The introduction of plenty of new tariffs have considerably affected confidence in U.S. shares.

Markets have corrected, financial uncertainty has spiked, shopper confidence has dropped and inflation expectations have risen – all in a short time.

Some fear that, after seeing these losses of their portfolios, retail buyers would possibly draw back from the market.

Nevertheless, the information suggests retail would possibly really be discount searching.

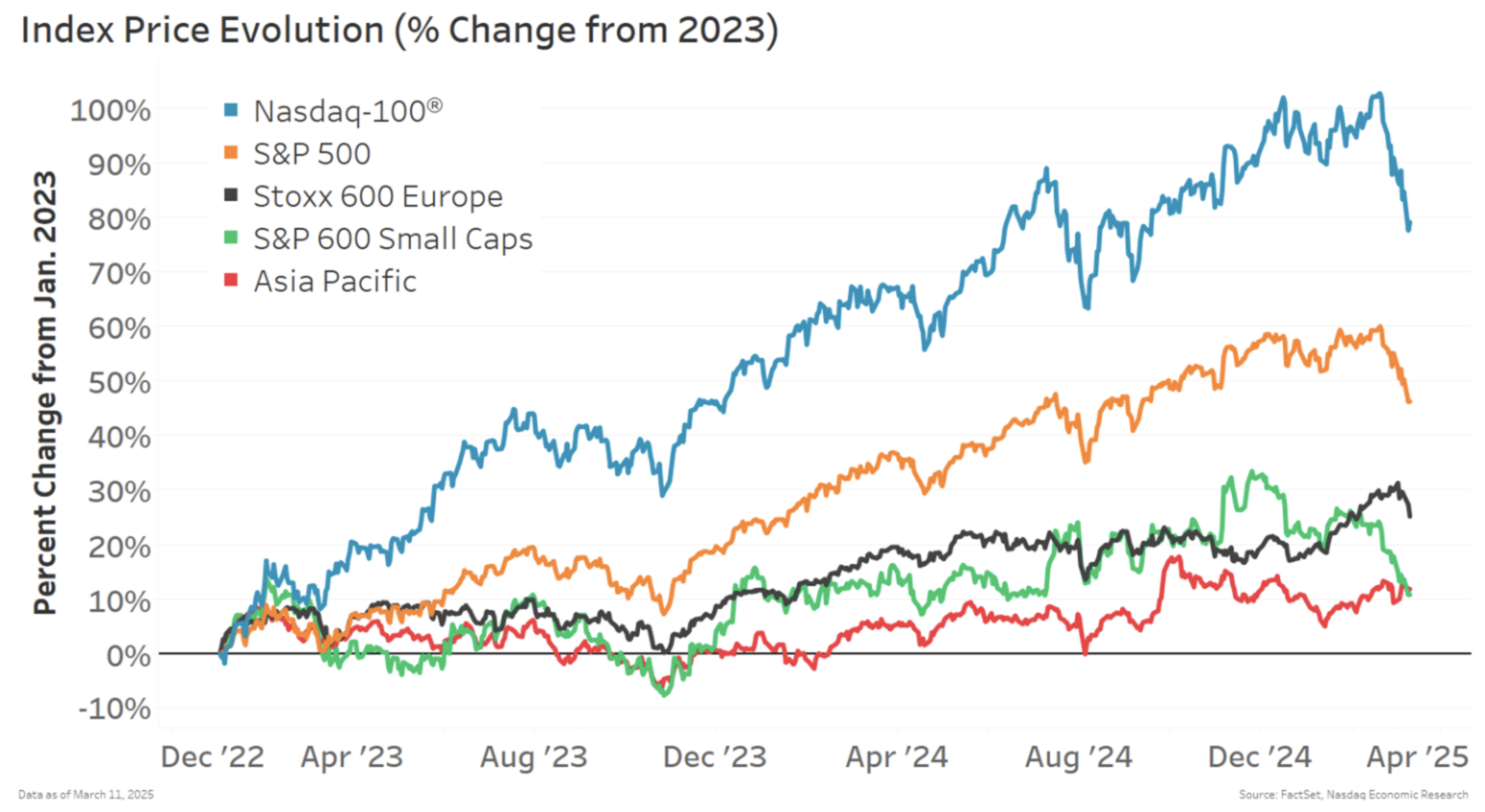

U.S. markets, particularly, have offered off

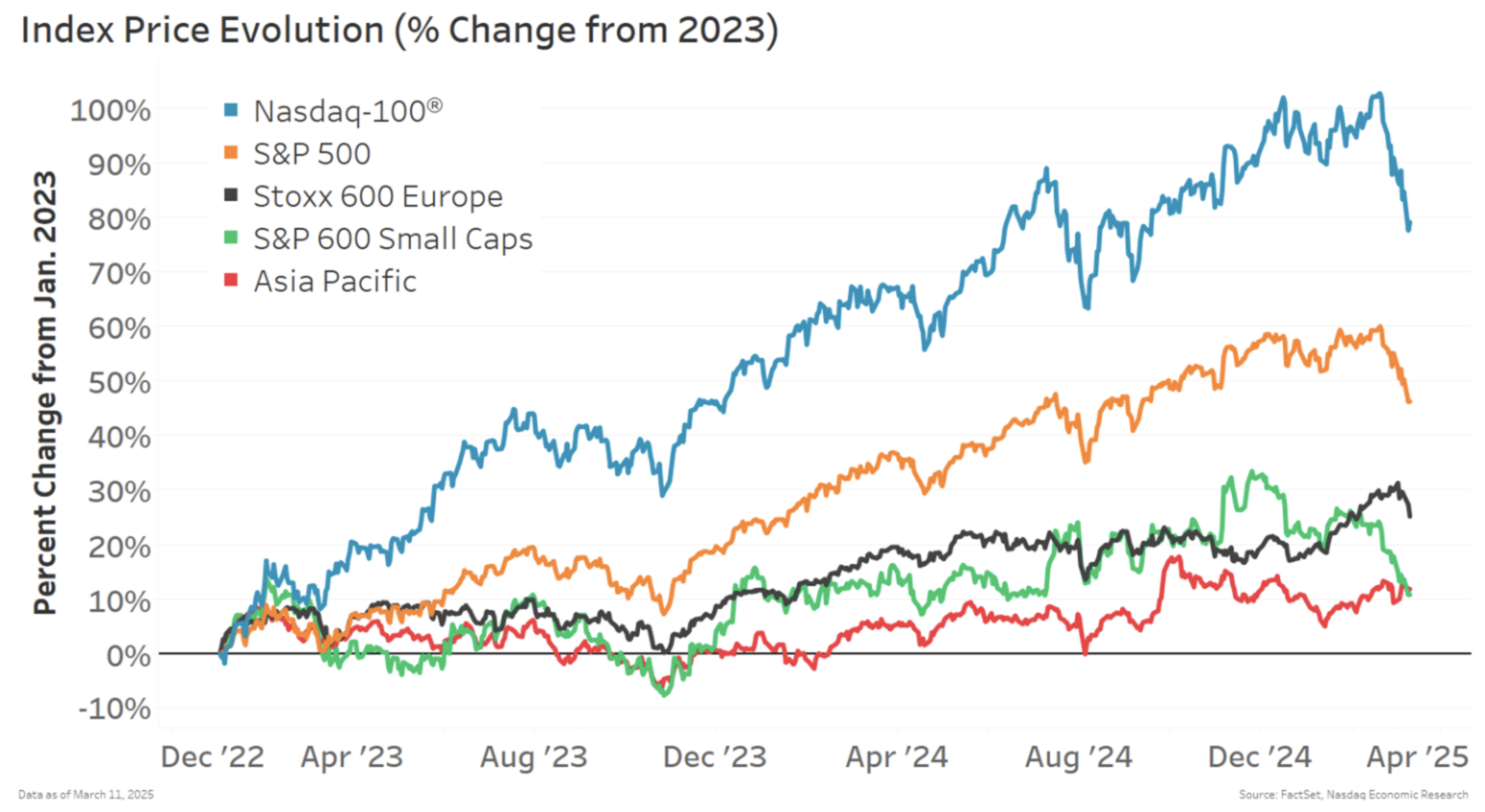

With all of the information round tariffs, financial uncertainty measures have spiked to ranges final seen throughout Covid and the Nice Recession. That has contributed to a sell-off in shares – no less than within the U.S. – with large- and small-cap U.S. shares underperforming different nations.

Chart 1: U.S. shares are underperforming different nations up to now in 2025

Retail exhibits no signal of slowing down

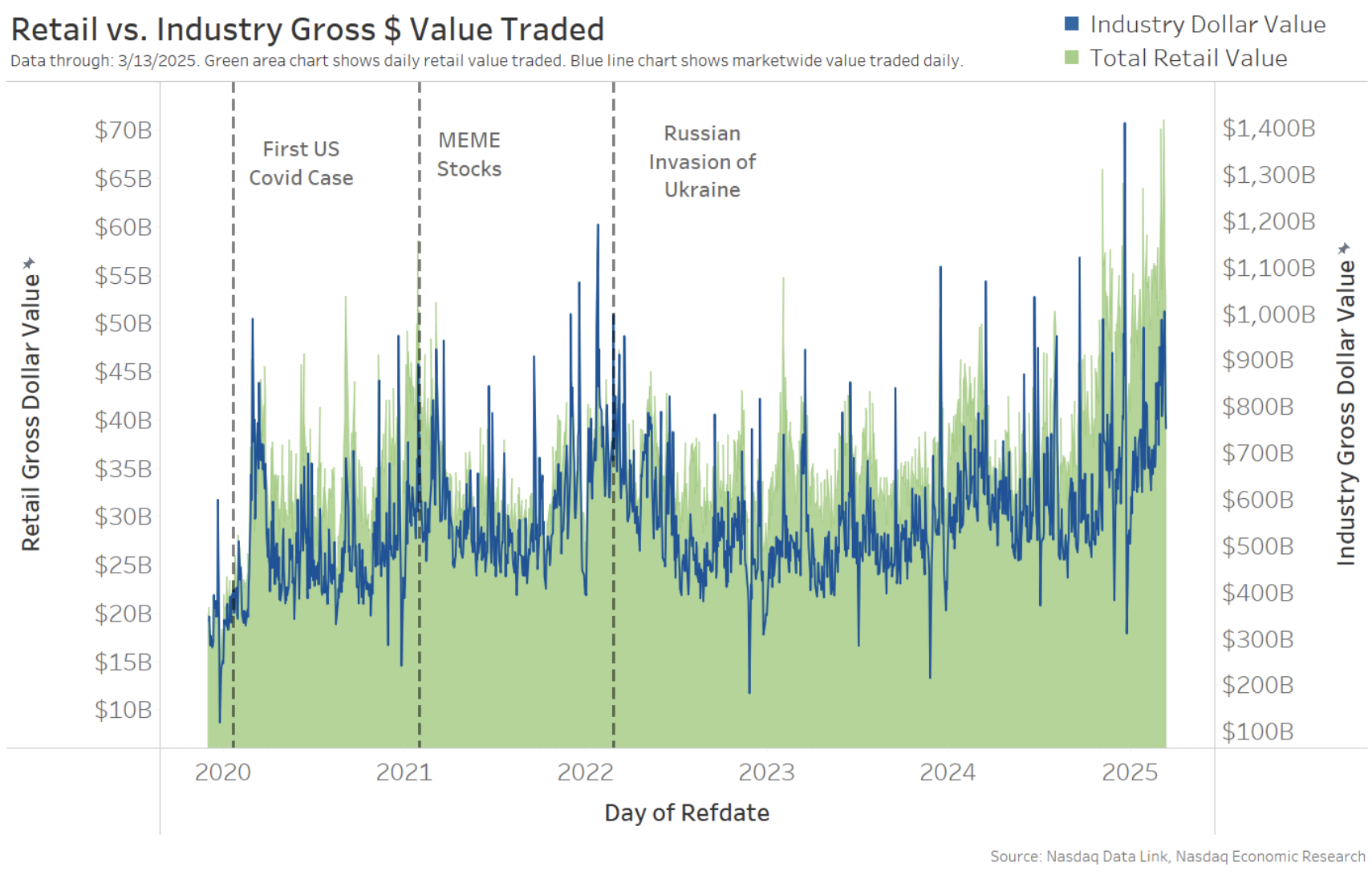

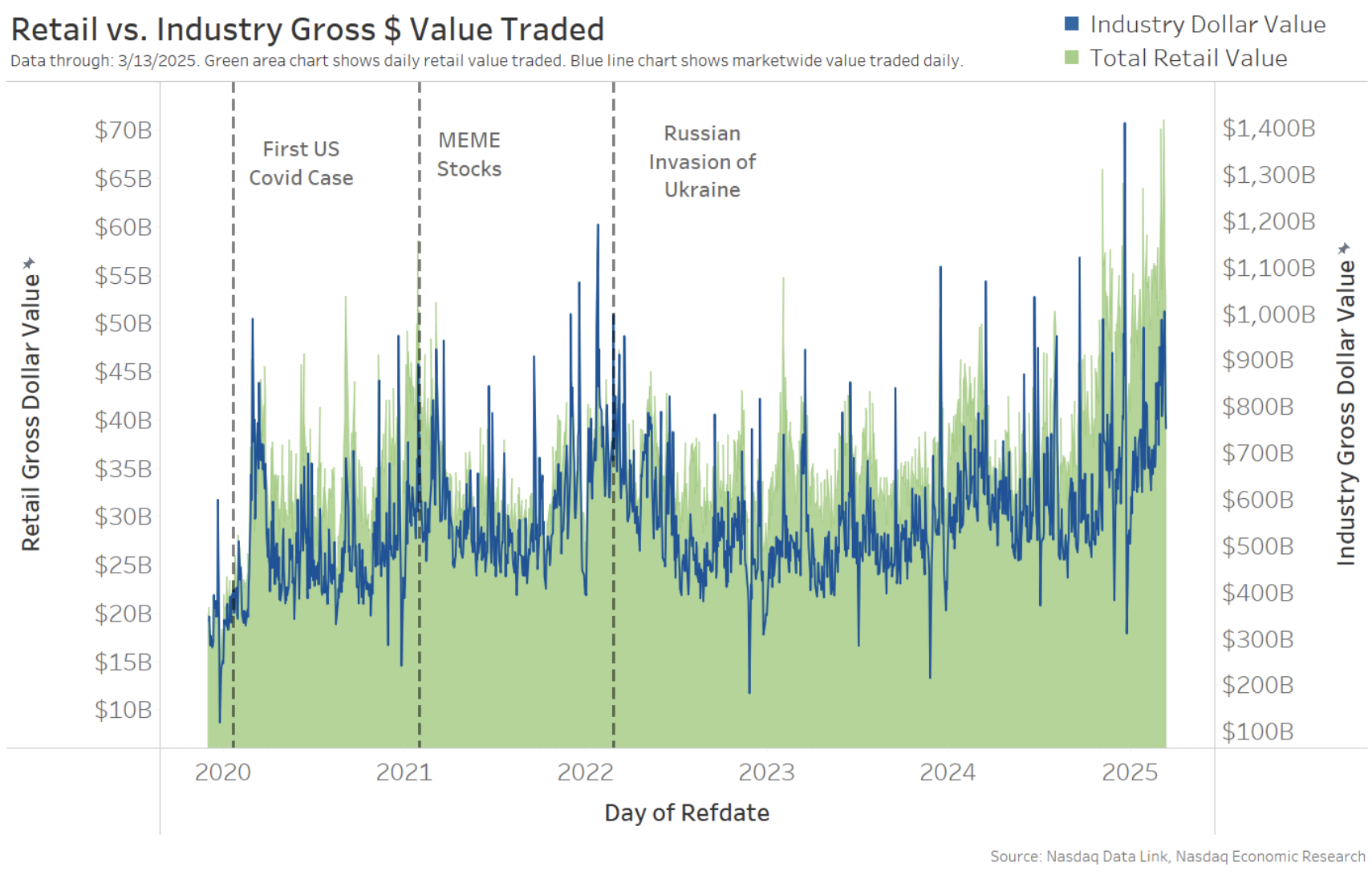

But our retail buying and selling knowledge exhibits no indicators of slowing down or withdrawing from the market.

It’s fairly the other in reality. Knowledge exhibits that retail buying and selling has elevated, nearly 49%, to averaging $62 billion each day up to now in 2025.

The information additionally exhibits that retail exercise began rising proper after the election – effectively earlier than tariff fears led to the present sell-off and spike in market-wide buying and selling (blue line).

Chart 2: Retail exercise picked up earlier than the beginning of 2025; market-wide exercise spiked extra not too long ago

Actually, they’re largely shopping for

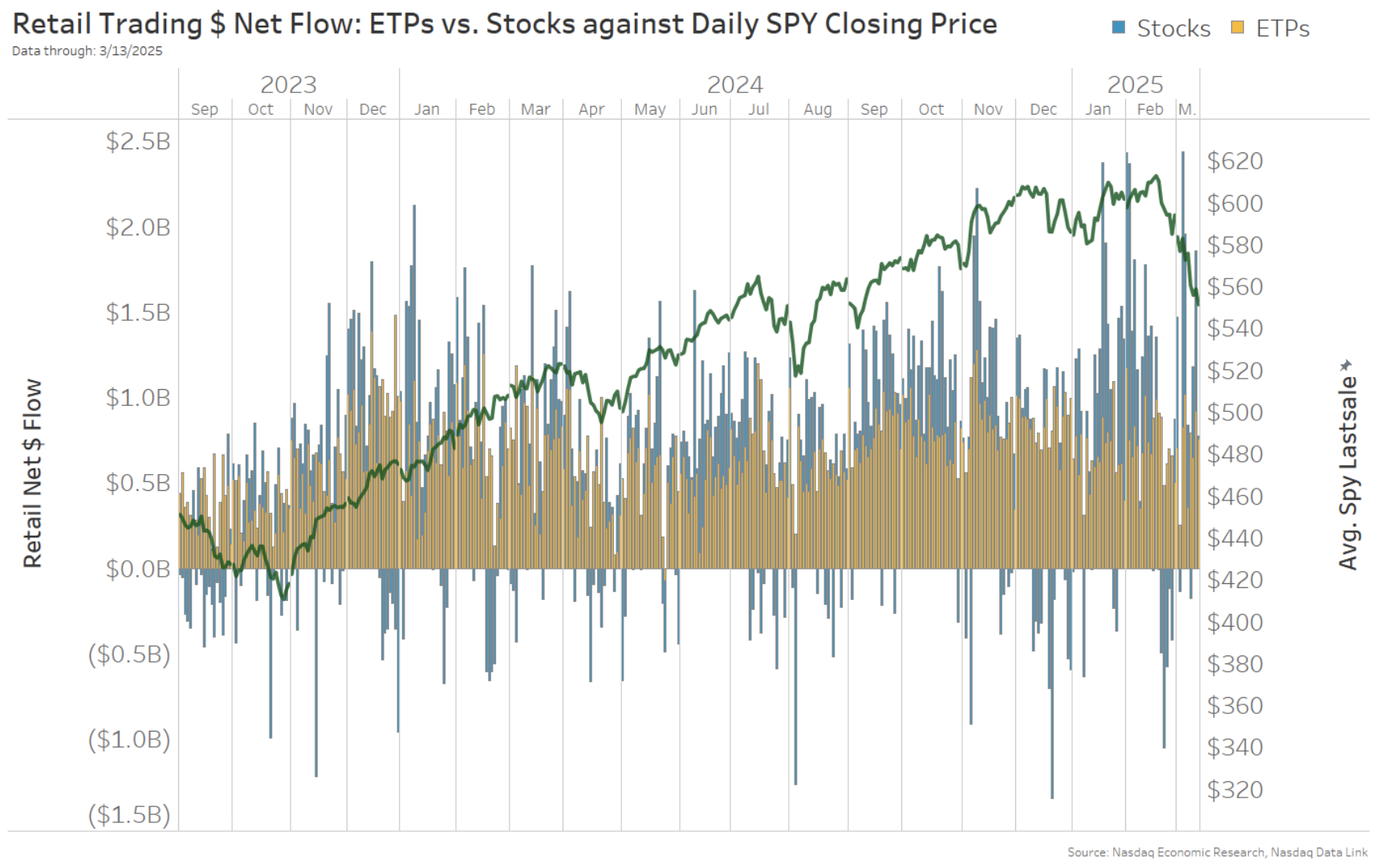

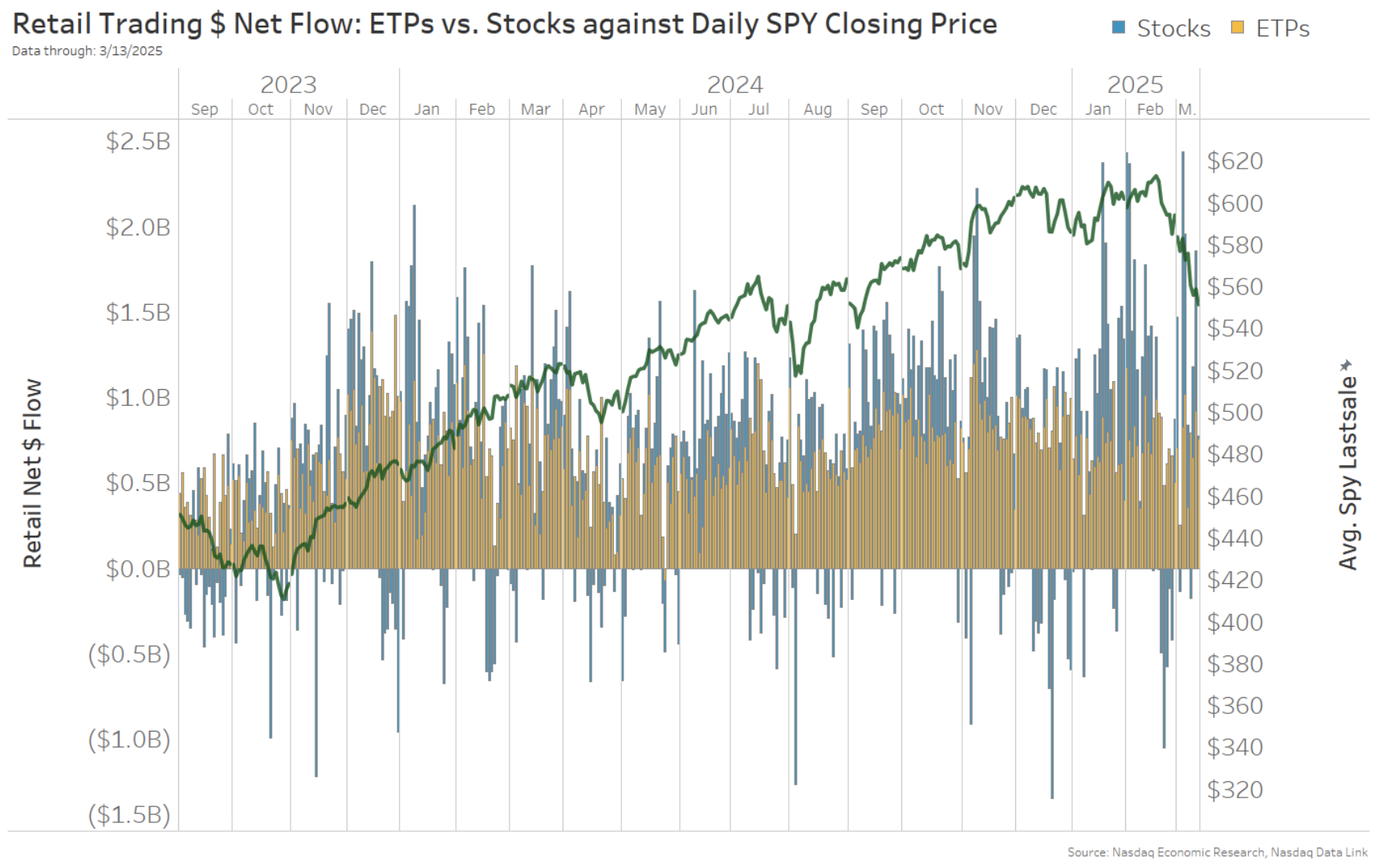

Curiously, retail buying and selling in firm shares was flat to a web promote instantly after the election.

However, in 2025, plenty of issues modified. Taking a look at buying and selling in shares and ETFs, we see two totally different tendencies:

- ETFs nonetheless web to purchase. Curiously, the extent of shopping for isn’t that totally different from regular.

- Shares largely robust shopping for, though there was web promoting of shares late in February. General, company shares have been strongly web to purchase most days in 2025.

Chart 3: Shares have seen robust web shopping for a lot of 2025

Retail shopping for tendencies

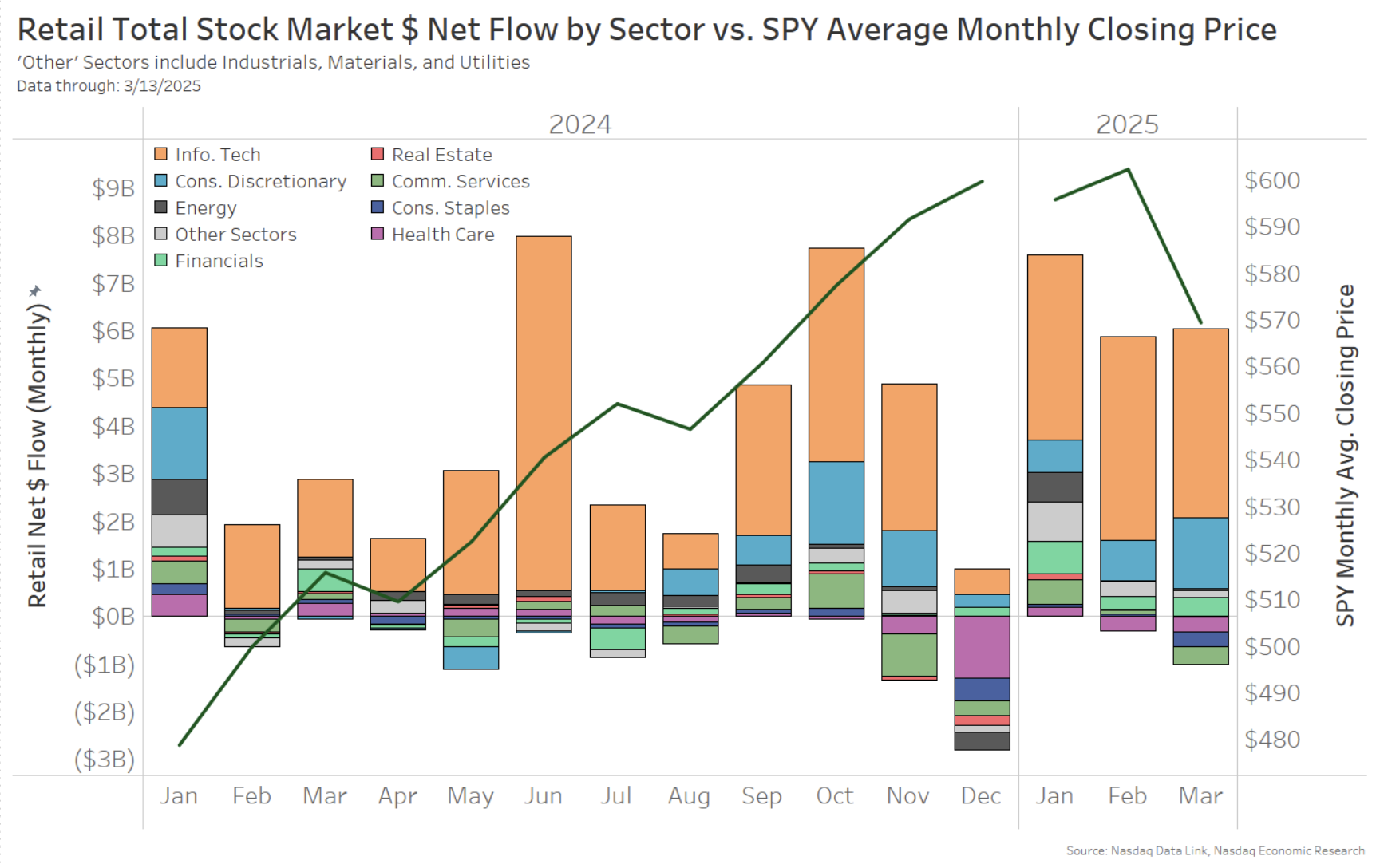

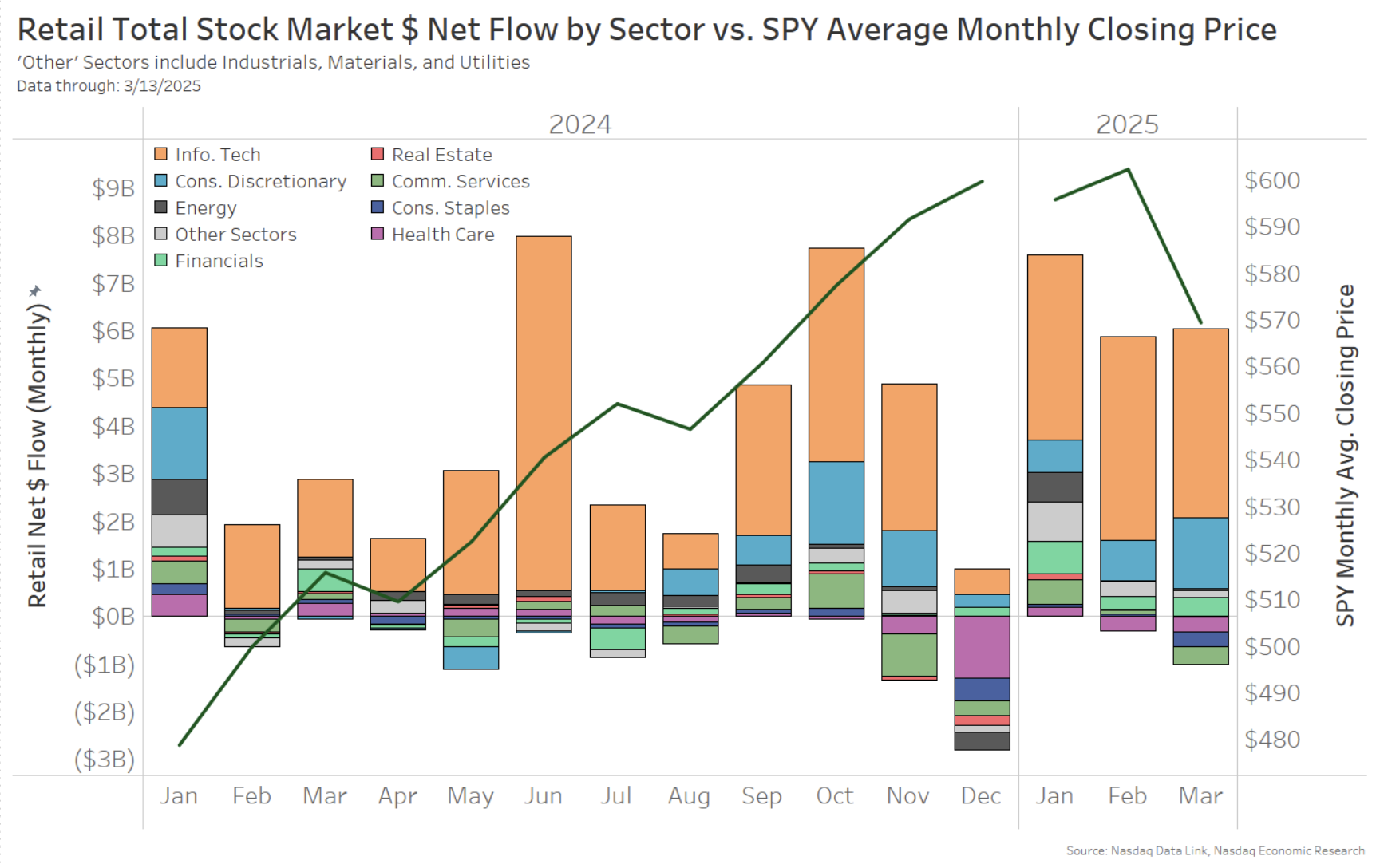

Taking a look at firm inventory buying and selling by sector every month, the interval of promoting in February isn’t seen. As a substitute, we see three months of web shopping for, particularly in Info Know-how.

A deeper dive exhibits that, for the reason that begin of February, the vast majority of Tech shopping for has been in NVDA, whereas over half of the web shopping for in Client Discretionary has been in TSLA.

Having stated that, the breadth of shopping for has fallen because the 12 months has progressed, with web promoting throughout Communications, Healthcare and Staples up to now in March.

Chart 4: Majority of shopping for in Know-how, regardless of the sell-off in that sector in March

Retail appears to be actively shopping for in 2025

Removed from being scared away from the market by latest volatility, retail buying and selling appears to have as an alternative elevated. Actually, latest buying and selling has retail shopping for the dip throughout many shares and sectors.

The introduction of plenty of new tariffs have considerably affected confidence in U.S. shares.

Markets have corrected, financial uncertainty has spiked, shopper confidence has dropped and inflation expectations have risen – all in a short time.

Some fear that, after seeing these losses of their portfolios, retail buyers would possibly draw back from the market.

Nevertheless, the information suggests retail would possibly really be discount searching.

U.S. markets, particularly, have offered off

With all of the information round tariffs, financial uncertainty measures have spiked to ranges final seen throughout Covid and the Nice Recession. That has contributed to a sell-off in shares – no less than within the U.S. – with large- and small-cap U.S. shares underperforming different nations.

Chart 1: U.S. shares are underperforming different nations up to now in 2025

Retail exhibits no signal of slowing down

But our retail buying and selling knowledge exhibits no indicators of slowing down or withdrawing from the market.

It’s fairly the other in reality. Knowledge exhibits that retail buying and selling has elevated, nearly 49%, to averaging $62 billion each day up to now in 2025.

The information additionally exhibits that retail exercise began rising proper after the election – effectively earlier than tariff fears led to the present sell-off and spike in market-wide buying and selling (blue line).

Chart 2: Retail exercise picked up earlier than the beginning of 2025; market-wide exercise spiked extra not too long ago

Actually, they’re largely shopping for

Curiously, retail buying and selling in firm shares was flat to a web promote instantly after the election.

However, in 2025, plenty of issues modified. Taking a look at buying and selling in shares and ETFs, we see two totally different tendencies:

- ETFs nonetheless web to purchase. Curiously, the extent of shopping for isn’t that totally different from regular.

- Shares largely robust shopping for, though there was web promoting of shares late in February. General, company shares have been strongly web to purchase most days in 2025.

Chart 3: Shares have seen robust web shopping for a lot of 2025

Retail shopping for tendencies

Taking a look at firm inventory buying and selling by sector every month, the interval of promoting in February isn’t seen. As a substitute, we see three months of web shopping for, particularly in Info Know-how.

A deeper dive exhibits that, for the reason that begin of February, the vast majority of Tech shopping for has been in NVDA, whereas over half of the web shopping for in Client Discretionary has been in TSLA.

Having stated that, the breadth of shopping for has fallen because the 12 months has progressed, with web promoting throughout Communications, Healthcare and Staples up to now in March.

Chart 4: Majority of shopping for in Know-how, regardless of the sell-off in that sector in March

Retail appears to be actively shopping for in 2025

Removed from being scared away from the market by latest volatility, retail buying and selling appears to have as an alternative elevated. Actually, latest buying and selling has retail shopping for the dip throughout many shares and sectors.