Rising uncertainty contributes to S&P 500 and Nasdaq-100 falling into correction

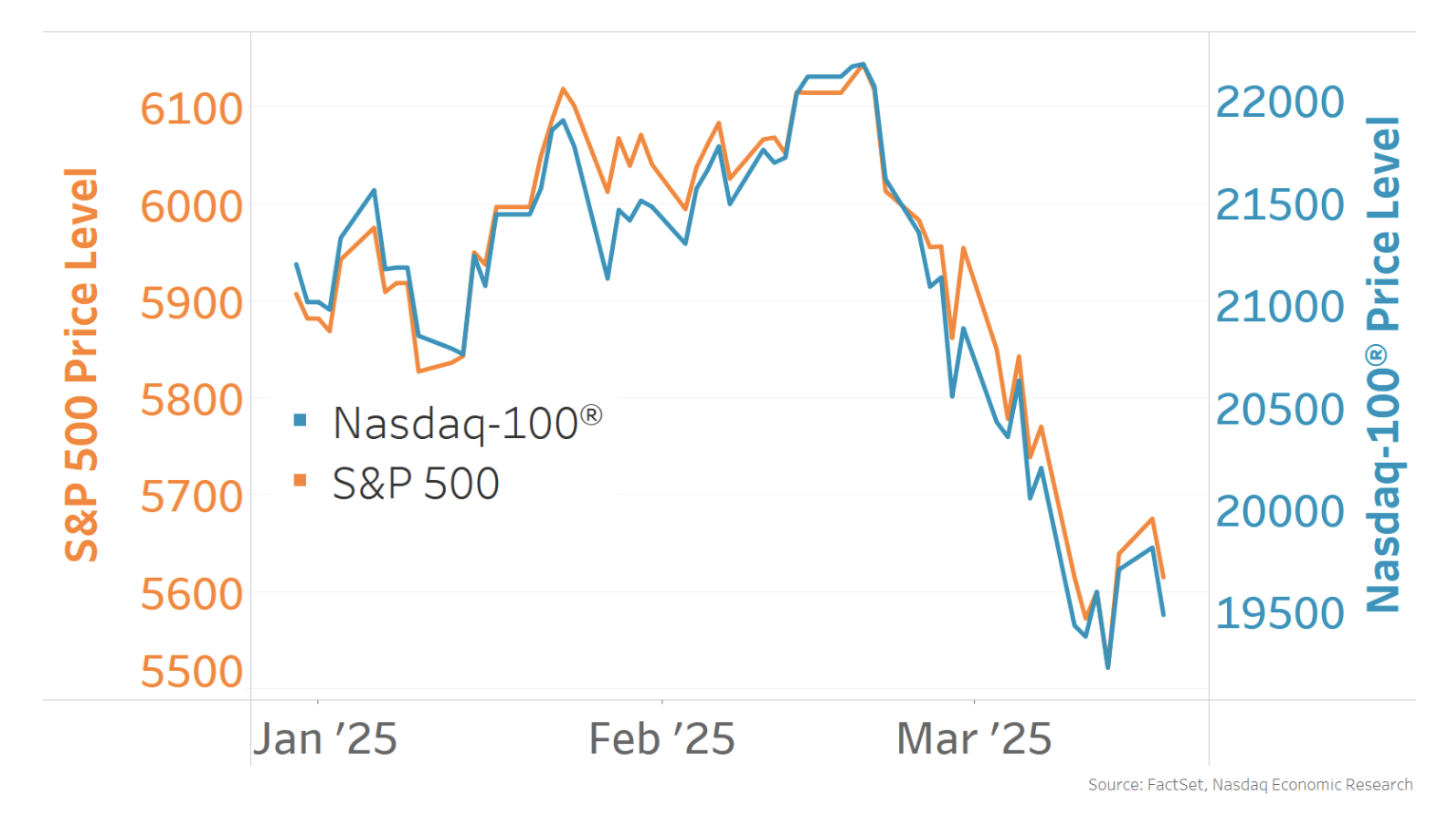

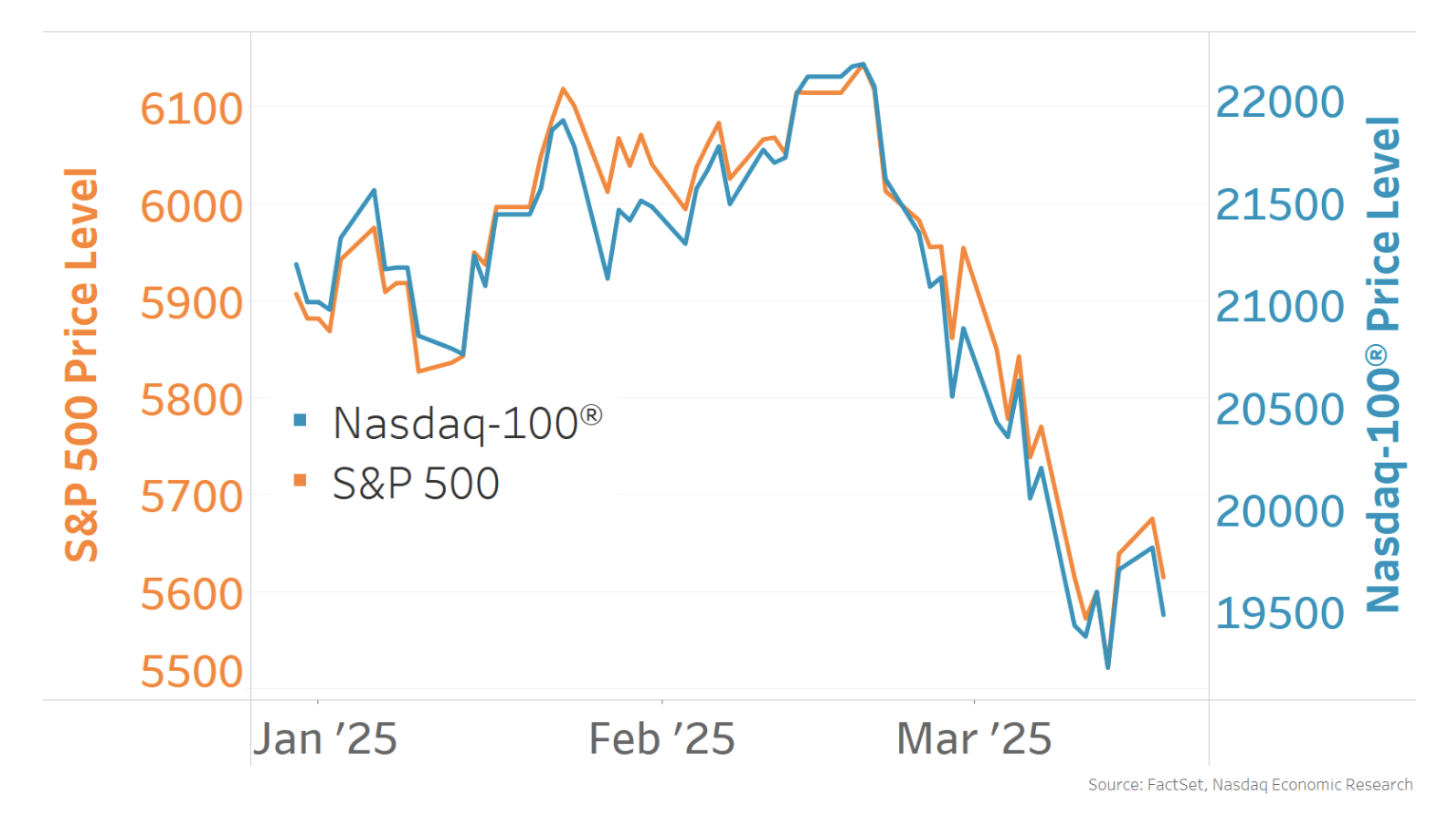

It’s been a troublesome few weeks for shares, with the S&P 500 and the Nasdaq-100 (chart beneath, blue line) each falling into correction just lately (down at the least 10% from their peaks).

There have been a number of components contributing to this selloff:

However loads of it comes all the way down to elevated coverage uncertainty.

The final couple months have seen speedy and vital coverage adjustments from the Trump administration. That is very true for tariffs, which have seen some insurance policies applied, some delayed, some reversed, and others simply being studied.

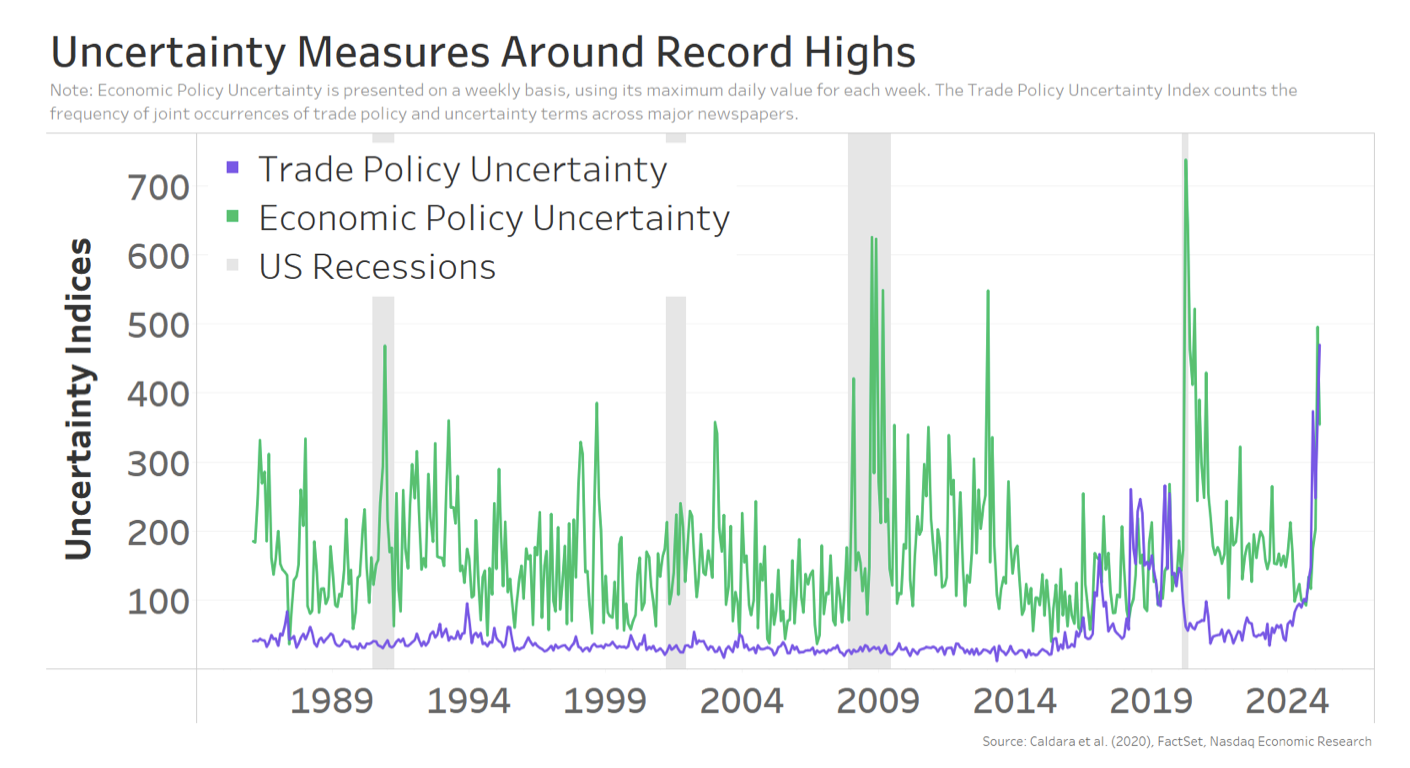

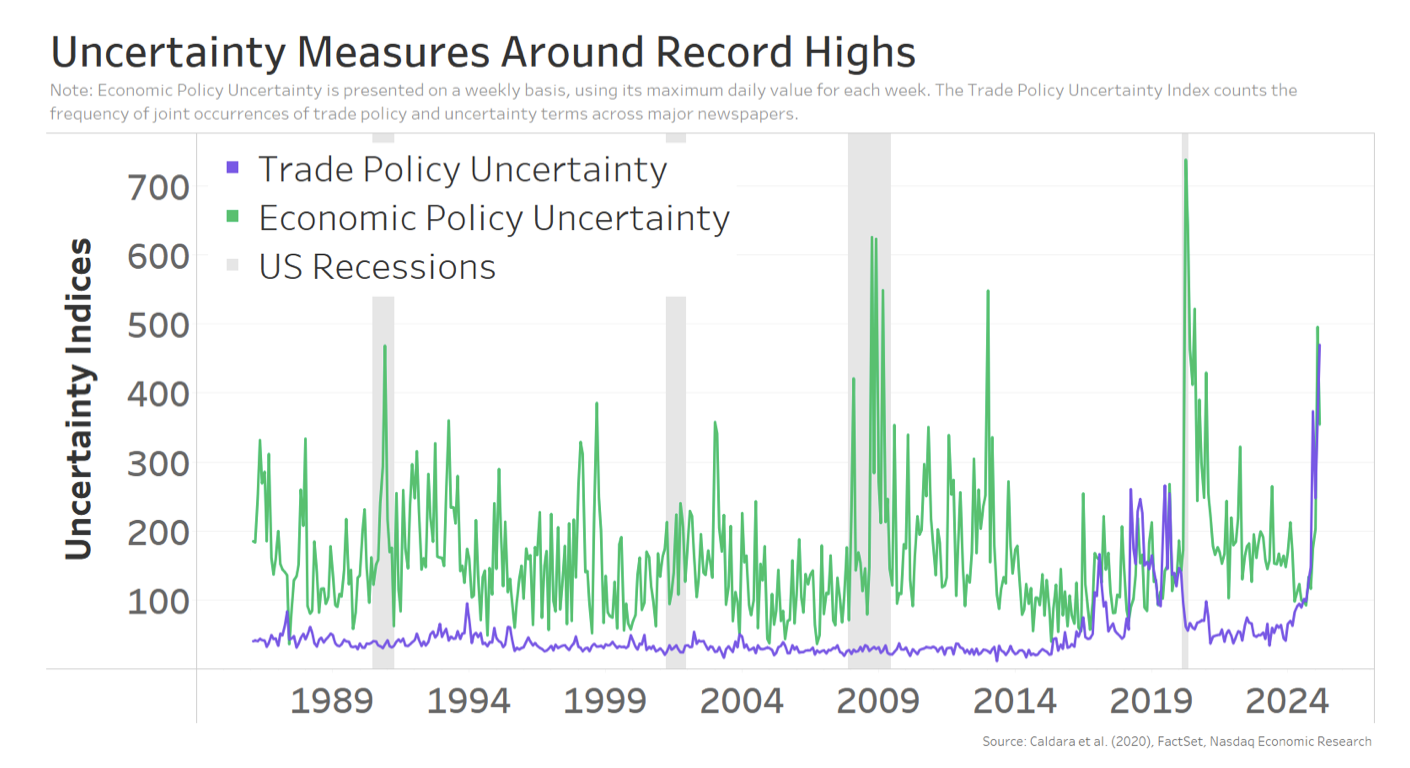

In response to those adjustments, the Commerce Coverage Uncertainty Index reached a report excessive in February (chart beneath, purple line), whereas the broader Financial Coverage Uncertainty Index is as much as ranges final seen throughout Covid and the World Monetary Disaster (inexperienced line)… and 2012’s (non-recessionary) “fiscal cliff” episode.

Surveys present shoppers and small companies pulling again in response to elevated uncertainty

The issue with elevated coverage uncertainty is that it makes it tougher for companies and shoppers to make selections, so that they delay funding and spending whereas they await extra readability.

That is precisely what we’re seeing in latest surveys of small enterprise and shoppers.

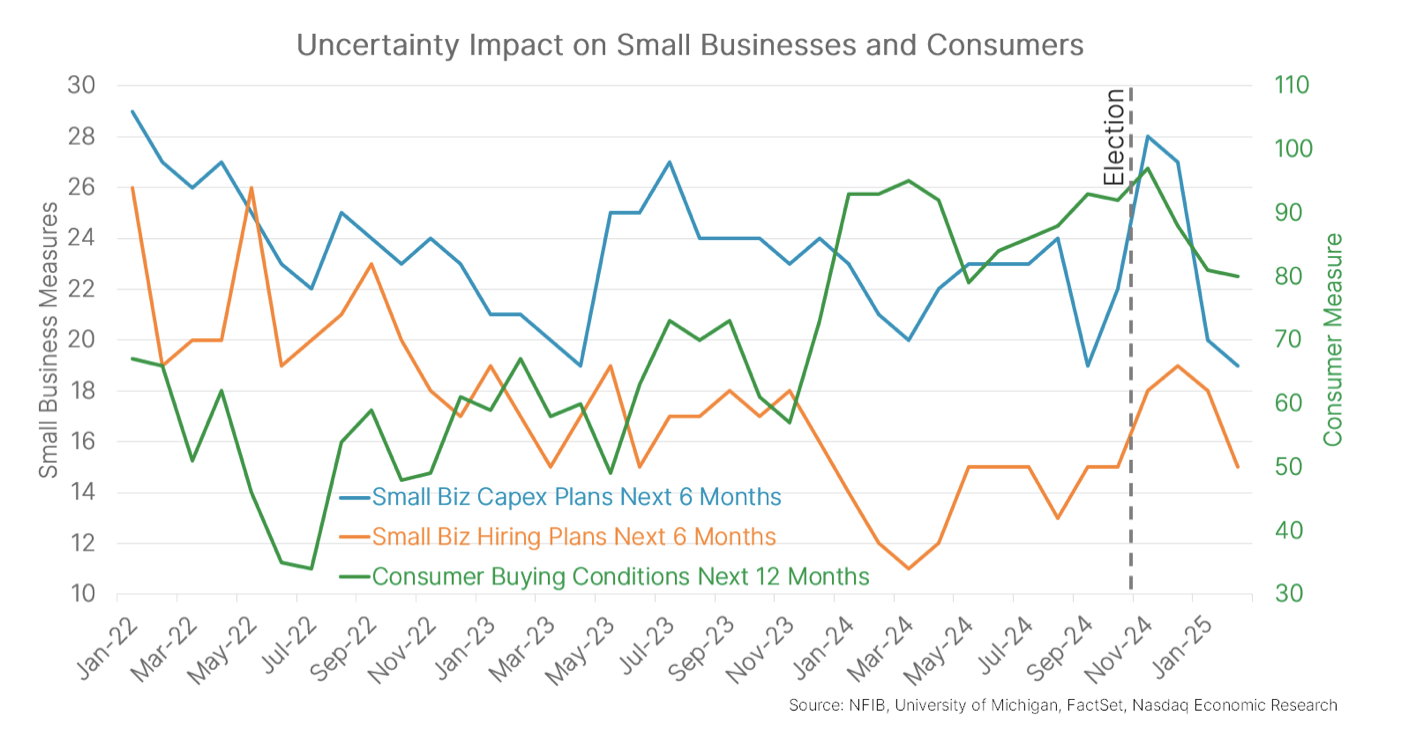

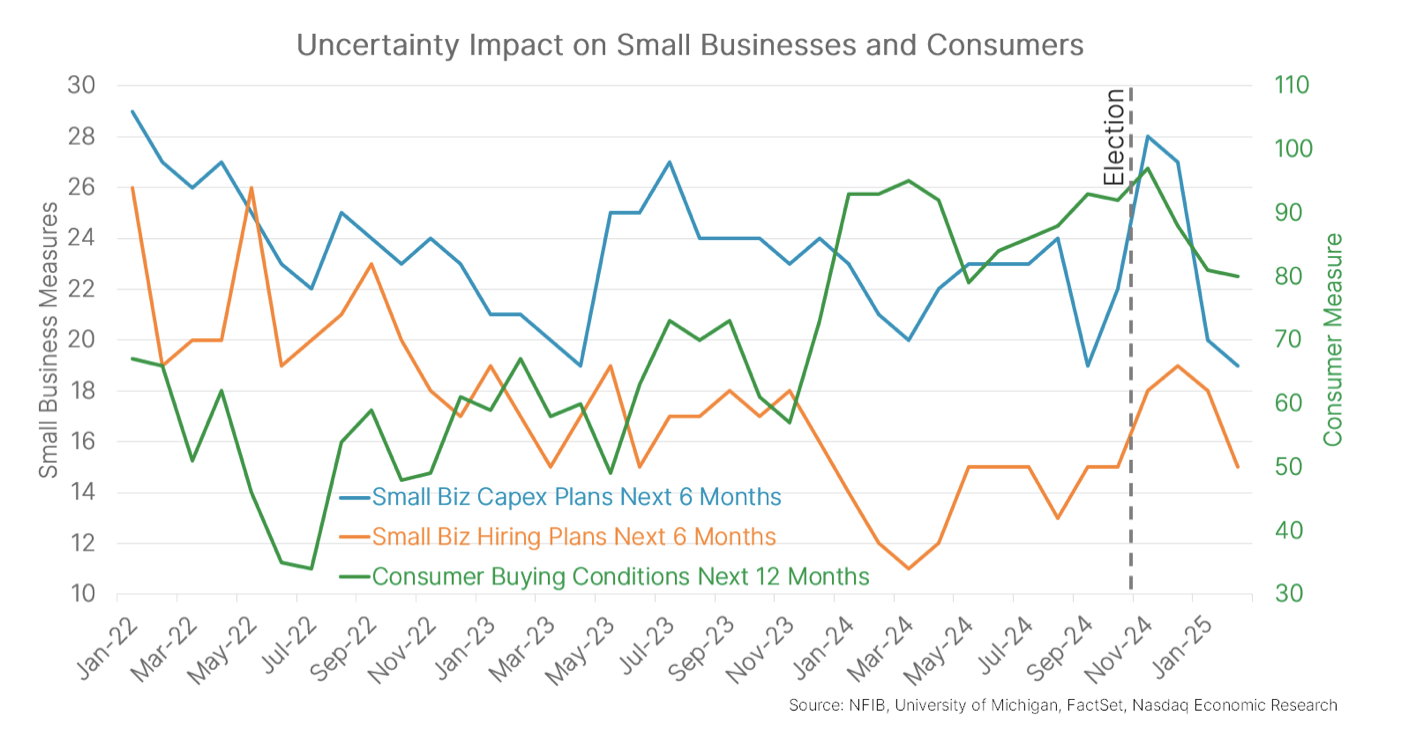

For companies, this implies lowering hiring plans (chart beneath, orange line) and slowing capex spending (blue line) – or funding in gear, factories, and so on.

And shoppers are saying that prospects for making a big-ticket buy (properties, vehicles, home equipment, and so on) are getting worse (inexperienced line).

Uncertainty may result in slower development this 12 months, however recession discuss is untimely

So, if elevated uncertainty means small companies and shoppers pull again on spending and funding, will probably be a drag on development. In truth, Goldman Sachs and the OECD each cited uncertainty once they just lately revised down their US development projections for 2025 to 1.7% and 2.2%, respectively.

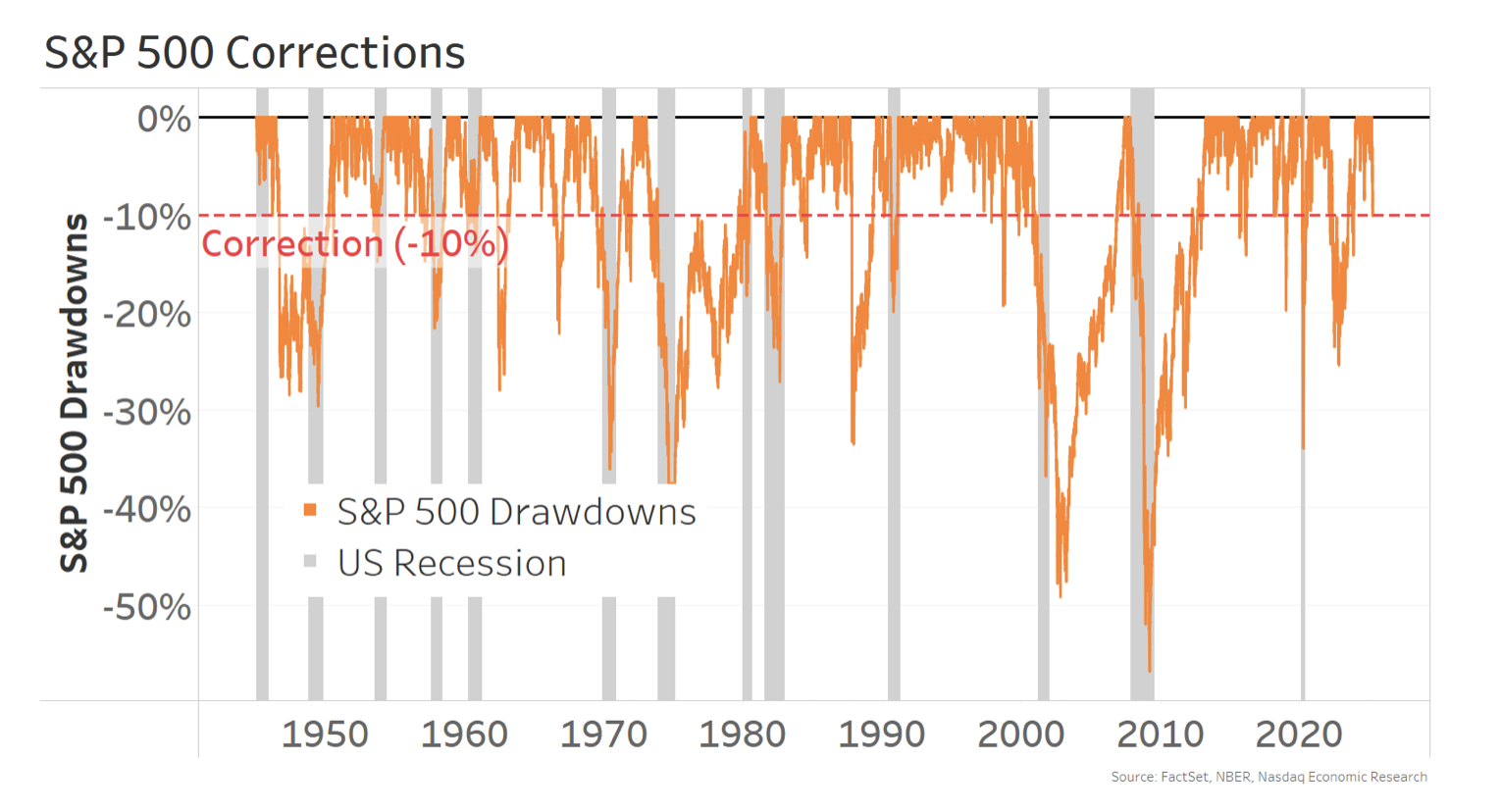

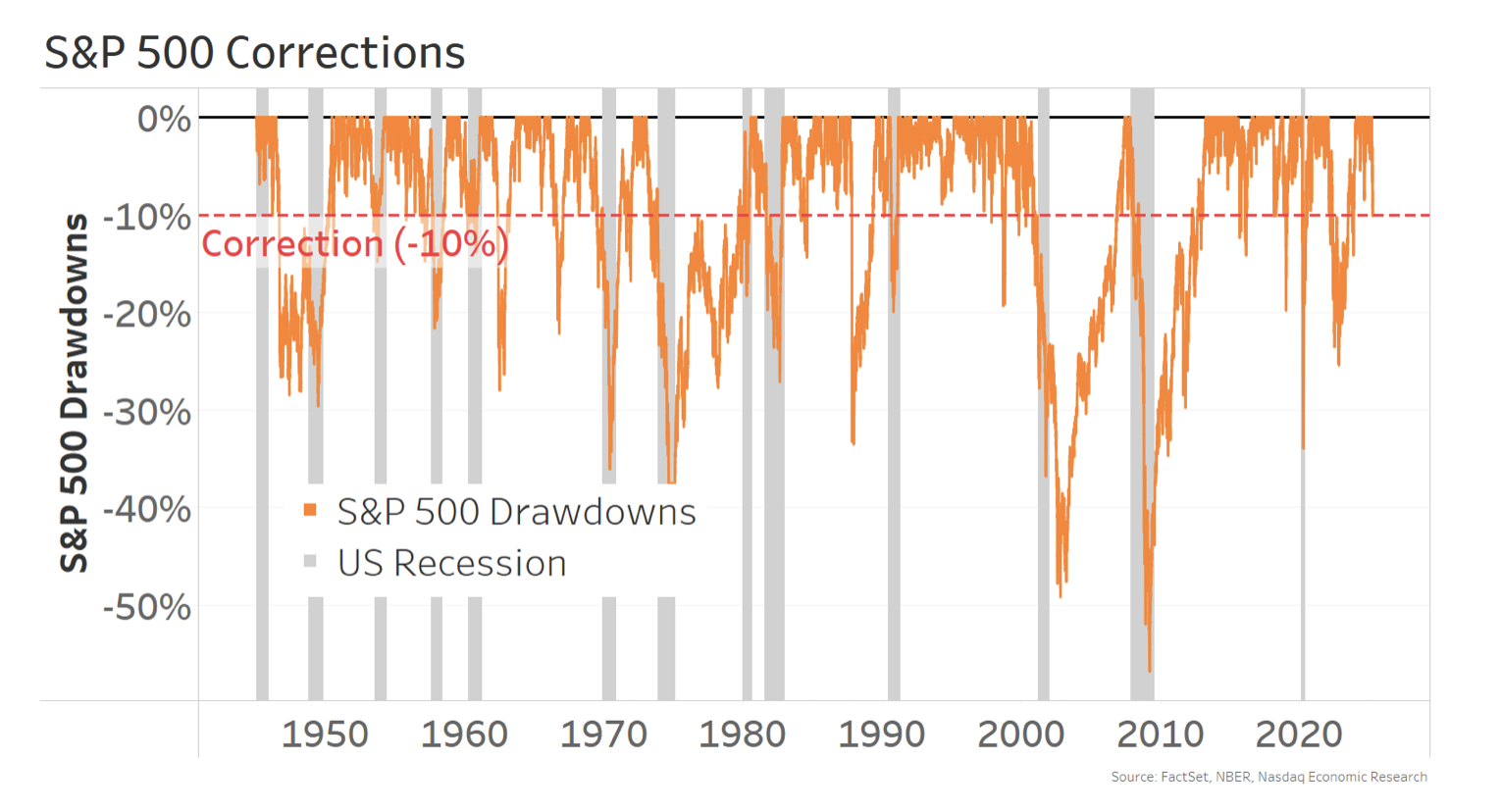

However ~2% actual GDP development is much from recessionary. And but, should you’re simply studying the information (or watching the inventory market), you’d be forgiven for (mistakenly) considering the US economic system is getting ready to recession. Nevertheless, market corrections (chart beneath, crimson line) occur routinely exterior recessions (grey shaded areas).

So, whereas it’d be finest for the economic system for companies and shoppers to get the readability they’re in search of, it’s necessary to keep in mind that the economic system ended 2024 on strong footing, which supplies it some means to soak up detrimental shocks. And the little laborious knowledge we’ve gotten for February (when tariffs first took impact) isn’t too regarding (but) – the economic system added a strong 151,000 jobs and “core” retail gross sales (ex. fuel, autos, and constructing supplies) rose 1% from January.

For now, earlier than worrying about recession, it’s value ready for some extra (laborious) knowledge.

The knowledge contained above is supplied for informational and academic functions solely, and nothing contained herein ought to be construed as funding recommendation, both on behalf of a selected safety or an total funding technique. Neither Nasdaq, Inc. nor any of its associates makes any advice to purchase or promote any safety or any illustration concerning the monetary situation of any firm. Statements relating to Nasdaq-listed firms or Nasdaq proprietary indexes should not ensures of future efficiency. Precise outcomes might differ materially from these expressed or implied. Previous efficiency will not be indicative of future outcomes. Traders ought to undertake their very own due diligence and thoroughly consider firms earlier than investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved.

Rising uncertainty contributes to S&P 500 and Nasdaq-100 falling into correction

It’s been a troublesome few weeks for shares, with the S&P 500 and the Nasdaq-100 (chart beneath, blue line) each falling into correction just lately (down at the least 10% from their peaks).

There have been a number of components contributing to this selloff:

However loads of it comes all the way down to elevated coverage uncertainty.

The final couple months have seen speedy and vital coverage adjustments from the Trump administration. That is very true for tariffs, which have seen some insurance policies applied, some delayed, some reversed, and others simply being studied.

In response to those adjustments, the Commerce Coverage Uncertainty Index reached a report excessive in February (chart beneath, purple line), whereas the broader Financial Coverage Uncertainty Index is as much as ranges final seen throughout Covid and the World Monetary Disaster (inexperienced line)… and 2012’s (non-recessionary) “fiscal cliff” episode.

Surveys present shoppers and small companies pulling again in response to elevated uncertainty

The issue with elevated coverage uncertainty is that it makes it tougher for companies and shoppers to make selections, so that they delay funding and spending whereas they await extra readability.

That is precisely what we’re seeing in latest surveys of small enterprise and shoppers.

For companies, this implies lowering hiring plans (chart beneath, orange line) and slowing capex spending (blue line) – or funding in gear, factories, and so on.

And shoppers are saying that prospects for making a big-ticket buy (properties, vehicles, home equipment, and so on) are getting worse (inexperienced line).

Uncertainty may result in slower development this 12 months, however recession discuss is untimely

So, if elevated uncertainty means small companies and shoppers pull again on spending and funding, will probably be a drag on development. In truth, Goldman Sachs and the OECD each cited uncertainty once they just lately revised down their US development projections for 2025 to 1.7% and 2.2%, respectively.

However ~2% actual GDP development is much from recessionary. And but, should you’re simply studying the information (or watching the inventory market), you’d be forgiven for (mistakenly) considering the US economic system is getting ready to recession. Nevertheless, market corrections (chart beneath, crimson line) occur routinely exterior recessions (grey shaded areas).

So, whereas it’d be finest for the economic system for companies and shoppers to get the readability they’re in search of, it’s necessary to keep in mind that the economic system ended 2024 on strong footing, which supplies it some means to soak up detrimental shocks. And the little laborious knowledge we’ve gotten for February (when tariffs first took impact) isn’t too regarding (but) – the economic system added a strong 151,000 jobs and “core” retail gross sales (ex. fuel, autos, and constructing supplies) rose 1% from January.

For now, earlier than worrying about recession, it’s value ready for some extra (laborious) knowledge.

The knowledge contained above is supplied for informational and academic functions solely, and nothing contained herein ought to be construed as funding recommendation, both on behalf of a selected safety or an total funding technique. Neither Nasdaq, Inc. nor any of its associates makes any advice to purchase or promote any safety or any illustration concerning the monetary situation of any firm. Statements relating to Nasdaq-listed firms or Nasdaq proprietary indexes should not ensures of future efficiency. Precise outcomes might differ materially from these expressed or implied. Previous efficiency will not be indicative of future outcomes. Traders ought to undertake their very own due diligence and thoroughly consider firms earlier than investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved.