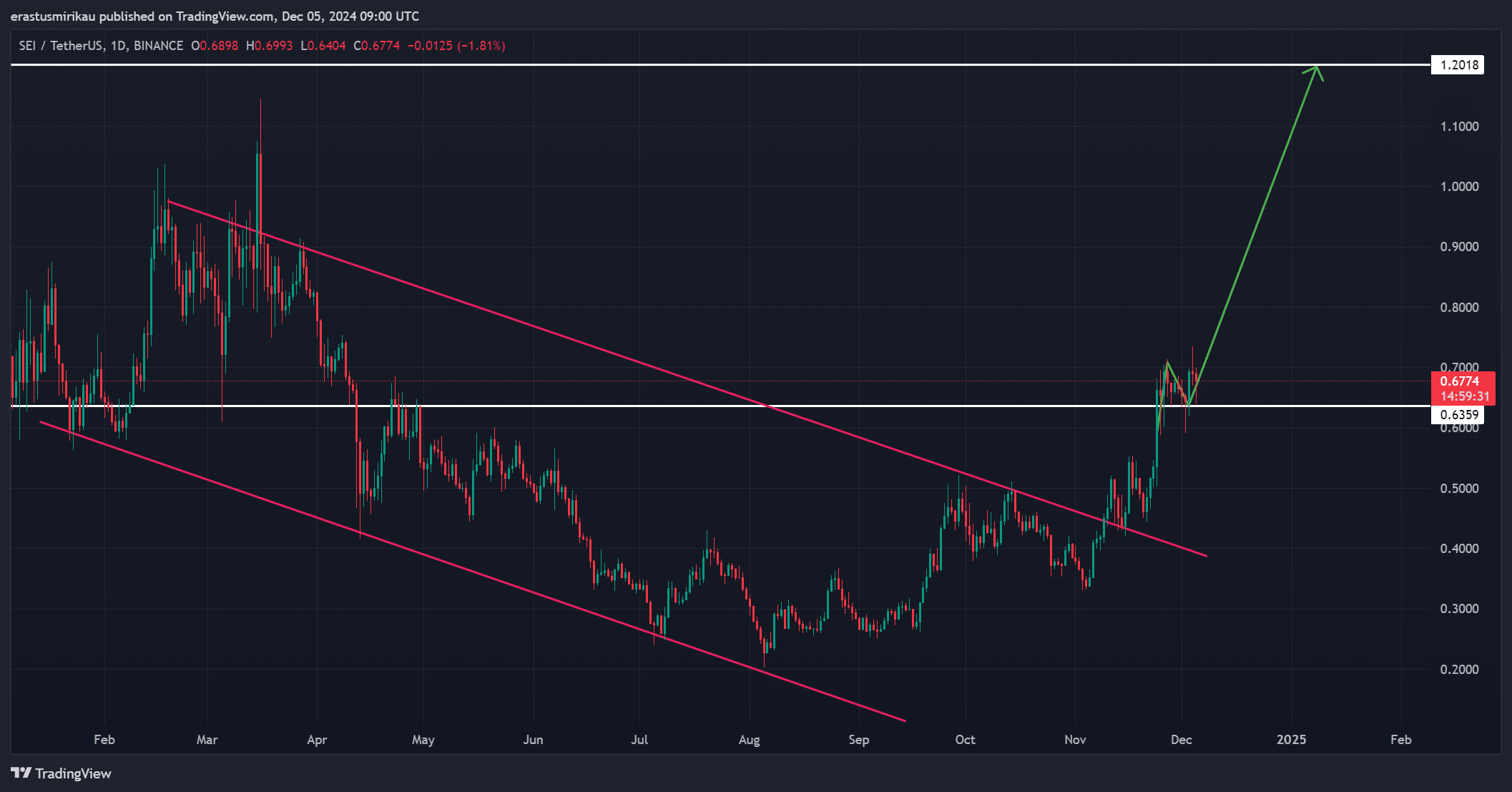

SEI worth motion: A breakout to look at

At press time, SEI was buying and selling at $0.635, reflecting a robust bullish development after efficiently breaking out of a descending channel. This transfer has cleared a key resistance degree, which was examined and retested at $0.635.

If the value maintains above this degree, the subsequent potential goal could possibly be $1.20, signaling a possible 90% upside.

This breakout signifies elevated shopping for curiosity and a shift in market sentiment. Nonetheless, merchants ought to monitor whether or not the value sustains above this crucial degree.

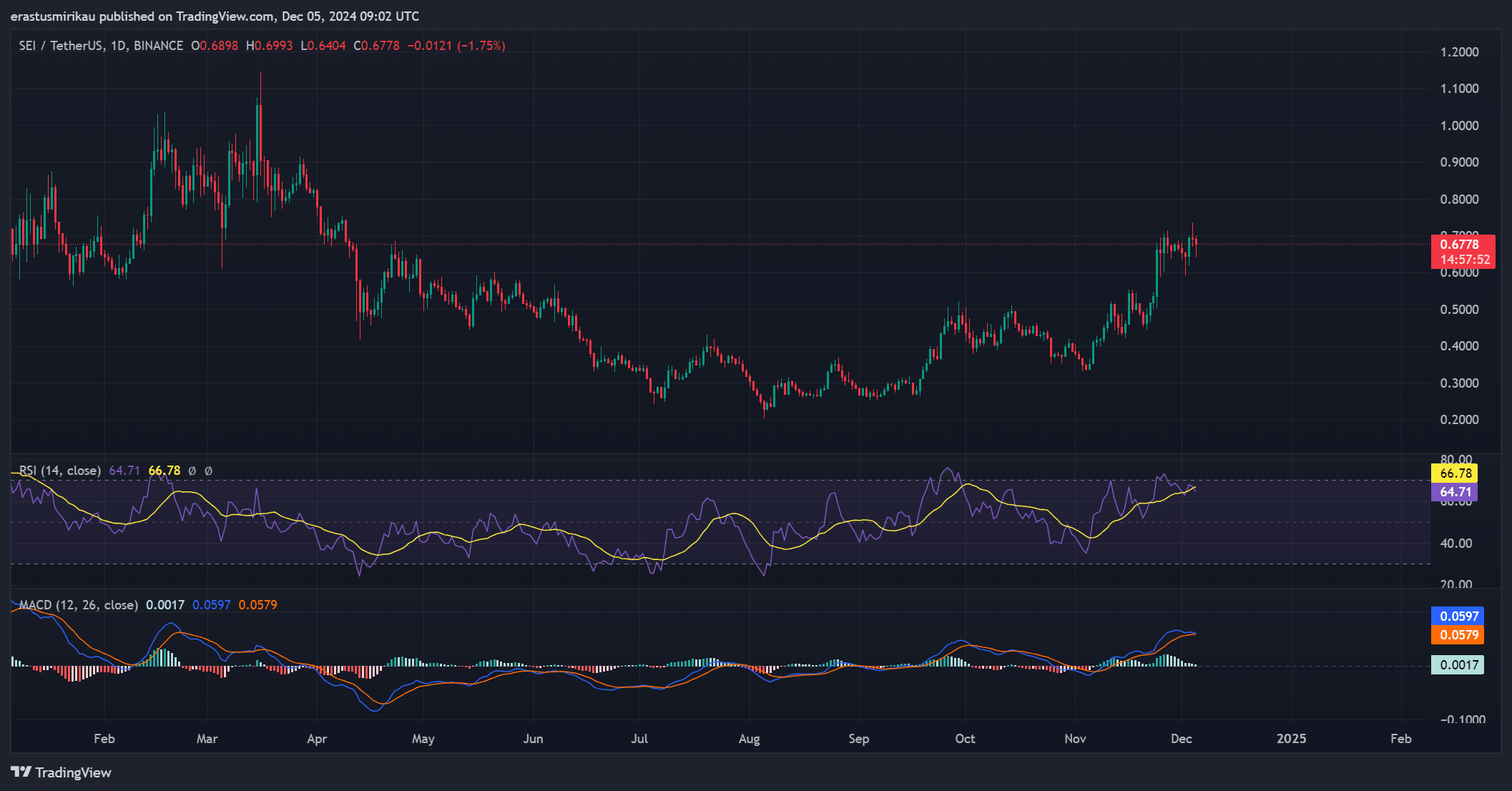

Technical indicators present a bullish outlook for Sei. The RSI presently sits at 64.71, suggesting that the asset is nearing overbought situations however nonetheless has room for additional beneficial properties.

Moreover, the MACD at 0.0017 helps the upward momentum, confirming that purchasing strain is outweighing promoting in the mean time. These indicators level towards a potential continuation of the bullish development, however merchants ought to keep cautious of any sharp reversals.

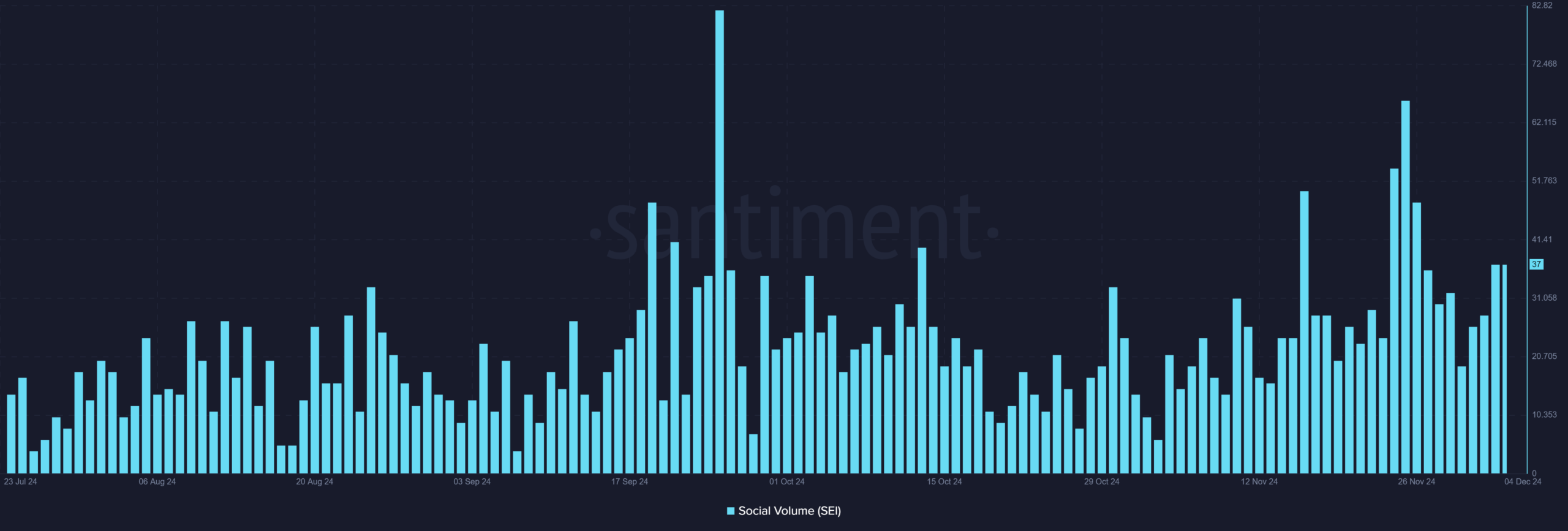

Is the rise in social quantity a bullish sign?

Social quantity has barely elevated from 28 to 37 in simply in the future, indicating rising curiosity within the challenge. Though this improve is modest, it’s essential to notice that social quantity typically correlates with market actions.

Because the challenge attracts extra consideration, this might result in larger worth motion. Consequently, this rise in engagement would possibly sign heightened investor sentiment, probably driving additional bullish momentum within the close to time period.

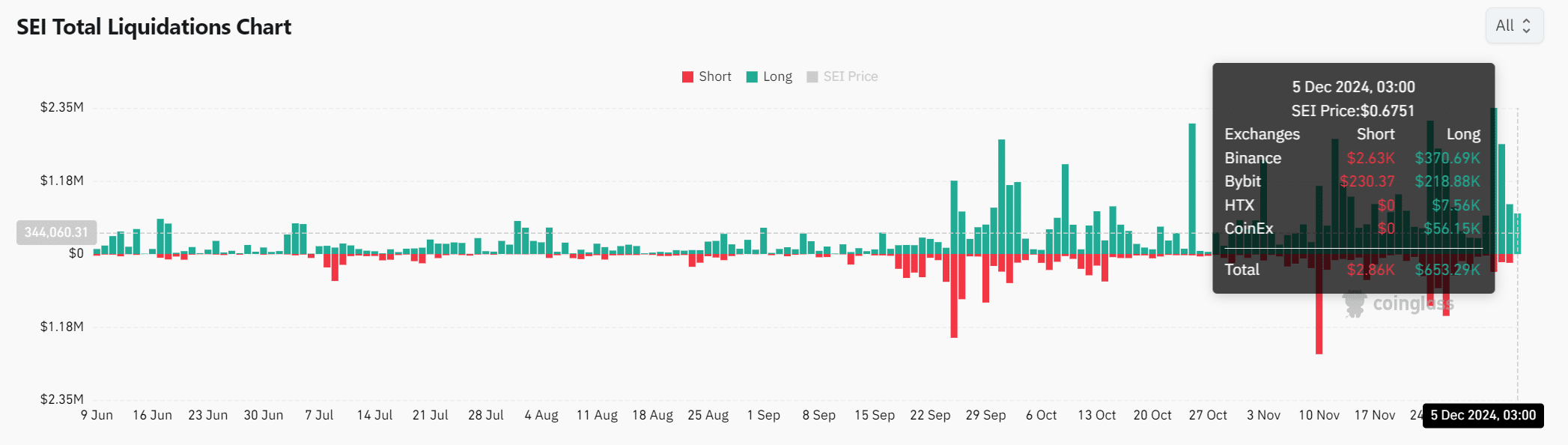

What does the liquidation knowledge reveal about market sentiment?

When analyzing liquidation knowledge, we see that brief liquidations are at a comparatively low $2.86k, whereas lengthy liquidations are a lot increased at $653.29k.

This imbalance means that lengthy positions are being squeezed, which might both be an indication of bullish energy or impending correction.

Due to this fact, merchants ought to monitor this carefully, as liquidation spikes typically precede vital worth shifts.

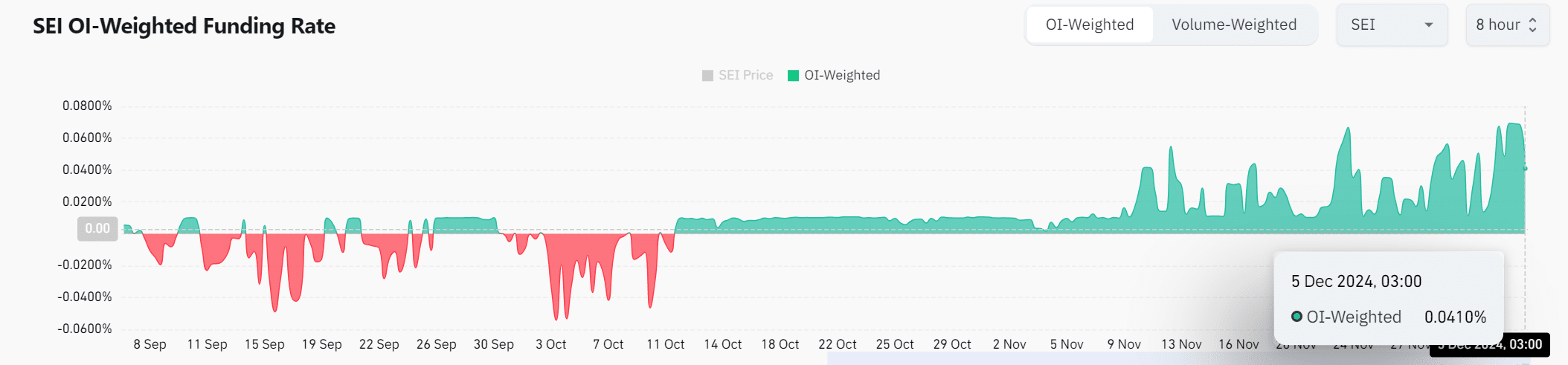

How does the funding price affect the market?

The funding price stood at 0.0410%, reflecting a barely optimistic outlook for the token. This implies that lengthy positions dominate the market, additional supporting bullish sentiment. Nonetheless, this might change shortly if market situations fluctuate.

Learn Sei’s [SEI] Worth Prediction 2024–2025

Can Sei maintain its momentum?

The latest worth motion, improve in social quantity, and optimistic funding price point out sturdy market confidence.

The breakout from its descending channel, together with an uptick within the community exercise, means that Sei is prone to keep its upward momentum. Consequently, Sei has positioned itself for sustained development within the aggressive blockchain area.