- Choices market knowledge indicated that ETH worth might have stabilized.

- Nonetheless, market sentiment was nonetheless detrimental amid overhangs from Center-East tensions.

Ethereum’s [ETH] worth appeared to stabilize after current volatility following geopolitical escalations within the Center East that spooked crypto markets.

In accordance with Jake Ostrovskis, a crypto dealer at Wintermute, choices market knowledge instructed {that a} native backside could possibly be in for the biggest altcoin. He famous,

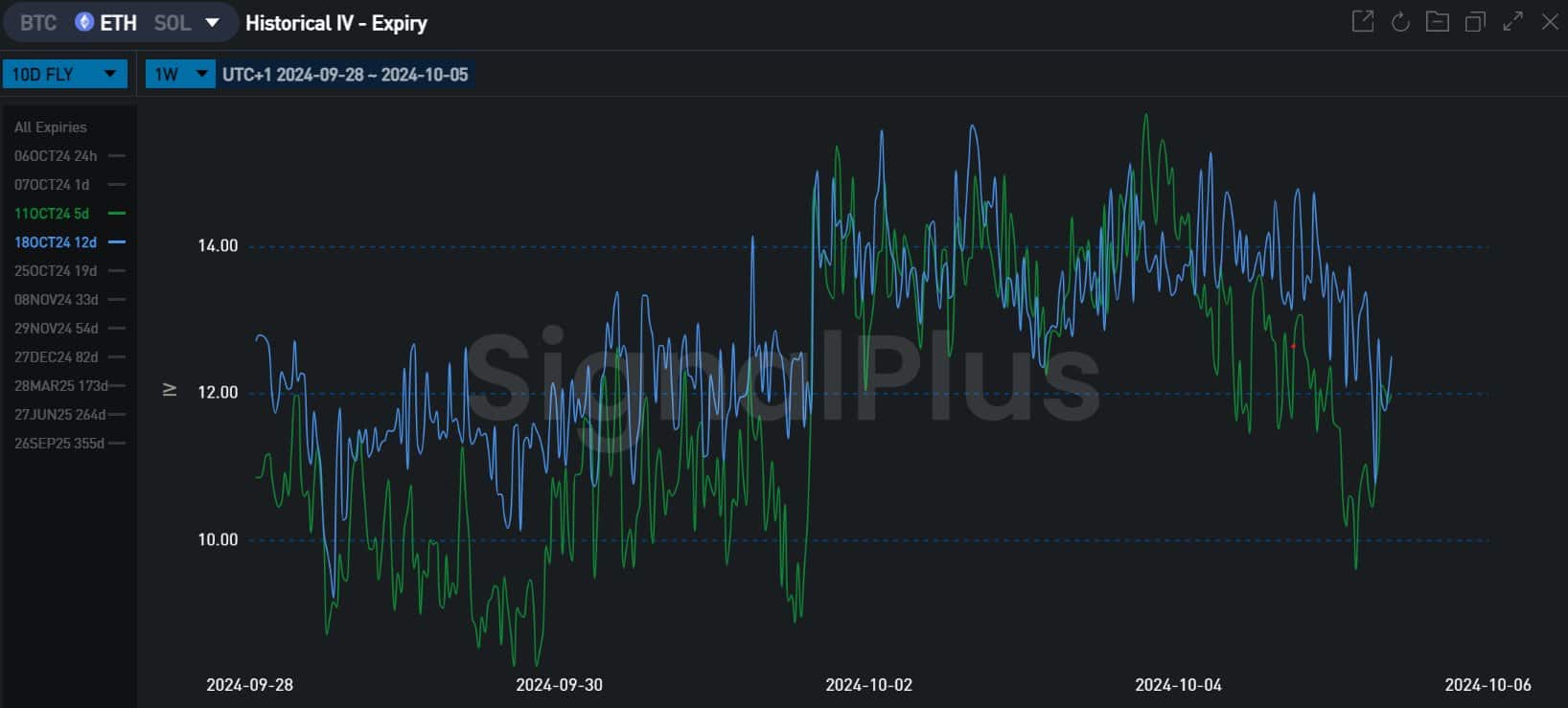

“From Tuesday (1st Oct.), the biggest hedging circulation was observable in #ETH in shorter-dated contracts, and these flows at the moment are unwinding because the market appears to agency.”

Is ETH’s native backside in?

For context, the hike in hedging circulation in short-dated ETH contracts up to now few days meant that merchants took hedging positions to guard in opposition to worth fluctuations, epecially amid Israel-Iran escalations.

They used short-term choices to realize this.

Nonetheless, there was a notable unwinding of the hedging flows and declining implied volatility for these short-term choices into the weekend.

This instructed that merchants have been turning into assured of ETH market stability and that hedging was pointless.

Put in another way, ETH’s native backside might quickly be in, particularly as Israel hasn’t retaliated in opposition to the current Iran assault.

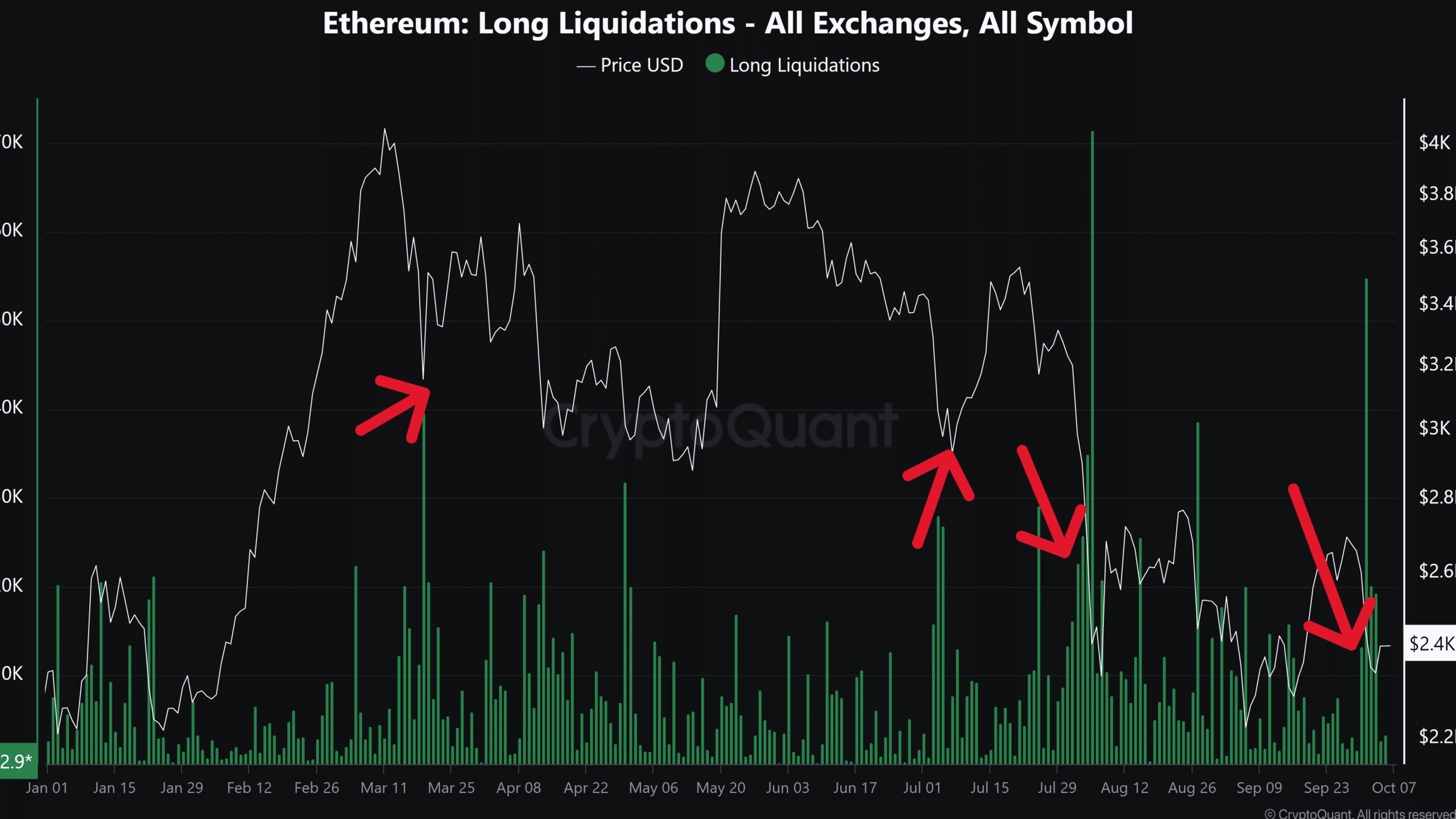

One other knowledge set that instructed ETH might need hit backside was the hike in lengthy liquidations. The current plunge liquidated over $50 million value of ETH lengthy positions.

In most previous traits, a spike in ETH lengthy liquidations coincided with native bottoms. This sample was seen in March, July and August.

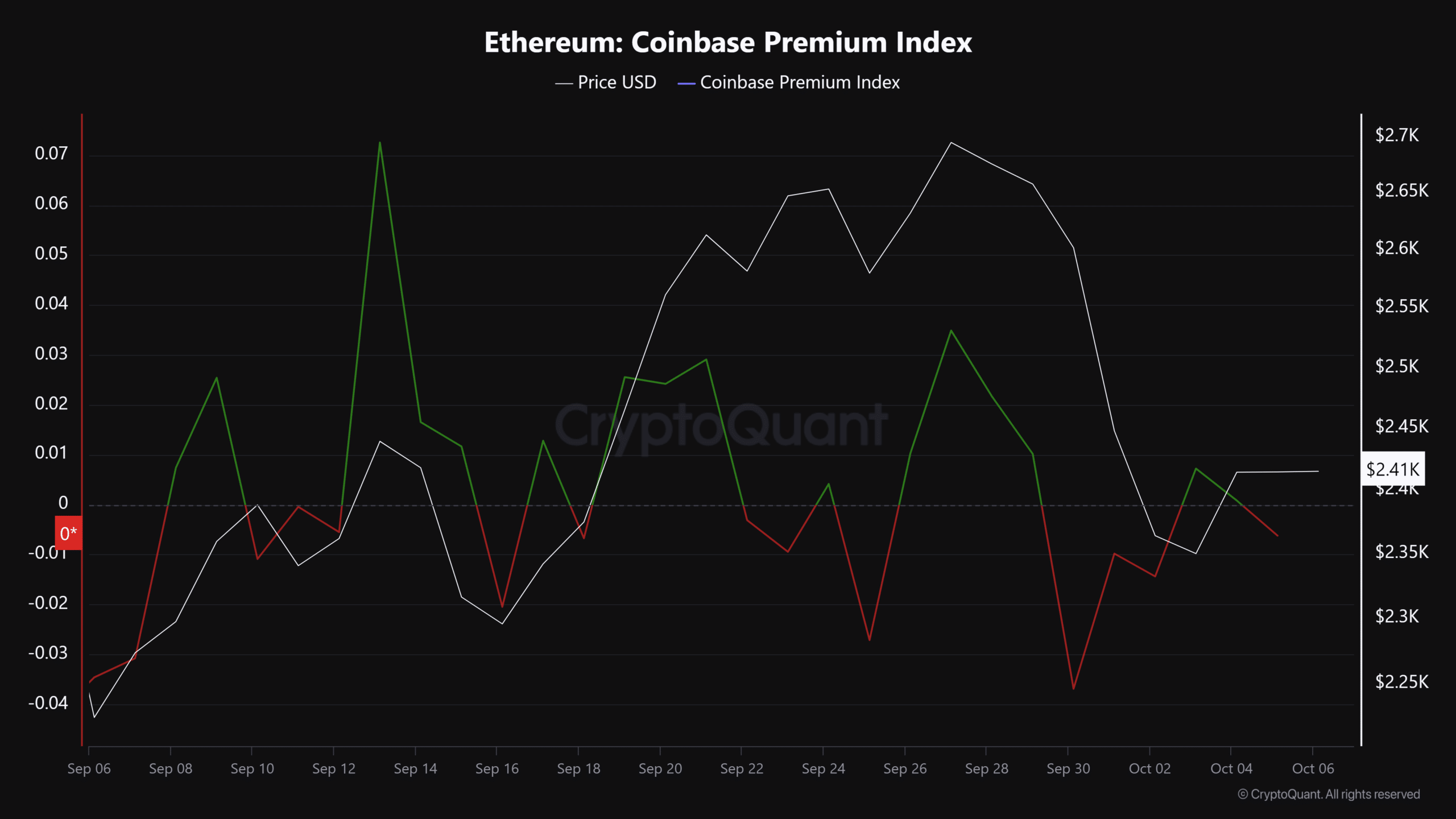

That stated, there was no important demand from US traders, as demonstrated by a detrimental studying on the Coinbase Premium Index. As a rule, hikes within the Coinbase Premium Index correlate with a robust ETH restoration.

Ergo, regardless of potential stability within the ETH market, monitoring US traders’ demand might sign whether or not the underside was in and if a aid restoration might observe.

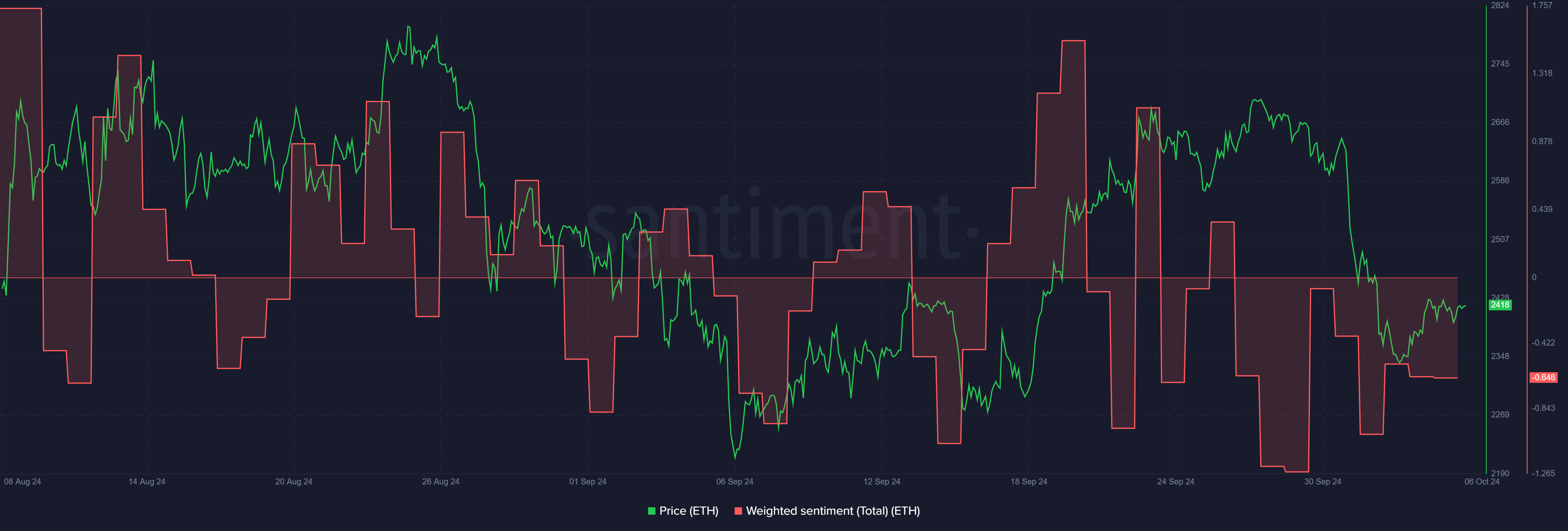

Moreover, a cautious outlook was nonetheless obvious, as denoted by ETH’s detrimental market sentiment.

This highlighted that traders took to the sidelines, in all probability to attend for Israel’s reactions to final week’s Iran transfer. At press time, ETH traded at $2.4K, down 8.4% up to now seven buying and selling days.

- Choices market knowledge indicated that ETH worth might have stabilized.

- Nonetheless, market sentiment was nonetheless detrimental amid overhangs from Center-East tensions.

Ethereum’s [ETH] worth appeared to stabilize after current volatility following geopolitical escalations within the Center East that spooked crypto markets.

In accordance with Jake Ostrovskis, a crypto dealer at Wintermute, choices market knowledge instructed {that a} native backside could possibly be in for the biggest altcoin. He famous,

“From Tuesday (1st Oct.), the biggest hedging circulation was observable in #ETH in shorter-dated contracts, and these flows at the moment are unwinding because the market appears to agency.”

Is ETH’s native backside in?

For context, the hike in hedging circulation in short-dated ETH contracts up to now few days meant that merchants took hedging positions to guard in opposition to worth fluctuations, epecially amid Israel-Iran escalations.

They used short-term choices to realize this.

Nonetheless, there was a notable unwinding of the hedging flows and declining implied volatility for these short-term choices into the weekend.

This instructed that merchants have been turning into assured of ETH market stability and that hedging was pointless.

Put in another way, ETH’s native backside might quickly be in, particularly as Israel hasn’t retaliated in opposition to the current Iran assault.

One other knowledge set that instructed ETH might need hit backside was the hike in lengthy liquidations. The current plunge liquidated over $50 million value of ETH lengthy positions.

In most previous traits, a spike in ETH lengthy liquidations coincided with native bottoms. This sample was seen in March, July and August.

That stated, there was no important demand from US traders, as demonstrated by a detrimental studying on the Coinbase Premium Index. As a rule, hikes within the Coinbase Premium Index correlate with a robust ETH restoration.

Ergo, regardless of potential stability within the ETH market, monitoring US traders’ demand might sign whether or not the underside was in and if a aid restoration might observe.

Moreover, a cautious outlook was nonetheless obvious, as denoted by ETH’s detrimental market sentiment.

This highlighted that traders took to the sidelines, in all probability to attend for Israel’s reactions to final week’s Iran transfer. At press time, ETH traded at $2.4K, down 8.4% up to now seven buying and selling days.