- Bullish exercise breathes extra life into Avalanche TVL and stablecoin market cap.

- Can AVAX maintain on to current good points as promote stress progressively creeps again in?

The Avalanche [AVAX] ecosystem has been experiencing a resurgence of exercise because the market enters restoration mode. On-chain information revealed important adjustments in a few of Avalanche’s metrics, particularly the overall worth locked (TVL).

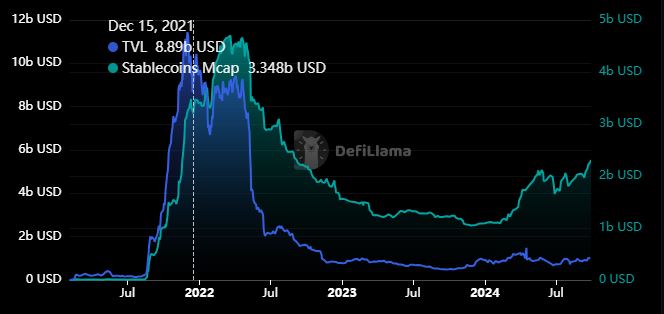

Avalanche’s TVL is a good distance off from its historic excessive. It peaked at $11.49 billion in December, 2021, however the community skilled heavy outflows throughout crypto winter.

The TVL dipped beneath $500 million in September final 12 months and solely managed to push again above $1 billion this week.

Avalanche had a $1.07 billion TVL on the time of writing. Whereas this can be a noteworthy restoration, it nonetheless pales compared to the historic highs. We additionally noticed important restoration within the community’s stablecoin market cap to a $2.31 billion native excessive.

The community’s stablecoin market cap hit a low of $536.96 million in October 2023, which implies it’s now up by over 300%. However identical to the TVL, Avalanche stablecoin market cap is at present at a fraction of its $4.67 billion peak in 2022.

Can the TVL and stablecoin market cap restoration assist AVAX upside?

Stablecoin progress and TVL are very important measures of a community’s progress and liquidity. They facilitate DeFi ecosystem progress so, technically this might sign extra natural demand for AVAX shifting ahead.

AVAX has been on a macro bearish pattern since March, which appears to have leveled out in August.

AVAX has to date rallied by nearly 50% from its September lows. The cryptocurrency just lately peaked at $30.85, however had a $29.33 press time worth after a slight pullback within the final 24 hours.

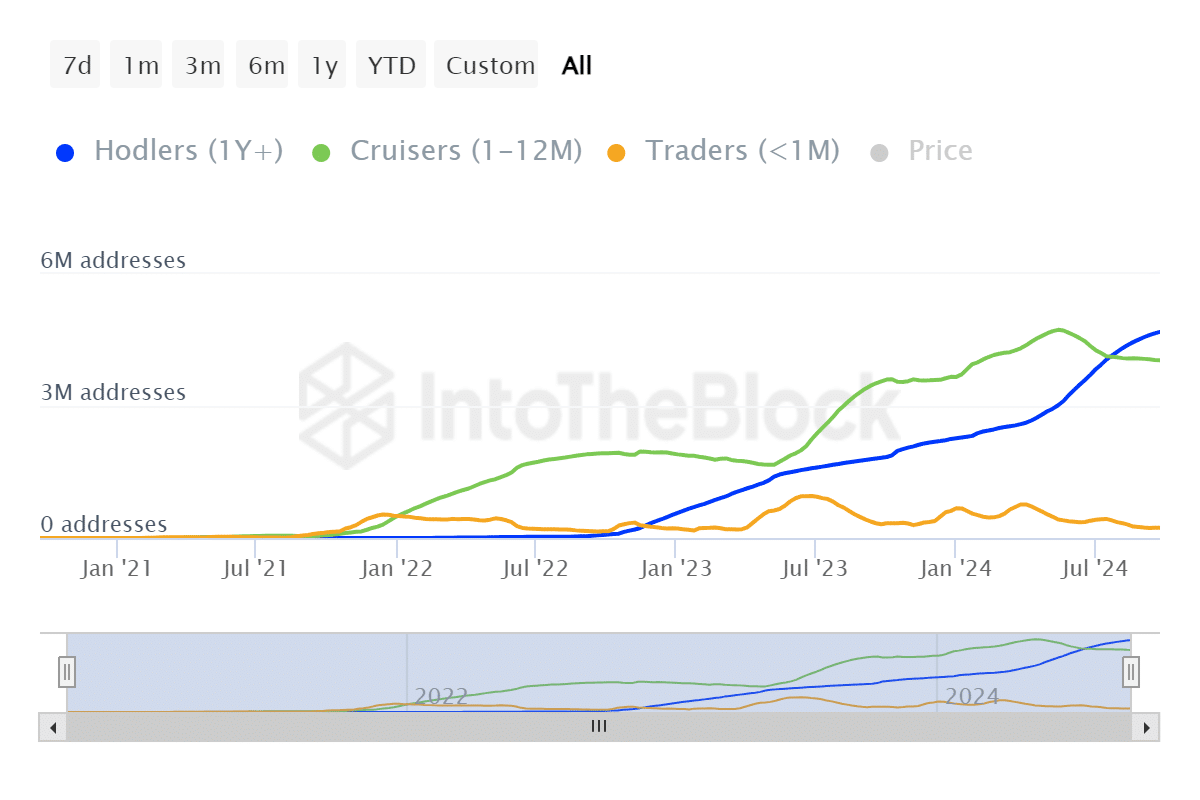

AVAX bulls are beginning to expertise resistance, suggesting that promote stress is perhaps increase after its newest rally. Will one other retracement happen? IntoTheBlock information confirmed that AVAX cruisers maintain nearly as a lot cash as HODLers.

Cruisers are equal to short-term holders whose holding period is lower than 12 months. There have been 4.04 million cruiser addresses, 4.69 million HODLers and 234,000 merchants on the time of statement.

Learn Avalanche’s [AVAX] Worth Prediction 2024–2025

The above statement means that AVAX is perhaps liable to some draw back if cruisers determine to start out taking revenue. However, promote stress is probably not as important particularly now that the market is simply simply exhibiting indicators of restoration.

This implies there is perhaps some incentive for AVAX holders to attend or extra potential upside.