- TIA is projected to proceed its downward trajectory within the coming days, probably reaching $4.55.

- This bearish development is underscored by a loss of life cross formation on the MACD, indicating a powerful chance of additional declines.

Based on CoinMarketCap, the general crypto market’s capitalization fell by 2.63%, largely as a result of losses in altcoin.

Celestia [TIA], particularly, emerged as one of many prime losers, recording a big drop of 6.53%. As market sentiment grows more and more damaging, additional evaluation by AMBCrypto suggests TIA’s worth could drop much more sharply.

Vital promote strain is prone to drive TIA’s worth downward

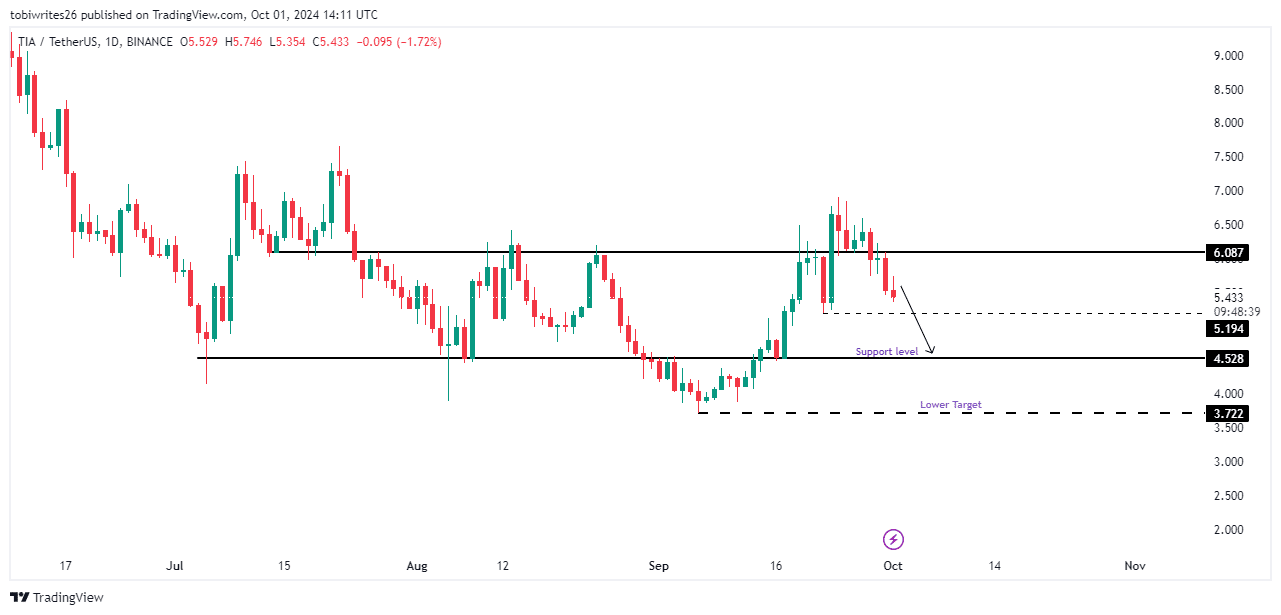

Since coming into a consolidation channel in early July, TIA has oscillated inside this vary, reacting notably to the channel’s vary. Presently, it has reacted from the resistance line, the place it’s dealing with vital promoting strain.

This resistance has turn out to be a focus for market members aiming to drive the worth decrease, as witnessed by TIA’s ongoing each day decline of 6.53%.

Ought to this promoting strain persist, TIA is predicted to drop to the help stage at $4.528, the place it would stabilize quickly. Nonetheless, with continued bearish momentum, TIA might probably attain its September low of $3.722 and even fall additional.

Dying cross signifies additional decline for TIA

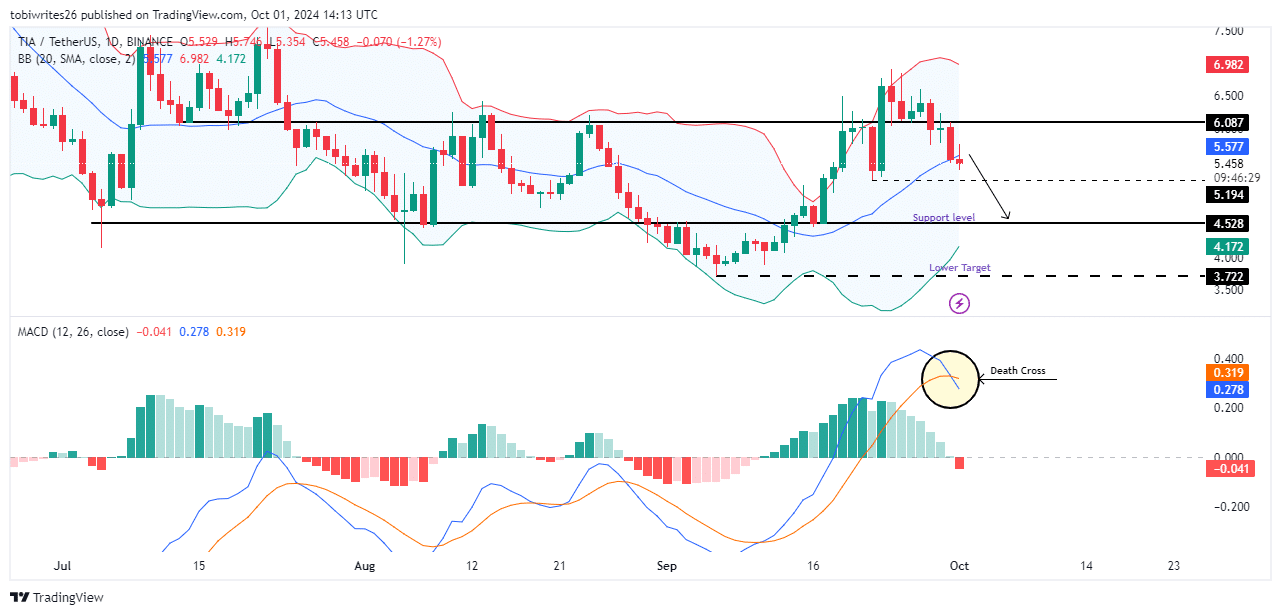

TIA has developed a bearish sample available in the market, marked by its blue MACD line crossing beneath the orange sign line, signaling that bearish forces are gaining management.

Usually, such a sample results in a continued decline in each momentum and worth. The possible subsequent goal is the help area at $4.55.

Moreover, the Bollinger Bands counsel this downward development will persist. TIA has moved away from the higher band, which frequently signifies an overbought situation, and is now trending towards the decrease zone, which might additional drive down its worth.

Market traits oppose bullish merchants on TIA

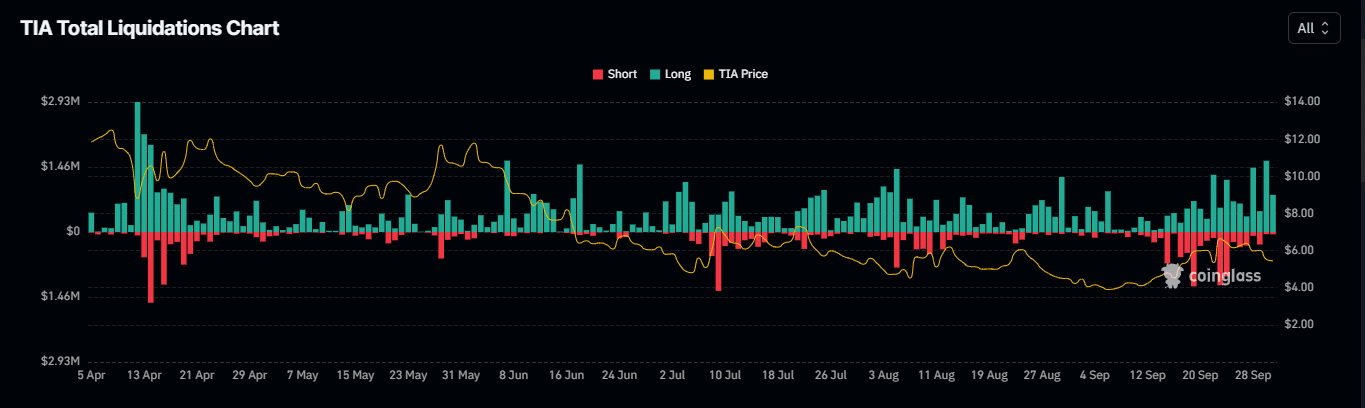

Based on Coinglass, TIA has skilled a notable disparity between lengthy and quick liquidations during the last 24 hours.

At press time, a complete of $1.24 million in TIA positions has been forcefully liquidated, with lengthy positions accounting for $1.17 million of this complete and quick merchants making up the remaining $75.84 thousand.

Is your portfolio inexperienced? Try the Celestia Revenue Calculator

This vital distinction in liquidations between lengthy and quick merchants signifies a closely bearish market sentiment, with extra merchants anticipating additional worth declines.

If the prevailing bearish sentiment persists, it’s possible that TIA’s downtrend will proceed till substantial shopping for strain emerges to stabilize the worth.