Every week in the past, the US authorities imposed but extra sanctions on Iran’s oil commerce. Crude costs have sagged greater than $5 a barrel since.

Article content material

(Bloomberg) — Every week in the past, the US authorities imposed but extra sanctions on Iran’s oil commerce. Crude costs have sagged greater than $5 a barrel since.

The decline was largely pushed by indications that Israel goes to keep away from attacking Iran’s oil infrastructure — one of many market’s massive issues.

However the drop however highlights how unfazed merchants are by actions the U.S. takes in opposition to foes which might be massive producers of oil — be it Iran or Russia. Whereas that may change with the end result of the Nov. 5 election, in the meanwhile merchants are skeptical that sanctions will ship costs greater as Washington seeks to maintain a lid on gasoline prices and steadiness competing priorities with China, a significant purchaser of Iranian oil.

Commercial 2

Article content material

The Oct. 11 measures in opposition to Iran primarily imply the US can goal any a part of the Islamic Republic’s oil commerce, and theoretically go after nearly anybody who offers with it.

“Our objective, and what we made very clear to the Iranians, is that in the event that they proceed with their destabilizing exercise and their assaults in opposition to Israel, we’re going to be ready to proceed to do extra,” US Deputy Treasury Secretary Wally Adeyemo stated.

However US officers privately concede that there’s a reluctance to focus on the most important Chinese language oil consumers and Emirati middlemen who’ve helped Iran’s oil exports surge because the second half of 2019, the interval shortly after the Trump administration re-imposed restrictions on the commerce.

Merely put, Washington has the means to harm Tehran however has kept away from pulling essentially the most aggressive levers as that might danger oil market volatility and complicate wider overseas coverage objectives, in keeping with folks with direct information of the matter, who requested anonymity discussing personal deliberations.

Treasury Secretary Janet Yellen denied that the US has gone simple on Iran, and known as the Oct. 11 transfer a possible “prelude” to extra measures.

Article content material

Commercial 3

Article content material

“We now have put in place tons of and tons of of sanctions on an ongoing foundation in opposition to Iran,” Yellen stated this week. “However it’s true that now we have just lately ramped up our sanctions considerably. I signed an motion that enables us to focus on Iran’s power sector broadly, and that could possibly be a prelude to a set of steps that might actually curtail Iran’s potential to achieve income from exports.”

Learn: Mideast Conflict Danger Places Highlight on Iran’s Quiet Oil Comeback

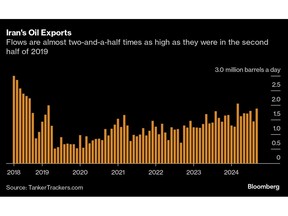

Iran’s oil exports averaged 1.7 million barrels a day within the third quarter of this yr, nearly two-and-a-half occasions as excessive as they had been in second half of 2019, in keeping with knowledge from TankerTrackers.com Inc., which has been monitoring the nation’s shipments utilizing satellite tv for pc knowledge for years. Nor had been they clearly impeded even when there was concern that Israel would possibly strike on the Islamic Republic’s oil installations.

The rise has occurred as a result of US officers have centered on measures that might add friction to Iran’s provide chain — boosting the nation’s prices of doing enterprise — whereas staying cautious about actions that might prohibit exports.

Commercial 4

Article content material

Third jurisdictions which might be strategically vital to Washington complicate issues. The UAE is dwelling to various middleman companies energetic within the commerce, whereas China is the place roughly 80% of Iran’s every day oil exports go. Lots of the transactions occur in yuan.

Russian Cap

It’s the same image within the case of Russia, the place the US has tried to steadiness provide dangers in opposition to an effort to harm the Kremlin’s entry to petroleum revenues.

That stance resulted within the implementation of a so-called price-cap that banned the usage of Western ships and companies for cargoes offered above sure costs, driving Moscow to amass a so-called shadow fleet of ships to haul its oil with out recourse to Western suppliers.

Nonetheless, the US presidential election could show a turning level. And the newest measures in opposition to Iran may give the subsequent administration larger powers to clamp down.

Former President Donald Trump’s “most stress” marketing campaign on Iran slashed the Persian Gulf state’s oil flows in 2019 after he pulled the US out of the 2015 nuclear deal between Tehran and world powers after which ended waivers that allowed some international locations to maintain shopping for Iranian barrels.

—With help from Alex Longley and Courtney McBride.

Article content material