The next is a visitor publish by Vincent Maliepaard, Advertising and marketing Director at IntoTheBlock.

Once you first hear about Bitcoin staking, you may assume there’s a mistake, given Bitcoin’s Proof of Work (PoW) mechanism. Nonetheless, Bitcoin staking is certainly a actuality, with hundreds of addresses collaborating and producing returns on their property. Right here’s what it’s worthwhile to know.

Bitcoin Staking Defined

Staking historically refers back to the course of the place holders of a cryptocurrency lock up their funds to take part in community operations, similar to transaction validation on Proof of Stake (PoS) blockchains. Bitcoin, nonetheless, operates on a PoW consensus mechanism, which doesn’t natively help staking. This dynamic has modified with the introduction of Bitcoin staking via platforms providing Bitcoin-based Liquid Staking Tokens (LSTs). These platforms allow BTC holders to interact in staking actions not directly.

EigenLayer, Babylon, and AVS’s

On Ethereum, the idea of “restaking” was launched in 2023 with EigenLayer, which gained important traction by mid-2024, reaching a complete worth locked (TVL) of over $20 billion in June. Usually, staking ETH helps safe the Ethereum community, rewarding stakers in return. EigenLayer extends this idea by permitting customers to “restake” their ETH to safe further companies, incomes further rewards.

Initially coined as Energetic Validated Providers (AVS) on Eigenlayer, these functions by completely different phrases relying on their related (re)staking platform. AVSs are functions or companies that may be secured with restaked ETH. This idea is now being prolonged to the Bitcoin blockchain and BTC-pegged tokens. Babylon is main this effort, constructing an structure that permits functions to leverage Bitcoin’s crypto-economic safety. In the meantime, on the Ethereum facet, Symbiotic and shortly Eigenlayer are restaking protocols accepting tokens similar to Wrapped Bitcoin (WBTC) as collateral to help functions that search to make the most of these property for enhanced safety.

Understanding Bitcoin Staking

In Bitcoin staking, customers deposit their BTC right into a staking protocol and obtain Liquid Staking Tokens (LSTs) in return. These LSTs characterize the staked BTC however typically provide enhanced liquidity and different functionalities. This permits individuals to interact in DeFi actions with out sacrificing staking rewards.

Presently, the most well-liked Bitcoin LST is LBTC, originating from the Lombard protocol. Right here’s a breakdown of the way it works:

- How LBTC is Created: To mint LBTC, customers ship their BTC to particular addresses linked to the Babylon protocol. This motion creates LBTC on Ethereum, appearing as a placeholder for the Bitcoin you despatched.

- What Occurs to the BTC: The precise BTC despatched is held securely inside Babylon protocol’s contracts. At current, this BTC isn’t being utilized or accessible, however it stays safely saved.

- Rewards for Depositors: Whereas the BTC is held in reserve, depositors are rewarded with factors from each the Babylon and Lombard techniques as an incentive for his or her participation.

- The Future Plan: The purpose is to finally use the BTC held by Babylon’s contracts to safe a broader ecosystem. This could contain permitting completely different apps and chains to make the most of this BTC to safe their networks whereas sustaining a connection to the principle Bitcoin community.

Main Protocols in Bitcoin Staking

A number of protocols have emerged as frontrunners within the Bitcoin staking enviornment:

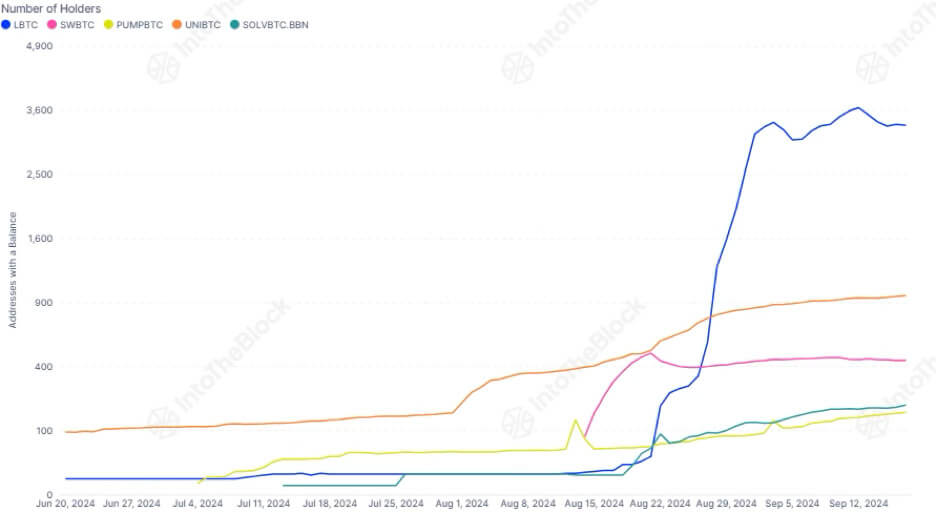

- Lombard Staked BTC (LBTC): As a frontrunner on this market, LBTC has seen its market cap develop considerably, now sitting at $300 million with over 3,000 holders.

- UniBTC: UnitBTC secured a big variety of holders early on. Whereas LBTC has surpassed it, it nonetheless ranks second with roughly 1000 holders.

- Swell BTC (SWBTC): SWBTC had a robust begin and appeared more likely to surpass uniBTC. Nonetheless, development has slowed down and it at the moment ranks third with round 440 holders.

Is Bitcoin Staking the Way forward for Bitcoin yield?

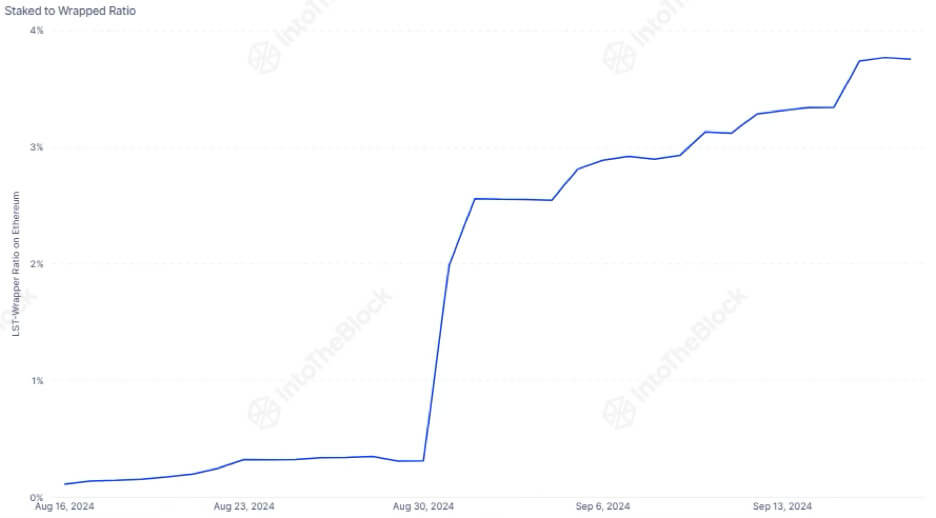

Bitcoin staking has seen a robust begin, with hundreds of holders already incomes factors via main protocols. Presently, staked Bitcoin represents 3.75% of all wrapped Bitcoin, indicating there may be nonetheless loads of room for development within the coming months.

The idea is promising, however its long-term success will rely upon whether or not the economics of staking make sense past the preliminary level rewards. The important thing issue would be the growth of companies constructed on high of those protocols. If a strong ecosystem of companies develops, Bitcoin staking may develop into one of the engaging yield alternatives for Bitcoin holders.