Crypto asset supervisor Grayscale has printed an in-depth report outlining sectors poised for bullish progress within the closing quarter of the 12 months amid a notable restoration within the cryptocurrency market, significantly for main gamers corresponding to Bitcoin (BTC) and varied altcoins, which have reached value ranges not seen in over two months.

Grayscale Highlights Key Tendencies In Crypto

In its Thursday report, Grayscale up to date its Crypto Sectors Indexes, showcasing rising themes inside the digital asset business. Key developments embody the rise of decentralized synthetic intelligence (AI) platforms, efforts to tokenize conventional property, and the rising reputation of memecoins.

Notably, Bitcoin and the cryptocurrency sector have outperformed different market segments in 2024, doubtless as a result of profitable launch of spot Bitcoin exchange-traded merchandise (ETPs) within the US earlier this 12 months and favorable macroeconomic situations following the Federal Reserve’s (Fed) rate of interest reduce on 18 September.

Associated Studying

Whereas gaining 13% this 12 months, Ethereum has underperformed Bitcoin however nonetheless surpassed many different cryptocurrencies. Grayscale’s Crypto Sectors Market Index (CSMI) has seen a slight decline of about 1% year-to-date, with the Sensible Contract Platforms Crypto Sector Index down roughly 11%, making Ethereum’s efficiency comparatively stronger than its friends.

Regardless of its challenges, the asset supervisor finds that Ethereum stays the Sensible Contract Platforms sector chief, boasting the very best variety of purposes, builders, and charge income.

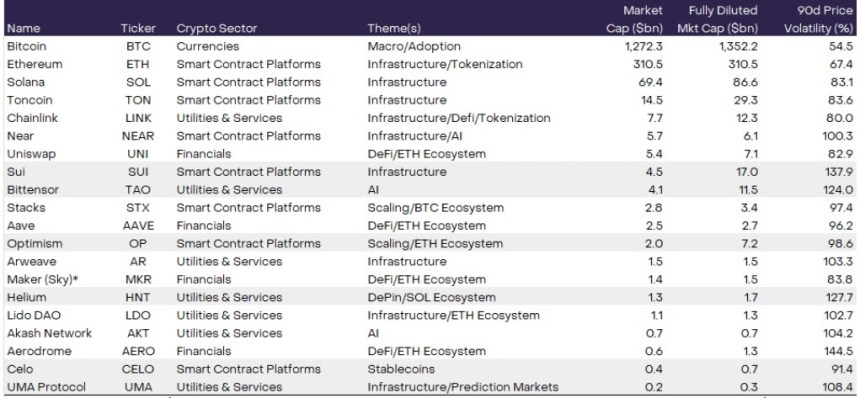

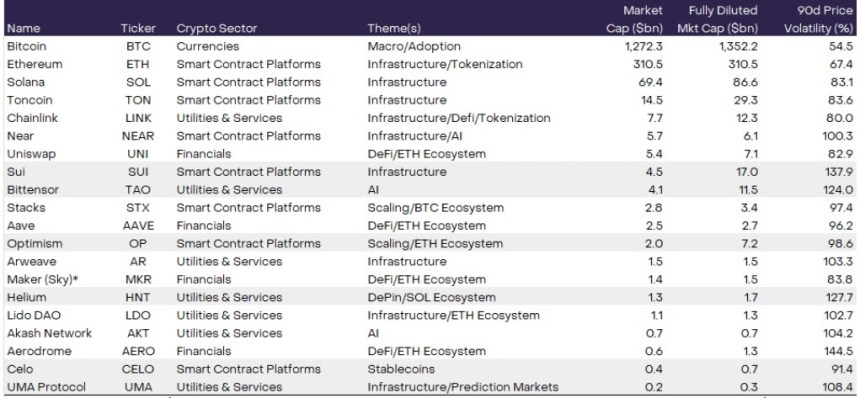

High 20 Cryptocurrencies For Upcoming Quarter

In producing its quarterly High 20 listing of cryptocurrencies, Grayscale completely analyzes lots of of digital property. This listing represents a diversified number of property with excessive potential for the upcoming quarter.

Amongst these highlighted by the agency are standout performers corresponding to Sui (SUI), Bittensor (TAO), Optimism (OP), Helium (HNT), Celo (CELO) and the UMA Protocol (UMA). Nevertheless, beneath is the total listing with different property past these to which Grayscale pays specific consideration.

Sui, a third-generation blockchain created by former Meta engineers, has made waves following a current community improve that enhanced its transaction velocity by 80%, surpassing Solana’s capabilities.

Optimism, an Ethereum Layer 2 answer, performs a vital function in scaling the Ethereum community. It has developed a framework referred to as the “Superchain,” which is utilized by platforms like Coinbase’s Layer 2 BASE.

Celo and UMA are capitalizing on distinctive developments, with Celo specializing in stablecoin use and fee options in creating areas, significantly in Africa. The platform just lately surpassed Tron in stablecoin utilization, whereas UMA serves as an oracle community for decentralized purposes like Polymarket.

Associated Studying

Helium’s inclusion within the High 20 displays Grayscale’s choice for class leaders with sustainable income fashions. The undertaking has established itself as a frontrunner in decentralized bodily infrastructure networks (DePIN), rising its community to over a million hotspots and producing important charge revenues.

Bittensor, which focuses on the intersection of AI and crypto, has just lately gained recognition inside Grayscale’s framework attributable to enhancements in market construction, providing a decentralized platform for AI innovation.

On this quarter’s changes, Grayscale has rotated out a number of property, together with Render, Mantle, ThorChain, Pendle, Illuvium, and Raydium. Whereas Grayscale sees worth in these initiatives, the revised High 20 listing goals to supply extra compelling risk-adjusted returns for buyers within the coming months.

On the time of writing, the largest winner throughout all time frames in Grayscale’s high 20 listing is Bittensor’s TAO token, which has seen good points of 86% over the fourteen-day timeframe and a considerable 841% year-to-date, leading to a present buying and selling value of $536.

Featured picture from DALL-E, chart from TradingView.com

Crypto asset supervisor Grayscale has printed an in-depth report outlining sectors poised for bullish progress within the closing quarter of the 12 months amid a notable restoration within the cryptocurrency market, significantly for main gamers corresponding to Bitcoin (BTC) and varied altcoins, which have reached value ranges not seen in over two months.

Grayscale Highlights Key Tendencies In Crypto

In its Thursday report, Grayscale up to date its Crypto Sectors Indexes, showcasing rising themes inside the digital asset business. Key developments embody the rise of decentralized synthetic intelligence (AI) platforms, efforts to tokenize conventional property, and the rising reputation of memecoins.

Notably, Bitcoin and the cryptocurrency sector have outperformed different market segments in 2024, doubtless as a result of profitable launch of spot Bitcoin exchange-traded merchandise (ETPs) within the US earlier this 12 months and favorable macroeconomic situations following the Federal Reserve’s (Fed) rate of interest reduce on 18 September.

Associated Studying

Whereas gaining 13% this 12 months, Ethereum has underperformed Bitcoin however nonetheless surpassed many different cryptocurrencies. Grayscale’s Crypto Sectors Market Index (CSMI) has seen a slight decline of about 1% year-to-date, with the Sensible Contract Platforms Crypto Sector Index down roughly 11%, making Ethereum’s efficiency comparatively stronger than its friends.

Regardless of its challenges, the asset supervisor finds that Ethereum stays the Sensible Contract Platforms sector chief, boasting the very best variety of purposes, builders, and charge income.

High 20 Cryptocurrencies For Upcoming Quarter

In producing its quarterly High 20 listing of cryptocurrencies, Grayscale completely analyzes lots of of digital property. This listing represents a diversified number of property with excessive potential for the upcoming quarter.

Amongst these highlighted by the agency are standout performers corresponding to Sui (SUI), Bittensor (TAO), Optimism (OP), Helium (HNT), Celo (CELO) and the UMA Protocol (UMA). Nevertheless, beneath is the total listing with different property past these to which Grayscale pays specific consideration.

Sui, a third-generation blockchain created by former Meta engineers, has made waves following a current community improve that enhanced its transaction velocity by 80%, surpassing Solana’s capabilities.

Optimism, an Ethereum Layer 2 answer, performs a vital function in scaling the Ethereum community. It has developed a framework referred to as the “Superchain,” which is utilized by platforms like Coinbase’s Layer 2 BASE.

Celo and UMA are capitalizing on distinctive developments, with Celo specializing in stablecoin use and fee options in creating areas, significantly in Africa. The platform just lately surpassed Tron in stablecoin utilization, whereas UMA serves as an oracle community for decentralized purposes like Polymarket.

Associated Studying

Helium’s inclusion within the High 20 displays Grayscale’s choice for class leaders with sustainable income fashions. The undertaking has established itself as a frontrunner in decentralized bodily infrastructure networks (DePIN), rising its community to over a million hotspots and producing important charge revenues.

Bittensor, which focuses on the intersection of AI and crypto, has just lately gained recognition inside Grayscale’s framework attributable to enhancements in market construction, providing a decentralized platform for AI innovation.

On this quarter’s changes, Grayscale has rotated out a number of property, together with Render, Mantle, ThorChain, Pendle, Illuvium, and Raydium. Whereas Grayscale sees worth in these initiatives, the revised High 20 listing goals to supply extra compelling risk-adjusted returns for buyers within the coming months.

On the time of writing, the largest winner throughout all time frames in Grayscale’s high 20 listing is Bittensor’s TAO token, which has seen good points of 86% over the fourteen-day timeframe and a considerable 841% year-to-date, leading to a present buying and selling value of $536.

Featured picture from DALL-E, chart from TradingView.com