Overview

The value of gold stays robust. In April 2024, the yellow metallic’s value handed US$2,400 per ounce for the primary time. The reason being multifaceted. The world teeters on the point of a extreme recession whereas some markets attribute the rise to protected haven rush. Amidst ballooning rates of interest, financial institution failures and falling bond yields, demand for gold continues to rise. At this exact second, gold is concurrently a wonderful portfolio diversifier and a compelling hedge in opposition to ongoing inflation — significantly if one invests in the suitable firm.

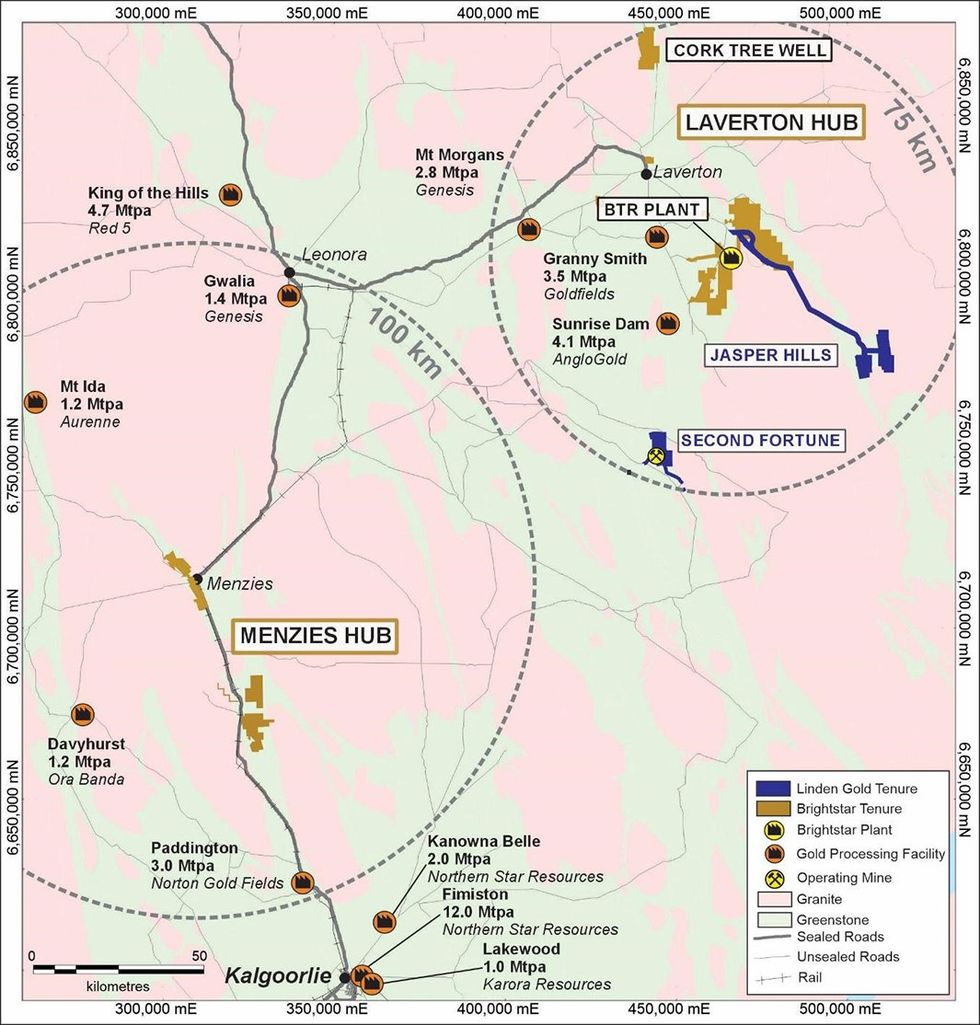

Brightstar Assets (ASX:BTR) goals to be that firm. An rising mining and growth firm, Brightstar occupies a strategic land place of roughly 300 sq. kilometers within the Laverton Tectonic Belt and 80 sq. kilometers of the Menzies Shear Zone.

The corporate additionally owns an present processing facility that may probably present super shareholder worth in a low-capital value restart state of affairs.

That plant, as soon as absolutely refurbished and operational, may show a key differentiator for the corporate, enabling quick gold manufacturing at a low capital value. That is particularly noteworthy on condition that many different gold firms buying and selling on the ASX are largely centered on greenfield exploration and growth. Even as soon as these firms uncover a promising useful resource, mining and processing amenities would nonetheless have to be constructed, undertakings which might incur important upfront capital prices and take a number of years.

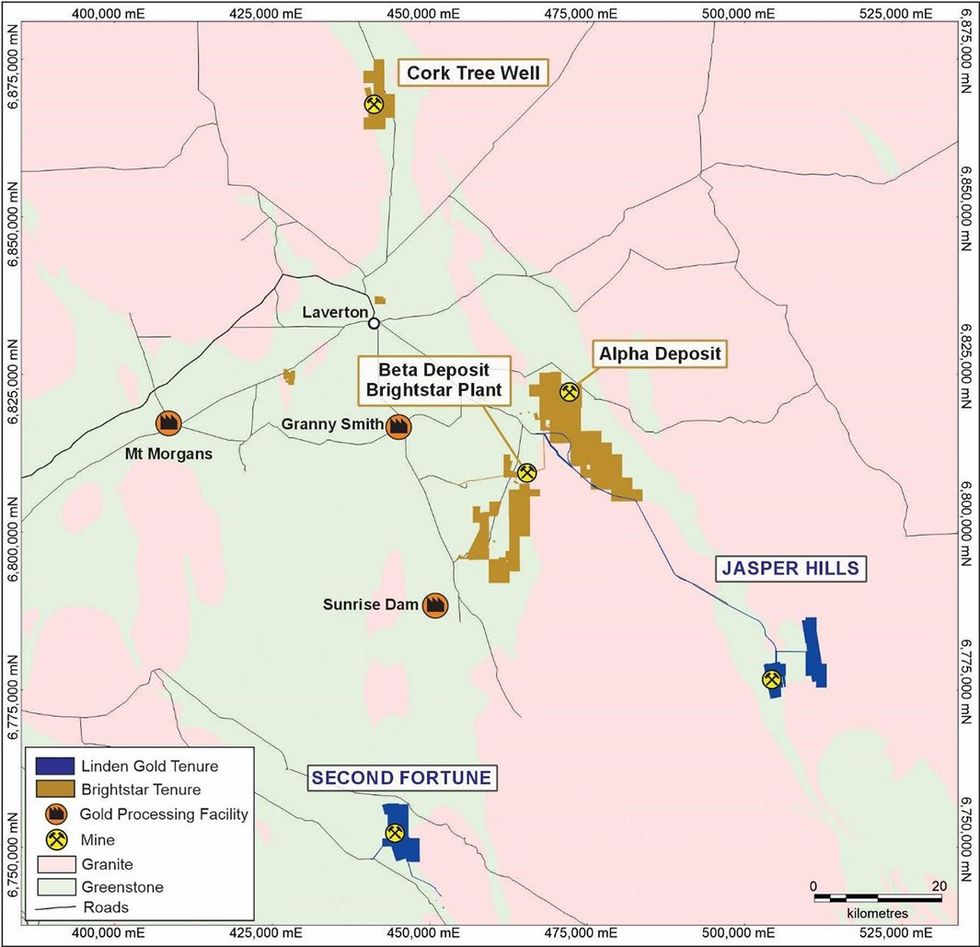

Brightstar’s Laverton gold property are all centered on a One hundred pc-owned 300-square-kilometer tenure within the Laverton Tectonic Zone and all inside 70 kilometers of the Laverton Processing Plant. Moreover, all assets inside this zone are open alongside strike and at depth. Solely minor drilling packages have been performed lately, paving the way in which for important exploration upside with the potential for additional regional and greenfields discoveries.

Brightstar additionally owns One hundred pc of the Menzies Gold Undertaking, a contiguous land package deal of granted mining leases over a strike size of roughly 20 kilometers alongside the Menzies Shear Zone and adjoining to the Goldfields Freeway.

In 2023 and 2024, the corporate introduced a mineral useful resource improve to the Cork Tree Nicely deposit (Laverton gold mission) and in addition delivered two maiden mineral useful resource estimates on the Hyperlink Zone and Aspacia deposits (Menzies gold mission). This has grown the full group MRE by roughly 150 koz gold by natural exploration.

The corporate has additionally acquired a related curiosity in 96.75 % shares and 96.81 % choice

shares and 96.81 % choice of Linden Gold Alliance, a gold producer, developer and explorer with present mineral assets of 350 koz @ 2.1 g/t gold close to Brightstar within the Laverton district. Brightstar’s MRE has reached 1.1 Moz gold throughout the Menzies and Laverton initiatives, with an extra 0.35 Moz gold in assets added after the profitable acquisition of Linden Gold Alliance. Brightstar has commenced the obligatory acquisition course of for the remaining Linden shares and choices in respect of which it has not obtained acceptances underneath the settlement.

In August 2024, Brightstar entered right into a scheme implementation deed to accumulate One hundred pc of Alto Metals, which owns the Sandstone gold mission positioned in East Murchison. The mission has a present mineral useful resource of 1.05 Moz of gold at 1.5 g/t.

Subsequent to the cope with Alto Metals, Brightstar entered right into a $4 million drill-for-equity settlement with Topdrill to aggressively advance the consolidated Sandstone gold mission. The deal strengthens Brightstar’s monetary capability to meet its multi-hub exploration and growth technique, which incorporates the Menzies and Laverton hubs and the Sandstone hub.

Brightstar additionally accomplished the acquisition of the gold rights on the Montague East gold mission (MEGP) from Gateway Mining Restricted (ASX:GML). The mission is positioned 70 km from the Sandstone gold mission. The acquisition provides an additional 9.6 Mt @ 1.6 g/t gold for 0.5 Moz god to Brightstar’s JORC Mineral Useful resource Estimate, giving the corporate a complete mineral endowment of 38.3 Mt @ 1.6 g/t gold for two.0 Moz gold.

Firm Highlights

- Brightstar Assets is an ASX-listed mining and growth firm with multiple million ounces of gold assets and an on-site processing infrastructure.

- Brightstar’s mineral property are located throughout roughly 300 sq. kilometers of 100-percent-owned land within the Laverton Tectonic Zone and ~80 sq. kilometers within the high-grade Menzies Shear Zone.

- The Laverton Gold mission has a mineral useful resource of 9.7 Mt @ 1.6g/t gold for 511 koz gold and the Menzies gold mission has 13.8Mt @ 1.3g/t gold for 595 koz gold. It is a complete mixed present mineral useful resource of 23 Mt @ 1.5 g/t gold for 1.1 Moz of gold

- In 2023, the corporate accomplished a scoping research into the event of its Menzies and Laverton gold initiatives and the refurbishment and restart of its processing plant in Laverton.

- The scoping research produced strong working outcomes and compelling monetary outputs, together with:

- 322 koz of gold recovered over eight years (40 koz every year)

- Internet current worth of AU$103 million (utilizing a gold value of AU$2,900/oz)

- Inner price of return of 79 %

- Pre-production capital necessities of AU$22 million

- All-in sustaining prices of A$2,041/oz

- As soon as refurbished, this infrastructure will permit Brightstar to fill a rising funding void for near-term gold builders in Western Australia, producing massive portions of gold at low capital value.

- In 2023 and 2024, Brightstar accomplished a small-scale mining three way partnership with BML Ventures which concerned a 50/50 profit-sharing settlement to use the Selkirk deposit at Menzies. In April 2024, Brightstar introduced that this three way partnership delivered a internet revenue to Brightstar of $6.5 million.

- In June 2024, the corporate efficiently acquired all the issued strange shares and choices in Linden Gold Alliance, a gold producer, developer and explorer with present mineral assets of 350 koz @ 2.1 g/t gold close to Brightstar within the Laverton district.

- Linden is presently a gold producer, mining 15-20 koz pa from its high-grade underground Second Fortune Mine south of Laverton.

- Brightstar’s complete MRE throughout the Menzies and Laverton gold initiatives elevated to 1.45 Moz gold after buying Linden. The entire mineral assets are positioned on granted mining licenses.

- As a part of the merger with Linden Gold, Brightstar launched a scoping research into Linden’s development-ready Jasper Hills gold mission, which delivered key metrics together with:

- 140 koz mined over 3.75 years (35 koz pa)

- Internet current worth of AU$99 million

- Inner price of return of 736 %

- Pre-production capital necessities of $12 million

- All-in sustaining prices of AU$1,972/oz

- Jasper Hills is positioned simply 50 km SE of Brightstar’s processing plant within the Laverton gold mission

- Brightstar plans to proceed producing shareholder worth by a mixture of growth and strategic acquisitions together with some exploration.

Key Initiatives

Brightstar Processing Facility

Located near Brightstar’s present mineral property at Laverton, the Brightstar Processing Plant gives the corporate with a substantial operational head begin over its friends.

Highlights:

- Intensive Infrastructure: Present amenities on the plant embrace two ball mills, an influence station and gravity and elution circuits. Different infrastructure contains:

- A tailings storage dam

- An on-site course of water pond

- An operational 60-person lodging camp

- An airstrip on the close by Cork Tree Nicely Undertaking

- Autos and gear embrace a forklift, bobcat, two loaders, a number of gentle automobiles and a 30-tonne crane.

- A Leg Up Over Rivals: The presence of pre-existing processing infrastructure represents important time financial savings in comparison with greenfields growth. Brightstar had an impartial valuation accomplished which valued the processing plant at AU$60 million in alternative worth.

- Low Upfront Capital Price: As a part of the scoping research launched in September 2023, GR Engineering estimated a capital value requirement to refurbish and develop the milling capability would value simply AU$18.5 million.

- Near Present Belongings: Brightstar’s main growth initiatives — Cork Tree Nicely, Jasper Hills, Beta and Alpha — are all near the plant.

Gold doré bars (BTR005 – BTR016) poured on 9 March 2024

Cork Tree Nicely

Cork Tree Nicely is a previously working mine, producing 45 koz of gold over its lifespan. Positioned roughly 35 kilometers north of Laverton on Bandya Station Highway, the mission’s JORC 2012-compliant mineral useful resource of 6.4 Mt at 1.4 g/t for 303 koz of gold.

Highlights:

- Promising Drilling Outcomes: Two 6,000-meter drill packages had been accomplished in late 2022, and within the first quarter of 2023 delivered an uplift in tonnages and ounces at a discovery value of AU$30 per ounce. In 2023 the JORC 2012 Mineral Useful resource Estimate elevated by 20 % to 303 koz, representing a 65-percent enhance to the indicated ounces to 157 koz @ 1.6 g/t gold.

- Upcoming Feasibility Research: The drilling program will underpin a number of feasibility research that Brightstar intends to conduct later this 12 months. At current, Brightstar has outlined a useful resource envelope over a strike size of roughly 1 kilometer and all the way down to 200 meters.

- Space Geology: The Cork Tree deposit is located alongside the western limb of the Erlistoun synclical construction, a sequence which incorporates mafic volcanic lavas, tuffs and tuffaceous sediments alongside minor interflow graphitic shales and banded iron formation. The mine itself consists of chlorite schist-altered high-magnesium basalt footwalls overlain by graphitic shales containing banded iron and chert beds. Gold mineralization is contained inside sediments intruded by concordant porphyry sills spanning the size of the mineralized zone.

- Excessive-grade Assays from the 2024 Drill Program: First spherical of assay outcomes from 20 diamond drill holes at Cork Tree Nicely had been extraordinarily constructive, with intercepts returned together with 34.4 metres @ 7.94 g/t gold from 43.5 metres (CTWMET004) and 27.6 metres @ 17.8 g/t gold from 51 metres (CTWMET003).

Second Fortune Gold Mine

Second Fortune is an working underground gold mine owned and run by Linden Gold, which is the topic of an off-market takeover by Brightstar introduced in March 2024. Second Fortune has produced +14,000oz gold in FY24 12 months up to now and is run underneath an ‘proprietor operator’ mannequin.

Second Fortune has a high-grade MRE of 165kt @ 10.9 g/t gold for 58 koz. Restricted fashionable and systematic exploration has occurred throughout the ~20km of strike size of potential geology at Second Fortune. This presents an excellent alternative to leverage present group, camp & associated infrastructure to quickly assess targets and conduct environment friendly drilling packages to additional develop the MRE and prolong the mine life at Second Fortune.

Menzies Gold Undertaking

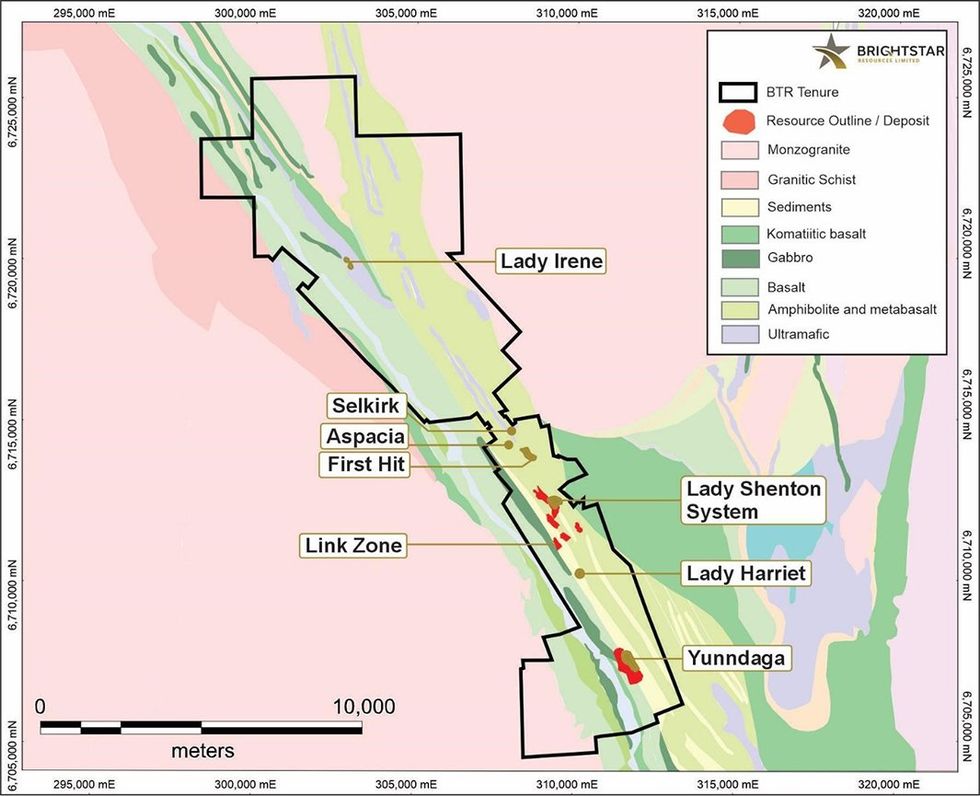

Located 130 kilometers north of the globally important Kalgoorlie gold deposit, Menzies represents one in every of Western Australia’s main historic gold fields. The mission, absolutely owned and operated by Kingwest earlier than its merger with Brightstar, consists of a contiguous land package deal of a strike size above 20 kilometers. All deposits at the moment are One hundred pc owned by Brightstar and lie inside granted mining leases.

Brightstar intends to leverage present processing infrastructure within the district to monetise the high-grade open pit ounces produced by this mine.

Highlights:

- Important Historic Manufacturing: Menzies has hosted a number of traditionally mined high-grade gold deposits which collectively produced a complete of over 800,000 ounces at 19 g/t gold. This contains 643,000 oz @ 22.5 g/t gold from underground.

- Revenue Sharing: Brightstar and BLM Ventures had a 50/50 profit-sharing three way partnership settlement to use the Selkirk deposit at Menzies. In March 2024, Brighstar introduced the profitable completion of all of the ore processing from the Selkirk JV, with a complete of 430.7 kg of gold doré poured which netted Brightstar $6.5 million as a part of its revenue share.

- Space Geology: The Menzies Gold Undertaking is hosted alongside the Menzies Shear Zone within the western margin of the Menzies greenstone belt. It shows a geologic setting just like the Sand Queen Gold Mine at Comet Vale.

LAVERTON GOLD PROJECT – OTHER RESOURCES

Beta

Positioned instantly adjoining to the Brightstar Plant, the Beta Undertaking features a 60-person camp. It comprises a mixed JORC 2012-compliant mineral useful resource of 1,882 kt at 1.7 g/t for 102 koz of gold. The deposit happens alongside the Japanese Margin of the Laverton Tectonic Zone, notable for internet hosting a number of main gold occurrences together with Granny Smith, Keringal, Pink October and Dawn Dam.

Alpha

Internet hosting a mixed JORC 2012-compliant mineral useful resource of 1,452 gold at 2.3 g/t for 106 koz, the Alpha Undertaking. Future exploration packages and feasibility research will search to probably capitalize on Alpha’s shut proximity to Beta.

Administration Crew – Publish Completion of Linden Merger

Alex Rovira – Managing Director

Alex Rovira is a professional geologist and an skilled funding banker having centered on the metals and mining sector since 2013. Rovira has expertise in ASX fairness capital markets actions, together with capital raisings, IPOs and merger and acquisitions.

Richard Crookes – Non-executive Chairman

Richard Crookes has over 35 years’ expertise within the assets and investments industries. He’s a geologist by coaching having beforehand labored because the chief geologist and mining supervisor of Ernest Henry Mining in Australia.

Crookes is managing accomplice of Lionhead Assets, a essential minerals funding fund and previously an funding director at EMR Capital. Previous to that he was an govt director in Macquarie Financial institution’s Metals Vitality Capital (MEC) division the place he managed all elements of the financial institution’s principal investments in mining and metals firms.

Andrew Wealthy – Govt Director

Andrew Wealthy is a level certified mining engineer from the WA College of Mines and has obtained a WA First Class Mine Managers Certificates. Wealthy has a powerful background in underground gold mining with expertise predominantly within the growth of underground mines at Ramelius Assets (ASX:RMS) and Westgold Assets (ASX:WGX).

Ashley Fraser – Non-executive Director

Ashley Fraser is an completed mining skilled with over 30 years expertise throughout gold and bulk commodities. Fraser was a founding father of Orionstone (which merged with Emeco in a $660-million consolidation) and is a founder/proprietor of Blue Cap Mining and Blue Cap Equities.

Jonathan Downes – Non-executive Director

Jonathan Downes has over 30 years’ expertise within the minerals business and has labored in varied geological and company capacities. Skilled with gold and base metals, he has been intimately concerned with the exploration course of by to manufacturing. Downes is presently the managing director of Kaiser Reef, a excessive grade gold producer, and non-executive director of Cazaly Assets.

Dean Vallve – Chief Working Officer

Dean Vallve holds technical {qualifications} in geology & mining engineering from the WA College of Mines, an MBA, and a WA First Class Mine Managers Certificates. Vallve was beforehand in senior mining and research roles at ASX listed mid-cap assets firms Sizzling Chili (ASX:HCH) and Calidus Assets (ASX:CAI).