It was a fantastic week to be Jensen Huang, the CEO and co-founder of chip large Nvidia (NVDA) .

His firm’s shares, at $141.54 on Friday, have been up a stable 2.6% on the week and are up 16.6% to date in October. And, after all, the shares are up 186% in calendar 2024.

💰💸 Don’t miss the transfer: SIGN UP for TheStreet’s FREE Every day publication 💰💸

He jetted off to ink a deal to make Nvidia’s chips out there to tech firms in India.

And when the week ended, Nvidia’s market capitalization stood at $3.47 trillion, barely second behind Apple’s (AAPL) $3.52 trillion.

In actual fact, at 11:22 a.m. Friday, in keeping with Nasdaq knowledge, Nvidia shares hit $144.06, producing a market capitalization of $3.53 trillion, ever so barely bigger than Apple.

Associated: Analyst adjusts Meta inventory value goal with earnings on faucet

However Nvidia fell again to shut at $141.54 and that $3.47 trillion market cap. Apple’s market cap remained at $3.52 trillion.

This was the second time in 2024 that Nvidia was Numero Uno. The primary time was in June. Then, the inventory sagged to as little as $98.91, whereas Apple and Microsoft (MSFT) retook their high positions. It is up 43% since.

NVIDIA will likely be a participant in Massive Tech’s earnings calls

This week, Nvidia, whether or not named or not, will likely be a part of the earnings reviews due from 5 of the largest tech or tech-related firms:

- Google-parent Alphabet (GOOGL) on Tuesday.

- Microsoft and Meta Platforms (META) on Wednesday.

- Apple and Amazon.com (AMZN) on Thursday.

(Tesla (TSLA) reported final week. Nvidia reviews on Nov. 20.)

An enormous query the CEOs of every firm might need to reply throughout earnings calls is, “How a lot do you anticipate to spend on synthetic intelligence? And do you could have probably the most highly effective know-how to get the job finished?”

These are necessary questions. Here is why.

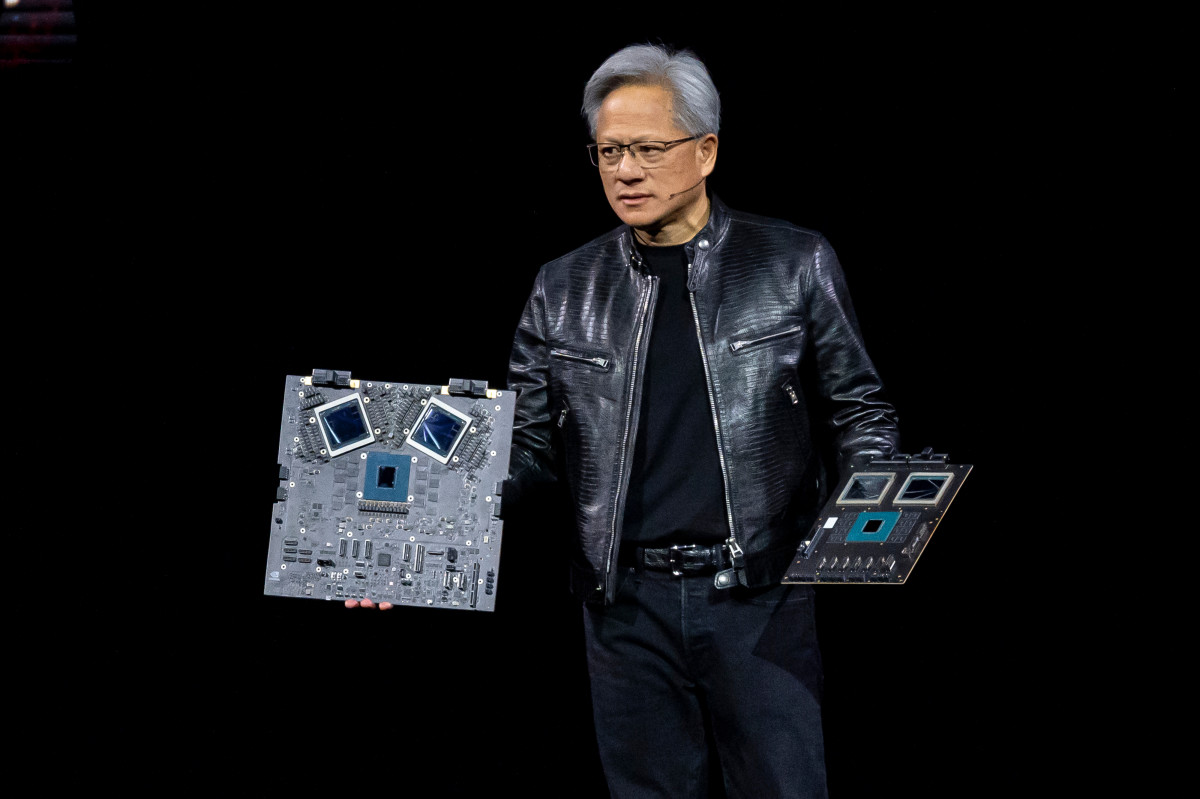

The frenzy over Nvidia’s Blackwell chips

Probably the most highly effective synthetic intelligence know-how proper now could be Nvidia’s. The corporate reportedly provides 80% to 85% of the graphic processing items wanted to make AI work.

Which implies everyone needs Nvidia’s latest, hottest chips, the Blackwell household. (Microsoft, Meta, Amazon and Alphabet already are Nvidia’s largest prospects.)

They’ll kind the heart of latest AI servers manufactured by Dell Applied sciences (DELL) . They’re because of begin delivery in November and changing into extra out there in early 2025.

Extra Tech Shares:

- Analysts replace outlook for Nvidia’s Blackwell chips amid AI growth

- Analysts replace Meta inventory value goal with Q3 earnings in focus

- Analyst updates Tesla inventory value goal forward of key robotaxi occasion

Higher nonetheless, points with the Blackwell chips, which had delayed their launch, have been mounted.

If you have not put in your order, nicely, too unhealthy. The following yr’s manufacturing is already pre-sold.

When two highly effective tech chieftains begged

Blackwell demand is so intense, Fortune famous, that Oracle’s govt chairman (ORCL) Larry Ellison and Tesla CEO Elon Musk took Jensen Huang to dinner.

At a September analyst assembly, Ellison described the assembly as “Oracle — me and Elon begging Jensen for GPUs.”

He added the duo instructed their visitor, “Please take our cash. Please take our cash. By the best way, I obtained dinner. No, no take extra of it. We’d like you to take extra of our cash please.”

Ellison instructed that Musk and he obtained their want.

The Motley Idiot’s Adria Cimino noticed the story and performed out what all of it meant. Her conclusions:

- Nvidia’s progress ought to proceed at a excessive stage as a result of demand is so nice.

- Nvidia does not want to fret competitors — but.

Associated: Veteran fund supervisor sees world of ache coming for shares