- The SUI circulating provide is about to extend by over 2%.

- The funding price stays constructive regardless of the upcoming unlock occasion.

This week, SUI is about to launch 64.19 million tokens, valued at over $100 million, as a part of a scheduled token unlock. This inflow represents 2.32% of SUI’s circulating provide, sparking hypothesis on how this occasion could influence the token’s value.

With a present market cap of roughly $4.6 billion and a circulating provide of two.76 billion tokens, it stands at a vital juncture because it prepares to navigate the results of this launch.

Unlock might improve promoting stress on SUI

Because the 64.19 million SUI tokens develop into liquid, there may be potential for elevated promoting stress. That is frequent throughout token unlocks when early traders and group members achieve entry to beforehand locked property.

On condition that this unlock represents over 2% of the circulating provide, a considerable variety of these tokens coming into the open market might exert downward stress on SUI’s value if holders determine to promote.

SUI was buying and selling round $1.69 at press time, exhibiting indicators of weak spot from current highs. The Relative Power Index (RSI) displays this, standing at 41.96 and indicating a leaning in the direction of bearish sentiment.

This sentiment might deepen if promoting exercise ramps up, pushing SUI’s value to check help ranges.

Key SUI help ranges to observe

Within the occasion of a selloff as a result of unlock, SUI’s value could take a look at vital help ranges. The 50-day transferring common at $1.69 serves because the speedy help stage.

If breached, it might result in additional declines towards the $1.50 mark, the place purchaser curiosity would possibly strengthen.

Historic patterns from earlier unlocks point out that such occasions can heighten market volatility as merchants react to the sudden improve in provide.

If it fails to keep up its present value ranges, it might expertise a short-term battle for restoration. Conversely, if it might probably stay above the 50-day transferring common, this might encourage consumers to reenter the market.

Lengthy-term holders could discover alternative regardless of short-term volatility

Though the token unlock presents speedy dangers, long-term holders could view this as a brief disruption slightly than a long-term setback.

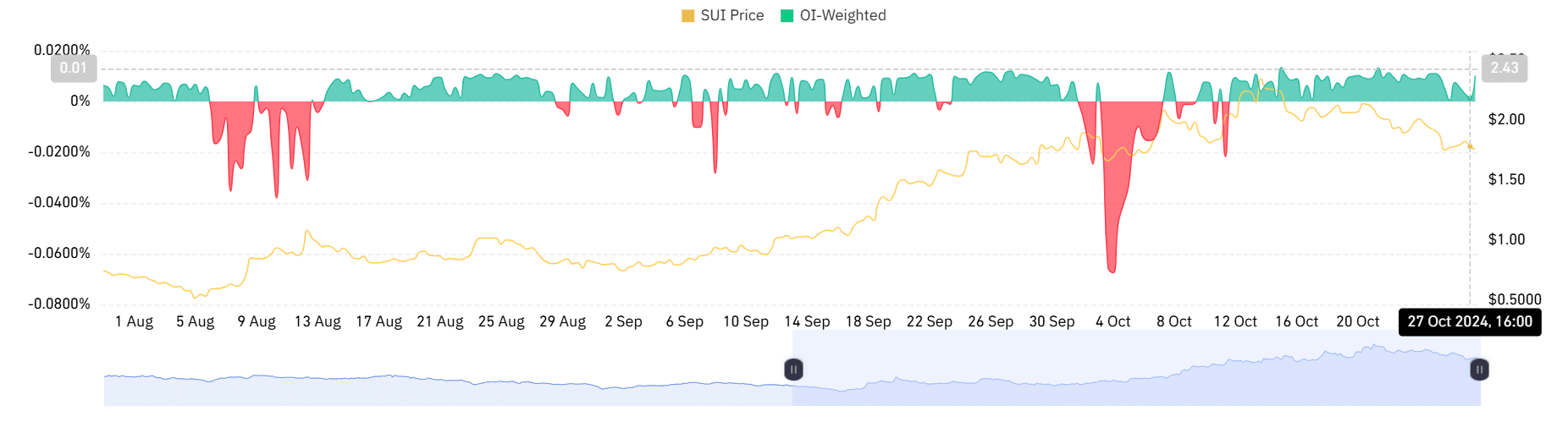

In response to information from Coinglass, the funding price has remained constructive. This implies there are extra consumers than sellers available in the market, which means extra lengthy positions.

Is your portfolio inexperienced? Take a look at the SUI Revenue Calculator

Finally, the influence of this token unlock will largely depend upon how holders react. A fast market restoration following the unlock might sign that SUI has effectively absorbed the elevated provide, stabilizing its market place.

Nevertheless, if vital promoting ensues, SUI’s value could face short-term challenges, testing the resilience of each the asset and its investor base.